EC vs Resale Flat: How Much More Can You End Up Paying?

September 21, 2020

Google ECs versus resale flats, and you’ll encounter any number of sites warning you that resale flats have poor appreciation compared to executive condos.

This is actually true. We’ve said in previous articles that, for over almost a decade, resale flats haven’t appreciated as well as executive condos.

But that aside, capital appreciation is not the sole concern for every Singaporean. Affordability is also a big issue; there’s no point buying an EC for “better appreciation”, and then be forced to sell it because you run out of funds.

It’s also important to look at the numbers in more detail; such as the bigger cash outlay, higher maintenance fees, property taxes, etc.

Here’s a comparison between a “typical” EC and resale flat:

Key cost differences:

- Overall price difference

- Availability of grants

- Initial cash outlay

- Monthly loan repayments

- Maintenance fees

- Property taxes

- Renovation cost differences

1. Overall price difference

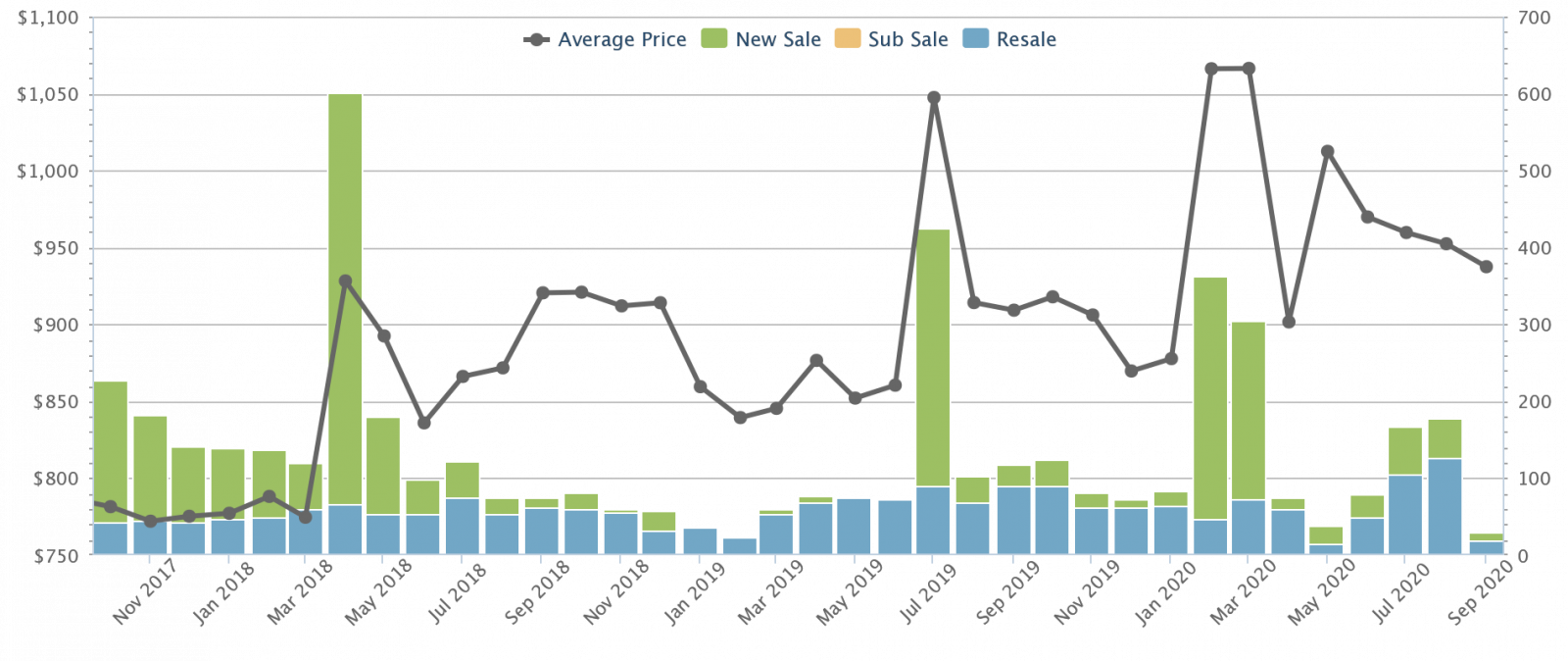

The most obvious difference between ECs and resale flats is the quantum (overall price). This is what it looks like across Singapore at the moment:

Island-wide, the typical EC project costs around $937 psf. The most common-sized EC unit for families today is between 1,050 to 1,200 sq.ft (note that this is close to the size of a five-room flat, which averages 1,184 sq. ft.)

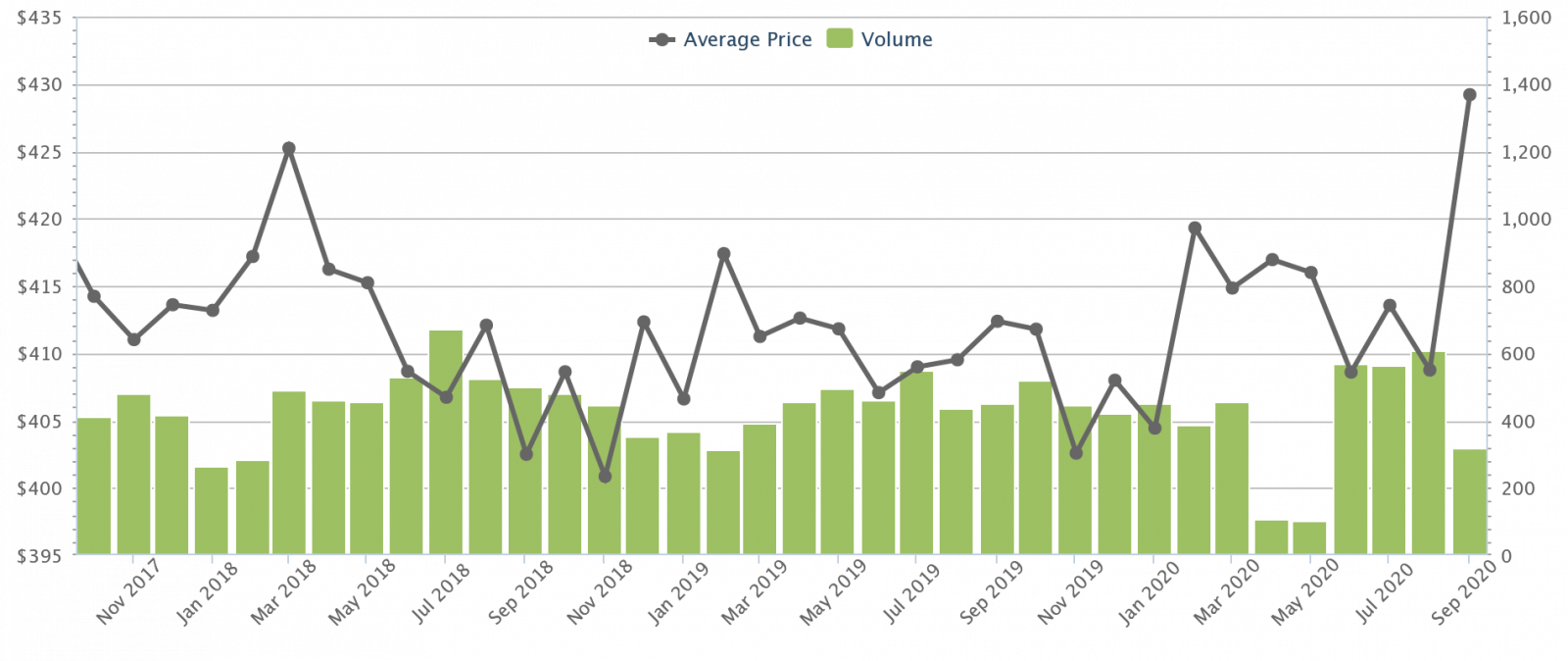

The average price of resale five-room flats, across Singapore, is currently about $429 psf:

This suggests that on average, an EC is more than double the price (118.4 per cent higher) than resale flats on a per square foot basis.

If we go by average quantum, the typical EC today costs about $1.04 million overall. Conversely, via our own data, the average quantum of a five-room flat today is about $524,000.

So home buyers should be aware that – on average – they will pay more than twice the price for an EC, compared to an equivalent sized resale flat. This is something to bear in mind, the next time you hear that ECs appreciate better than HDB flats.

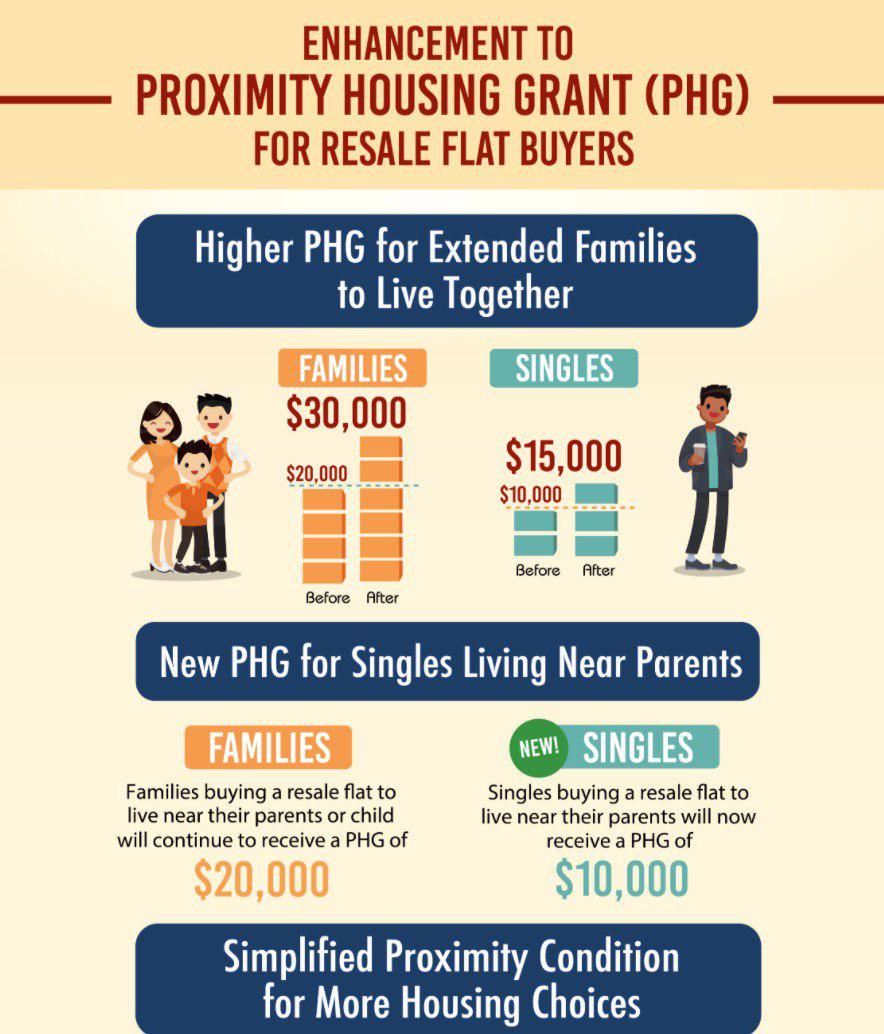

2. Availability of grants

The maximum possible grants for a resale flat add up to $160,000 (although it’s improbable for most Singaporeans to get the full amount). These are:

- Family Grant – up to $50,000 (or up to $40,000 for five-room or larger flats)

- Enhanced CPF Housing Grant (EHG) – up to $80,000

- Proximity Housing Grant (PHG) – up to $30,000

(Please refer to the HDB website to see the qualifying requirements for each of the grants)

For ECs, however, you can only get a Family Grant of up to $30,000.

On a practical level, however, you wouldn’t even be considering an EC if you could qualify for the full $160,000 of grants (e.g. your average monthly household income can’t be above $1,500 to get the full EHG, and you can’t buy reasonably buy an EC at that income level anyway).

So it’s reasonable to mainly just consider the PHG and family grant.

In terms of the Family Grant, you could lose out on up to $10,000; that’s the difference between the $40,000 grant for five-room or bigger resale flats, versus the $30,000 Family Grant for ECs.

Property AdviceCPF Accrued Interest: Why You Should Not Pay For Your HDB With CPF

by Sean Goh3. Initial cash outlay

As there are no HDB loans for ECs, you’ll have to use a bank or other financial institution.

For resale ECs:

You need to make a minimum down payment of 25 per cent of the property. In addition, the first five per cent of the property must be paid in cash.

So with regard to a $1.04 million EC, for instance, you would pay at minimum $52,000 in cash, and $208,000 in any combination of cash or CPF.

For ECs still under construction:

You need to pay five per cent of the property in cash, to make the booking. Within nine weeks of the date of option, you pay another 15 per cent in any combination of cash or CPF.

For a $1.04 million new EC, this means $52,000 in cash to book the unit, and then $156,000 in any combination of cash or CPF.

With a resale flat, you can choose to use an HDB loan or a bank loan.

HDB loan for resale flat:

The minimum down payment is 10 per cent of your flat price or valuation, whichever is lower. This is payable in cash or CPF. So for a $524,000 flat, you would pay $52,400; it’s possible for the full down payment to come from your CPF ($0 in hard cash).

Do note that your OA will be depleted before your loan is granted. So the maximum amount you can leave in your OA is $20,000 per person.

As an example, if you had $400,000 in your CPF OA, you would have to use $380,000 for your resale flat – no questions asked.

Bank loan for resale flat:

This is the same as the EC. On a $524,000 flat, you would pay at least $26,200 in cash, and $104,800 in any combination of cash or CPF.

The key difference between ECs and resale flats is the cash component of the down payment. You need to be prepared to fork out roughly $50,000 in cash for ECs in the $1 million range.

More from Stacked

I Bought My Parent’s Condo (For A Higher Price): Here’s What I’ve Learnt

Buying a property from your own parents should be less stressful; but as one reader shares with us, it’s also…

4. Monthly loan repayments

Say you take an HDB loan of $471,600 (for a $524,000 flat), with a loan tenure of 25 years. The interest rate for HDB loans is 2.6 per cent per annum. You’d pay about $2,140 per month, with cash or CPF.

For new ECs, you will make monthly home loan repayments via the progressive payment scheme. Say you use a 25-year loan, at 1.3 per cent per annum.

Assuming you borrow $780,000 (for a $1.04 million EC), your monthly repayments could look something like this:

- $174 per month (while laying foundations)

- $528 per month (while laying concrete)

- $700 per month (while building walls)

- $885 per month (while completing roofs)

(Just to give you an example)

And so on and so forth, until the condo is complete three years later. By then, monthly repayments would rise to about $2,729 per month. This can all be paid with cash or CPF.

For completed ECs, if you borrow $780,000 over 25 years at 1.3 per cent, you’d pay about $3,047 per month, via cash or CPF.

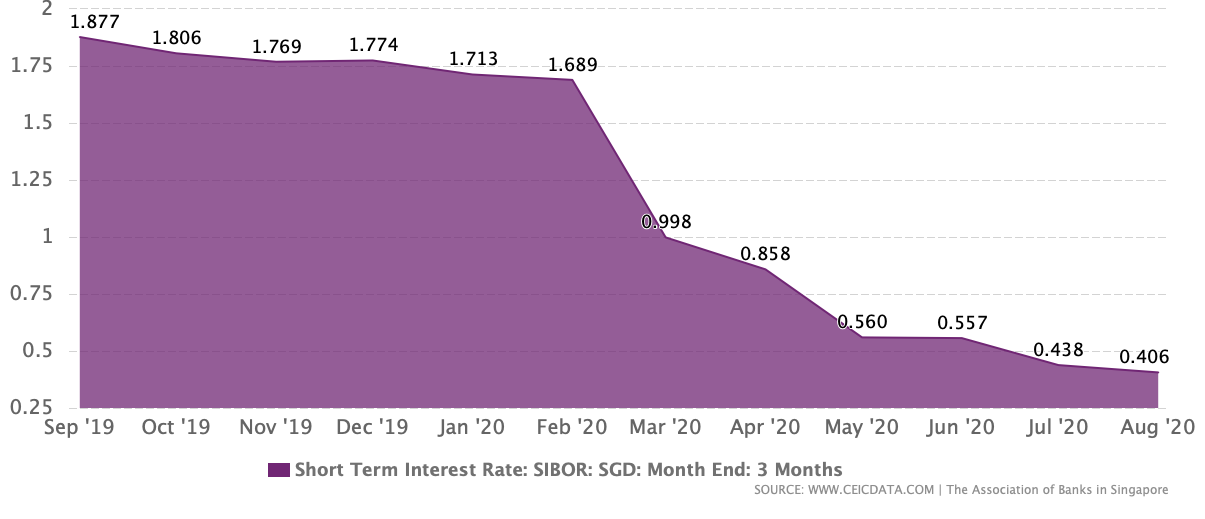

Don’t overlook the fact that bank loans have more volatile interest rates.

Bank interest rates are unpredictable. Today they’re about half the HDB loan rate; but if you go back to the 1990’s, you’ll see bank rates were around four per cent, while HDB loan rates were still at about the same rate as today.

This is a long-term cost factor to consider when buying ECs, and it’s more or less luck-based. If interest rates stay low, you’ll pay less interest for an EC than a flat. If interest rates go back to historic levels, you’ll pay even more interest for your EC than for a flat.

5. Maintenance fees

This one is straightforward. Some of the highest conservancy fees for five-room flats are about $90 a month.

As for an EC this is dependent on the size and range of facilities. To give you an example, the newly launched Ola EC which has one of the bigger ranges of facilities will have maintenance fees of between $300 – $440 per month.

6. Property taxes

Your (owner-occupied) property tax rate is based on the Annual Value (AV) of your house. This is estimated by IRAS, based on the likely rental income you could earn (even if you don’t rent the property)

You can use the IRAS tax calculator to work out the amount.

The median AV of a five-room flat, at the time of writing, is about $10,380. That’s about $95.20 in property tax.

The median AV of an EC, on the other hand, is $22,000. That’s about $560.

7. Renovation cost differences

This is a highly subjective area, as it depends on how you renovate.

What we can say is that ECs come with basic fixtures like sinks, toilet bowls, white goods, etc. and save you the cost of buying these. Also, ECs are built by private developers, which usually means higher-end finishing. You may find there’s no need to improve elements like the flooring.

Of course, all of this is moot if you decide to hack it up and renovate it to your liking anyway.

(Also, there’s nothing to stop you from more sparsely renovating a resale flat, thus making this a moot point again).

How much more do ECs cost?

To summarise, here are the definite cost differences between our example EC, and five-room resale flat:

- ECs cost about twice as much; in our example, a price difference of $516,000

- Our example has a minimum cash down of $52,000, versus a minimum cash down of $0 for the resale flat

- ECs can cost an additional $300 plus a month in terms of maintenance fees

- You would pay higher property tax; in our example, a higher difference of $464.80 for the EC

Here are the variable costs:

- You could end up paying $30,000 to $40,000 less due to resale flat grants (depending on the grants you qualify for, and assuming you’re at the income level to reasonably consider both options)

- You are likely to pay less interest on an EC than a resale flat, given that bank loans have been cheaper than HDB loans since around 2009 (but this is not guaranteed).

- You may or may not save on renovations for an EC

If you have an actual EC in mind, and are comparing to a flat, let us help you work out the exact numbers.

The above is based on an “average” EC versus an “average” five-room resale. The figures can differ significantly for specific ECs and HDB flats. Drop us a message on Facebook, so we can update you on how much more you can expect to spend.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much more does an executive condo typically cost compared to a resale flat?

What are the main differences in grants available for ECs and resale flats?

How does the initial down payment differ between buying an EC and a resale flat?

What are the differences in monthly loan repayments for ECs and resale flats?

How do maintenance fees and property taxes compare between ECs and resale flats?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

0 Comments