$1.89m For A New Luxury Condo In District 7: A Pricing Review Of Aurea

March 14, 2025

One of Aurea’s heavily marketed selling points is that units start from below $2 million. That’s interesting for a centrally located condo for sure; but those competitive numbers refer to two-bedders or smaller. For family buyers, we think a more comprehensive review of pricing is in order, especially for three-bedder or larger units.

In this article, we will compare prices between Aurea and similar projects, to see if it’s as competitively priced as advertised. Let’s compare it to equivalent developments in District 7, to see if it’s a value buy:

Indicative prices

| Unit type | No. of units | % of unit mix | Approx. unit size (sqft) | Starting prices |

| 2 Bedroom | 84 | 44.70% | 635 | $1,898,000 |

| 646 | $1,898,815 | |||

| 710 | $1,932,390 | |||

| 3 Bedroom | 28 | 14.90% | 1,001 | $2,831,010 |

| 4 Bedroom | 56 | 29.80% | 1,442 | $4,080,510 |

| 1,798 | $5,186,105 | |||

| 5 Bedroom | 18 | 9.60% | 2,863 | – |

| 3,251 | – | |||

| Penthouse | 2 | 1% | 5,608 | – |

| 8,816 | – |

Based on the indicative prices above, the starting $PSF ranges from around $2,722 to $2,989, with the average being approximately $2,856.

Average $PSF of recent launches (99-year leasehold)

| Project | District | No. of units | Lowest $PSF | Highest $PSF | Average $PSF |

| Chuan Park | 19 | 916 | $2,269 | $2,765 | $2,588 |

| Elta | 5 | 501 | $2,200 | $2,881 | $2,541 |

| Emerald Of Katong | 15 | 846 | $2,387 | $2,973 | $2,638 |

| Norwood Grand | 25 | 348 | $1,895 | $2,252 | $2,080 |

| Parktown Residences | 18 | 1193 | $2,146 | $2,585 | $2,366 |

| The Collective @ One Sophia | 9 | 367 | $2,561 | $2,917 | $2,743 |

| The Orie | 12 | 777 | $2,399 | $3,064 | $2,735 |

| Union Square Residences | 1 | 366 | $2,856 | $3,752 | $3,175 |

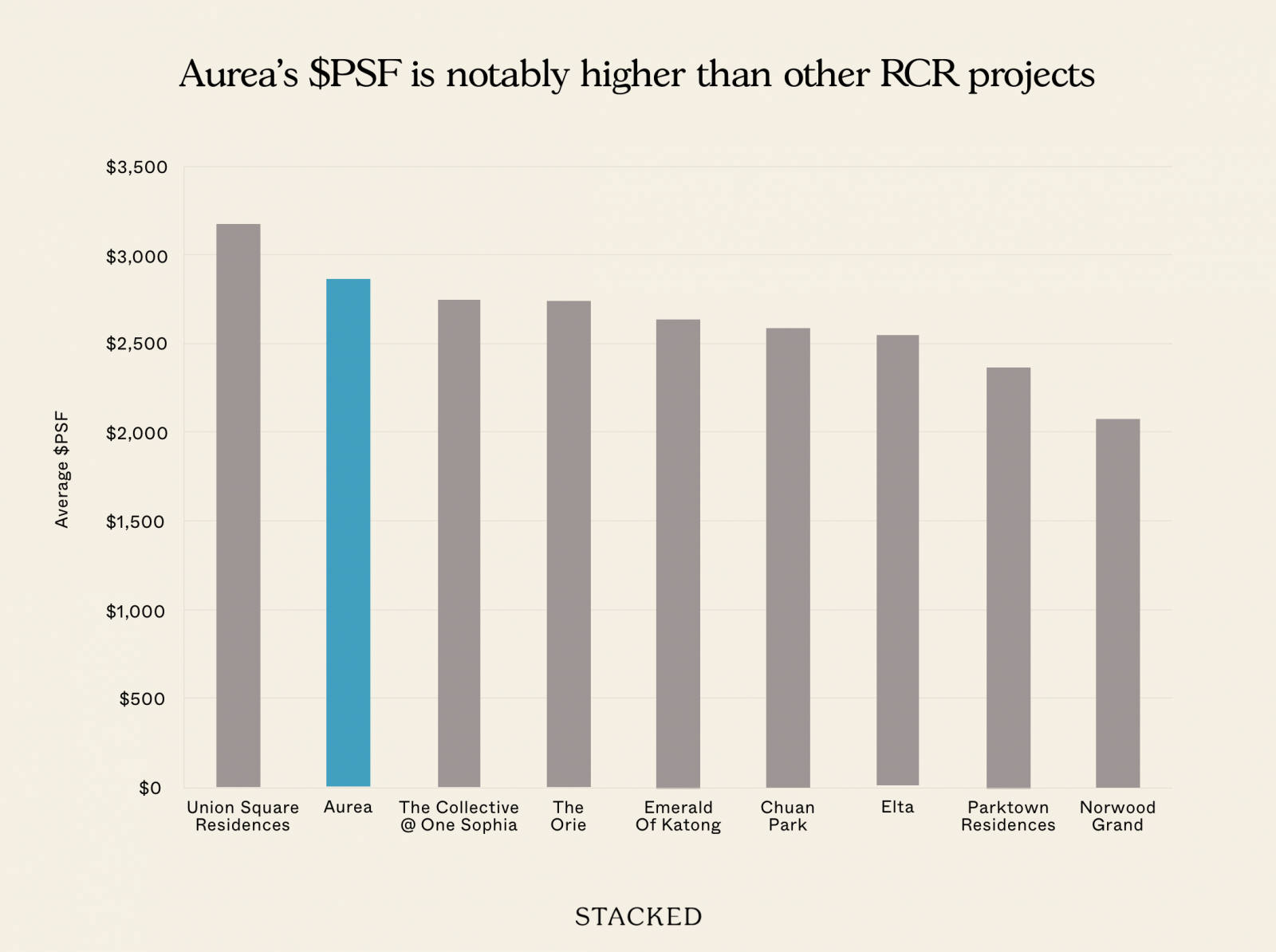

Aurea’s average starting $PSF of $2,856 is notably higher than the average $PSF of other RCR projects like Emerald Of Katong and The Orie. It is also higher than the average $PSF of The Collective @ One Sophia, which is located in the CCR.

However, without the full pricing range for Aurea, it remains to be seen whether its prices will be considered competitive.

Recent project launches have shown $PSF variations ranging from 13.9 to 31.4% between the lowest and highest price points. Using this as a benchmark, we can estimate Aurea’s potential average price at different percentage points based on its average starting $PSF of $2,856. Here’s the potential price matrix.

| Unit type | Approx. unit size (sqft) | 10% | 20% | 30% |

| 2 Bedroom | 635 | $1,994,916 | $2,176,272 | $2,357,628 |

| 646 | $2,029,474 | $2,213,971 | $2,398,469 | |

| 710 | $2,230,536 | $2,433,312 | $2,636,088 | |

| 3 Bedroom | 1,001 | $3,144,742 | $3,430,627 | $3,716,513 |

| 4 Bedroom | 1,442 | $4,530,187 | $4,942,022 | $5,353,858 |

| 1,798 | $5,648,597 | $6,162,106 | $6,675,614 | |

| 5 Bedroom | 2,863 | $8,994,401 | $9,812,074 | $10,629,746 |

| 3,251 | $10,213,342 | $11,141,827 | $12,070,313 | |

| Penthouse | 5,608 | $17,618,093 | $19,219,738 | $20,821,382 |

| 8,816 | $27,696,346 | $30,214,195 | $32,732,045 |

Now, let’s examine some of Aurea’s resale competitors.

Resale Competitors for Aurea

In its immediate vicinity, there are three notable resale projects: City Gate, Concourse Skyline, and Southbank. Below is an overview of these developments.

| Project | TOP year | Tenure | No. of units | Average $PSF in 2024 | % difference compared to Aurea’s average starting $PSF of $2,856 |

| City Gate | 2018 | 99 years from 2014 | 311 | $2,089 | 36.72% |

| Concourse Skyline | 2014 | 99 years from 2008 | 360 | $1,987 | 43.73% |

| Southbank | 2010 | 99 years from 2006 | 197 | $1,893 | 50.87% |

Average price by bedroom (includes all sales in 2024)

| Project | 2-bedroom | 3-bedroom |

| City Gate | $1,898,143 | $2,390,000 |

| Concourse Skyline | $2,960,000 | – |

| Southbank | $1,794,114 | $2,650,000 |

Among them, City Gate, being the newest, is likely to be Aurea’s closest competitor. City Gate’s average $PSF is nearly 37% lower than Aurea’s average starting $PSF, a rather sizable difference despite being just 11 years older than Aurea. However, in terms of overall quantum, the starting price of 2-bedders in Aurea is similar to those in City Gate.

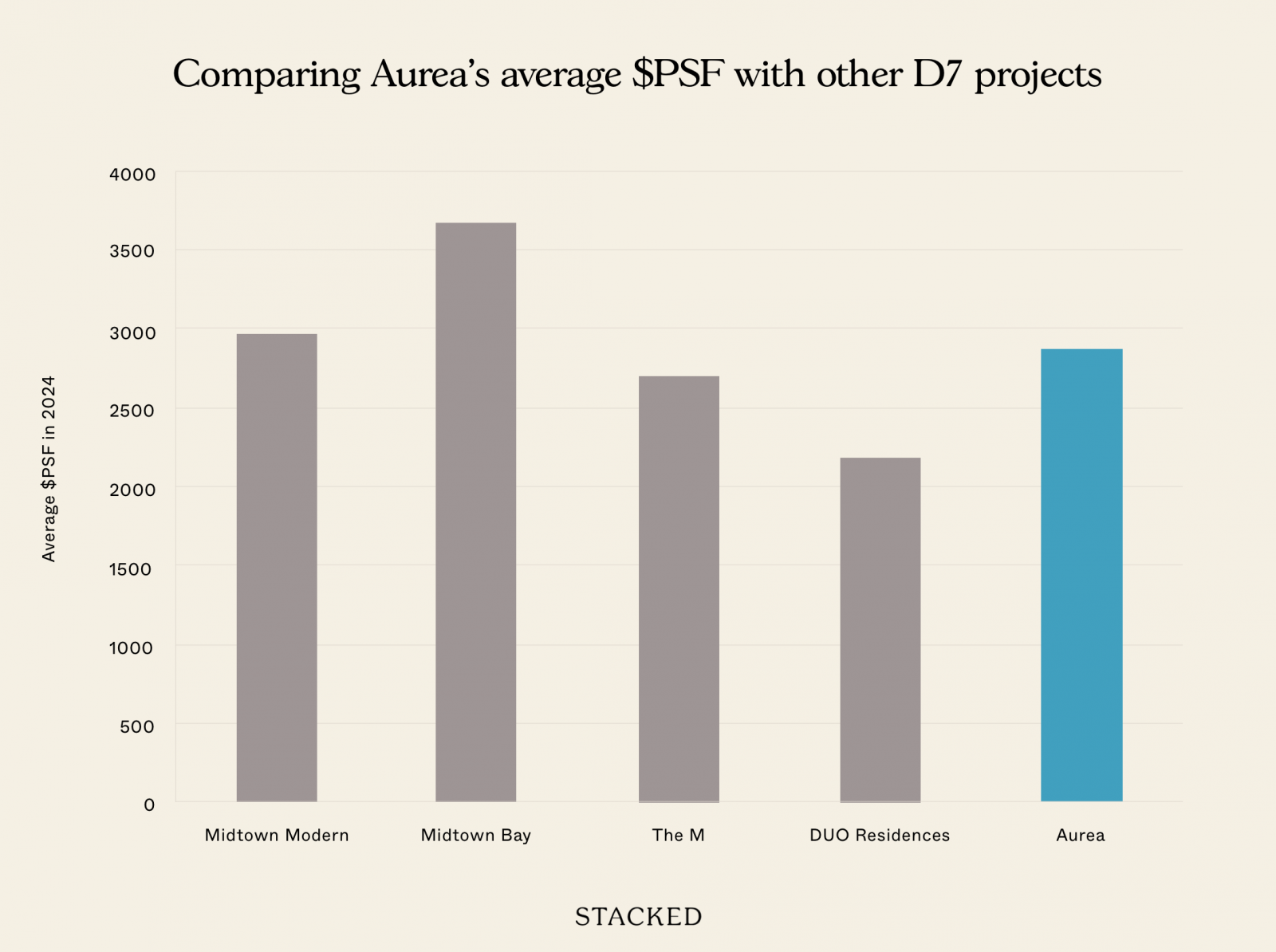

Further down in the Bugis area, several newer resale developments could also serve as key reference points for buyers comparing options. These projects—Midtown Bay, Midtown Modern, The M, and DUO Residences—are also in District 07.

| Project | TOP year | Tenure | No. of units | Average $PSF in 2024 | % difference compared to Aurea’s average starting $PSF of $2,856 |

| Midtown Modern | 2025 | 99 years from 2019 | 558 | $2,956 (Sub sale tnx done in 2024) | -3.50% |

| Midtown Bay | 2024 | 99 years from 2018 | 219 | $3,668 (Avg $PSF for current unsold units) | -28.43% |

| The M | 2023 | 99 years from 2019 | 522 | $2,702 (Resale and sub sale tnx done in 2024) | 5.39% |

| DUO Residences | 2017 | 99 years from 2011 | 660 | $2,175 | 23.84% |

*Blue highlight indicates that Aurea’s pricing is higher, and red indicates that it’s lower than the project it’s being compared against

Average price by bedroom (includes all sales in 2024)

| Project | 2-bedroom | 3-bedroom | 4-bedroom |

| Midtown Modern | $2,400,000 | $3,000,000 | $5,792,091 |

| Midtown Bay | $2,533,216 | – | – |

| The M | $2,142,578 | – | – |

| DUO Residences | $2,007,143 | – | – |

Midtown Bay, which still has around 35% of unsold units, has an average asking $PSF of $3,668—about 28% higher than Aurea’s starting price. This pricing gap may potentially encourage Aurea’s developer to test the upper range of its launch prices.

Looking at the overall quantum, based on Aurea’s starting prices, it is comparatively lower than the 4 developments listed above.

Given the availability of unsold units at Midtown Bay, buyers will likely use it as a benchmark when evaluating Aurea. Additionally, with Midtown Modern being the newest project in the area, resale units from this development could also be a key point of comparison. For this reason, we will conduct a more in-depth pricing analysis between Aurea, City Gate, Midtown Modern, and Midtown Bay below.

But first, let’s examine the performance of other condos that launched at around the same time as these developments.

Projects that were launched around the same time as City Gate:

| Gains | Losses | |||||

| Project | Average gains | Average annualised gains (%) | No. of tnx | Average gains | Average % gains | No. of tnx |

| City Gate | $135,929 | 1.5 | 60 | -$26,063 | -0.35 | 4 |

| Commonwealth Towers | $206,813 | 2.65 | 261 | -$14,580 | -0.38 | 5 |

| Highline Residences | $302,273 | 2.91 | 87 | -$61,633 | -1.1 | 3 |

| LakeVille | $252,387 | 2.57 | 144 | -$24,191 | -0.55 | 4 |

| Marina One Residences | $132,535 | 1.65 | 23 | -$193,891 | -1.97 | 27 |

| The Crest | $207,391 | 1.71 | 45 | -$114,220 | -2.9 | 27 |

Projects that were launched around the same time as Midtown Modern:

| Gains | Losses | |||||

| Project | Average gains | Average annualised gains (%) | No. of tnx | Average gains | Average % gains | No. of tnx |

| Canninghill Piers | $186,583 | 2.08 | 12 | – | ||

| Irwell Hill Residences | $170,800 | 2.68 | 5 | – | ||

| Midwood | $211,814 | 5.11 | 26 | – | ||

| Midtown Modern | $264,928 | 4.33 | 6 | – | ||

| Normanton Park | $270,025 | 5.46 | 71 | – | ||

| Pasir Ris 8 | $201,500 | 5.1 | 2 | – | ||

| The Reef at King’s Dock | $211,777 | 2.94 | 12 | – | ||

| Treasure at Tampines | $261,278 | 5.54 | 503 | -$238,000 | -8.6 | 1 |

Projects that were launched around the same time as Midtown Bay:

| Gains | Losses | |||||

| Project | Average gains | Average annualised gains (%) | No. of tnx | Average gains | Average % gains | No. of tnx |

| Avenue South Residences | $218,814 | 3.18 | 75 | – | ||

| Fourth Avenue Residences | $185,684 | 2.68 | 19 | -$48,500 | -1.7 | 2 |

| Midtown Bay | $56,000 | 0.9 | 1 | -$70,000 | -2.1 | 1 |

| One Pearl Bank | $163,361 | 2.36 | 18 | -$110,000 | -2.6 | 1 |

| Parc Clematis | $360,091 | 6.29 | 225 | – | ||

| The M | $205,698 | 3.34 | 14 | – | ||

From the above tables, it is evident that the City Gate, Midtown Modern, and Midtown Bay have not performed as well as other developments launched around the same time.

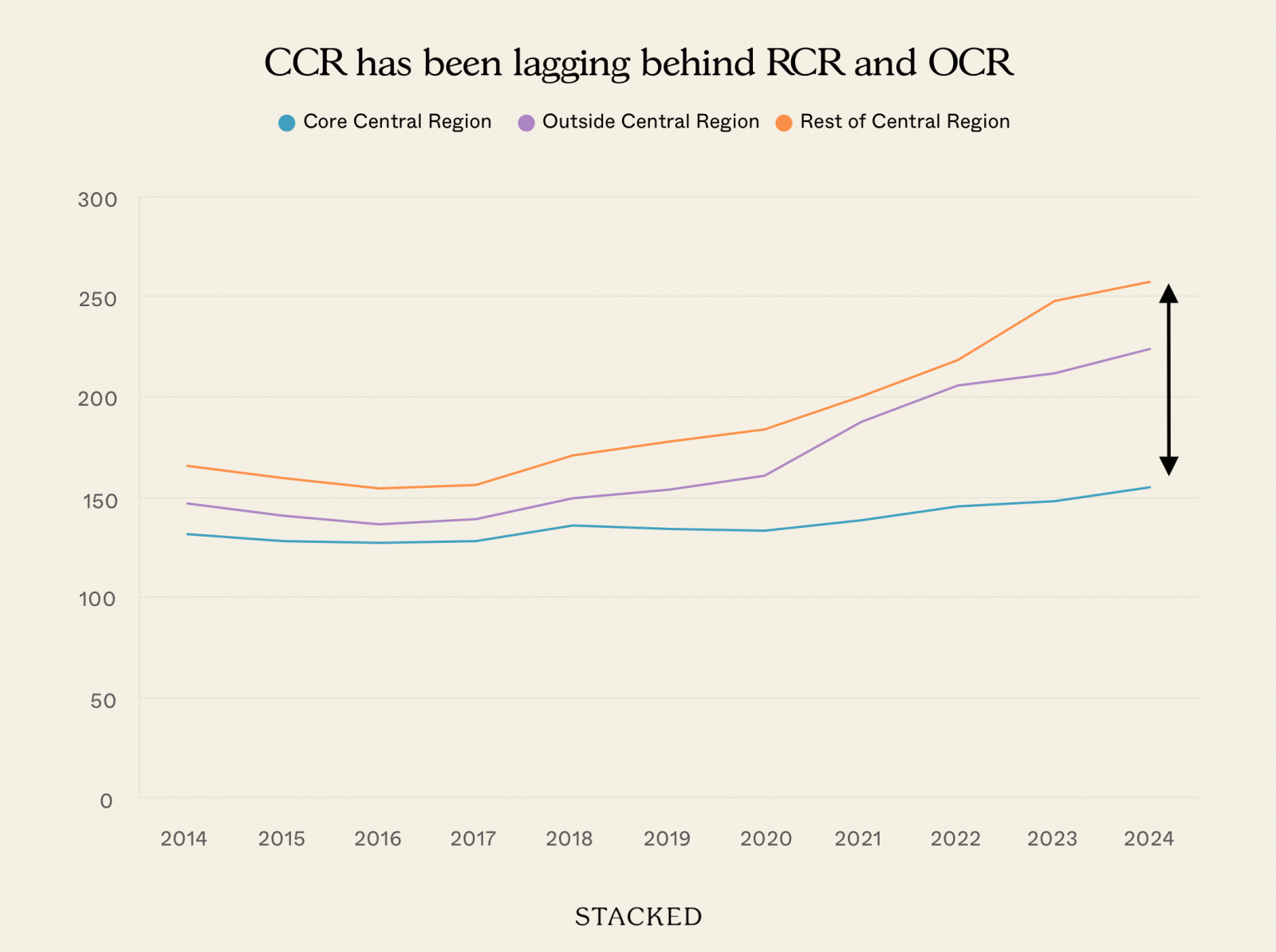

However, a clear pattern emerges—projects in the OCR (Outside Central Region) and RCR (Rest of Central Region) have generally outperformed those in the CCR (Core Central Region). This trend aligns with the broader market growth rates observed over the past decade.

| Year | CCR | YoY | RCR | YoY | OCR | YoY |

| 2014 | 131.9 | – | 146.6 | – | 165.6 | – |

| 2015 | 128.6 | -2.50% | 140.3 | -4.30% | 159.4 | -3.74% |

| 2016 | 127 | -1.24% | 136.4 | -2.78% | 154 | -3.39% |

| 2017 | 127.8 | 0.63% | 138.9 | 1.83% | 156.1 | 1.36% |

| 2018 | 136.4 | 6.73% | 149.2 | 7.42% | 170.7 | 9.35% |

| 2019 | 134.1 | -1.69% | 153.4 | 2.82% | 177.9 | 4.22% |

| 2020 | 133.6 | -0.37% | 160.6 | 4.69% | 183.6 | 3.20% |

| 2021 | 138.7 | 3.82% | 186.7 | 16.25% | 199.7 | 8.77% |

| 2022 | 145.4 | 4.83% | 204.9 | 9.75% | 218.2 | 9.26% |

| 2023 | 148.1 | 1.86% | 211.3 | 3.12% | 248.1 | 13.70% |

| 2024 | 154.8 | 4.52% | 223.5 | 5.77% | 257.3 | 3.71% |

| Average growth rate | – | 1.66% | – | 4.46% | – | 4.65% |

One key reason for this trend is the strong demand from HDB upgraders and owner-occupiers, who form a significant portion of the buyer base in the OCR and RCR. With rising HDB resale prices in recent years, many homeowners have gained stronger purchasing power, allowing them to upgrade to private condominiums. These buyers may be more price-sensitive and prefer developments in the city fringe or suburban areas, where they can get larger units at a lower price per square foot compared to the CCR.

Rental yield is another consideration that has worked in favour of the OCR and RCR developments. These properties typically offer better rental yields than those in the CCR, mainly due to their lower entry prices. Investors looking to generate rental income may be more inclined to purchase properties in the RCR or OCR, where they can achieve higher yields compared to the CCR, where rental returns tend to be compressed due to high purchase prices.

Lastly, market cycles and economic uncertainty have also played a role in shaping these trends. Over the past decade, government cooling measures have had a more significant impact on the CCR, where investment demand is higher. For example, the ABSD rate on foreign buyers has doubled to 60%, and affluent foreign investors make up a significant buyer demographic in the CCR.

During periods of economic uncertainty, such as the current volatile global economy, buyers also tend to become more cautious, prioritising affordability and practicality over luxury and prestige. This has further fueled demand for RCR and OCR projects, reinforcing their stronger price performance compared to CCR developments.

The key question is whether Aurea will follow the broader trend of RCR properties outperforming CCR properties.

Sub sale and resale price comparison (2024)

Next, we will examine the sub sale and resale prices of these developments in 2024 and compare them against Aurea. We will focus only on similar unit types across the different projects. Given that unit sizes vary, we will use the smallest available unit size for each type, unless there are comparable sizes across developments.

| City Gate (Only resale) | % difference in price compared to Aurea at varying percentile range | ||||||

| Unit type | Size (sqft) | Average $PSF | Average price | Starting $PSF of $2,856 | 10% | 20% | 30% |

| 2-bedroom | |||||||

| 2-bedroom 1-bathroom | 560 | $2,144 | $1,199,781 | 51.16% | 66.27% | 81.39% | 96.50% |

| 2-bedroom 2-bathroom (Dual key) | 710 | $2,111 | $1,499,697 | 35.21% | 48.73% | 62.25% | 75.77% |

| 3-bedroom | |||||||

| 3-bedroom (Dual key) | 904 | $1,969 | $1,780,330 | 60.58% | 76.64% | 92.70% | 108.75% |

More from Stacked

Irwell Hill Residences Review: Surprisingly Expansive Grounds + Good Entry Price

Irwell Hill Residences offers a very spacious ground with a good entry price, especially if we consider this to be…

| Midtown Modern (Only sub sale) | % difference in price compared to Aurea at varying percentile range | ||||||

| Unit type | Size (sqft) | Average $PSF | Average price | Starting $PSF of $2,856 | 10% | 20% | 30% |

| 2-bedroom | |||||||

| 2-bedroom 2-bathroom | 721 | $3,328 | $2,400,120 | -15.51% | -7.07% | 1.38% | 9.83% |

| 3-bedroom | |||||||

| 3-bedroom | 1066 | $2,815 | $2,999,777 | -4.70% | 4.83% | 14.36% | 23.89% |

As there has only been one sub sale transaction done for Midtown Bay so far, we have included the new sale transactions from launch till date.

| Midtown Bay (Sub sale and new sale from launch till date) | % difference in price compared to Aurea at varying percentile range | ||||||

| Unit type | Size (sqft) | Average $PSF | Average price | Starting $PSF of $2,856 | 10% | 20% | 30% |

| 2-bedroom | |||||||

| 2-bedroom 2-bathroom | 732 | $3,168 | $2,319,084 | -12.56% | -3.82% | 4.93% | 13.67% |

| 3-bedroom | |||||||

| 3-bedroom | 1324 | $2,672 | $3,538,089 | -19.20% | -11.12% | -3.04% | 5.04% |

While City Gate is the closest project to Aurea in terms of location, it is a decade older, which may impact its price performance.

Midtown Bay still has unsold units though, making it a more relevant benchmark for comparison; so buyers considering Aurea are likely to assess it against Midtown Bay.

To provide deeper insights, we will analyse pricing trends and floor plans across various unit types. This will help us assess their relative value and appeal, offering a clearer picture of how Aurea stacks up against its competitors.

2-bedroom

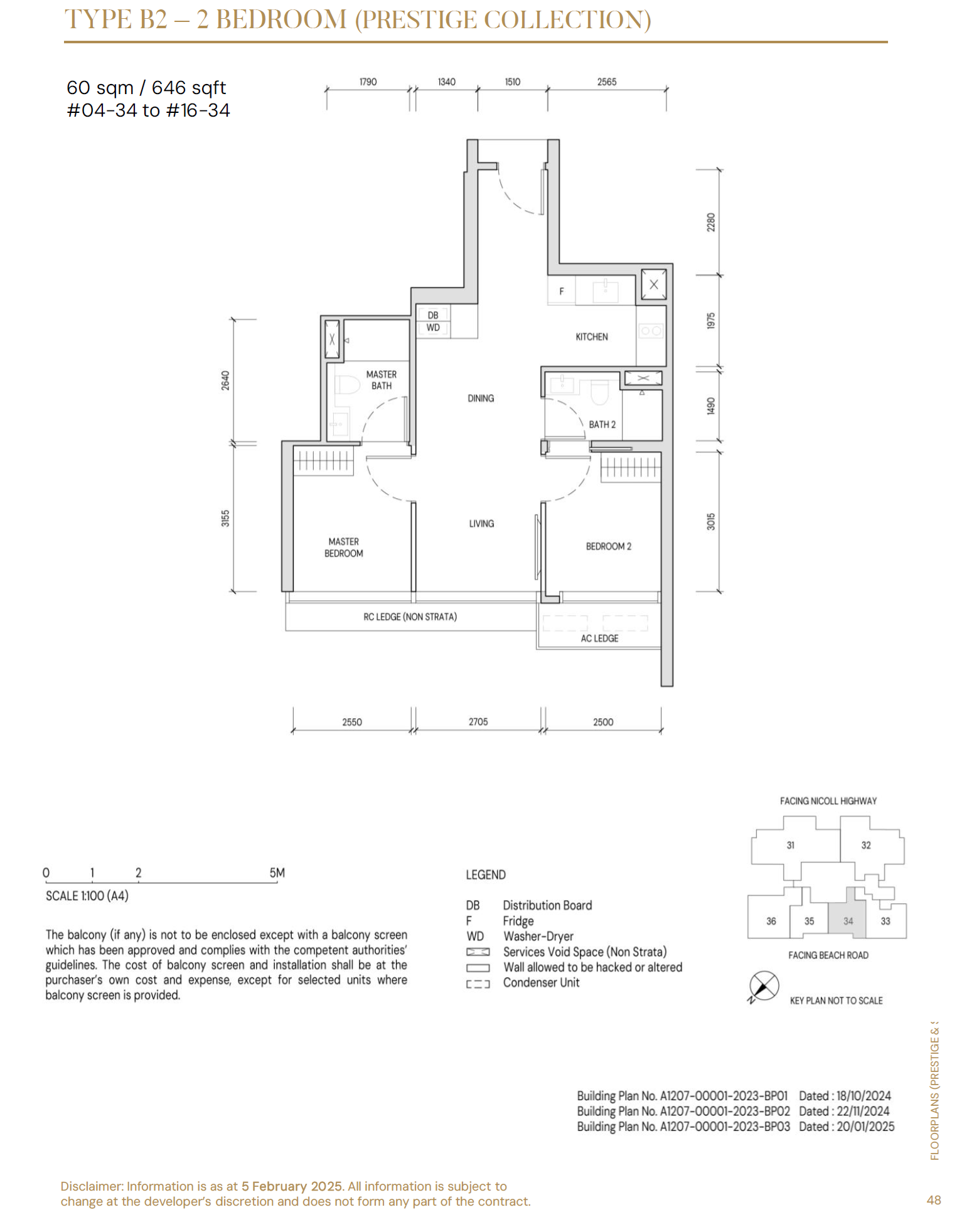

All 2-bedroom units in Aurea come with 2 bedrooms and 2 bathrooms.

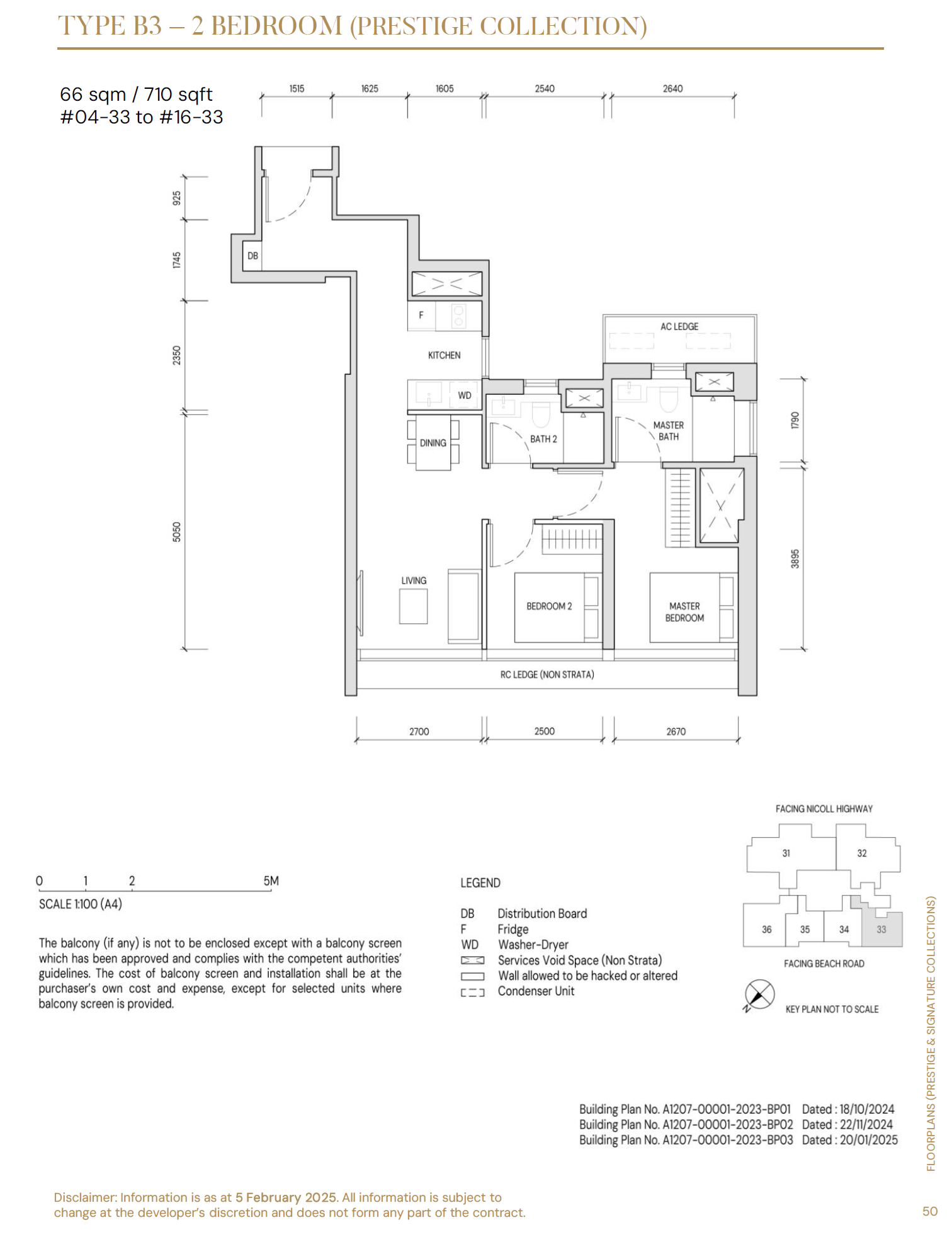

Aurea – 646/710 sqft

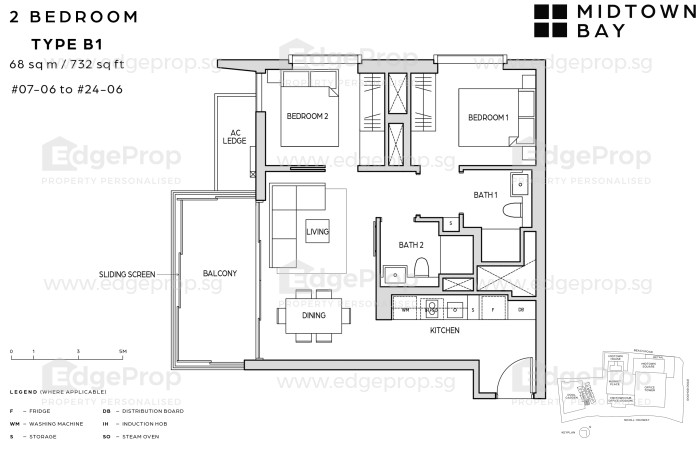

Midtown Bay – 732 sqft

Aurea offers three different 2-bedroom layouts, two of which are dumbbell layouts (635 and 646 sqft), with the largest being a 710 sqft unit. In contrast, Midtown Bay’s smallest 2-bedroom, 2-bathroom unit is 732 sqft. For this comparison, we’ll focus on the 710 sqft unit at Aurea and the 732 sqft unit at Midtown Bay.

One significant difference is that all of Aurea’s 2-bedroom units lack a balcony. For buyers who prioritise outdoor space, this could be a drawback. However, the absence of a balcony allows for more interior space. At Aurea, the living and dining areas are distinctly separated, which offers a more defined layout. In Midtown Bay, however, the living and dining areas are combined in a more open-plan space. The sizable balcony at Midtown Bay could also serve as an alfresco dining area, effectively freeing up more room inside for the living area, giving it a more spacious feel overall.

Another key difference lies in the kitchens. The layout of Aurea’s kitchen allows it to be enclosed if preferred, though this might make the space feel slightly cramped. However, it benefits from a small window, improving ventilation. On the other hand, while the kitchen at Midtown Bay can also be enclosed, it lacks a window, meaning there is no natural ventilation to alleviate cooking fumes.

Aurea also offers a small foyer area, which provides additional privacy, especially for those who prefer to leave their doors open. However, the small walkway from the foyer to the living/dining area might feel like a wasted space. Midtown Bay, in contrast, has a more efficient layout.

When comparing prices, based on the average starting $PSF of $2,856 for Aurea, its 710 sqft unit would cost almost 13% less than the average price of a 732 sqft unit in Midtown Bay. This price difference translates to a savings of approximately $291,324, which is quite significant. Even if Aurea’s prices were to increase by 10%, it would still be nearly 4% cheaper than the Midtown Bay unit.

3-bedroom

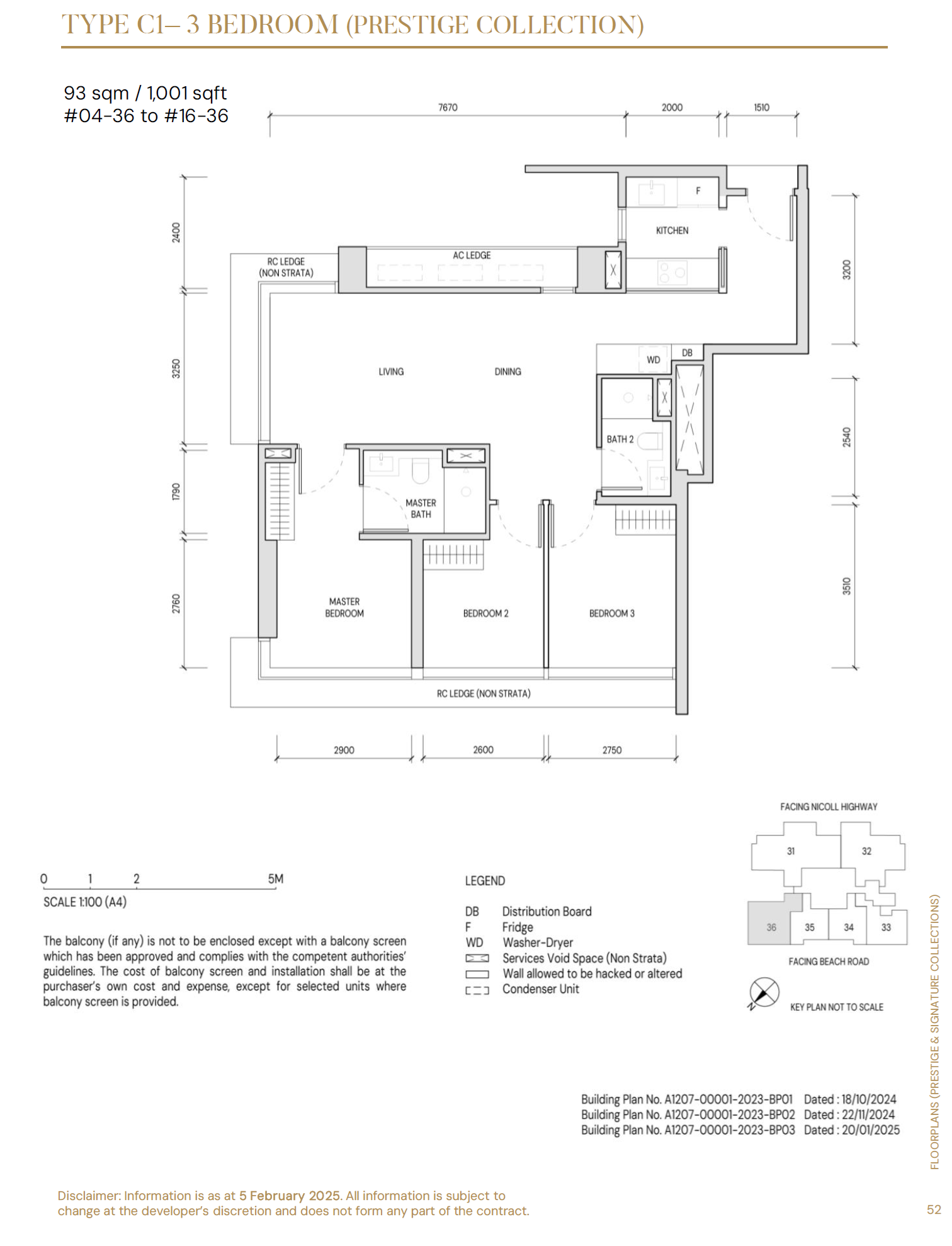

Aurea – 1,001 sqft

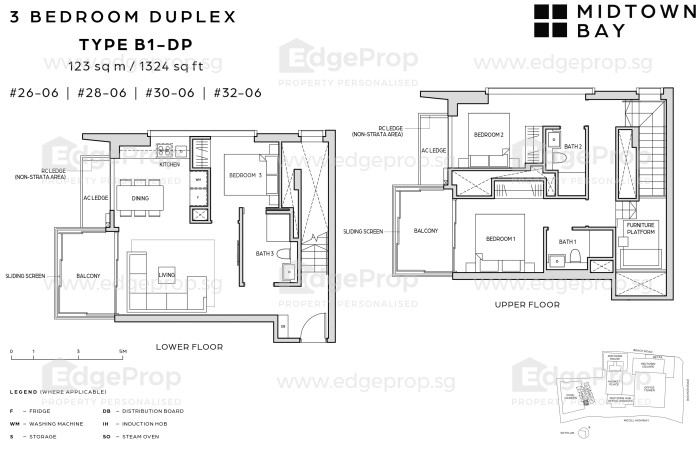

Midtown Bay – 1,324 sqft

Both Aurea and Midtown Bay offer a single 3-bedroom layout, but three key differences stand out:

- The Midtown Bay unit is a duplex, while Aurea’s unit is a single-level apartment.

- Aurea’s 3-bedroom units do not come with balconies, unlike Midtown Bay, which offers two balconies—one on the lower floor and another on the upper floor.

- Aurea has two bathrooms, while Midtown Bay offers three—one for each bedroom, adding extra convenience and luxury.

While Midtown Bay’s units are larger, the inclusion of multiple balconies, air-con ledges, and stairs, means that the actual livable space may not be considerably bigger than Aurea. In contrast, Aurea offers a highly efficient layout with minimal wasted space, ensuring that most areas of the unit are well-sized and functional. While the kitchen is slightly compact, it is enclosed, which might be more desirable for those who prefer to separate cooking from the living areas.

Midtown Bay on the other hand features an open-concept kitchen, which faces the dining area, and is quite compact. However, this may not be ideal for homeowners who do a lot of heavy cooking, unless they are comfortable with frequent cleaning. The kitchen area can be enclosed by relocating the dining area to the balcony. One of the major advantages of Midtown Bay, however, is that it has three ensuite bedrooms, offering added convenience, particularly for larger families.

In terms of pricing, based on the average starting $PSF of $2,856 for Aurea, the 3-bedroom unit at Aurea will cost 19% less than the average price of a 3-bedroom unit at Midtown Bay. This price difference amounts to approximately $679,233, which is significant.

Given that Aurea and Midtown Bay are less than a 15-minute walk apart, both are close to MRT stations, and both are surrounded by a wide range of amenities, buyers may find that Aurea offers more value for money.

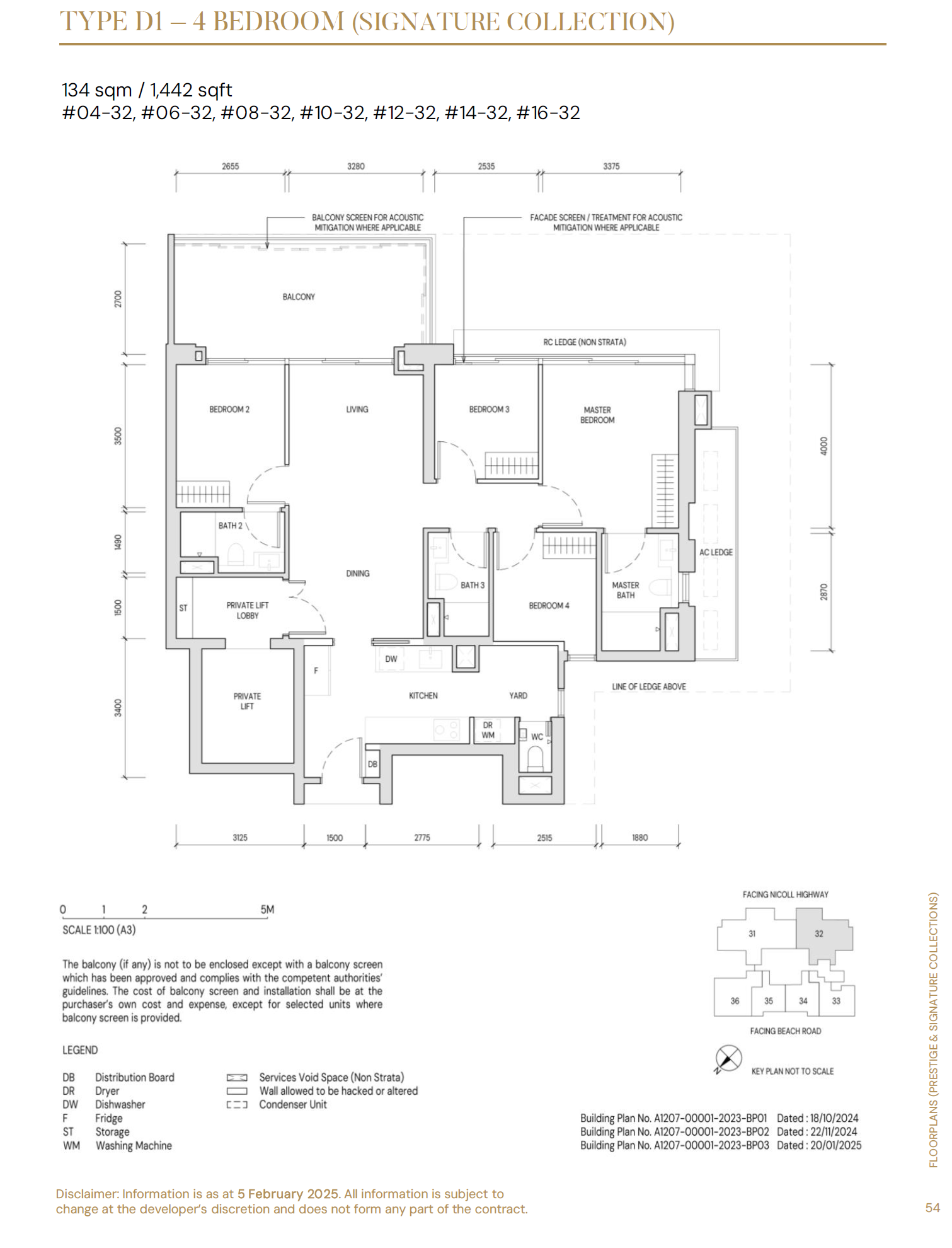

4-bedroom

As there are no 4-bedders in Midtown Bay, for this unit type, we will compare it against the Midtown Modern 4-bedroom unit.

Aurea – 1,442 sqft

Midtown Modern – 1,442 sqft

These two 4-bedroom units are identical in size at 1,442 sqft and share several similarities:

- Both come with a private lift for enhanced privacy.

- Each has two ensuite bedrooms, two common bedrooms, and one common bathroom.

- Both kitchens include a yard and WC.

However, there are a few key differences:

- While both have a dumbbell layout, Aurea’s design is more efficient, with fewer walkways compared to Midtown Modern.

- Both feature spacious balconies, but Aurea’s extends from the living room to Bedroom 2 and is accessible from both areas. In contrast, Midtown Modern’s balcony is only connected to the living room.

- Aurea’s kitchen is more squarish, potentially making it feel more spacious than Midtown Modern’s, which is long and narrow. Additionally, Midtown Modern has a home shelter in the kitchen, whereas Aurea does not.

- Aurea’s living and dining areas are clearly separated, whereas Midtown Modern combines them into a shared space.

So far, no 4-bedroom units in Midtown Modern have been sold on the resale market. For comparison, we will use the project’s average price of $2,956 PSF, which translates to $4,262,552 for a 1,442 sqft unit. Based on Aurea’s starting price of $2,856 PSF, it will be approximately 3.5% more affordable than Midtown Modern.

Given Aurea’s more efficient layout and lower price point, it does present a compelling alternative.

Potential buyers

The Bugis/Beach Road area has a relatively old stock of flats with limited supply. As a result, it’s unlikely that HDB upgraders will form a large pool of potential buyers in this area.

To better understand the buyer profiles in District 7, we analysed transactions over the past five years, excluding developments with fewer than five transactions.

| Project | Previous Address Before Purchase | Total Transactions | % Of Private Buyers | % Of HDB Upgraders | ||

| Private | HDB | Unknown | ||||

| Burlington Square | 20 | 9 | 29 | 69% | 31% | |

| City Gate | 42 | 22 | 64 | 66% | 34% | |

| Concourse Skyline | 73 | 21 | 94 | 78% | 22% | |

| Duo Residences | 55 | 18 | 73 | 75% | 25% | |

| Midtown Bay | 61 | 24 | 18 | 103 | 59% | 23% |

| Midtown Modern | 363 | 89 | 111 | 563 | 64% | 16% |

| South Beach Residences | 15 | 2 | 17 | 88% | 12% | |

| Southbank | 24 | 19 | 43 | 56% | 44% | |

| Sunshine Plaza | 18 | 6 | 24 | 75% | 25% | |

| Textile Centre | 19 | 10 | 29 | 66% | 34% | |

| The Bencoolen | 39 | 34 | 1 | 74 | 53% | 46% |

| The M | 298 | 144 | 93 | 535 | 56% | 27% |

| The Plaza | 23 | 6 | 29 | 79% | 21% | |

| Total | 1050 | 404 | 223 | 1677 | 63% | 24% |

While there are still HDB upgraders in the area, the majority of buyers already own private properties prior to their District 7 purchase.

Next, let’s examine the supply of private properties in District 7. Given that the projects listed above have shown decent turnover rates, we will focus on developments with at least five transactions over the last five years, excluding those with lower turnover.

| Project | Tenure | Completion year | Total number of units |

| Burlington Square | 99-years | 1998 | 179 |

| City Gate | 99-years | 2018 | 311 |

| Concourse Skyline | 99-years | 2014 | 360 |

| Duo Residences | 99-years | 2017 | 660 |

| Midtown Bay | 99-years | 2024 | 219 |

| Midtown Modern | 99-years | 2025 | 558 |

| South Beach Residences | 99-years | 2016 | 190 |

| Southbank | 99-years | 2010 | 197 |

| Sunshine Plaza | 99-years | 2001 | 160 |

| Textile Centre | 99-years | 1977 | 132 |

| The Bencoolen | 99-years | 1998 | 94 |

| The M | 99-years | 2023 | 522 |

| The Plaza | 99-years | 1979 | 234 |

| Total | – | – | 3816 |

| Project | No. of 1-bedroom units | No. of 2-bedroom units | No. of 3-bedroom units | No. of 4-bedroom units | No. of 5-bedroom units | % of 1 and 2 bedders |

| Aurea | 84 | 28 | 56 | 20 | 44.68% | |

| Burlington Square | 32 | 110 | 34 | 3 | 79.33% | |

| City Gate | 44 | 216 | 48 | 3 | 83.60% | |

| Concourse Skyline | 242 | 69 | 16 | 30 | 3 | 86.39% |

| Duo Residences | 367 | 194 | 59 | 34 | 6 | 85.00% |

| Midtown Bay | 107 | 104 | 8 | 96.35% | ||

| Midtown Modern | 168 | 139 | 139 | 111 | 1 | 55.02% |

| South Beach Residences | 87 | 66 | 37 | 45.79% | ||

| Sunshine Plaza | 18 | 64 | 78 | 51.25% | ||

| The M | 233 | 272 | 17 | 96.74% | ||

| Total | 1211 | 1339 | 493 | 274 | 30 |

*Southbank, Textile Centre, The Bencoolen and The Plaza were not included due to the lack of data on their unit mixes

Number of sub sale and resale transactions over the last 5 years

| Project | 2020 | 2021 | 2022 | 2023 | 2024 | % of project sold in 2024 |

| Burlington Square | 6 | 6 | 4 | 5 | 8 | 4.47% |

| City Gate | 4 | 15 | 17 | 9 | 19 | 6.11% |

| Concourse Skyline | 10 | 25 | 17 | 19 | 23 | 6.39% |

| Duo Residences | 5 | 16 | 11 | 19 | 22 | 3.33% |

| Midtown Bay | 1 | 1 | 0.00% | |||

| Midtown Modern | 2 | 3 | 0.54% | |||

| South Beach Residences | 7 | 6 | 1 | 1 | 2 | 1.05% |

| Southbank | 6 | 15 | 4 | 6 | 12 | 6.09% |

| Sunshine Plaza | 6 | 7 | 4 | 4 | 3 | 1.88% |

| Textile Centre | 3 | 9 | 6 | 6 | 5 | 3.79% |

| The Bencoolen | 5 | 5 | 4 | 58 | 2 | 1.10% |

| The M | 3 | 10 | 1.92% | |||

| The Plaza | 3 | 10 | 5 | 4 | 7 | 2.99% |

| Total | 55 | 114 | 74 | 137 | 116 | 2.97% |

From the tables above, we can observe that despite a decent supply of units in the area, the secondary market transaction volume remains relatively low, at just under 3% last year.

Additionally, there is a higher supply of smaller unit types such as 1- and 2-bedroom units, while larger unit types are notably less common. This low resale transaction volume could suggest a couple of possibilities: either investors are holding on to their units for rental income or in anticipation of a price increase, or homeowners purchasing in the area are opting for smaller units and choosing to live in them rather than reselling.

Could the conservation status of the development affect its pricing?

The conservation status of Aurea could have an impact on its pricing, though its effects may vary depending on several factors.

The Golden Mile Complex, completed in 1973, was a pioneering modernist building and was conserved in 2021 as part of Singapore’s broader effort to preserve post-independence architecture. Its conservation status sets it apart from many other conserved buildings, which are typically from the colonial era. As the first large-scale strata-titled building to be conserved, Golden Mile Complex holds unique historical and architectural significance, which could positively influence the market’s perception of the development.

However, this conservation status can be a double-edged sword. On one hand, it can attract buyers who appreciate the building’s heritage and desire to live in a culturally significant project. On the other hand, conservation status means certain restrictions are imposed, such as limitations on redevelopment or modifications to the exterior of the building.

Conservation often enhances the exclusivity of a property, and as more post-independence buildings like Golden Mile Complex are conserved, there may be a growing sense of nostalgia or appreciation for modernist architecture, leading to increased demand down the road, but this is hard to predict.

We have previously written a piece discussing whether it is worth paying the price premium for a conservation house, which you can read here.

Conclusion

Aurea offers a well-balanced unit mix compared to many other developments in the area, which often feature a higher proportion of smaller units like 1- and 2-bedroom apartments. Notably, Aurea does not offer any 1-bedroom units, and its 2-bedroom units account for about 45% of the project, with the remaining units consisting of 3- and 4-bedroom configurations. This mix suggests that the developer aims to target a diverse pool of buyers, including both investors and homeowners.

In general, projects with a higher percentage of investor-owned units tend to experience more price volatility and may not perform as well in terms of long-term value. Investors are often more focused on short-term gains and may be more inclined to sell or flip their properties if better opportunities arise. In contrast, homeowners typically develop a stronger emotional attachment to their properties and are less likely to sell at a loss unless necessary. As a result, developments with a higher proportion of owner-occupiers tend to see more stable price growth. Therefore, Aurea’s relatively balanced unit mix could contribute to its price stability, which could be a positive factor for mid to long-term investment.

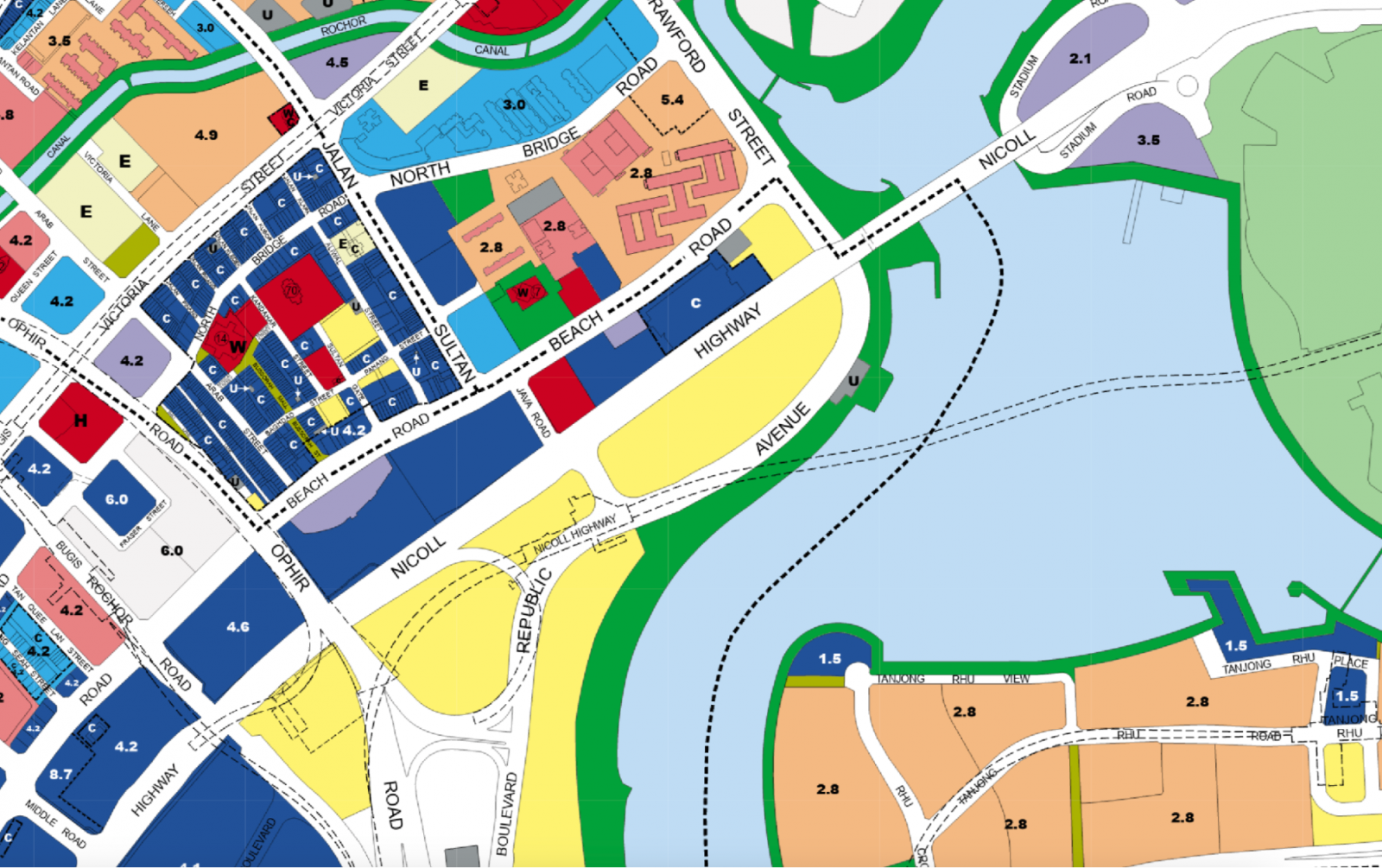

Aurea’s average starting $PSF of $2,856 places it above the price point of recent RCR launches, but below the prices of nearby projects like Midtown Modern and Midtown Bay. This competitive pricing could position Aurea as an attractive option for buyers seeking value in a well-located development. Furthermore, according to the Master Plan, the land plots next to and across from Aurea are currently reserved, which means that their intended use has not yet been determined.

Whether these plots are developed into residential or commercial properties, they could have a positive impact on Aurea’s value.

If the sites are developed into residential properties, particularly new condominiums, this could lead to higher prices in the area, supporting Aurea’s pricing. On the other hand, if they are designated for commercial use, it could further enhance the liveability of the surrounding area, which could, in turn, benefit the residential market. While the timeline for these developments remains uncertain, it is important to consider the potential long-term benefits they could bring to Aurea.

Another factor to consider is Aurea’s layout. The absence of balconies in its 2- and 3-bedroom units may deter some buyers, as balconies have increasingly become a desired feature in modern condominium living. While the inclusion of a balcony is a subjective preference, it remains an important consideration for many buyers who view it as essential to their lifestyle.

Ultimately, whether Aurea proves to be a good value buy will depend on how much its $PSF increases above the starting price.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Matthew Kwan

Matt read Law in university but has since traded legal statutes for the world of high finance on weekdays. On weekends, he delves into his keen interest in real estate, which has taken him to more 150 new and resale developments since the age of 16. Since first writing for Stacked, Matt has made his first home purchase and continues to appreciate the evolving trends of today's market. In his free time, Matt goes on walks and writes about (more) real estate on his personal Instagram page @propertyzaikiaNeed help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

0 Comments