“Can I Afford It?” Is Only Part of The Big Question When Buying A First Home

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

“Can I afford it?” is the wrong first question to ask young homebuyers.

Or at least, a dangerously incomplete one. I get that it’s intuitive; if you’re a young first-time homebuyer, the first thoughts that float to mind are: Can I make the down payment? Do I have enough in my CPF? Can I meet the Mortgage Servicing Ratio or Total Debt Servicing Ratio, and why is everything an alphabet soup of acronyms?

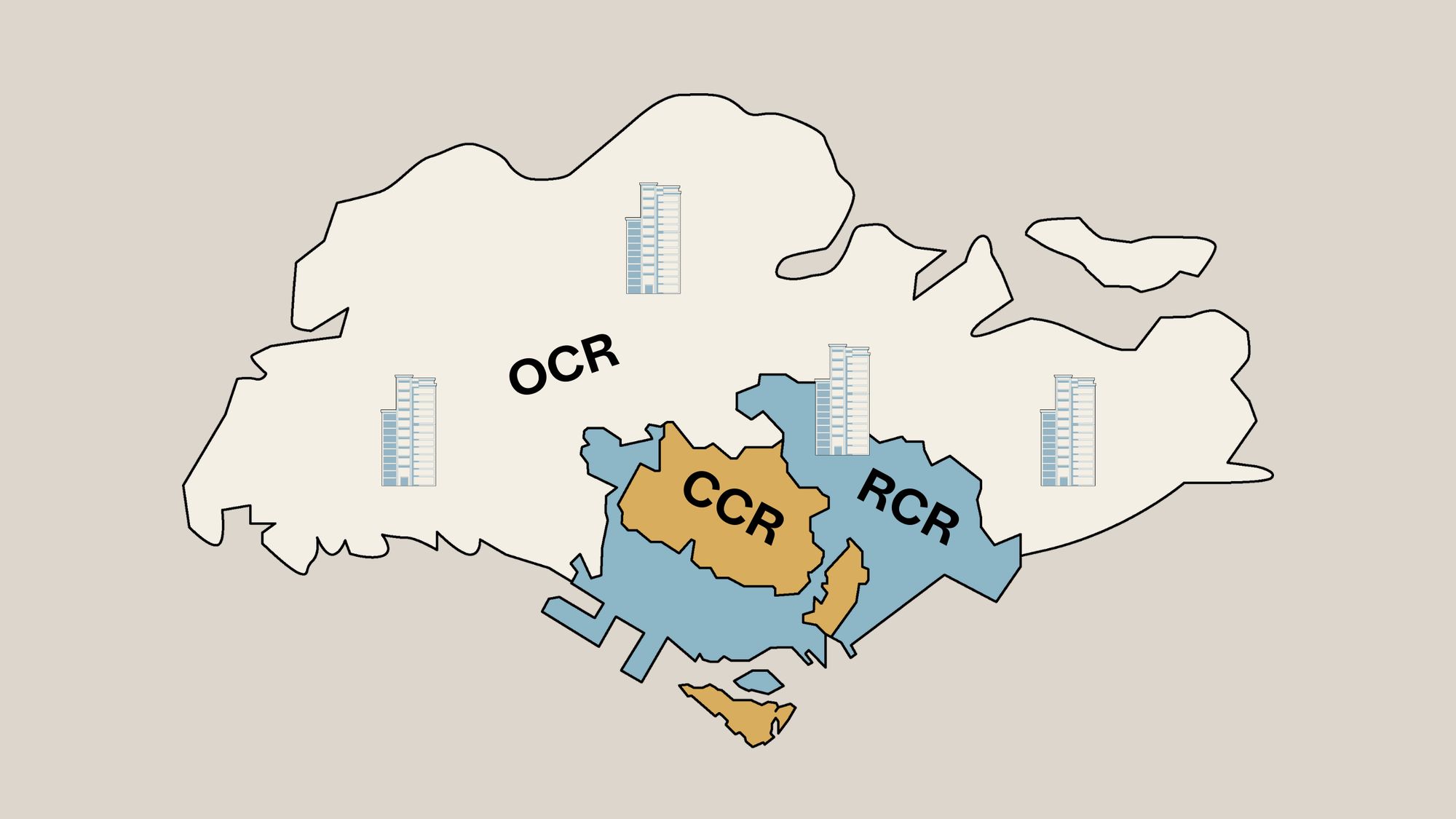

The good news is that, when the home-hunting season starts after Chinese New Year, there will be a lot of options at many different price points. We have around 13,400 flats reaching MOP this year, and around 55,000 BTO flats that will be launched between last year and 2027. We’re also seeing a return to (hopefully) more affordable properties in the Outside of Central Region (OCR) this year.

Chances are, most of you young, first-time homebuyers will find something affordable – either in the sense of qualifying for the loan, or a mortgage that doesn’t result in premature hair loss. You’d have done better than me, in the latter case.

But having gone through this process myself – more than once now – I’ve come to realise “Can I afford it” is just one-half of the consideration. It feels like the responsible question to ask, but it skips over the issue of optionality. Affordability only tells you whether you can get in, but it tells you very little about what happens after you buy.

A more important question is this:

“If my life changes, can I change my housing decision without getting burned?”

Many young buyers today are doing well on paper. They have decent incomes, stable careers, and more or less have their first property locked-in. But in the years that follow the first property purchase, some will realise serious issues creeping in.

The most common one I encounter – and which I’ve mentioned often – is that of singles who buy a private one-bedder instead of an HDB flat as their first home. Subsequently, they meet the right person and want to settle down, but now find their shoebox unit is too small; and it’s not always a simple matter to just sell and get an HDB flat. There is, for instance, no assurance that the market will be good at the time you need to sell; and a one-bedder is not the easiest property to market.

(Ps. there’s also a 15-month waiting period to buy a resale flat after you liquidate a private property, and a 30-month wait for a BTO flat).

But there are other instances as well. I meet young homeowners who change their career or employer, and realise they can’t move closer to work without paying much more. Some run into job cuts like we saw last year, and realise they can’t downgrade without losing money.

In some cases, the results are a loss of opportunity. Just this week, for instance, I spoke to a 33-year-old first-time homeowner who got an offer for her dream job abroad. But this is just her second year of home ownership, and she can’t take a career risk when the mortgage looms over her head.

Even if nothing goes “wrong” per se, these homeowners feel trapped because there’s suddenly very little room to change course in their lives.

Passing the affordability check alone can be misleading

Many homebuyers are prudent – it’s not as if you can choose to overleverage anyway, with the many loan curbs the government has put in place. But just because a home is affordable now, that doesn’t mean the home is still the right fit in 10 years’ time; and life changes come quicker and more frequently in younger years.

When those changes come, initial affordability doesn’t guarantee a painless exit. In fact, young first-time buyers often face the most asymmetric risks: they have less in the way of accrued savings, and they’re often pushed to buy earlier. Waiting too long can push prices even further out of reach, so even prolonged rental isn’t a great solution.

The end result is a demographic of buyers who are quietly pressured to commit early, commit heavily, and get it right the very first time. For those who don’t, the least-worst result is long commutes; but there are also lifestyle compromises, career decisions shaped around their mortgage instead of their opportunities, and even shattered relationships, depending on who they buy with. These aren’t always dramatic failures, but they can be a source of long-term grinding stress.

More from Stacked

4 Key Trends Reshaping Singapore’s New Launch Condo Market In 2026

As 2025 draws to a close, the new launch market can look forward to a bit of a breather -…

I think the worst outcome is a property that forces an unhappy couple to stay together. We often talk about how Singaporeans are obsessed with acquiring a flat before marriage; perhaps we should talk more about the dangers of a flat that keeps two people bound together, even if a relationship sours or turns abusive.

Besides affordability, focus on having the ability to be wrong

You can’t change the property market, but you have a little more control over how you’re exposed to its risks. The aim is not to look at just affordability, but at whether you’re giving up future options.

Among your shortlisted homes, which ones have layouts that can adapt? A two-bedder may be able to house a small family for a time, even if it’s a bit cramped; but not a one-bedder. A project that’s in the OCR, where there are more schools and heartland conveniences, can cater to multiple buyer profiles and not just one niche. A good question to ask your property agent is:

“Who else would want this unit if I needed to sell or rent it?”

Perhaps most importantly, it’s good to have the distinctly un-Singaporean trait of separating your housing from your self-worth. If you’re buying just because it’s a milestone and a proof of adulthood, you’re more likely to overcommit and to end up enduring a bad fit for too long.

Don’t think of affordability as just whether you can buy, but also whether you can back out later with minimal damage. That way your home will support your lifestyle, rather than define it.

Meanwhile in other property news…

- We finally have more Executive Condominiums to rescue sandwiched buyers in 2026; and at the forefront is Coastal Cabana. Have a look at our review.

- Does buying a one-bedder still make sense, or should you go for a two-bedder instead? Here’s a data-backed answer to the question.

- Woodlands used to be the definition of “ulu,” but this may be the year that all changes. Forever.

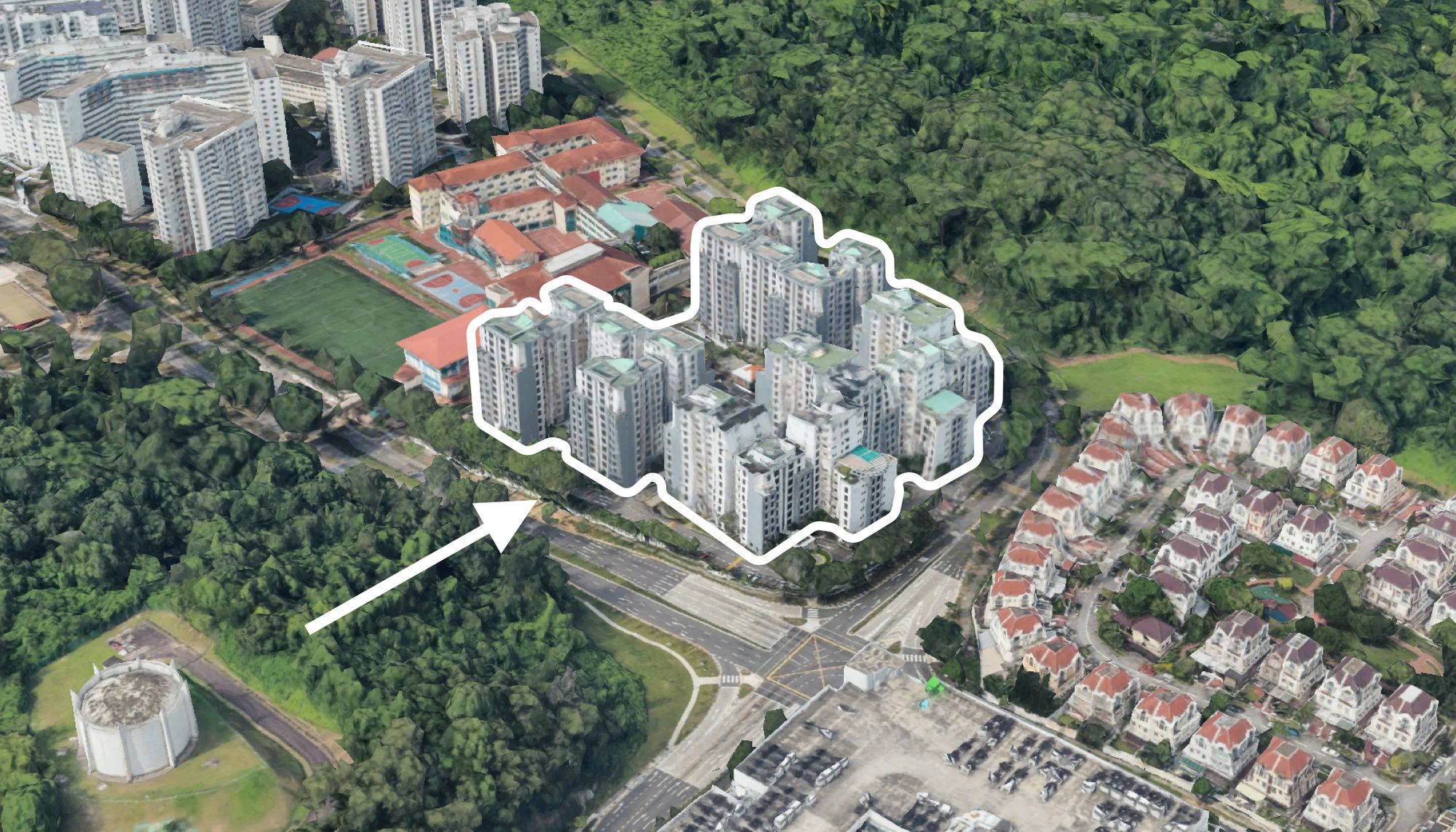

- At one point, it was said that Rio Vista was being crowded out by too many newer condos. Well, they were wrong, and join our Stacked Pro readers in finding out how it was one of 2025’s top performers.

Weekly Sales Roundup (29 December – 04 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CHUAN PARK | $4,067,600 | 1550 | $2,624 | 99 yrs (2024) |

| ONE MARINA GARDENS | $3,738,000 | 1238 | $3,020 | 99 yrs (2023) |

| AMBER HOUSE | $3,732,474 | 1216 | $3,069 | FH |

| NAVA GROVE | $3,670,000 | 1464 | $2,507 | 99 yrs (2024) |

| SPRINGLEAF RESIDENCE | $3,489,000 | 1475 | $2,366 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE CONTINUUM | $1,428,000 | 560 | $2,551 | FH |

| OTTO PLACE | $1,442,000 | 872 | $1,654 | 99 yrs (2024) |

| BLOOMSBURY RESIDENCES | $1,716,000 | 678 | $2,530 | 99 yrs (2024) |

| HILLHAVEN | $1,748,000 | 700 | $2,498 | 99 yrs (2023) |

| CANBERRA CRESCENT RESIDENCES | $2,067,400 | 990 | $2,088 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE VERMONT ON CAIRNHILL | $9,050,000 | 6060 | $1,493 | FH |

| MARINA COLLECTION | $6,800,000 | 4725 | $1,439 | 99 yrs (2007) |

| GLOUCESTER MANSIONS | $5,100,000 | 3466 | $1,471 | FH |

| BAYSHORE PARK | $4,275,000 | 3800 | $1,125 | 99 yrs (1982) |

| PATERSON RESIDENCE | $4,220,000 | 1496 | $2,820 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PAVILION SQUARE | $618,000 | 398 | $1,552 | FH |

| SUITES@CHANGI | $690,000 | 441 | $1,563 | FH |

| RIVERBANK @ FERNVALE | $750,000 | 495 | $1,515 | 99 yrs (2013) |

| GUILLEMARD SUITES | $800,888 | 635 | $1,261 | FH |

| THE WOODGROVE | $825,000 | 872 | $946 | 99 yrs (1996) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CHARMING GARDEN | $3,400,000 | 1808 | $1,880 | $2,500,000 | 20 Years |

| THE SIXTH AVENUE RESIDENCES | $4,200,000 | 2605 | $1,612 | $2,007,140 | 19 Years |

| THE WINDSOR | $4,120,000 | 2454 | $1,679 | $1,752,000 | 14 Years |

| VALLEY PARK | $2,700,000 | 1216 | $2,220 | $1,650,000 | 27 Years |

| CASPIAN | $2,580,000 | 1593 | $1,620 | $1,559,790 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA COLLECTION | $6,800,000 | 4725 | $1,439 | -$3,524,600 | 16 Years |

| OUE TWIN PEAKS | $3,950,000 | 1604 | $2,463 | -$718,000 | 9 Years |

| MARINA ONE RESIDENCES | $2,315,000 | 1163 | $1,991 | -$285,000 | 7 Years |

| FOURTH AVENUE RESIDENCES | $1,030,000 | 484 | $2,126 | -$62,000 | 5 Years |

| GUILLEMARD SUITES | $800,888 | 635 | $1,261 | -$38,000 | 4 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| CHARMING GARDEN | $3,400,000 | 1808 | $1,880 | 278% | 20 Years |

| PALMWOODS | $1,080,000 | 850 | $1,270 | 195% | 19 Years |

| PARC EMILY | $1,958,000 | 904 | $2,165 | 186% | 20 Years |

| YISHUN SAPPHIRE | $1,368,000 | 1216 | $1,125 | 174% | 21 Years |

| VALLEY PARK | $2,700,000 | 1216 | $2,220 | 157% | 27 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINA COLLECTION | $6,800,000 | 4725 | $1,439 | -34% | 16 Years |

| OUE TWIN PEAKS | $3,950,000 | 1604 | $2,463 | -15% | 9 Years |

| MARINA ONE RESIDENCES | $2,315,000 | 1163 | $1,991 | -11% | 7 Years |

| FOURTH AVENUE RESIDENCES | $1,030,000 | 484 | $2,126 | -6% | 5 Years |

| GUILLEMARD SUITES | $800,888 | 635 | $1,261 | -5% | 4 Years |

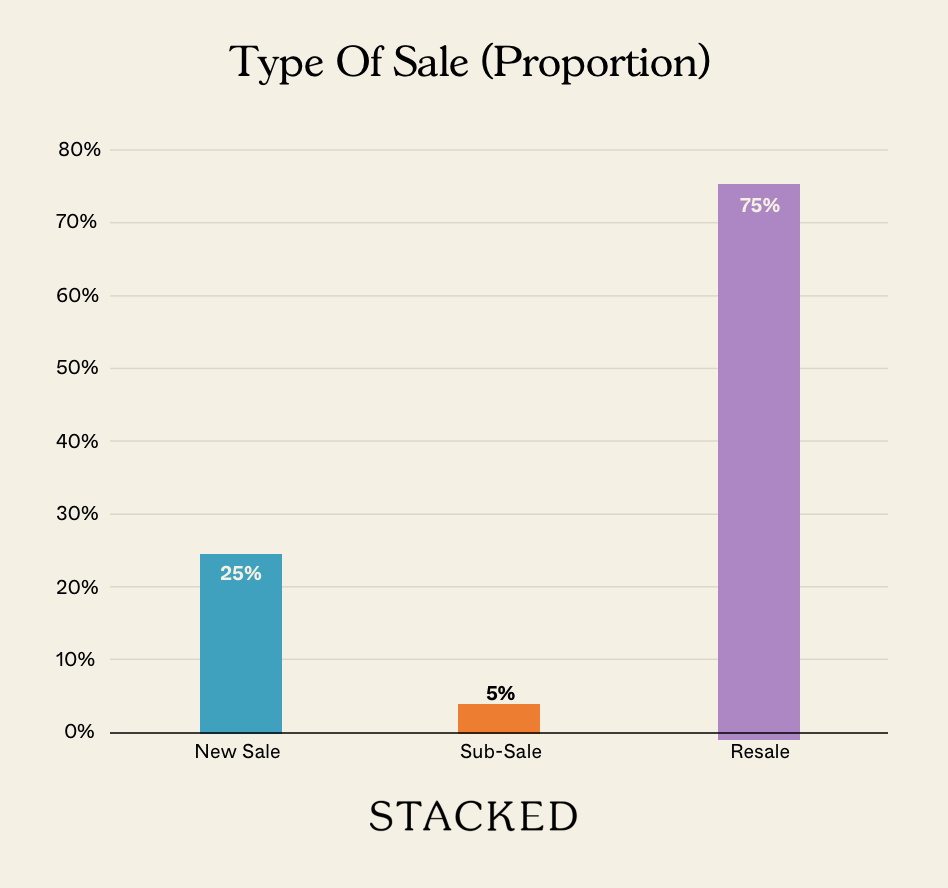

Transaction Breakdown

Follow us on Stacked for news and developments (pun intended) in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News This 4-Room HDB Just Crossed $1.3M — Outside the Usual Prime Hotspots

Singapore Property News More BTO Flats Are Coming In 2026 And Why This Could Change The HDB Market

Singapore Property News This HDB Just Crossed $1.3M For The First Time — In An Unexpected Area

Singapore Property News “I Never Thought I’d Be Sued by a Tenant.” What Long-Time Landlords in Singapore Miss

Latest Posts

Overseas Property Investing I’m A Singaporean Property Agent In New York — And Most Buyers Start In The Wrong Neighbourhood

Property Market Commentary How To Decide Between A High Or Low Floor Condo Unit — And Why Most Buyers Get It Wrong

Overseas Property Investing What A $6.99 Cup of Matcha Tells Us About Liveability in Singapore

On The Market Here Are 5 Rare Newly-Renovated HDB Flats Near MRT Stations You Can Still Buy In 2026

Pro Why This 24-Year-Old Condo Outperformed Its Newer Neighbours In Singapore

Editor's Pick We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Pro How A 625-Unit Heartland Condo Launched In 2006 Became One Of 2025’s Top Performers

Property Investment Insights Does Buying A One-Bedroom Condo Still Make Sense As An Investment In 2026

Property Market Commentary Why This Once-Ulu Town In Singapore Is Going To Change (In A Big Way)

Editor's Pick I Lived In Bayshore When It Was ‘Ulu’. Here’s How Much It Has Changed

On The Market Here Are The Cheapest 3-Bedroom Condos in Central Singapore You Can Still Buy From $1.15M

Property Market Commentary Why The Singapore Property Market Will Be Different In 2026 — And It’s Not Just About Prices

Editor's Pick 2025 Year-End Review Of The Singapore Property Market: What The Numbers Reveal

Pro This 21-Year-Old Condo Didn’t Sell Out Initially, Yet Became A Top Performer

Editor's Pick How The HDB Resale Market Performed In 2025, And What It Means For 2026 Prices