10 Foreigners Owning 105 Properties: What Happens Next?

August 20, 2023

I could never sell a superlux property to anyone.

By this I mean the cream-of-the-crop properties, like Good Class Bungalows (GCBs) and penthouses and the like. Even if I were a realtor, and I had a shot at such deals, I would 100 per cent scare off the buyer or seller before closing*.

I blame this on my natural curiosity about how people make their money. In fact, it’s my dream to one day make a video of going door-to-door in Sentosa Cove or Nassim, asking the owners of those houses what they do for a living (Keep an eye out for that video, which is due around the time I decide to get fired from here.)

This is a strict no-no in the superlux property business. As most realtors can tell you, privacy is the number one rule for these buyers/sellers. Part of the reason is that the buyers are sometimes celebrities, corporate head honchos, etc. who would see real security risks from exposing their address.

Another part of the reason is…well, it’s starting to look a bit like white-collar crime. I’m certainly not saying that every rich person with a penthouse or GCB is some sort of crook (except maybe from a certain eat-the-rich perspective)…but I do notice that every one of the people involved in the $1 billion money-laundering scam all either rented or bought a superlux property.

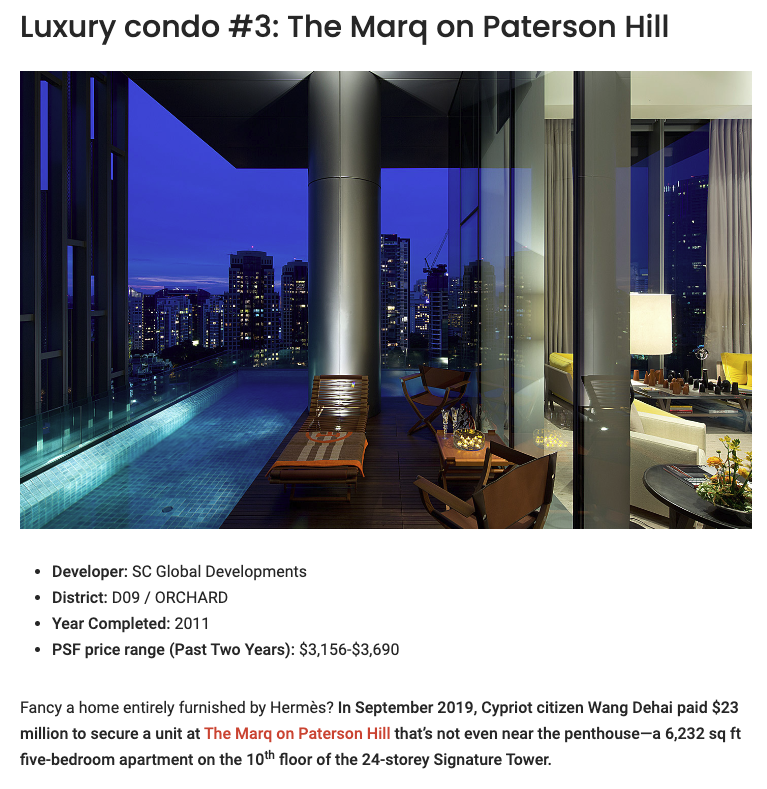

From the reports I see a GCB at Ewart Park, a GCB at Bishopsgate, a GCB at Third Avenue, a GCB at Lewis Road, and a GCB at Nassim Road. Then there’s this guy who has a unit at The Marq:

*The fact that I also have no chance of selling normal properties, because I have all the charm of a deceased cockroach, is besides the point.

