We Analysed Dual-Key Condo Units Across 2, 3 and 4 Bedders — And One Clear Pattern Emerged

November 25, 2025

Dual-key units have been an interesting property type to watch recently. Previously, we noted that dual-key units appeared to move more slowly at new launches, as of 2025. However, it’s challenging to draw a sweeping conclusion as to why: dual-key units have very different layouts and sizes, and not to mention, the transactions are low. To that end, we’ve taken a second look at dual-key units, in particular the resale projects, as we near the end of this year. Let’s see if the performance of dual-key units has shifted in any meaningful way this year.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The performance of dual-key two-bedders versus regular two-bedders

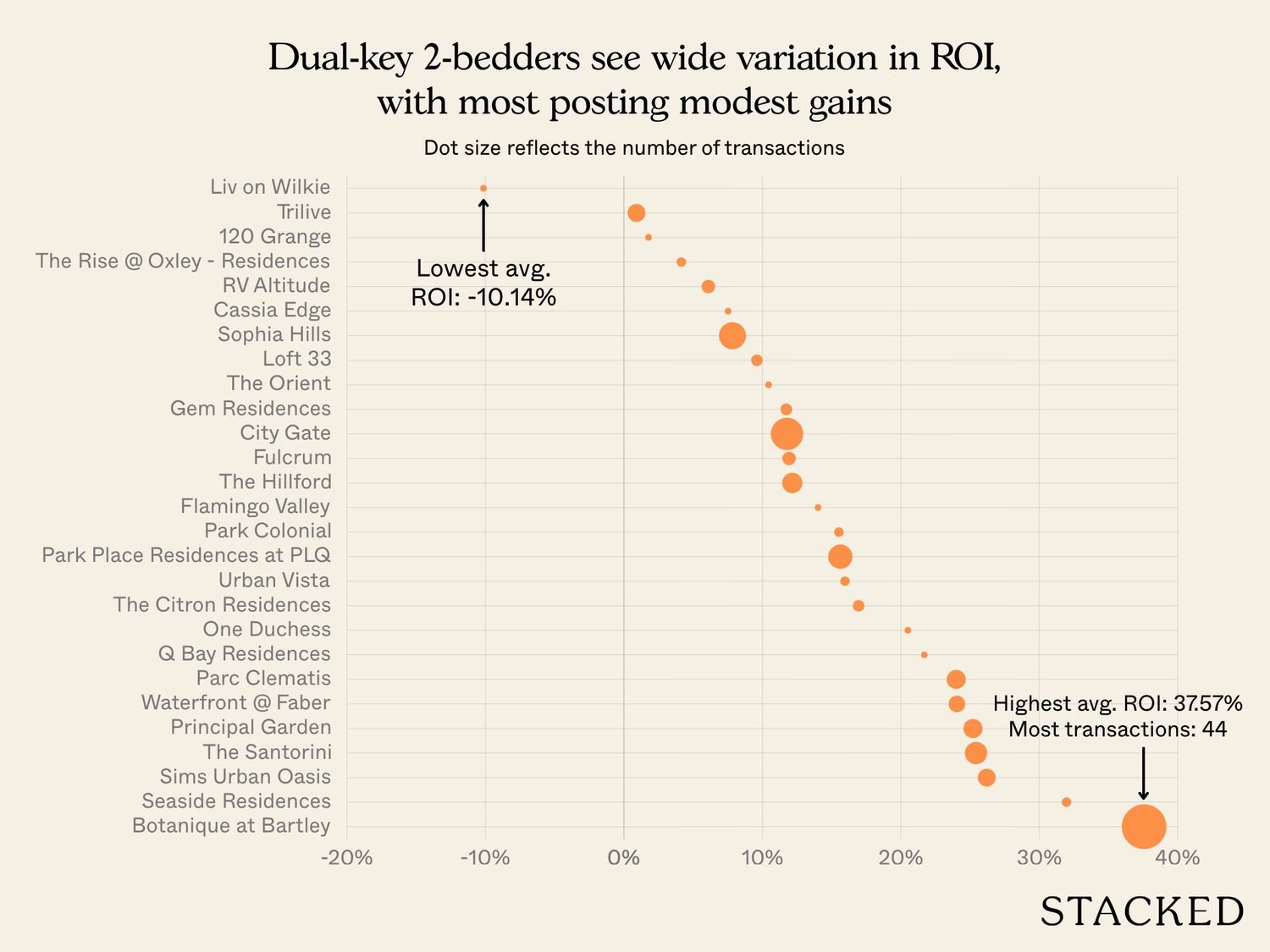

For the following, we looked at the resale performance of two-bedders (dual-key and regular) purchased in 2014 and after, and sold between 2024 to June 2025:

2-bedroom dual key units

| Project | Average ROI | No. of transactions |

| LIV ON WILKIE | -10.14% | 1 |

| TRILIVE | 0.91% | 7 |

| 120 GRANGE | 1.78% | 1 |

| THE RISE @ OXLEY – RESIDENCES | 4.15% | 2 |

| RV ALTITUDE | 6.10% | 4 |

| CASSIA EDGE | 7.53% | 1 |

| SOPHIA HILLS | 7.84% | 16 |

| LOFT 33 | 9.61% | 3 |

| THE ORIENT | 10.45% | 1 |

| GEM RESIDENCES | 11.73% | 3 |

| CITY GATE | 11.78% | 23 |

| FULCRUM | 11.93% | 4 |

| THE HILLFORD | 12.16% | 9 |

| FLAMINGO VALLEY | 14.02% | 1 |

| PARK COLONIAL | 15.53% | 2 |

| PARK PLACE RESIDENCES AT PLQ | 15.63% | 13 |

| URBAN VISTA | 15.97% | 2 |

| THE CITRON RESIDENCES | 16.95% | 3 |

| ONE DUCHESS | 20.51% | 1 |

| Q BAY RESIDENCES | 21.70% | 1 |

| PARC CLEMATIS | 24.00% | 8 |

| WATERFRONT @ FABER | 24.05% | 6 |

| PRINCIPAL GARDEN | 25.21% | 8 |

| THE SANTORINI | 25.43% | 11 |

| SIMS URBAN OASIS | 26.21% | 7 |

| SEASIDE RESIDENCES | 31.97% | 2 |

| BOTANIQUE AT BARTLEY | 37.57% | 44 |

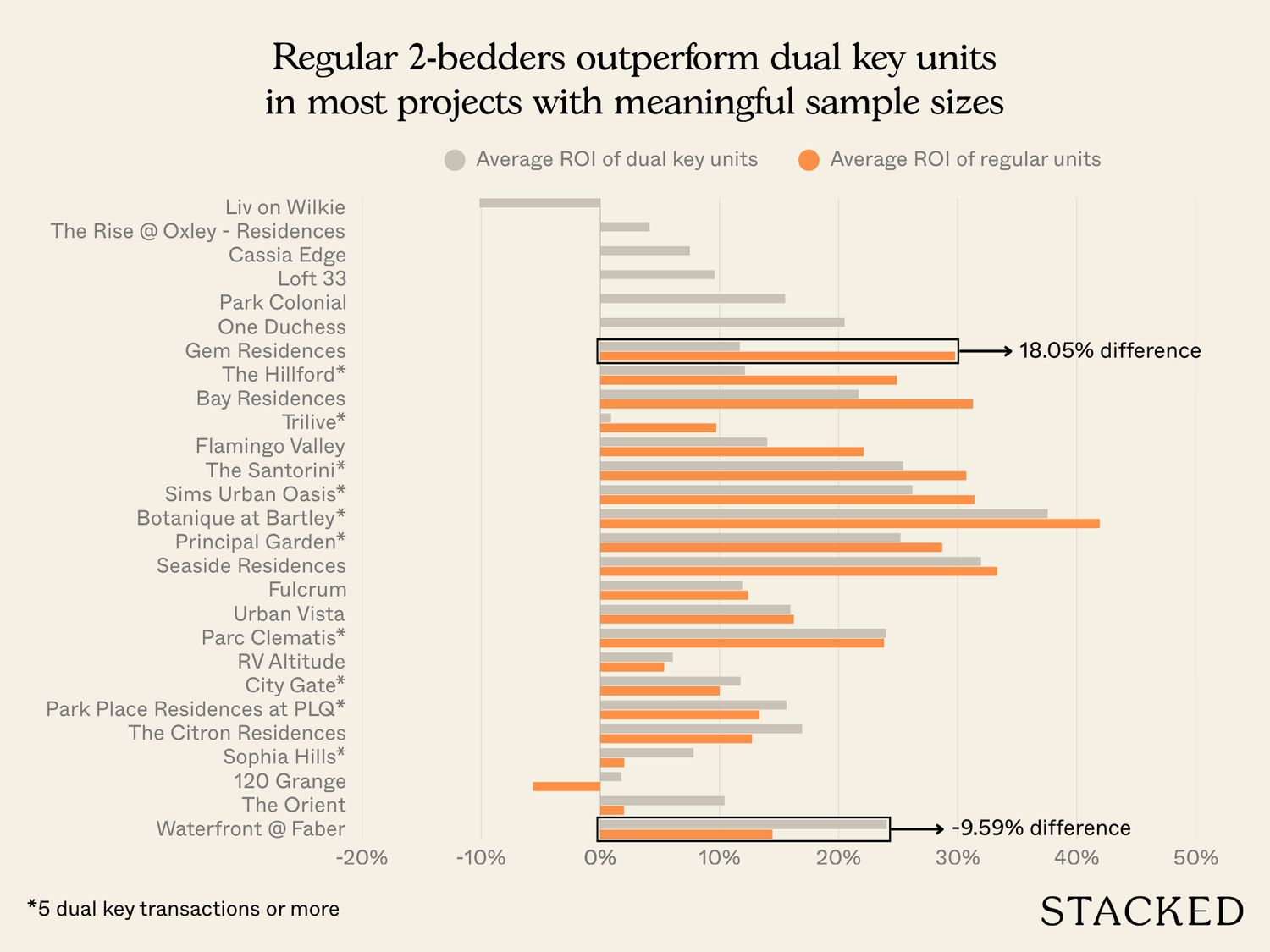

2-bedroom dual key vs regular units

| Project | Average ROI of dual key units | Average ROI of regular units | Difference |

| LIV ON WILKIE | -10.14% | – | – |

| THE RISE @ OXLEY – RESIDENCES | 4.15% | – | – |

| CASSIA EDGE | 7.53% | – | – |

| LOFT 33 | 9.61% | – | – |

| PARK COLONIAL | 15.53% | – | – |

| ONE DUCHESS | 20.51% | – | – |

| GEM RESIDENCES | 11.73% | 29.78% | 18.05% |

| THE HILLFORD | 12.16% | 24.92% | 12.77% |

| Q BAY RESIDENCES | 21.70% | 31.29% | 9.59% |

| TRILIVE | 0.91% | 9.75% | 8.84% |

| FLAMINGO VALLEY | 14.02% | 22.12% | 8.10% |

| THE SANTORINI | 25.43% | 30.73% | 5.30% |

| SIMS URBAN OASIS | 26.21% | 31.44% | 5.23% |

| BOTANIQUE AT BARTLEY | 37.57% | 41.93% | 4.37% |

| PRINCIPAL GARDEN | 25.21% | 28.71% | 3.49% |

| SEASIDE RESIDENCES | 31.97% | 33.32% | 1.35% |

| FULCRUM | 11.93% | 12.43% | 0.50% |

| URBAN VISTA | 15.97% | 16.26% | 0.29% |

| PARC CLEMATIS | 24.00% | 23.83% | -0.16% |

| RV ALTITUDE | 6.10% | 5.38% | -0.72% |

| CITY GATE | 11.78% | 10.04% | -1.75% |

| PARK PLACE RESIDENCES AT PLQ | 15.63% | 13.38% | -2.25% |

| THE CITRON RESIDENCES | 16.95% | 12.74% | -4.21% |

| SOPHIA HILLS | 7.84% | 2.02% | -5.81% |

| 120 GRANGE | 1.78% | -5.67% | -7.45% |

| THE ORIENT | 10.45% | 2.01% | -8.44% |

| WATERFRONT @ FABER | 24.05% | 14.46% | -9.59% |

One issue with comparisons is that dual-key units are more scarce than conventional units, so transaction volumes are lower. Most projects above only showed one or two dual-key transactions. As such, we should take this with the proverbial grain of salt, but it could provide an episodic glimpse of which way the dual-key demand might be tilting.

But let’s work with what we have. In total, we have 11 projects with more than five dual-key transactions. Six projects saw regular two-bedders achieving a higher ROI, whilst in the remaining five, the dual-key units performed better.

Overall, regular two-bedders tended to deliver stronger resale performance on average, but a six-to-five win rate hardly makes that decisive.

There are also benefits to the dual-key that aren’t reflected in ROI alone.

Because the dual-key layout makes rental easier (each one is effectively two separate studios), they can sometimes fetch higher combined rent than a conventional two-bedder. As this is a rental issue, it’s not reflected in the ROI.

In addition, note that dual-key units count as a single unit for tax purposes, thus avoiding ABSD. A landlord can find substantial savings in renting out the sub-unit of their dual key, as opposed to buying a whole other unit for rental.

More from Stacked

Tour An Old 1980 Everton Park Transformation: How A Couple Achieved A Monochrome Look With A $110k Reno Budget

The term monochrome is often very much misunderstood when it comes to interior design.

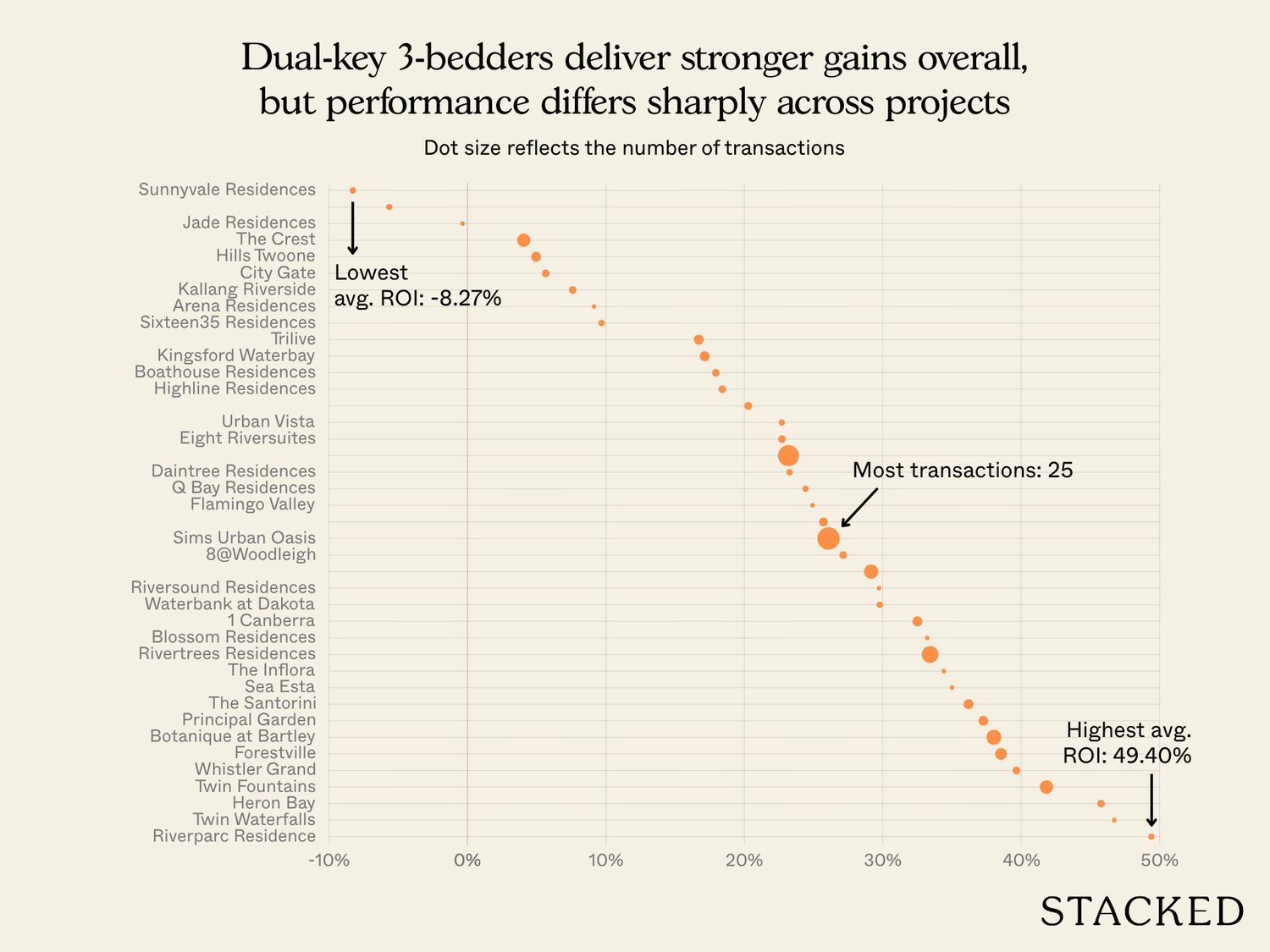

Now let’s take a look at dual-key three-bedders, versus their regular counterparts

