Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

June 21, 2025

There was a time when living in the Core Central Region (CCR) had a simple meaning: you were near Orchard, which had brands and shops you couldn’t find in the heartlands, and probably you had an easier time getting to work (in the CBD). However, the meaning of “prime” has changed over the years, and so have the lines on the map.

Today, if I were looking at the CCR – not for short flips, but for real long-term value – I’d focus on a handful of streets that still hold quiet but continued appeal. These are not the loudest or most attention grabbing areas, but the ones that have the strong fundamental qualities of the right price, coupled with more balanced, family-centric lifestyle zones.

Here are the main places that come to mind:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Kim Seng and Zion Road: Perhaps my top picks for the CCR in 2025

Let’s start with Kim Seng Road and Zion Road. This pocket of the CCR has always been more practical than fancy. You’re close to Orchard, but just far enough to avoid the traffic and noise. You’re also (usually) within one kilometre of River Valley Primary School, and you don’t even have to cross any major roads to get there. In real-world parenting terms, that’s an everyday win.

I also feel it’s convenient to stay within walking distance of Great World City; this is an old mall, but it has quietly become one of the most useful lifestyle nodes in central Singapore. In my younger days, it was just considered a cheaper alternative to Orchard, but now it holds its own with dining, childcare centres, and the Great World MRT station on the Thomson-East Coast Line (TEL).

As to why Great World is so differentiated from Orchard or Marina, it goes back to its earlier history. This was formerly Tua Seh Kai – Great World Amusement Park – which drew families with rides and street food. It closed down in 1964, and in 1997, Great World City Mall was built here and named after the old park. But for years, it was in an odd place: close to the city centre but visibly different from places like Orchard and lacked MRT access; so it was regarded as a sort of “cheaper Orchard”, even though the two were close in proximity.

But by the mid-2000s, Great World was becoming an enclave on its own, and there has been a recent big shift in 2022 when the TEL station opened. Today, it’s part of the CCR “ecosphere” since you can get to Orchard in two stops, Marina Bay in five. The mall has since been revamped, and foot traffic has also surged.

Now it’s part of the wider amenity hub of central Singapore, no longer sitting on the fringe of it. That’s why developers are piling in, and that’s why more families are gravitating towards it.

Plus, Great World didn’t go through several decades when it was just a “pure” shopping area for designer brands, unlike Orchard Road; so it’s a real neighbourhood with roots, and one of the established CCR family areas.

In terms of nearby condos, The Cosmopolitan still stands out.

Although it’s a bit older (TOP in 2008), The Cosmopolitan is one of the stand-out projects for me. The layouts are regular-shaped and spacious, no awkward corners or shapes that waste space. It’s one of the closest condos to River Valley Primary, and it’s possible to walk. The side gate opens almost directly to Great World City and the MRT station, which I think some buyers prefer, compared to the condos tucked deeper into landed enclaves where you need to drive out.

The unit sizes can even go beyond 1,700 sq. ft. by the way, something you rarely see in newer launches. It’s freehold, and it’s a condo where the fundamentals – location, layout, and accessibility – all tick the right boxes.

The surroundings have changed quite a bit over the past two decades though. Last time there were still old walk-ups and blue-painted HDB flats, with popular zi char stalls and small shops. These have gradually been replaced by boutique condos and more atas “lifestyle” retail, but the sense of livability is still there. Not every neighbourhood pulls that off. (Tiong Bahru, for example, saw gentrification push out some of its long-time residents and original charm.) River Valley, by contrast, has evolved without losing its core appeal.

There’s one other condo in this area that’s a favourite of mine

If The Cosmopolitan is the older, trusted choice, then Irwell Hill Residences is the newer counterpart I would aim for. Prices started at around $2,650 psf at launch in April 2021, with many units transacting between $2,600 and $2,700 psf.

More from Stacked

Here’s What I Learnt After Spending 2 Weeks To Earn A $300 Commission.

I know that real estate agents sometimes get a bad rep. People think we are pushy, too salesy and love…

But prices have climbed, with resale transactions in 2025 hitting up to $3,341 psf. For instance, a 667 sq. ft. two-bedder initially bought for $1.82 million was resold in May 2025 for $2.23 million, netting the owner a tidy $256,000 profit.

Another similar unit fetched $2.02 million in January 2025, working out to $3,027 psf. Irwell Hill Residences has “broken the code” and disproved the myth that CCR condos can’t make money.

One main reason is that Irwell Hill has unit options that are a bit smaller; it’s three-bedder compact unit is only around 860 sq ft, like its OCR counterparts – so this allows it to have a more manageable quantum of around $2.8 million.

Also, Irwell Hill Residences benefits from being walkable to Great World, and within one kilometre of River Valley Primary. Homes within that zone command a premium. It’s not just about resale; it’s about certainty. Irwell Hill Residences advertises this. So will GuocoLand’s new launch (see below). As one agent put it: “You’re not just buying the house, you’re buying the chance at the school.”

GuocoLand’s Bet on River Valley

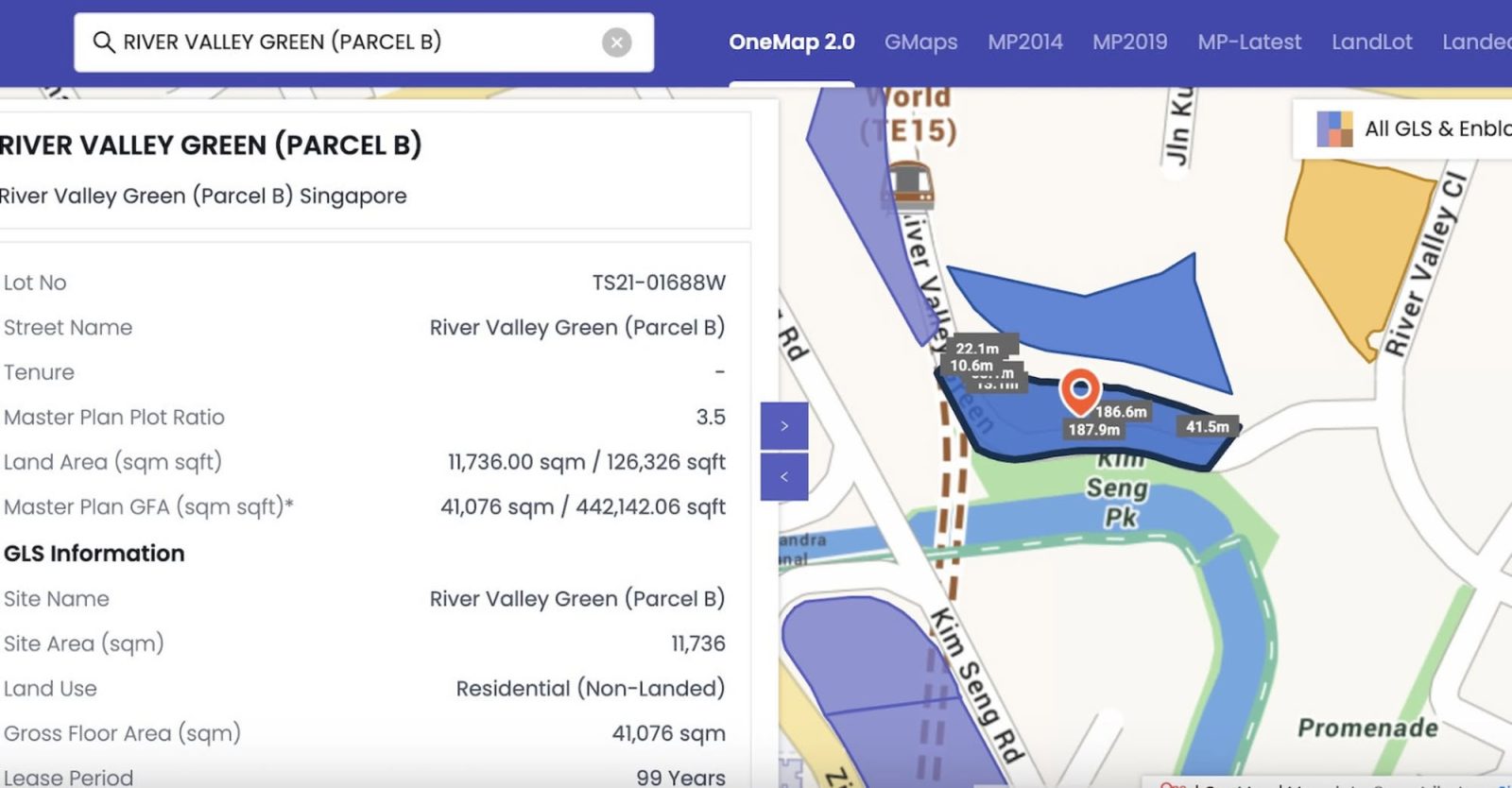

Sometimes we can take cues from developers who have done in-depth research to back up their choices. I did notice GuocoLand’s recent acquisition of River Valley Green (Parcel B). They paid $627.8 million for the site, or about $1,420 psf, and maybe it’s another sign that Great World is a major core.

The site will yield about 475 homes with first-storey retail, right beside Great World MRT. Together with a neighbouring plot by Wing Tai, we could see 900+ new units redefining the area by 2027. And based on GuocoLand’s track record (Martin Modern, Wallich Residence), I think this won’t be one of the cookie-cutter condos; I would expect high-spec units and something different.

For current owners nearby (Melrose, Cosmopolitan, Tiara), it means a possible halo effect. Strong new launches can help to maintain the desirability of older projects.

Why Not Orchard (At Least, Not for Me Right Now)

Some people will ask: “What about Orchard?” It’s the heart of the CCR, after all.

And yes, Orchard still has some great condos, especially if you’re looking at convenience or prestige. But honestly, the pricing is just too steep for what you’re getting. There are 99-year leasehold launches asking for close to $4,000 psf (e.g., The Orchard Residences, Hana). Even with all the branding and flash, that’s a tough entry point unless you’re buying for lifestyle, not investment.

There are other CCR areas I may keep an eye on. Newton and Novena, for instance, have their own MRT lines and a more “liveable” vibe than Orchard; plus, you’re near schools like ACS and SJI Junior. These areas tend to attract families and older buyers who want a bit more quiet.

Holland and Tanglin have their appeal also, especially if you’re looking for landed homes or larger units. Some of the older freehold condos there are very liveable, and you’re near the Botanic Gardens. But again, entry prices are high, and these are lifestyle choices; lifestyle projects don’t always have resale momentum.

So to recap, if I had to put money down today, I’d still be looking at these few:

- Cosmopolitan – older, spacious, and sensible pricing

- Irwell Hill Residences – new, well-located, and already showing healthy resale gains

- Maybe GuocoLand’s upcoming project – again, pricing will be the most important thing; so even though the location is good, let’s reserve judgement until the price is clear

There are, of course, other CCR areas worth exploring, but for me, this little pocket near Great World still feels like the smartest buy. I’ll be keeping an eye on the area as new projects come up; and if you’re curious to hear more on how Singapore is changing (and sometimes how it’s stayed the same), follow Stacked for future updates.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Norman Koh

Having weathered three market cycles, Norman makes for a seasoned real estate ally. With 14 years of extensive experience, he is equipped with the knowledge and skills to guide you through any scenario. As a former engineer, his approach is rooted in data and logic, offering a clear path forward amidst the complexities of real estate decisions. As a PropNex Signature Resale Trainer and a consistent top producer from 2013 to 2023, including being a Million Dollar Producer in 2022, Norman's track record speaks for itself. His exceptional leadership was evident in 2022 as the champion project chief for both large and boutique projects, and in 2024 as the pac boutique champion project chief, further solidifying his expertise in the industry. When he's not busy with real estate, you'll likely find him at the gym or the Karting circuit, fuelling his passion for both adventure and personal growth.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

7 Comments

The cosmopolitan is a freehold project. Not 99 years leasehold.

This article is very confused. Why do you say Cosmo is your favourite yet not recommend it as one of the places u would buy?

Also, Cosmopolitan is Freehold not 99 years old.

Hi Mr Lim, apologies for that, there was a typo in the earlier draft that has been removed and updated! Thanks for the heads-up!

Irwell is selling their 3BR at 3100psf and above. Do you think they are overcharging if RiverGreen or Promenade Peak launches at 3000psf?

Am I the only one who feels the Kim Seng / River Valley area is too congested with high capacity condos? Great World City is also crowded and getting worse with more condos coming up in that area.

I’d far prefer Bukit Timah or Balmoral as they are quieter yet near to orchard and schools, or Draycott/ Ardmore if schools aren’t a requirement

Draycott/Ardmore is actually very residential & quiet and still walking distance to amenities. If you live here – you walk to most places (and actually dress very casually since you are just walking in your ‘hood!).

How about Botanic Gardens Mansion and Botanic Gardens View?