Does This Mean The Foreigner ABSD Is Going To Be Lowered Soon?

June 9, 2024

Why do we have so many new land plots for sale in prime areas right now?

For those who have been keeping track of new land releases in Singapore, it may seem like bit of a puzzle why the government has released land plots in some very pricey areas late:

And a few others in places like Bukit Timah (Turf City), or where you find residents who consider real Bird’s Nest to be a casual beverage.

This is in the immediate aftermath of ABSD measures, which raised stamp duties on foreigners to 60 per cent. And as we’ve pointed out in previous articles, prime areas bear the brunt of this. These are the preferred locations for wealthy foreigners, who are now disincentivised; but that hardly means the average Singaporean is going to be buying a condo in Orchard Boulevard.

From word on the ground, viewings at properties have also been dropping; Singaporeans already struggle with fringe region family units reaching $2 million, so it’s going to be a narrow slice of the population that would go for prime region new launches. Even developers know enough to be nervous, with the recent failure of the Marina Crescent site being an example.

In any case, given Singapore’s declining birth rates and the current high foreigners ABSD it points to either an increase in foreigners in the future or a relaxation of the ABSD rules.

And in light of how much prices rose during Covid, it may be high time we saw the release of more land in OCR areas. This will raise the number of homes for the average Singaporean, with more palatable prices. But in the meantime, raising the supply in prime areas – whoever may be buying – will just apply even more downward pressure than the ABSD in the region.

(Unless that is the deliberate intent, and the government has a long term game plan of making sure more locals aren’t priced out of our city centre maybe?)

Also this week, I was told by some people that Singapore really needs rent control

I don’t think this is out of the question for locals who need to rent. As some of you know, I dislike the mentality that – just because very few Singaporeans rent – we allow landlords to pretty much have things their way.

But there’s something seemingly few people remember or know: we have had rent control in Singapore before. It even lasted surprisingly long, with the final rent-controlled areas ending only in 2001 under the Control of Rent (Abolition) Act.

In the aftermath of WWII (around 1947), Singapore actually did have rent control, due to a surging need for accommodation after the Japanese Occupation. But because there was a need to encourage new construction to raise supply, there was a compromise: the rent control only applied to buildings that were built in ‘47 or before.

Worst. Idea. Ever.

Way to crush our architectural heritage, since the owners of the older buildings just stopped renovating them, and let them become slums. Why would they bother? Rent couldn’t go up. This was the period in which shophouses – which were the bulk of rent-controlled assets – were actually among the worst properties to own, unlike today.

More from Stacked

We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

When the Stacked editorial team were brainstorming ideas for the first new PRO series of 2026, I can truthfully say…

Eventually the government started to remove rent controls, but they had to do it one area at a time, while keeping pace with the rising availability of new construction (otherwise you just get a lot of homeless people, if you remove all the rent control at one go).

This was what created the Golden Shoe Area in the city centre, in 1970 (the area around Raffles Place to Cecil Road). This was the first area where rent control was removed, and property values here boomed; so now you know how the name came about.

From the ‘70s to ‘80s, rent control was gradually removed from parts of the city, right up till the final end in ‘01. And with the removal of rent control, there was also renewed interest in buildings like shophouses.

So it’s not that we haven’t tried it before; and hopefully we’ve learned our lesson if we decide to try it again.

Meanwhile in other property news…

- Freehold two-bedder units for $960,000 or under? That’s not a bad deal for a young couple, here’s where to find them.

- Using the bank of mom and dad to buy a home? Think through the potential consequences first.

- Should you get an HDB flat, or a cheaper resale condo? Here’s something to think about in the 2024 market.

- There are still condos that are $800 psf in the 2024 market, and this is where you’ll find them.

Weekly Sales Roundup (27 May – 02 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RESERVE RESIDENCES | $4,346,488 | 1625 | $2,674 | 99 yrs (2021) |

| GRAND DUNMAN | $3,665,000 | 1432 | $2,560 | 99 yrs (2022) |

| 19 NASSIM | $3,600,000 | 1109 | $3,247 | 99 yrs (2019) |

| TEMBUSU GRAND | $3,352,000 | 1432 | $2,341 | 99 yrs (2022) |

| THE CONTINUUM | $3,121,000 | 1087 | $2,871 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLHAVEN | $1,482,546 | 700 | $2,119 | 99 yrs (2023) |

| LENTORIA | $1,498,000 | 732 | $2,047 | 99 yrs (2022) |

| HILLOCK GREEN | $1,628,000 | 710 | $2,292 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,677,300 | 732 | $2,292 | 99 yrs (2023) |

| THE MYST | $1,855,000 | 850 | $2,181 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE PARK | $11,850,000 | 2885 | $4,108 | FH |

| NOUVEL 18 | $7,500,000 | 2476 | $3,029 | FH |

| CAIRNHILL CREST | $3,930,000 | 1733 | $2,268 | FH |

| FLORIDIAN | $3,828,000 | 1658 | $2,309 | FH |

| TANGLIN VIEW | $3,450,000 | 2121 | $1,627 | 99 yrs (1997) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NOTTINGHILL SUITES | $718,000 | 398 | $1,803 | FH |

| ESPIRA SUITES | $745,000 | 441 | $1,688 | FH |

| HIGH PARK RESIDENCES | $750,000 | 474 | $1,584 | 99 yrs (2014) |

| ROSEWOOD SUITES | $783,000 | 667 | $1,173 | 99 yrs (2008) |

| KINGSFORD . HILLVIEW PEAK | $800,000 | 527 | $1,517 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ARDMORE PARK | $11,850,000 | 2885 | $4,108 | $2,650,000 | 4 Years |

| CITY SQUARE RESIDENCES | $2,900,000 | 1518 | $1,911 | $1,820,000 | 15 Years |

| TANGLIN VIEW | $3,450,000 | 2121 | $1,627 | $1,620,000 | 17 Years |

| THOMSON 800 | $2,850,000 | 1625 | $1,753 | $1,600,000 | 23 Years |

| CLOVER BY THE PARK | $3,180,000 | 1744 | $1,824 | $1,490,000 | 13 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| NOUVEL 18 | $7,500,000 | 2476 | $3,029 | -$548,000 | 1 Years |

| ALTEZ | $1,538,000 | 861 | $1,786 | -$481,740 | 14 Years |

| V ON SHENTON | $2,800,000 | 1528 | $1,832 | -$271,000 | 11 Years |

| THE SAIL @ MARINA BAY | $1,250,000 | 678 | $1,843 | -$241,600 | 17 Years |

| 26 NEWTON | $1,080,000 | 484 | $2,230 | -$111,058 | 7 Years |

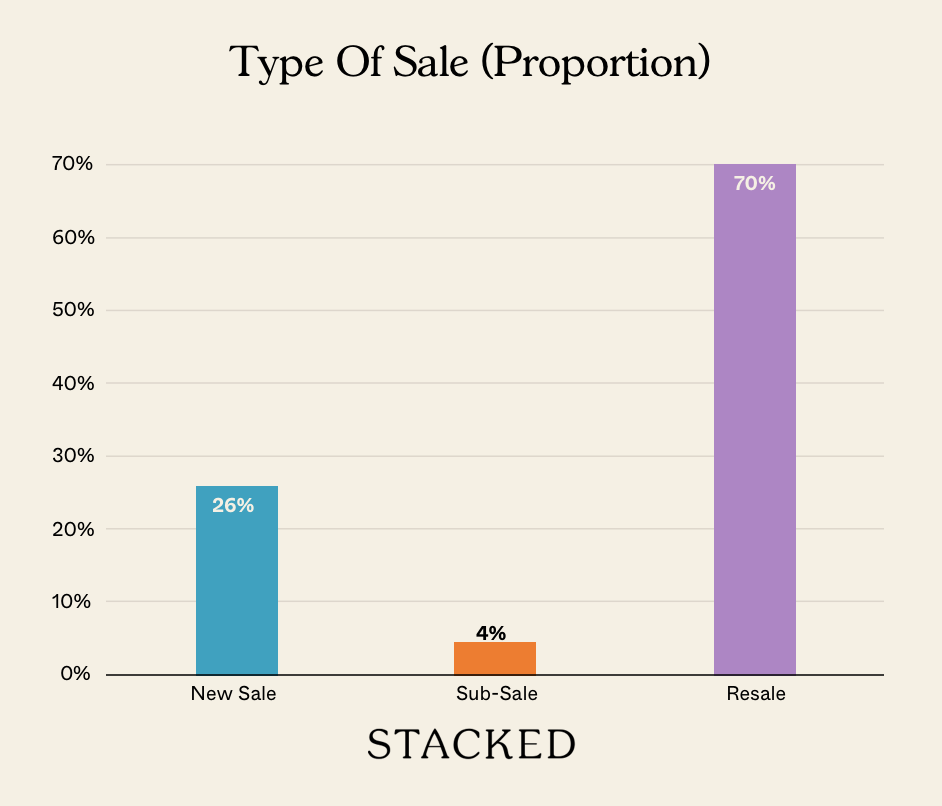

Transaction Breakdown

Follow us on Stacked for more news and details in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will the foreign buyer stamp duty in Singapore be lowered soon?

Why are there new land plots being released in expensive areas like Orchard Boulevard and River Valley?

Could rent control return to Singapore in the future?

How might the recent property measures affect the housing market for locals?

What lessons can be learned from Singapore’s past rent control policies?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

Editor's Pick How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

1 Comments

Curious article that gets no where.