Why Land Price Is the Single Biggest Factor Behind New Launch Condo Pricing

September 18, 2025

How do you guess the likely (fair) price of an upcoming condo? Location for sure, yes – but besides location, the key factor is land price. Beyond market positioning issues like luxury tags, probable buyer demographics, and cleverly sabotaging nearby launches via timing, the core component is the LAND PRICE. It underlies the developer’s pricing just like it physically underlies your upcoming condo – the higher the land price, the bigger the hit on your wallet. Here’s how to predict the likely pricing based on land costs, as well as check if you’re getting a good deal:

An important note on early launch pricing

Everything you’re about to read is based on the initial launch pricing of developers. Once you enter the sales phase late, prices can exceed the numbers described below. Barring a few exceptional cases, such as a rare relaunch at lower prices, in general, the later you wait, the more you pay.

So, roughly speaking, the methods below help you to predict likely launch prices within the first 12 months of the launch. Beyond that, the developer will raise prices (or not) depending on how quickly units are moving.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How does land cost affect developer pricing?

Think of land price as the starting line in a race. When a developer wins a GLS site, that winning bid sets the baseline, or the entry cost. From there, the developer adds construction expenses, marketing, financing, and of course, their profit margin.

For example: if one GLS site is won at $1,388 psf ppr (like the Bayshore plot SingHaiyi grabbed in March 2025), you can bet the eventual launch pricing won’t stray too far below that. In fact, SLA’s own Land Betterment Charge (LBC) revisions track these very bids: after Bayshore’s record tender, the LBC in that sector jumped 15.4 per cent, effectively “locking in” higher valuations for future redevelopments.

The same happened at Lorong Chuan, where a $1,376 psf ppr bid translated into a 9.5 per cent rise in LBC. In simple terms, land costs don’t just nudge prices up – they hardwire a floor into the market.

It’s not just GLS sites. The same dynamic plays out in en-bloc sales, where a developer pays a collective sale price to take over an older condo or estate. Those winning bids are also pegged on a psf ppr basis, so they set a hard floor on the eventual launch price. The only difference is having to top up the lease to 99 years again (if it’s not a freehold condo), and maybe a more drawn-out and messy process in getting the needed number of votes.

What’s the general rule of thumb in predicting eventual prices?

A rough industry shortcut is that land cost accounts for around 70 per cent of the eventual selling price. On top of that, another 20 per cent goes to construction, financing, marketing, and agency commissions.

Within that 20 per cent, a significant chunk goes to marketing and agency commissions. Marketing costs typically cover the show flat, advertising, and agent commissions. For smaller developers though, less may be spent on marketing, as they’re more dependent on the agents to do the work.

Agent commissions don’t add as much as they used to, compared to the previous decades: the fee is usually 2.5 to 3 per cent of the selling price, broken down roughly as:

- 2.1 per cent for the individual agent

- 0.4 per cent for tagging (for the people who bring the buyers to the agents)

- 0.5 per cent for the main agency

This can sometimes be even less for projects that the developers peg as an easy sell, such as an Executive Condominium (EC).

Nonetheless, this is generally how it works: if a site is bought at $1,388 psf ppr, add about 20 per cent (roughly $278 psf) for hard costs, and you get a breakeven of around $1,666 psf.

Then add the 20 per cent for the developer’s margin and marketing and other assorted costs, and the launch price is likely to be in the $1,9xx–$2,1xx psf range, depending on how aggressive the market allows the developer to be.

It’s not always exactly 20 per cent, because other factors may change this

Economy of scale is one issue: smaller boutique projects tend to have higher per-unit costs, since showflat and marketing costs are spread across fewer units. Mega-developments, on the other hand, can dilute these expenses across thousands of units, making their per-unit overhead much lower. This is one reason why you often see mega-projects launch at slightly more competitive psf rates than boutique condos, despite paying similar land costs.

Another factor is whether we’re in a buyer’s or seller’s market. In situations where sellers have the edge (e.g., the housing supply crunch after COVID), developers will aim for the full 20 per cent or more; but in tough markets – such as right after a cooling measure – developers may have no choice but to see margins dip under 20 per cent.

Finally, construction issues can add to the cost. Any additional work needed for the ground, such as having to elevate it, can cause a developer to go beyond the 20 per cent mark.

Terra Hill (Hoi Hup and Sunway, launched 2023) showed how site-specific costs can derail expectations: the developers acquired the former Flynn Park site for $371 million, about $1,355 psf ppr. Based on the usual land cost arithmetic, analysts pegged breakeven at around $1,9xx psf, suggesting launch prices in the low $2,3xx psf range.

Instead, buyers were greeted with starting prices closer to $2,4xx–$2,6xx psf.

One of the main reasons was elevation and engineering works. The Pasir Panjang plot was hilly and required extensive retaining walls, platforming, and slope stabilisation. The resulting works added development costs that blew past analyst assumptions.

So while (+70 per cent) + 20 per cent is a good rough gauge, you should expect occasional variances.

Some examples of condos where we see the formula at work

Here are some examples where the formula checks out:

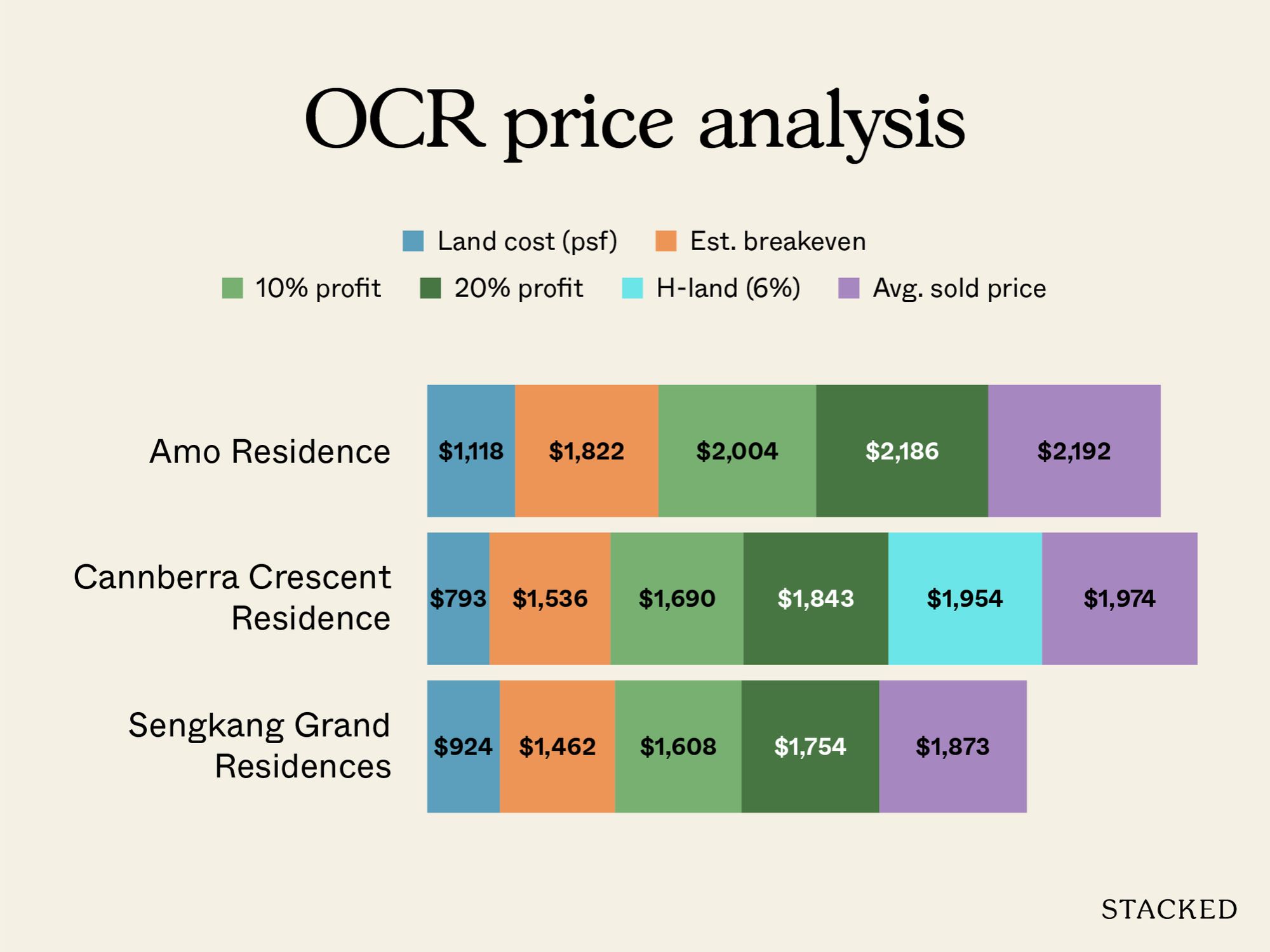

From the above, we can see the land prices of the various land parcels. The yellow bar shows the absolute minimum at which the developer can sell.

More from Stacked

Record $1.27M Sale Makes This 30-Year-Old HDB The Town’s Priciest Yet

October 2025 saw a new record in the north: an executive flat at Block 850, Woodlands Street 82, transacted for…

The blue bar shows how much the developer needs to sell to see around a 10 per cent profit. In other, tougher markets, this could be the price to look for – but as of 2025, we would suggest you ignore it. Sellers have the edge right now, so prices are likely to be determined by the green bars (20 per cent profit).

The brown bars refer to Harmonisation effects. In essence, the Post-GFA harmonisation reduced saleable square footage by around six per cent; developers can no longer use air-con ledges or other unlivable areas to pad sales. For projects where the land was bought before GFA Harmonisation, this marks a rough estimate of how much the developer needs to shave off.

AMO Residence is one of the clearest examples of the formula working almost to the dollar. The Ang Mo Kio Avenue 1 GLS site was awarded at about $1,118 psf ppr, which, under the 70 + 20 rule, pointed to a likely launch price in the $1,900–$2,100 psf range.

True enough, when AMO launched in July 2022, prices started from around $1,890 psf, with average sales hovering close to $2,100 psf in the opening phase. That’s almost exactly what the formula predicted.

We also see this with Canberra Crescent Residences. The Canberra Crescent GLS site was awarded at about $721 psf ppr in March 2023. Using the +70/+20 framework, that implied a breakeven of roughly $1,200+ psf, and therefore a likely launch price in the ballpark of $1,8xx–$2,0xx psf once profit and marketing were factored in.

When sales opened in August 2025, units were indeed priced right in that range, averaging around $1,974 psf.

But in some cases, like Sengkang Grand Residences, factors like its integrated nature changed the end price. The land for Sengkang Grand was secured at around $924 psf ppr, which puts the breakeven at roughly $1,109 psf. The formula suggests a launch price in the ballpark of $1,330 psf.

In practice, units launched from about $1,946 psf, which is higher than the formula would predict, but not wildly off when you factor in its integrated nature (i.e., direct links to MRT, retail, and bus interchange facilities). It should also be noted that Sengkang Grand Residences’ land was acquired at the tail end of the last land sales cycle, when developers were still bidding aggressively and GLS prices were climbing quickly. This meant the breakeven benchmark was already on the higher side, compared to sites secured in the following cycle; so the eventual launch prices appear steeper in hindsight.

In other cases, condos like Sceneca Residence are a good example of how post-GFA harmonisation can shift the numbers. The Sceneca Residence site was awarded at about $930 psf ppr, which put the estimated breakeven at around $1,480 to $1,550 psf.

Based on the standard +70/+20 rule, this suggested an eventual launch price in the range of $1,700 to $1,800 psf. When sales began, however, units transacted between $1,896 and $2,341 psf, with an average of about $2,061 psf. The higher-than-expected figures were because Sceneca was one of the first projects affected by post-GFA harmonisation. With air-con ledges and other non-functional spaces excluded from saleable floor area, the price psf had to be increased.

Meanwhile, one of the more anticipated sites is the one at Bayshore, where a new township is planned. The Bayshore site is a textbook example of how high land costs translate into high launch prices: the GLS plot was acquired at a record $1,388 psf ppr, already setting a high baseline. While the standard formula would point to a launch price of around $2,000 psf, analysts are projecting starting prices of $2,700–$2,800 psf instead.

This reflects the integrated nature of the project, direct access to Bayshore MRT (TEL), and the broader transformation of the area. So we can see that fundamental market factors sometimes push prices beyond the +70/+20 rule; but it still provides a useful gauge.

How all this can guide you as a buyer

Knowing the land price lets you gauge whether a launch price is fair. The +70 per cent (costs) +20 per cent (profit and marketing) rule of thumb helps you work out the developer’s likely breakeven and margins: if the sale price you’re paying is beyond the formula, there had better be a good reason (e.g., no other alternative for kilometres around).

In 2025’s market, a fair outcome for early buyers is to pay at or within a 20 per cent profit of the developer’s range. Later buyers, after multiple rounds of price increases, will naturally drift further from that zone.

For buyers, the key is to use land cost and the +70/+20 framework as your compass. It won’t tell you the exact psf down to the dollar, but it tells you the terrain: where the floor is, how much room the developer has to manoeuvre, and what sort of gains you’re likely to see in future.

This being said, do be prepared for variances based on the situation

One factor to beware of is market norms. If the established norm in an area is $2,200+ psf (as it often is in 2025), then a developer will stick to that, even if they happen to get the land for an unexpectedly low price. This is one of the main reasons why the government can’t lower condo prices by just lowering the reserve price of land; and also why redevelopments are pricey even when the en-bloc price was below expectation.

This means you can’t take the “land price plus markup” formula as guaranteed, but it does work as a loose rule of thumb to help frame what’s reasonable.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the main factor influencing new condo prices according to the article?

How does land cost affect the initial launch price of a condo?

Can the land price help predict the condo's launch price?

Why might actual condo prices be higher than the predicted price based on land costs?

How should buyers use land prices when considering a condo purchase?

Are there cases where the formula for predicting condo prices does not work perfectly?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

2 Comments

Can you explain how the estimated breakeven price for Amo residences is derived?

At land cost S$1118 psf ppr, then +70% would yield S$1118×1.7 = $1,900.60. However, the included table has the estimated breakeven price at S$1,822.00

Hi! The numbers in the chart come from industry estimates, which aren’t easily accessible to the public. We’ve put together these figures as a general guide to give readers without paid subscriptions or agent access a close approximation of those sources.