96 Million-Dollar HDBs Sold In June: Who Is Buying?

July 14, 2024

Some time ago, I mentioned that prices of certain resale flats are likely to go higher because of the Plus and Prime flats. At least for the near term.

So it’s not too surprising that the number of million-dollar HDB flats hit another consecutive high in June, at 96 units. Average resale flat prices have also continued to rise by 1.8% across the board.

There has been some theorising that once the Plus and Prime models (i.e., the new classification system, replacing the old system of mature vs. non-mature) are out, the upward trend may slow. Or if anything, it may slow due to various other reasons (more BTO supply coming on the market, etc). June’s BTO launch was the last one without the new system, which we’ll see in its full glory come October.

I’m going to stick to my guns though, and disagree with this. I still think that even with the rollout of the new Plus and Prime models, the prices of resale flats in certain hotspots will remain high. There are several reasons for this:

First, the Plus and Prime classification is not retroactively applied. If you had to choose between a Prime/Plus flat with a 10-year MOP, income ceiling, Subsidy Recovery, etc., and one that’s five minutes across the road with zero such restrictions, which sounds better?

And don’t forget the existing resale flat also has the bonus of already being built.

Second, the demand would remain for Plus and Prime flats despite the increased restrictions. For the crowd that absolutely must have a given location, the response to a failed ballot may not be to throw up their hands and give up. They may, instead, opt for a pricier resale flat nearby as a last resort. Intergenerational wealth transfer doesn’t only result in young people buying condos – it can also result in young people having the help to buy high-demand HDB flats, like units at Pinnacle.

Third, the rise of private condo prices. With most new launch condos today being priced above $2,000 psf, more and more homebuyers are being priced out. As such, we can see that some demand has shifted to resale HDB’s – where even million-dollar flats can seem reasonable when viewed from that perspective.

Meanwhile, some 50 odd listings have been taken off the HDB resale portal

But there hasn’t been any exact detail on the reasons, just that it’s related to misinformation or unrealistic pricing. To which I say, HDB is about to embark on a journey of annoying discovery – one I’ve been on with property portals.

I’ve touched a bit on the portal before; but what I didn’t mention in that article is how much effort it takes to police the listings. From potential scams to indecent exposure*, it’s incredible how people will attempt to use a portal. There’s also a lot of grey areas involved, when it comes to prices and listings.

More from Stacked

Why These Newly Completed Condos Have Made Owners Up to $700K in Just 5 Years

It’s said that, thanks to COVID, we’ve seen more market disruption in the past five years than in the past…

For example: Is $700,000 unrealistic for a 4-room flat? That’s far from rare these days; but what if the neighbourhood average is $600,000? Or when it comes to “misinformation,” who’s to check that my renovations are really just two years old, or whether they’re worth my claimed value of $100,000?

These aren’t issues the portal’s regulators can’t resolve; but doing so requires a tremendous number of hours, and at some point, they might end up questioning if this is really a good use of their resources (as well as how much further they have to the end of their fraying sanity).

*Yes, someone has accidentally put their genitalia in listing pics on a certain portal. If you Google around enough you’ll still find the old reports I’m sure.

Meanwhile, in other property news…

- Would you buy a really old flat if you’re still in your 20s? This couple did, and here’s why.

- Where are the best 4-room flats in Singapore? Here are some for $500,000 or under, and near MRT stations to boot.

- Freehold condos with over 2,000 sq. ft. They’re still around, although they’re quite a bit older.

- Older luxury condos are finding it harder to stand out from mass-market condos today. Do they still have anything going for them besides location?

Weekly Sales Roundup (01 July – 07 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PINETREE HILL | $4,448,000 | 1733 | $2,567 | 99 yrs (2022) |

| GRAND DUNMAN | $3,702,000 | 1432 | $2,586 | 99 yrs (2022) |

| TEMBUSU GRAND | $3,512,000 | 1432 | $2,453 | 99 yrs (2022) |

| SANCTUARY@NEWTON | $3,448,000 | 1216 | $2,835 | FH |

| THE LAKEGARDEN RESIDENCES | $3,433,800 | 1550 | $2,215 | 99 yrs (2023) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SORA | $996,000 | 538 | $1,851 | 99 yrs |

| HILL HOUSE | $1,320,000 | 431 | $3,066 | 999 yrs |

| THE LAKEGARDEN RESIDENCES | $1,405,000 | 678 | $2,072 | 99 yrs (2023) |

| HILLOCK GREEN | $1,555,000 | 710 | $2,189 | 99 yrs (2022) |

| LENTORIA | $1,567,000 | 700 | $2,240 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE THREE | $6,150,000 | 1744 | $3,527 | FH |

| TRIBECA | $4,300,000 | 1765 | $2,436 | FH |

| CASABELLA | $4,000,000 | 3079 | $1,299 | FH |

| SOMMERVILLE GRANDEUR | $3,860,000 | 1884 | $2,049 | FH |

| MAPLE WOODS | $3,750,000 | 1787 | $2,099 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $578,000 | 398 | $1,451 | 60 yrs (2013) |

| SUITES @ TOPAZ | $668,000 | 377 | $1,773 | FH |

| # 1 SUITES | $718,000 | 581 | $1,235 | FH |

| KINGSFORD WATERBAY | $730,000 | 484 | $1,507 | 99 yrs (2014) |

| EUHABITAT | $740,000 | 527 | $1,403 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MAPLE WOODS | $3,750,000 | 1787 | $2,099 | $2,150,000 | 27 Years |

| WINDY HEIGHTS | $3,300,000 | 2476 | $1,333 | $2,140,000 | 27 Years |

| PEBBLE BAY | $3,500,000 | 2336 | $1,498 | $1,620,000 | 17 Years |

| TREVISTA | $3,026,000 | 1561 | $1,939 | $1,591,400 | 15 Years |

| GRANDE VISTA | $3,350,000 | 3434 | $976 | $1,550,000 | 16 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SUITES AT ORCHARD | $1,180,000 | 549 | $2,150 | -$85,000 | 6 Years |

| ONEROBEY | $1,580,000 | 1302 | $1,213 | -$35,000 | 12 Years |

| VISIONCREST | $1,522,000 | 721 | $2,110 | $22,000 | 17 Years |

| # 1 SUITES | $718,000 | 581 | $1,235 | $51,068 | 9 Years |

| EUHABITAT | $740,000 | 527 | $1,403 | $54,752 | 13 Years |

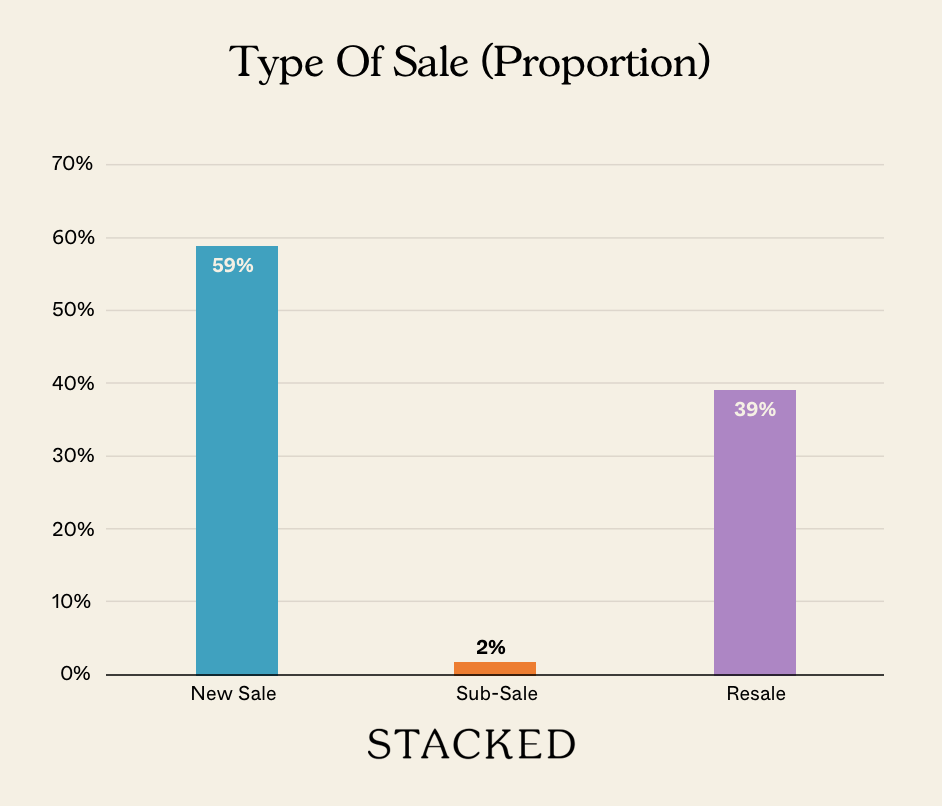

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are some HDB flats selling for over a million dollars in Singapore?

Will the new Plus and Prime classifications affect HDB flat prices in Singapore?

What are some reasons for the high demand for resale HDB flats in Singapore?

What challenges do property portals face in listing and regulating resale flats?

Are older flats still a good option for young buyers in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

Sorry, but why are you shilling for higher flat prices? Does Stacked Homes benefit from this in some indirect way? Perhaps you moonlight as a property agent or receive advertising from property agencies like Huttons or Savills?

An average homebuyer like me simply wants to buy a flat with the longest possible lease in my location. This is because if I buy older flats, they hit the depreciation cycle much faster. This means logical people would prefer the longer MOP HDB BTOs.

And lol, the rest of the speculators can duck themselves.

HDB is non strata titled. Hence it will have zero value once the lease period expires. If the unit is bought at $1m twenty years down the line it will never be worth more than $1m. Did the buyers ever thought of this?