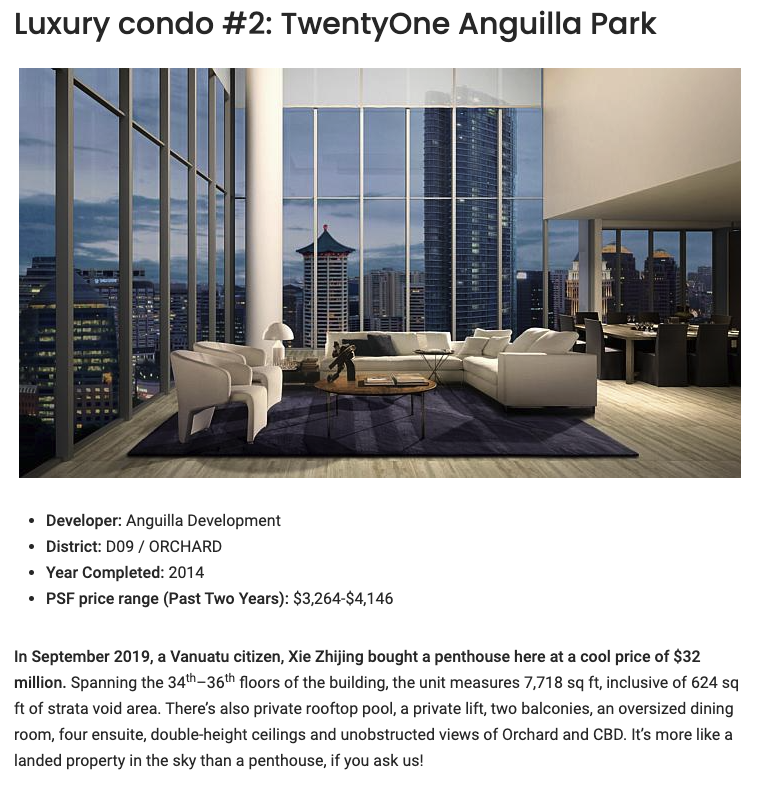

And this one who has a unit at TwentyOne Angullia Park:

(There’s also speculation that the bulk purchase at Canninghill Piers was part of this and, whilst some may argue that’s not superlux, I’d say that $85 million for 20 units there still counts).

There’s also the famous $150,000 record-breaking GCB rental at Bishopsgate, which many people were curious about this crazy rich person who would be splashing close to $2 million a year on rent.

The fact is, superlux properties are ideal for some of these white-collar criminals.

These properties are far from prying eyes, have way too much space for hiding anything, and the penthouse properties come with 24/7 security. It also kind of makes sense that people with their luxury goods would be living in these units. It’s congruent, unlike if they lived in a mass-market condo.

Here’s what I’m really curious about though. I remember reading about these ultra lux properties being sold, and the first thing that popped into my mind was – who are these people from Vanuatu and Cypriot buying such homes? Plus, how coincidental was it that they both have Chinese names?

A quick search on Vanuatu will tell you that this is a controversial golden passport scheme that saw shady people like Crypto bosses, or disgraced businessmen and politicians.

This scheme has been a cash cow for the country, as each citizenship cost US$130,000 (earning them more than $116m in 2020), and can be completed in a month without ever even having to visit the country.

Given how odd it was even back then, it seems implausible that these people weren’t already on some sort of watchlist from the beginning. If anything, it seems like a crafty plan to lure these people in and earn all that cash from all the stamp duties – it’s a pity the 60 per cent foreign ABSD wasn’t done earlier, eh?

More from Stacked

Why Old, Strata Malls Matter More Than You Think

Queensway Shopping Centre, Katong Shopping Centre, Golden Mile Tower…these old malls are often disregarded, or even considered eyesores. When it…

Also, most people would probably be wondering about the possible impact on our prices. We don’t know how many more of such people are out there, and perhaps having acquired properties as well but on a smaller scale. How much would these affect our property data (and perhaps even our typical profitable/unprofitable condo pieces!).

Finally, I know what the number one question is on everyone’s minds: what happens to these seized properties and assets? Apparently these get put into these site called Sheriff’s Sales. For those on the lookout for deals coming up, you’d probably want to keep close tabs on this site.

The government isn’t unaware of it, property agents apparently have Know – Your – Customer (KYC) requirements too.

CEA has the guidelines. To date, I haven’t heard of any property agents getting into trouble over this. But if the situation does get worse, agents might end up having to ask more questions, or look more deeply.

