Condo Profits Averaged $270K In 2024 Sub Sales: Could This Grow In 2025?

April 17, 2025

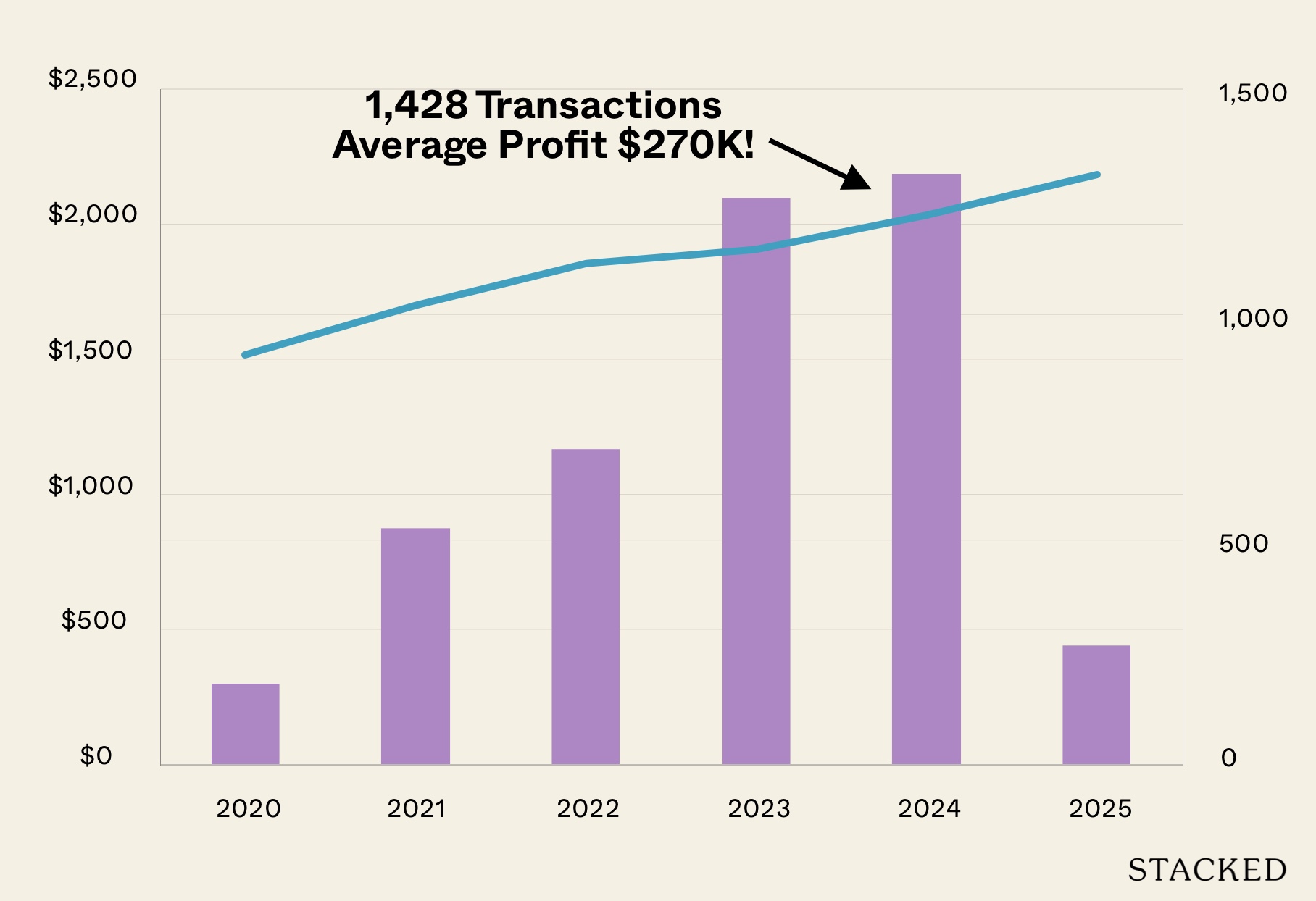

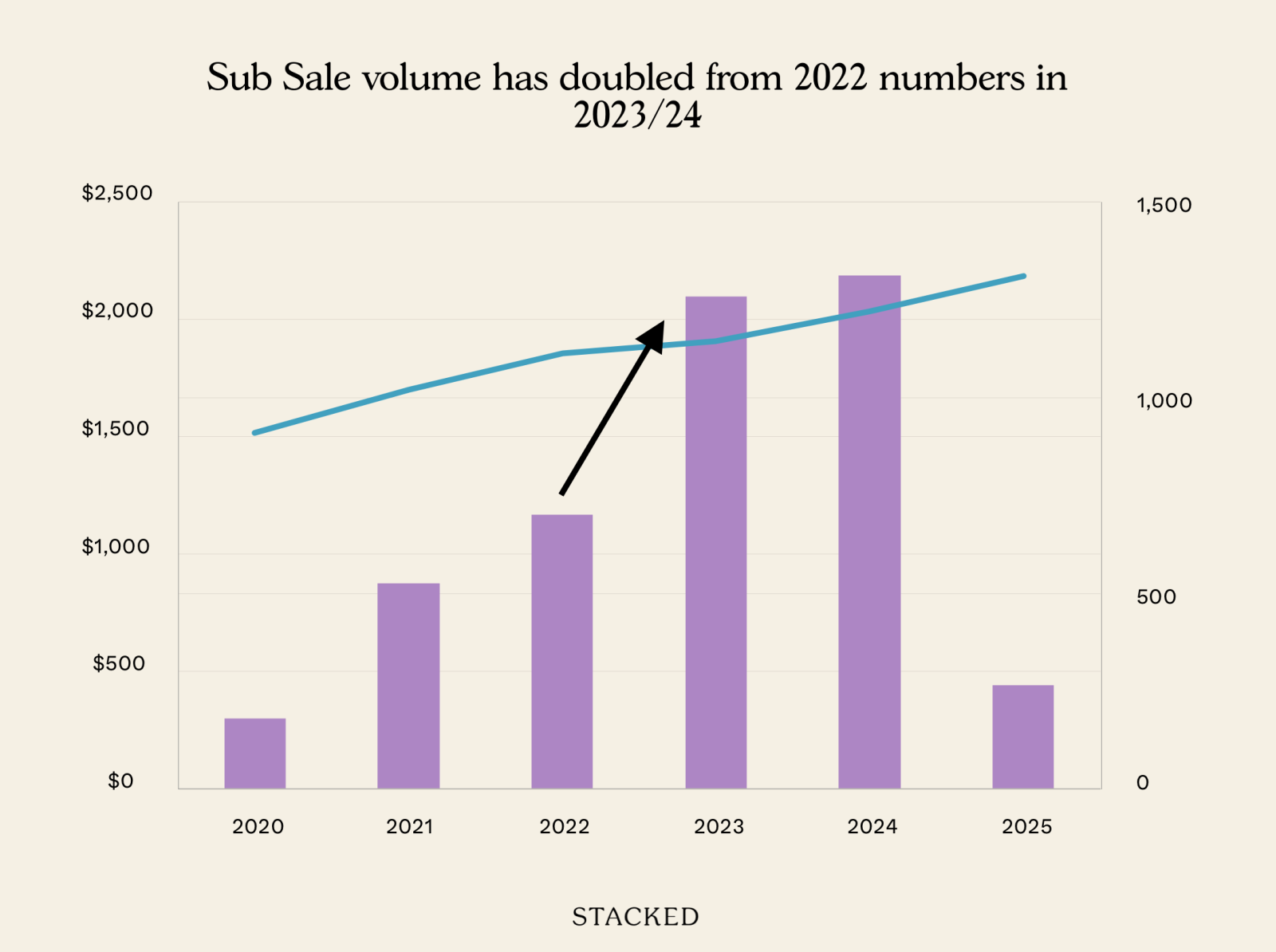

2024 was the year of the sub sale transaction. Usually rare, there were 1,428 sub sale transactions for the whole of the year; up from 1,294 units in 2023, and up from a mere 178 units(!) back in 2020. But realtors on the ground say they expect sub sales to continue growing for the coming year, and in fact, this may be the year that we see them peak. Here’s what’s happening on the ground:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s a sub sale transaction?

Sub sale transactions occur when a property is sold before completion (i.e., before the Temporary Occupancy Permit, or TOP). Sub sale units are often purchased by buyers who cannot wait for construction times, which are usually around four years. Sellers, on the other hand, are usually motivated by faster returns.

Developers tend to price units lower in the earliest sales phases. In subsequent phases, the prices will be raised, so this means a fast return on investment. E.g., if you purchased a unit at $1.8 million during the earliest phase, you might be able to sell it for $2 million as a sub sale unit, thus raking in $200,000 in as little as three to four years.

(Note, however, that the Sellers Stamp Duty or SSD still applies, if the unit is sold within the first three years.)

More rarely, a unit may be sold as a sub sale unit due to changes in the seller’s circumstances; such as reduced income, or a change-of-life circumstance like going abroad.

Why did sub sale transactions boom in 2024?

Several sub sale transactions were highly profitable in 2024, such as Boulevard 88, where three units saw a profit of $3.1 million to $3.9 million. Besides Boulevard 88, other top-selling sub sale projects included Florence Residences (159 transactions), Parc Clematis (133 transactions), Affinity at Serangoon (120 transactions) and Penrose (100 transactions). These were the most profitable sub sale transactions for the year:

| Project | Gains | Bought At | Sold At | Size (Sq Ft) | Bought Date | Sold Date | ROI | Holding Period |

| LEEDON GREEN | $1,150,000 | $3,750,000 | $4,900,000 | 1,496 | 14/4/21 | 23/9/24 | 30.7% | 3.4 |

| THE AVENIR | $1,000,000 | $7,888,000 | $8,888,000 | 2,411 | 2/12/20 | 20/6/24 | 12.7% | 3.6 |

| TREASURE AT TAMPINES | $981,000 | $2,007,000 | $2,988,000 | 1,690 | 16/11/20 | 23/1/24 | 48.9% | 3.2 |

| CLAVON | $906,000 | $2,044,000 | $2,950,000 | 1,356 | 28/5/21 | 25/9/24 | 44.3% | 3.3 |

| PARC CLEMATIS | $895,000 | $2,563,000 | $3,458,000 | 1,496 | 27/9/21 | 6/11/24 | 34.9% | 3.1 |

According to word on the ground, the two key issues are a lack of supply. We recently explained why the supply of resale condos have been drying up: the costs of a replacement property are high right now, and sellers see little they can afford even if they sell at the current high prices (i.e., when you sell high, you also tend to buy high.)

There’s also the issue of fewer completed units being available; we were still recovering from many delays that stemmed from the COVID era. A quick glance at sub sale volumes since the peak of COVID (April 2020) shows how much more commonplace they became in the aftermath:

For those seeking own-stay use, it would seem that lower gains (as they’re buying at higher prices compared to the initial launch) are a fair trade-off for being able to move in sooner.

Another factor in 2024 was growing concerns over the rental market, which softened since COVID. Some aspiring landlords may have second-guessed themselves, and decided to sell rather than go through the hassle of chasing tenants and yields. One seller we spoke to said they decided to go ahead with their sub sale at Clavon in 2024, because interest rates had risen since they first bought in 2020, and the rental market was weakening – this would have left them with the double whammy of high loan repayments and lower rental income.

(Note: interest rates were much lower in 2020 because at the time, the US cut interest rates to keep the economy stimulated throughout COVID; rates could have been as low as two per cent, whereas 3.75 per cent is a typical rate today.)

As such, some sellers were more amenable to these transactions.

Finally, there’s the issue of the specific locations. One realtor noted that many of the sub sales occurred in condos that were on former HUDC land. Florence Residences, for instance, was a former HUDC estate; as was Parc Clematis. These land plots tend to be very large, thus allowing for more facilities and generally lower prices; they’re also established and familiar areas. As such, own-stay users who missed the launch opportunity may still be eager to purchase units, even if it means paying more for a sub sale.

Is it likely to carry on in 2025?

In general, most agents agreed that 2025 would see a continuation of a thriving sub sale market; and some even felt it might reach a new peak this year.

This is due to the following reasons:

1. Tight supply in the resale market continues to be a problem

There’s no clear end to this issue right now. New launches averaged $2,640 psf as of January this year, so the typical 1,000 sq. ft. three-bedder costs about $2.6 million. The “sweet spot” for most HDB upgraders is in the range of $1.8 million to $2.1 million. Without options here, some would rather hold on to their existing properties and not upgrade.

(In case it needs mentioning, they can’t easily find resale units because, well, other resale sellers are in the same boat as them!)

Among buyers who aren’t price sensitive, but are time sensitive, there are only two easy options right now:

The first is to buy into new launches that have just reached their TOP, but have a few units left. These are usually at peak prices, and the final units are usually premium, high quantum units like penthouses or four and five-bedders.

The second, as you’ve probably guessed, is to find a sub sale unit that’s very close to completion. While a sub sale unit is also expensive, it’s not much different from the high cost of a recent TOP unit from the developer (in fact, it may be less if it’s a smaller unit). So between the two, the sub sale becomes a palatable choice.

2. More new launches are in the pricier CCR

We discuss this in more detail here; but to recap, 14 of the roughly 22 remaining projects this year are in the CCR. This is the most expensive region, where family-sized three-bedders can reach a frightening quantum like $3 million. As we mentioned in the linked article, it will probably be the province of those who already have RCR units and are upgrading; not really a mass-market demographic.

So, for those priced out of the upcoming CCR, and who also can’t get a resale unit, then sub sale options at OCR condos might be the way forward. This is likely to just drive up the demand we’re already seeing.

3. Fewer units are expected to be completed in 2025

There are fewer condos being completed in 2025; and some of these – like Tenet and Copen Grand – aren’t much help as they’re Executive Condominiums (ECs) with a five-year holding period. We can also see that there aren’t any mega-developments being completed.

Stay with us, as we’ll soon be putting up a list of projects that are about to be completed this year.

That aside, all of this demonstrates how time works in your favour, when it comes to buying your home. If you put off buying a new launch now, you could end up paying a steep price later, when buying a sub sale or recently TOP’ed unit. If you do decide to buy later, at least ensure you can bear with the construction time plus the time you spend waiting it out.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments