6 Key Trends Of The Singapore Property Market In 2024: Here’s What Buyers Can Expect

January 3, 2024

New year, new market – at least that seems to be the case with real estate in Singapore. Property here is dynamic and ever-changing, and not just because of our overnight cooling measures; everything from layout preferences to rental prospects can be different in a year. Here are some of the likely trends we’ll see, based on where we left off in 2023:

Property trends that we may see in 2024:

- 1. Landlords and tenants taking advantage of higher occupancy caps

- 2. A departure from fixed-interest home loans in late 2024

- 3. Renewed interest in ageing, mixed-use properties

- 4. Bargain hunters in the hard-hit CCR

- 5. Stabilising prices as we resolve the supply crunch

- 6. More demand for properties near the MRT

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Landlords and tenants taking advantage of higher occupancy caps

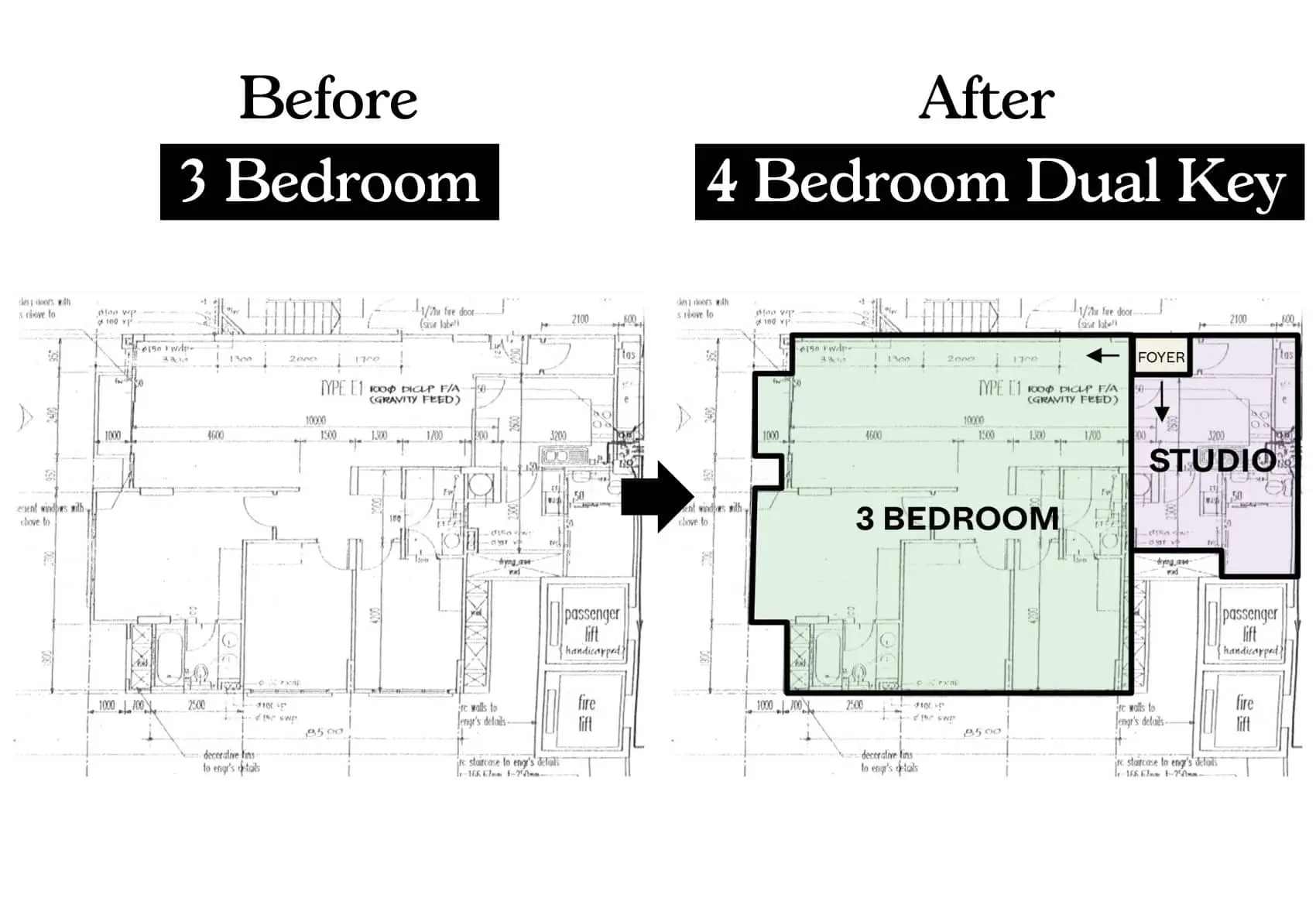

The occupancy cap on unrelated tenants has been raised: for 4-room or larger flats, it’s now possible to have eight unrelated tenants (up from six). For private properties that are 90 sqm. or larger, it’s also possible to have eight unrelated tenants.

This is beneficial to both sides. Landlords may be able to earn more from taking on two other tenants; whilst some tenants may find that taking on a roommate will make the rent more affordable.

As we’ve discussed in this article though, the rental market is softening – we saw this as early as Q2 and Q3 in 2023. Rental rates are still likely to dip as the supply of housing increases and new projects get completed, and we expect tenants to have more bargaining power going into 2024.

2. A departure from fixed-interest home loans in late 2024

The Fed aggressively pumped interest rates in the aftermath of COVID-19, causing home loan interest rates in Singapore to rise. This has been going on since 2022; you can read our detailed explanation here.

In light of falling inflation in the US, however, and an economic outlook that’s increasingly dim, the Fed has reversed its position. We’re now looking at three to six potential rate cuts in 2024 and 2025, which will gradually reduce home loan interest rates in Singapore as well.

This may cause borrowers to rethink their position on fixed-rate home loans, going into the latter half of 2024 (rate cuts tend to be gradual, so we may not see the effect in the early stages).

While cheaper home loans are beneficial to buyers, we don’t think it’s sufficient for investors to ignore ABSD rates and jump back in just yet – but it will be a relief to existing landlords, who may be seeing falling rental rates.

3. Renewed interest in ageing, mixed-use properties

There are two interesting redevelopments that will be closely watched this year:

The first is the redevelopment of Golden Mile Complex. When we first covered this, the attitude among developers seemed to be a lot of hand-waving and ambivalence – and there were serious concerns that Golden Mile was too big to easily redevelop and sell within the five-year deadline.

Now however, Far East Organization, Sino Land, and Perennial Holdings have all teamed up and bought it for $700 million; and their success (or lack of it) will be closely monitored by other developers.

The second redevelopment of note is the former Peace Centre/Peace Mansion, a property that was once denounced as an eyesore despite its prime location. Like Golden Mile, Peace Centre was a mixed-use project in a prime location, but run-down and had a reputation for shadiness.

If these redevelopment projects do well, they can renew interest in similar properties like Orchard Towers or Sultan Plaza; these are also older, mixed-use properties with good potential in terms of location. Developers might finally be convinced to buy them over.

4. Bargain hunters in the hard-hit CCR

As we showed in our year-end review, the CCR took some hard knocks in 2023; average gains stood at a mere one per cent, while other regions saw double-digit increases.

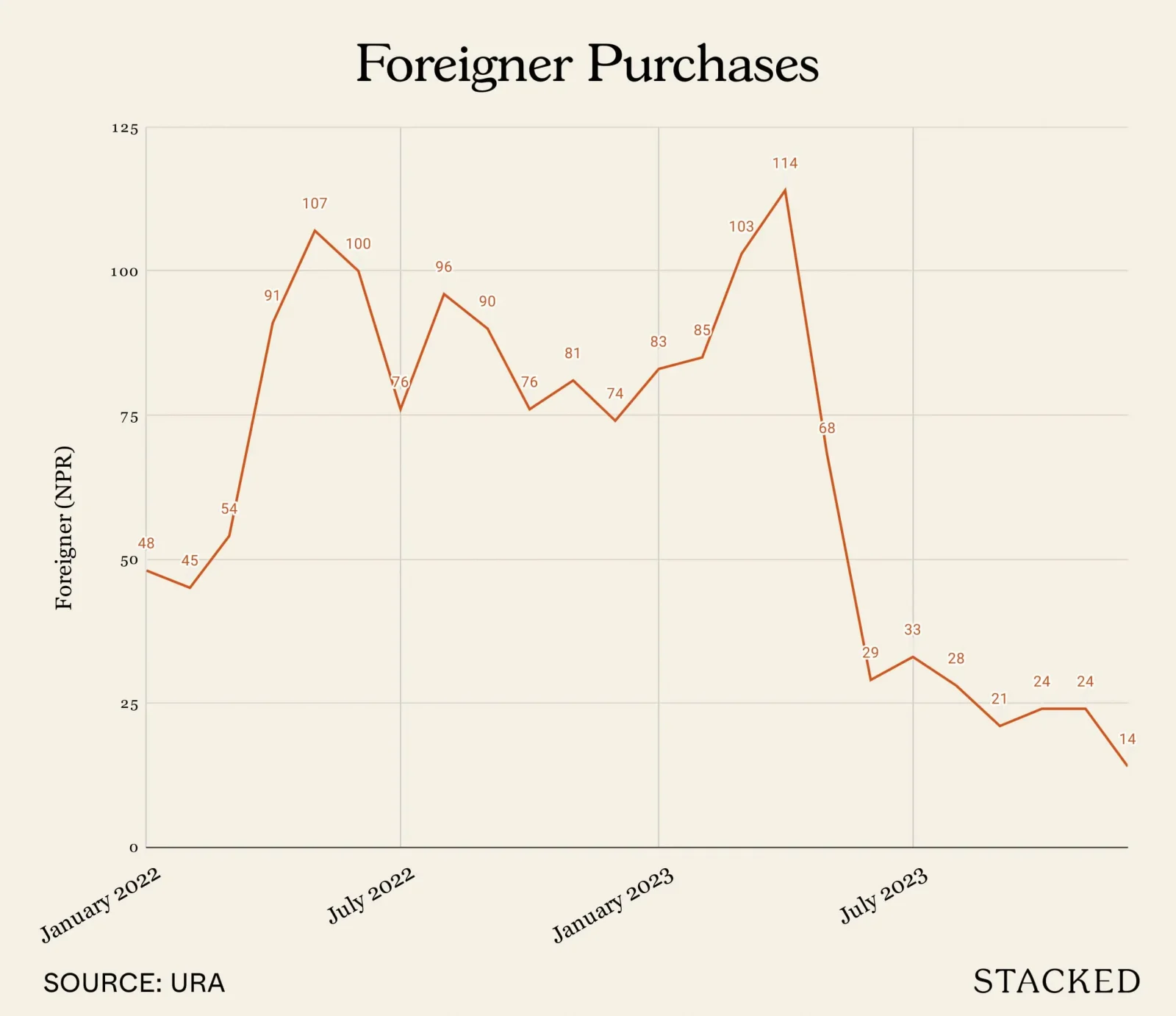

We daresay most market-watchers saw it coming, the moment new cooling measures were announced in April ‘23. ABSD rates for foreigners have been doubled to 60 per cent, and this buyer demographic is most prominent in the CCR.

Well, the situation may be getting worse: Huttons Asia mentioned in an Edgeprop report that, for 2024, we may be seeing the largest supply in the region since 2021, at around 2,968 units.

The combination of recent cooling measures, plus higher supply, is likely to drag on CCR prices. This may represent an opportunity for some home buyers, who may be sniffing around for a bargain or two next year. And don’t forget, the redevelopment of Golden Mile and Peace Centre are both in this region too.

5. Stabilising prices as we resolve the supply crunch

As mentioned in our year-end report, transaction volumes have been falling; and for the whole of 2023, average private home prices rose about 6.7 per cent. This is down from 8.6 per cent the year before, so there’s a clear slowdown.

Various property firms have also given numbers ranging from 8,000 to over 11,000 new units for 2024 (an estimated 38 launches so far). This is far ahead of the approximately 7,500 units in 2023. The housing supply crunch is mostly over, and we expect the higher supply to further rein in rising prices.

While it’s hard to say at this point still whether prices will actually drop (developers are too squeezed for this, and sellers are too well capitalised), we at least won’t see the same feverish pace we experienced right after COVID-19.

Overall though, prices are still high, and HDB upgraders are still feeling the pinch – the average new launch three-bedder is still at the $2 million mark, which is way past a comfortable budget for many of them. We’d expect their interest to still be on larger and older resale properties (for families), or lower-quantum OCR projects.

6. More demand for properties near the MRT

COE rates saw record highs last year; and with rising GST rates and overall cost of living, more Singaporeans are being priced out of cars.

This could explain the high take-up rates in condos such as J’den and Reserve Residences (you can see the top-selling projects for 2023 here). Both these projects are connected to MRT stations, and they managed to see high demand even though they launched near the cooling measures.

On the HDB front, incidentally, the new Plus model flats (of which Bayshore will be the first) are located near the MRT station for their neighbourhood. If demand for these flats is strong, regardless of their 10-year MOP and eligibility requirements, that could also reflect the growing demand for car-free living.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the expected trends in Singapore's property market in 2024?

How might the rental market change in Singapore in 2024?

What is the outlook for home loan interest rates in Singapore in 2024?

Why is there renewed interest in ageing, mixed-use properties in Singapore?

What opportunities might arise from the property market in the CCR region in 2024?

Why is there increasing demand for properties near MRT stations in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

2 Comments

Residential property prices surged unexpectedly during COVID, an anomaly unlikely to repeat in the next 3-5 years.