That may sting a bit, as compliance can get expensive (these costs filter down to clients in the end). But I suppose it’s better than having the luxury property sector become an incubator for Bond villains.

Meanwhile in other property news…

- Some freehold condos just don’t hold up too well. We looked at why one example, Starlight Suites, has struggled with gains.

- On the topic of freehold homes, here are some with private pools, that still cost under $2.6 million.

- We looked at why we just had our slowest launch weekend to date, with three projects moving just 53 units.

- We checked out some unusual mixed-lease properties, where some units are 99-years, some are 999-years, and some just have a mish-mash of different start dates for the lease.

- We toured the ever-popular Katong area, a former hotspot of Peranakan culture.

Weekly Sales Roundup (07 August – 13 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $4,233,000 | 1464 | $2,892 | 99 yrs (2019) |

| LIV @ MB | $4,194,000 | 1668 | $2,514 | 99 yrs (2021) |

| TEMBUSU GRAND | $4,008,000 | 1518 | $2,641 | 99 yrs (2021) |

| ONE PEARL BANK | $3,374,000 | 1432 | $2,357 | 99 yrs (2022) |

| CAIRNHILL 16 | $3,310,000 | 1195 | $2,770 | 99 yrs (2019) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,124,000 | 657 | $1,712 | 99 yrs leasehold |

| ORCHARD SOPHIA | $1,229,000 | 441 | $2,785 | FH |

| PINETREE HILL | $1,297,000 | 538 | $2,410 | 99 yrs (2022) |

| THE MYST | $1,364,000 | 678 | $2,011 | 99 yrs (2023) |

| THE LANDMARK | $1,412,601 | 495 | $2,853 | 99 yrs (2020) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ORCHARD SCOTTS | $3,780,000 | 2282 | $1,656 | 99 yrs (2001) |

| ONE DEVONSHIRE | $3,700,000 | 1216 | $3,042 | FH |

| FLORIDIAN | $3,568,000 | 1658 | $2,152 | FH |

| THE BERTH BY THE COVE | $3,500,000 | 3057 | $1,145 | 99 yrs (2004) |

| VALLEY PARK | $3,300,000 | 1615 | $2,044 | 999 yrs (1877) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MILLAGE | $730,000 | 463 | $1,577 | FH |

| RIVERBANK @ FERNVALE | $733,000 | 495 | $1,480 | 99 yrs (2013) |

| LE REGAL | $760,000 | 689 | $1,103 | FH |

| # 1 LOFT | $770,000 | 560 | $1,376 | FH |

| HARBOUR SUITES | $770,000 | 420 | $1,834 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| TERESA VILLE | $3,150,000 | 1981 | $1,590 | $2,145,000 | 25 Years |

| VALLEY PARK | $3,300,000 | 1615 | $2,044 | $1,610,000 | 23 Years |

| VARSITY PARK CONDOMINIUM | $2,350,000 | 1894 | $1,240 | $1,542,025 | 17 Years |

| VILLA MARTIA | $2,530,000 | 1615 | $1,567 | $1,523,836 | 25 Years |

| SHAW PLAZA – TWIN HEIGHTS | $2,210,000 | 1421 | $1,555 | $1,438,656 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ORCHARD SCOTTS | $3,780,000 | 2282 | $1,656 | -$826,721 | 13 Years |

| EON SHENTON | $1,780,000 | 1044 | $1,705 | -$124,900 | 11 Years |

| CONCOURSE SKYLINE | $2,230,000 | 1141 | $1,954 | -$81,920 | 5 Years |

| KINGSFORD WATERBAY | $960,000 | 689 | $1,394 | -$50,431 | 6 Years |

| THE CREST | $1,513,500 | 797 | $1,900 | -$48,620 | 3 Years |

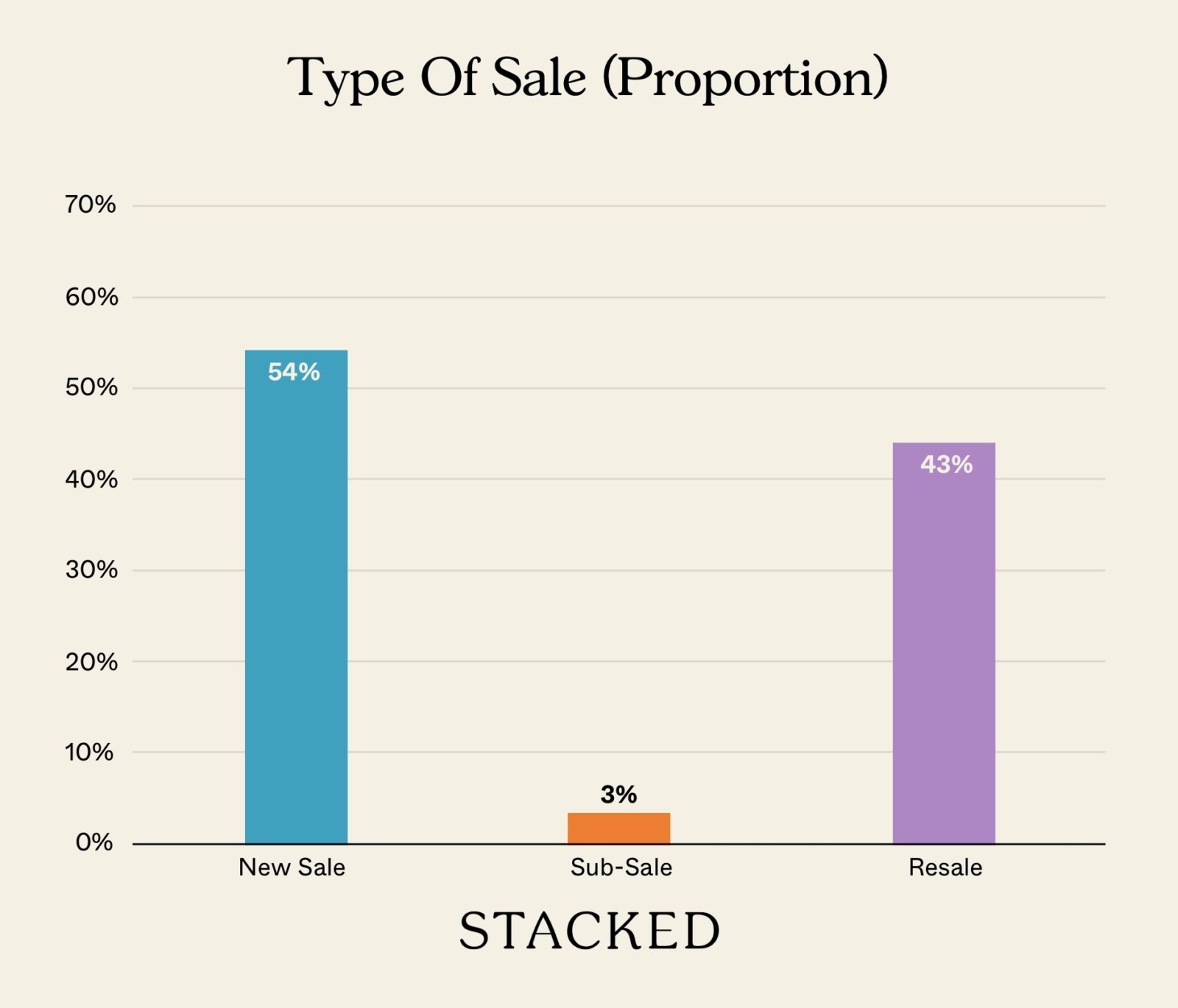

Transaction Breakdown

Follow us on Stacked for more insights into new and resale properties alike, as well as updates on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Who are the typical buyers of luxury properties like GCBs and penthouses?

Why do some wealthy individuals prefer to buy or rent superlux properties?

What is the controversy surrounding foreigners from Vanuatu and Cyprus buying luxury homes?

What happens to properties seized from illegal or suspicious activities?

Are property agents required to verify the identities of buyers of luxury properties?

Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments