$1.658 Million For 5-Room HDB Loft In Queenstown Sets New Record

June 5, 2025

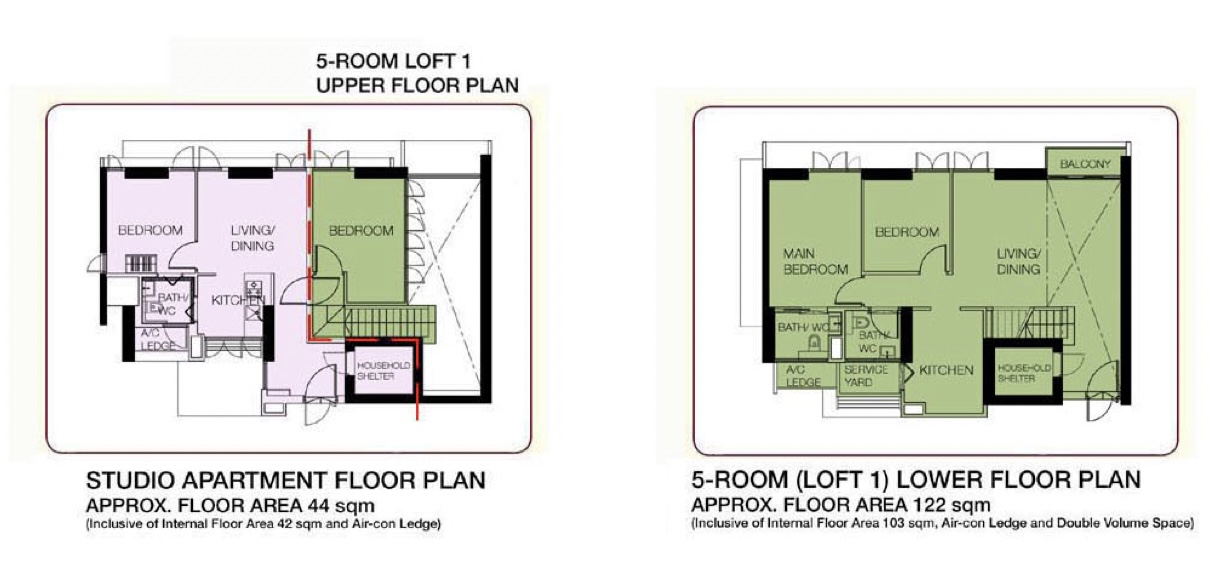

Singapore just got a new record holder for the most expensive HDB flat. In June 2025, a 122 sqm (1,313 sq ft) loft unit at Block 92 Dawson Road changed hands for $1,658,888. This officially became the most expensive 5-room flat in the country.

This Premium Apartment Loft sits between the 22nd and 24th floors with 89 years and 10 months left on its lease. And while there was an unofficial transaction announced at $1,725,888 at Margaret Drive, this Dawson Road sale takes the official crown since it actually appears in HDB’s database.

So what goes through someone’s mind when they’re paying over a million dollars for an HDB flat? Here are some factors that likely played a role:

Table of contents

1. HDB loft units are rare

This isn’t your standard 5-room flat. It’s a Premium Apartment Loft, a true unicorn of Singapore’s HDB stock that’s tough to find. Loft units exist in maybe a handful of developments across the entire island; and even those in Punggol are hitting $1.2 million these days. Finding one in central Queenstown? That’s as rare as they come.

The double-height ceiling and loft design sets it apart from a typical 5-room flat.

2. The Dawson precinct is convenient

Block 92 sits right in the middle of what’s become a pretty well-integrated neighbourhood:

- 8-minute walk to Queenstown MRT (with a covered route if you prefer)

- Two 24-hour supermarkets within five minutes: NTUC at Dawson Place and ShengSiong at SkyVille

- Direct access to Alexandra Park Connector and the Rail Corridor

- Multiple food courts and retail stores are scattered across Dawson Place and SkyVille@Dawson

- Childcare centres are practically next door

It’s the kind of setup where you rarely need to venture far for daily necessities. IKEA Alexandra and Anchorpoint and Delta Sports complex (with a public pool including kids pool) are also just a few bus stop rides away.

3. The size may look big – but it’s due to the high ceiling

At 122 sqm, this unit sounds massive. But here’s the thing: the actual usable floor area is around 103 sqm once you exclude the double-ceiling volume and air-con ledge.

What you get:

- Regular 5-room layout on the main floor

- Loft space with those dramatic high ceilings

- Proper yard area (something even many private condos skimp on)

- Views toward landed houses or the city skyline

4. Flats in the area are not comparable

As with most million-dollar HDB flats at this price point, the buyer probably wasn’t comparing this to other resale flats. They were looking at what else $1.658 million gets you in the same area.

Recent big-ticket Queenstown sales paint a picture:

- Margaret Drive 45th floor: $1.73 million (though unofficial)

- Dover Crescent improved unit: $1.55 million

- Mei Ling Street executive maisonette: $1.51 million

This transaction fits right into that pattern.

5. Private condos still costs more

When you look at private alternatives in Queenstown, the numbers get interesting. Generally, condos here are above the $2 million mark, given the location.

More from Stacked

Looking To Buy Singapore Property In 2025? Here’s What’s Different (And What Could Catch You Off Guard)

The 2025 property market is going to be unique, for several reasons: a pivot to the Core Central Region (CCR),…

| Projects | Tenure | Completion | Average of Unit Price ($ PSF) | Average of Transacted Price ($) | Average of Area (SQFT) |

| Alex Residences | 99 yrs from 18/03/2013 | 2017 | $2,242 | $2,147,378 | 956 |

| Ascentia Sky | 99 yrs from 26/03/2008 | 2013 | $1,953 | $2,880,000 | 1,475 |

| Casa Jervois | Freehold | – | $2,009 | $3,200,000 | 1,593 |

| Commonwealth Towers | 99 yrs from 07/05/2013 | 2017 | $2,346 | $2,334,629 | 997 |

| Echelon | 99 yrs from 06/03/2012 | 2016 | $2,094 | $2,342,625 | 1,117 |

| Jervois Grove | Freehold | 1986 | $1,853 | $2,593,000 | 1,399 |

| Jervois Meadows | Freehold | 1999 | $1,531 | $3,000,000 | 1,959 |

| Jervois Prive | Freehold | 2023 | $3,040 | $3,370,000 | 1,109 |

| Queens | 99 yrs from 16/02/1998 | 2002 | $1,677 | $2,046,667 | 1,224 |

| Queens Peak | 99 yrs from 28/09/2015 | 2020 | $2,190 | $1,998,125 | 912 |

| Tanglin Park | Freehold | 1989 | $2,469 | $3,653,333 | 1,478 |

| Tanglin Regency | 99 yrs from 01/05/1994 | 1998 | $1,731 | $2,125,000 | 1,227 |

| Tanglin View | 99 yrs from 17/05/1997 | 2001 | $1,795 | $2,112,500 | 1,176 |

| The Anchorage | Freehold | 1997 | $1,939 | $3,178,833 | 1,647 |

| The Crest | 99 yrs from 21/12/2012 | 2017 | $2,018 | $2,610,750 | 1,289 |

| The Metropolitan Condominium | 99 yrs from 17/02/2006 | 2009 | $1,858 | $2,620,000 | 1,410 |

- Alex Residences: Around $2.15 million for just 956 sq ft

- Commonwealth Towers: $2.33 million for 997 sq ft

- Echelon: $2.34 million for 1,117 sq ft

- Ascentia Sky: $2.88 million for 1,475 sq ft

Drilling down to individual transactions, you can find compact 3-bedroom units at Queens Peak starting around $1.75 million. But here’s the catch: these are smaller units that usually don’t include proper yard space, which is less practical compared to HDB layouts that typically have yards.

For someone willing to top up a bit more to jump to private, the options exist. But when you factor in what this loft unit offers, greenery views, unique loft features, and a practical layout, the HDB might actually be the better choice if facilities aren’t a priority.

The loft unit also has the advantage of being relatively new (2016), with 89 years still left on the lease.

Another loft unit in the same block sold for $1.418 million back in 2022, and that was on a higher floor (37th-39th). The price jump to $1.658 million reflects both general market movements and the simple reality that these units barely exist.

HDB isn’t making any more loft units, and the existing ones are spread across just a few developments. Basic economics applies here.

6. Other things to know about this area

A few other things stand out about this transaction:

Schools had nothing to do with it. There’s only one primary school nearby, and it’s not exactly on anyone’s wishlist. This buyer was thinking about other things entirely.

The layout matters. When you combine a rare flat configuration with a central location and practical layout, some buyers are willing to pay significantly for that combination.

7. What does all this mean?

Traditional HDB metrics don’t apply anymore at this price level. The usual considerations, age of building, school proximity, and even exact distance to MRT, take a backseat to uniqueness and overall lifestyle package.

At the end of the day, $1.658 million is a lot of money for any HDB flat. But for someone who wanted a genuinely unique living space in a convenient central location, and didn’t particularly care about condo facilities or status, this loft unit offered something that simply isn’t available anywhere else.

Whether that’s worth $1.658 million is, of course, entirely up to the buyer. What’s clear is that Singapore’s property market has evolved to the point where certain HDB units are playing in a completely different league from traditional public housing.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the $1.658 million HDB loft in Queenstown sell for such a high price?

What makes HDB loft units in Singapore so expensive and rare?

How does the size of the HDB loft compare to its usable space?

How does the price of this HDB loft compare to private condos in Queenstown?

What factors might influence someone to pay over a million dollars for an HDB flat?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

1 Comments

Singaporeans get the government they deserve, so I don’t want to hear any more complaints!