3-bedroom dual key units

| Project | Average ROI | No. of transactions |

| SUNNYVALE RESIDENCES | -8.27% | 2 |

| THE RISE @ OXLEY – RESIDENCES | -5.64% | 2 |

| JADE RESIDENCES | -0.34% | 1 |

| THE CREST | 4.07% | 9 |

| HILLS TWOONE | 4.96% | 5 |

| CITY GATE | 5.66% | 3 |

| KALLANG RIVERSIDE | 7.60% | 3 |

| ARENA RESIDENCES | 9.15% | 1 |

| SIXTEEN35 RESIDENCES | 9.69% | 2 |

| TRILIVE | 16.71% | 5 |

| KINGSFORD WATERBAY | 17.14% | 5 |

| BOATHOUSE RESIDENCES | 17.94% | 3 |

| HIGHLINE RESIDENCES | 18.41% | 3 |

| GEM RESIDENCES | 20.28% | 3 |

| URBAN VISTA | 22.71% | 2 |

| EIGHT RIVERSUITES | 22.72% | 3 |

| RIVERBANK @ FERNVALE | 23.19% | 22 |

| DAINTREE RESIDENCE | 23.27% | 2 |

| Q BAY RESIDENCES | 24.42% | 2 |

| FLAMINGO VALLEY | 24.93% | 1 |

| COCO PALMS | 25.72% | 4 |

| SIMS URBAN OASIS | 26.08% | 25 |

| 8@WOODLEIGH | 27.14% | 3 |

| PARC CLEMATIS | 29.16% | 10 |

| RIVERSOUND RESIDENCE | 29.73% | 1 |

| WATERBANK AT DAKOTA | 29.78% | 2 |

| 1 CANBERRA | 32.50% | 5 |

| BLOSSOM RESIDENCES | 33.20% | 1 |

| RIVERTREES RESIDENCES | 33.42% | 14 |

| THE INFLORA | 34.41% | 1 |

| SEA ESTA | 35.00% | 1 |

| THE SANTORINI | 36.19% | 5 |

| PRINCIPAL GARDEN | 37.26% | 5 |

| BOTANIQUE AT BARTLEY | 38.02% | 11 |

| FORESTVILLE | 38.54% | 7 |

| WHISTLER GRAND | 39.65% | 3 |

| TWIN FOUNTAINS | 41.82% | 9 |

| HERON BAY | 45.76% | 3 |

| TWIN WATERFALLS | 46.72% | 1 |

| RIVERPARC RESIDENCE | 49.40% | 2 |

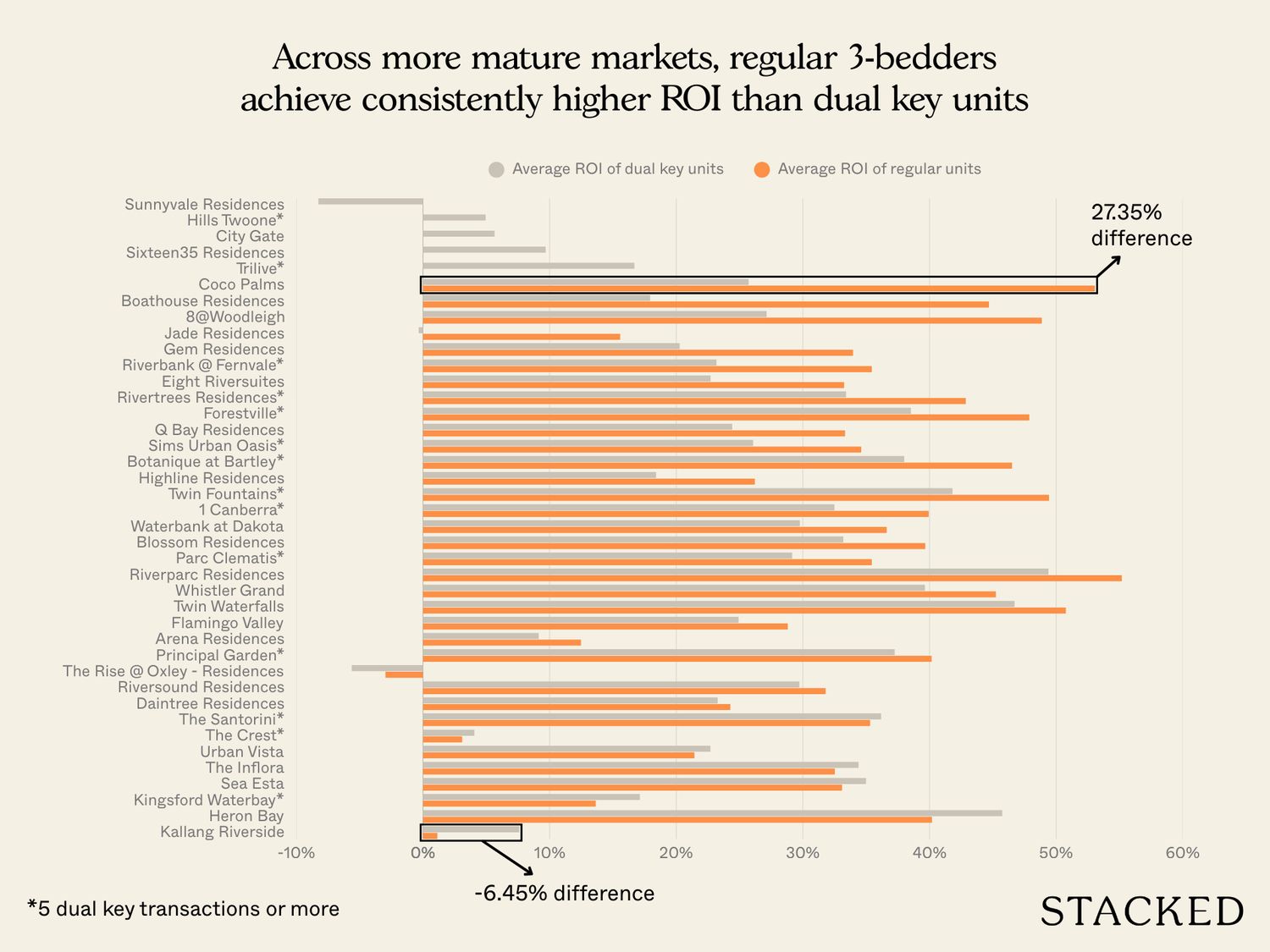

3-bedroom dual key vs regular units

| Project | Average ROI of dual key units | Average ROI of regular units | Difference |

| SUNNYVALE RESIDENCES | -8.27% | – | – |

| HILLS TWOONE | 4.96% | – | – |

| CITY GATE | 5.66% | – | – |

| SIXTEEN35 RESIDENCES | 9.69% | – | – |

| TRILIVE | 16.71% | – | – |

| COCO PALMS | 25.72% | 53.07% | 27.35% |

| BOATHOUSE RESIDENCES | 17.94% | 44.70% | 26.76% |

| 8@WOODLEIGH | 27.14% | 48.88% | 21.74% |

| JADE RESIDENCES | -0.34% | 15.58% | 15.92% |

| GEM RESIDENCES | 20.28% | 33.97% | 13.69% |

| RIVERBANK @ FERNVALE | 23.19% | 35.45% | 12.26% |

| EIGHT RIVERSUITES | 22.72% | 33.27% | 10.56% |

| RIVERTREES RESIDENCES | 33.42% | 42.88% | 9.46% |

| FORESTVILLE | 38.54% | 47.89% | 9.34% |

| Q BAY RESIDENCES | 24.42% | 33.34% | 8.92% |

| SIMS URBAN OASIS | 26.08% | 34.61% | 8.53% |

| BOTANIQUE AT BARTLEY | 38.02% | 46.52% | 8.50% |

| HIGHLINE RESIDENCES | 18.41% | 26.22% | 7.80% |

| TWIN FOUNTAINS | 41.82% | 49.44% | 7.62% |

| 1 CANBERRA | 32.50% | 39.94% | 7.44% |

| WATERBANK AT DAKOTA | 29.78% | 36.63% | 6.85% |

| BLOSSOM RESIDENCES | 33.20% | 39.67% | 6.47% |

| PARC CLEMATIS | 29.16% | 35.45% | 6.29% |

| RIVERPARC RESIDENCE | 49.40% | 55.19% | 5.79% |

| WHISTLER GRAND | 39.65% | 45.25% | 5.59% |

| TWIN WATERFALLS | 46.72% | 50.78% | 4.06% |

| FLAMINGO VALLEY | 24.93% | 28.81% | 3.88% |

| ARENA RESIDENCES | 9.15% | 12.49% | 3.34% |

| PRINCIPAL GARDEN | 37.26% | 40.18% | 2.93% |

| THE RISE @ OXLEY – RESIDENCES | -5.64% | -2.98% | 2.66% |

| RIVERSOUND RESIDENCE | 29.73% | 31.81% | 2.08% |

| DAINTREE RESIDENCE | 23.27% | 24.28% | 1.01% |

| THE SANTORINI | 36.19% | 35.32% | -0.88% |

| THE CREST | 4.07% | 3.10% | -0.97% |

| URBAN VISTA | 22.71% | 21.44% | -1.27% |

| THE INFLORA | 34.41% | 32.53% | -1.88% |

| SEA ESTA | 35.00% | 33.10% | -1.90% |

| KINGSFORD WATERBAY | 17.14% | 13.65% | -3.49% |

| HERON BAY | 45.76% | 40.20% | -5.56% |

| KALLANG RIVERSIDE | 7.60% | 1.15% | -6.45% |

Among three-bedders, the regular units tended to outperform dual-key counterparts as well. That said, some projects still saw respectable results for dual-key layouts. As with two-bedders though, this ignores the rental element.

As an aside, note that the spread for the dual-key ROIs (from -8 per cent to 46 per cent) is much wider than for regular units (20 to 50 per cent), so the dual-key three-bedders seem to be much more volatile.

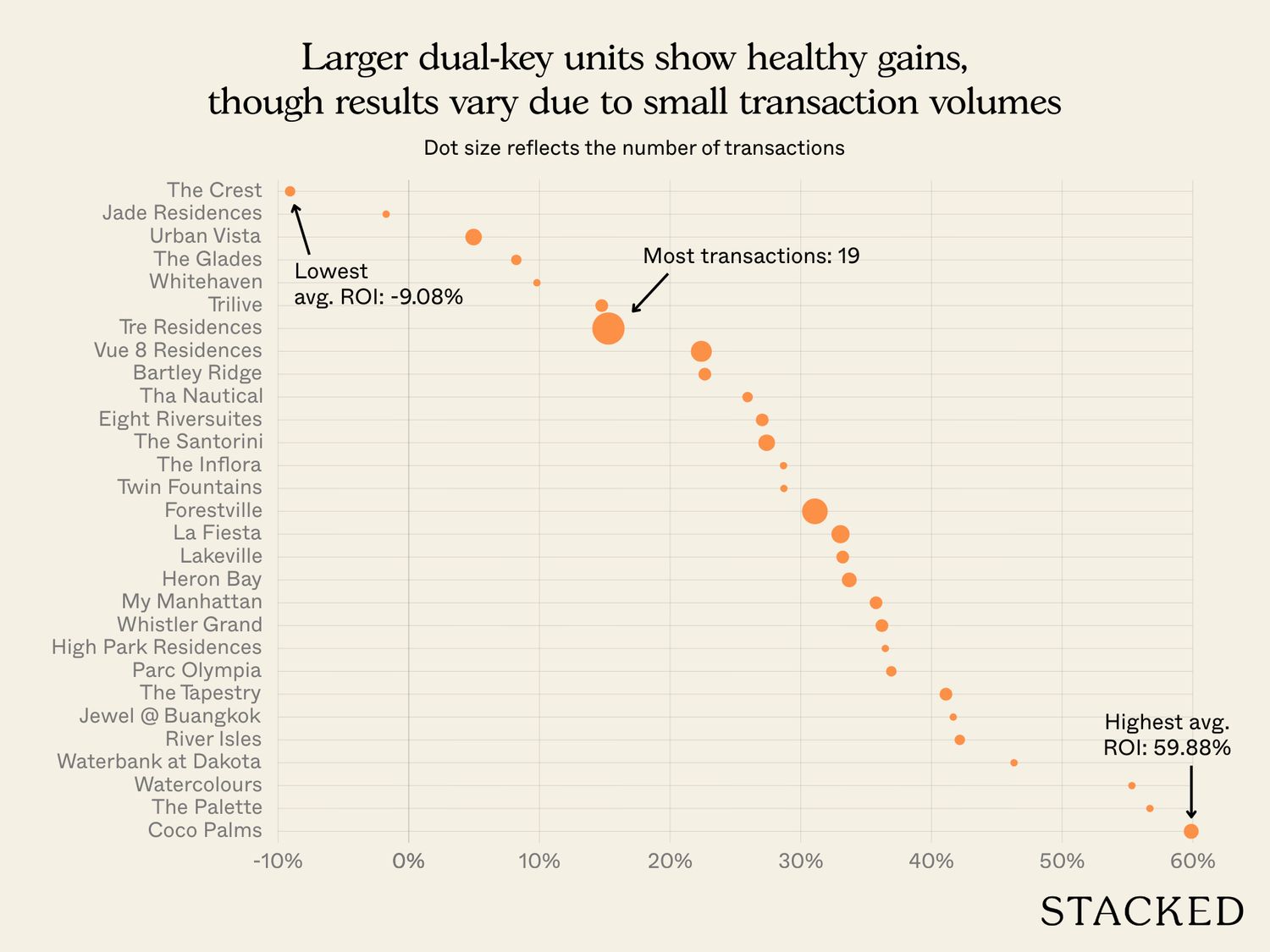

Now, let’s take a look at four-bedder dual key units

4-bedroom dual key units

| Project | Average ROI | No. of transactions |

| THE CREST | -9.08% | 2 |

| JADE RESIDENCES | -1.73% | 1 |

| URBAN VISTA | 4.96% | 5 |

| THE GLADES | 8.23% | 2 |

| WHITEHAVEN | 9.81% | 1 |

| TRILIVE | 14.77% | 3 |

| TRE RESIDENCES | 15.28% | 19 |

| VUE 8 RESIDENCE | 22.39% | 8 |

| BARTLEY RIDGE | 22.66% | 3 |

| THE NAUTICAL | 25.93% | 2 |

| EIGHT RIVERSUITES | 27.05% | 3 |

| THE SANTORINI | 27.39% | 5 |

| THE INFLORA | 28.68% | 1 |

| TWIN FOUNTAINS | 28.71% | 1 |

| FORESTVILLE | 31.08% | 12 |

| LA FIESTA | 33.04% | 6 |

| LAKEVILLE | 33.21% | 3 |

| HERON BAY | 33.71% | 4 |

| MY MANHATTAN | 35.76% | 3 |

| WHISTLER GRAND | 36.21% | 3 |

| HIGH PARK RESIDENCES | 36.47% | 1 |

| PARC OLYMPIA | 36.93% | 2 |

| THE TAPESTRY | 41.11% | 3 |

| JEWEL @ BUANGKOK | 41.67% | 1 |

| RIVER ISLES | 42.17% | 2 |

| WATERBANK AT DAKOTA | 46.32% | 1 |

| WATERCOLOURS | 55.34% | 1 |

| THE PALETTE | 56.72% | 1 |

| COCO PALMS | 59.88% | 4 |

4-bedroom dual key vs regular units

| Project | Average ROI of dual key units | Average ROI of regular units | Difference |

| JADE RESIDENCES | -1.73% | – | – |

| URBAN VISTA | 4.96% | – | – |

| WHITEHAVEN | 9.81% | – | – |

| TRILIVE | 14.77% | – | – |

| TRE RESIDENCES | 15.28% | – | – |

| EIGHT RIVERSUITES | 27.05% | – | – |

| MY MANHATTAN | 35.76% | – | – |

| PARC OLYMPIA | 36.93% | – | – |

| JEWEL @ BUANGKOK | 41.67% | – | – |

| WATERBANK AT DAKOTA | 46.32% | – | – |

| HIGH PARK RESIDENCES | 36.47% | 77.99% | 41.51% |

| VUE 8 RESIDENCE | 22.39% | 46.14% | 23.74% |

| TWIN FOUNTAINS | 28.71% | 51.71% | 23.00% |

| THE GLADES | 8.23% | 30.96% | 22.74% |

| LA FIESTA | 33.04% | 50.59% | 17.55% |

| FORESTVILLE | 31.08% | 48.21% | 17.13% |

| BARTLEY RIDGE | 22.66% | 38.22% | 15.56% |

| THE NAUTICAL | 25.93% | 35.84% | 9.91% |

| THE SANTORINI | 27.39% | 36.96% | 9.57% |

| HERON BAY | 33.71% | 42.36% | 8.65% |

| THE INFLORA | 28.68% | 36.06% | 7.38% |

| THE CREST | -9.08% | -3.23% | 5.85% |

| LAKEVILLE | 33.21% | 38.69% | 5.49% |

| THE TAPESTRY | 41.11% | 44.04% | 2.93% |

| RIVER ISLES | 42.17% | 44.47% | 2.30% |

| WHISTLER GRAND | 36.21% | 37.55% | 1.34% |

| THE PALETTE | 56.72% | 43.41% | -13.31% |

| WATERCOLOURS | 55.34% | 37.80% | -17.54% |

| COCO PALMS | 59.88% | 26.84% | -33.04% |

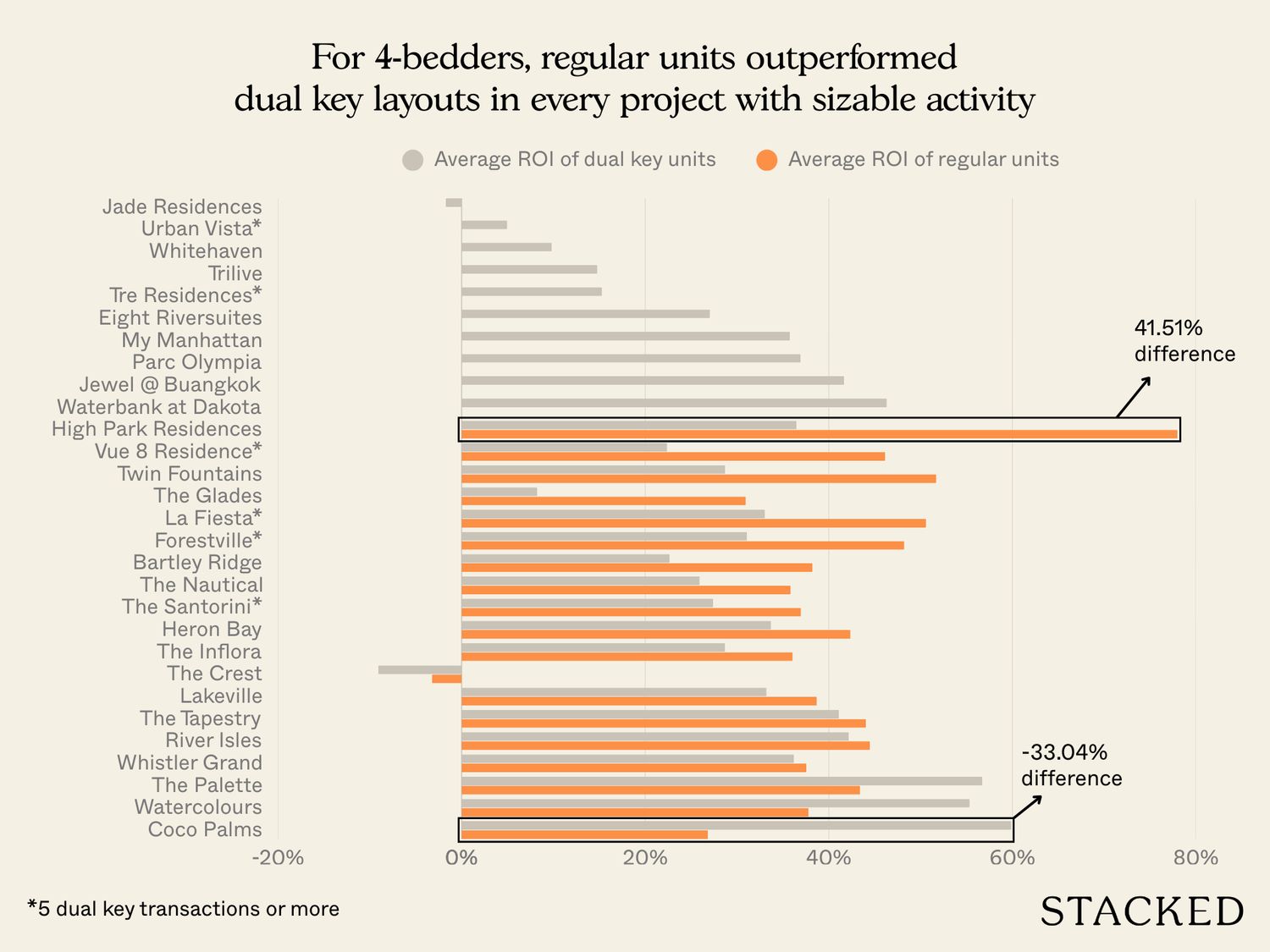

Just like in the two- and three-bedder segments, regular four-bedders consistently achieved higher average ROI than their dual-key equivalents. Among projects with more than five dual-key transactions – such as High Park Residences, Forestville, La Fiesta, and Vue 8 Residence – every one saw regular units outperform.

The difference can be quite substantial. In High Park Residences, regular four-bedders averaged roughly 42 per cent higher ROI, while Vue 8 Residence and Twin Fountains showed gaps of 23 per cent and 22 per cent, respectively.

This is not entirely unexpected though, as large dual-key units are something of a niche product. Landlords will typically aim for smaller units, to avoid the high quantum of a four-bedder; so these units tend to be bought for other reasons, such as intergenerational living while maintaining privacy.

Conclusion:

Data is limited, unfortunately; so it’s hard to draw definite conclusions still. From what we can see, however, our end-of-year update suggests regular units are still a safer bet for now; and also that the ROI gap was smallest for two-bedder units.

Plausibly, the dual-key layout works better for more compact units; perhaps not surprising, since its layout is angled at rental. Landlords tend to prefer smaller units with a lower quantum; and there’s a rentability edge versus one-bedders, in that unrelated roommates still maintain their privacy.

We can also see that, as of late 2025, dual-key four-bedders are still the struggling segment. Across every project with meaningful sales volume (High Park Residences, La Fiesta, Forestville, Vue 8 Residence, and Twin Fountains), the regular four-bedders consistently achieved far higher ROIs.

This is also somewhat consistent with recent trends, where buyers have focused on a lower quantum for more accessible properties. We’ve also seen this translate in the new launch market, where for certain projects, the four-bedder dual-key units have been slow to move. As such, some developers have taken steps to reconfigure them to regular four-bedder units. In short, you might consider a dual-key unit if renting out is a big part of your plan; but not so much for resale gains. In addition, keeping to a smaller unit might help with the eventual exit strategy.

Do keep in mind, however, that this is based on a small number of transactions to date – and that trends can change quickly in a dynamic market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are dual-key condos good for investment resale?

How does the rental potential compare between dual-key and regular units?

Do dual-key units have advantages for property owners?

Are smaller dual-key units more profitable than larger ones?

Should I buy a dual-key unit for resale gains?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

0 Comments