5 Lower-Priced Alternatives To The Watergardens At Canberra

August 29, 2021

The Watergardens at Canberra is proving popular already, with its attractive new launch price (we have a full review of Watergardens at Canberra on Stacked). According to UOL, about 60% of the 448 units were sold over the launch weekend, with the demand well spread out across the unit types. So if you were unable to get the unit you want, however, or are pondering alternatives, you’ll be glad to know there are several other condos within walking distance. As these are quite close by, the locational advantages will not be too different. The following developments are all, at most, a 10-minute walk from Watergardens. In this piece, we’d be looking at the 5 closest competitors:

| Development | Units | Psf | TOP | Tenure |

| The Watergardens at Canberra | 448 | $1,400 est | 2026 | 99 Years |

| Provence Residence EC | 413 | $1,153 | 2026 | 99 Years |

| Parc Canberra EC | 495 | $1,096 | 2023 | 99 Years |

| The Brownstone EC | 638 | $981 | 2017 | 99 Years |

| The Visionaire EC | 632 | $999 | 2018 | 99 Years |

| 1 Canberra EC | 665 | $913 | 2015 | 99 Years |

| Eight Courtyards | 656 | $1,007 | 2014 | 99 Years |

| The Nautical | 435 | $1,025 | 2016 | 99 Years |

| Yishun Sapphire | 380 | $781 | 2001 | 99 Years |

| Yishun Emerald | 436 | $785 | 2002 | 99 Years |

1. The Commodore

Address: Canberra Drive (District 27)

Developer: JBE (Canberra) Pte. Ltd.

Lease: 99-years

TOP: 2026

Number of units: 219

(The Commodore will launch sometime this year, but for now, there is no confirmed pricing. It is expected to be in the range of $1,400 to $1,490 psf). The land purchase price is similar ($644 psf for The Commodore and $650 psf for The Watergardens at Canberra) so JBE Holdings will definitely be taking some indication for how The Watergardens fares.

Key points of comparison:

The Commodore will be a smaller development than Watergardens, with only 219 units. This could mean a little more exclusivity, with the trade-off of higher maintenance costs; we’ll know for sure once the launch happens (the fewer the units, the higher maintenance fees tend to be).

The Commodore is located further up the road from Watergardens, placing at just 330 metres from Canberra MRT station; this is about a nine-minute walk. This is slightly closer than Watergardens (520 metres, or around a 12-minute walk).

The Commodore is technically closer to Sembawang Shopping Centre, where you’ll find Giant, Popular, and Daiso among others.

However, a check on walking routes shows that – The Commodore is actually located closer to the Canberra MRT station – but only when Canberra Vista is completed (slated to be done in 2024), so that’s when you can cut through the estate for a quick and easy walk.

Other than this, not much information is out for The Commodore just yet; but keep in mind this is an upcoming new launch alternative.

2. 1 Canberra EC

Address: Canberra Drive (District 27)

Developer: MCC Land

Lease: 99-years

TOP: 2015

Number of units: 665

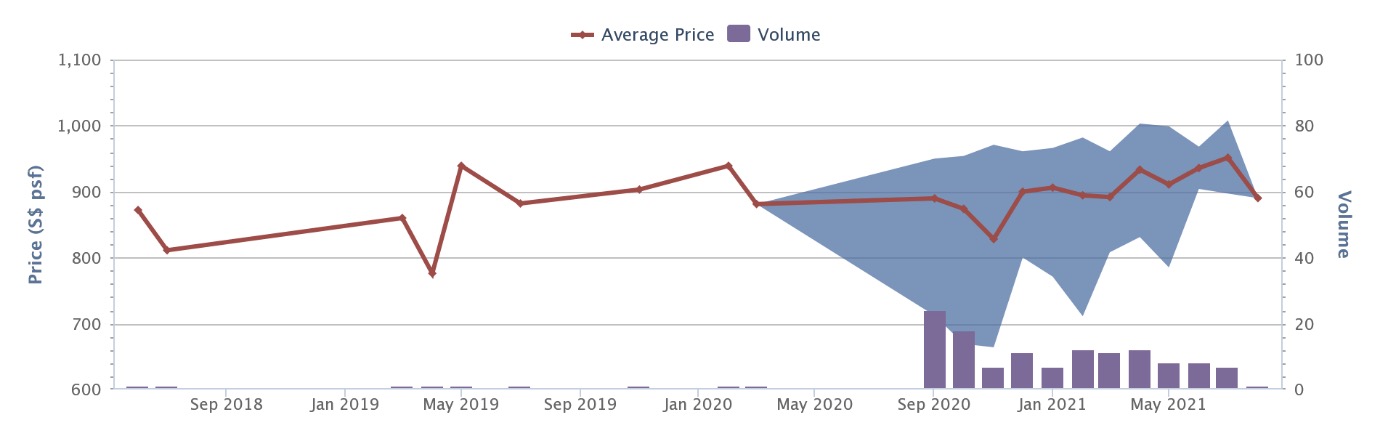

Current prices shows indicative pricing of $785 to $1,008 psf, with an average of $922 psf.

There have been 121 profitable transactions, with no losses.

Key points of comparison:

1 Canberra is right across the road from Eight Courtyards (see below).

One salient point to consider is that 1 Canberra is a resale EC, which recently reached its five-year Minimum Occupancy Period (MOP). This offers a number of advantages:

HDB upgraders can buy an EC unit before selling their flat, without incurring the upfront ABSD. In addition, the MOP only applies to the first batch of EC buyers. So if you were to buy 1 Canberra today, you could rent out the entire unit straight away.

Being a resale EC, 1 Canberra is of course a lot cheaper than a private new launch like Watergardens. For example 1 Canberra has 1,249 sq. ft., dual-key units, which have shown transaction prices as low as $1.218 million; while the 948 sq. ft. units have seen totals as low as $850,000.

That said, 1 Canberra is a bit closer to the Yishun end, around 740 metres away from Canberra MRT station. By contrast, Watergardens is just 520 metres away from the MRT.

Another drawback is the distance from Sembawang Shopping Centre, the area’s main hub of amenities. This is about a 15-minute walk from 1 Canberra.

This EC is closer to Ahmad Ibrahim and Yishun Primary Schools, however, which may be a draw if your children attend. For enrolment purposes though, there’s no difference; all the condos here fall well within the 1km distance.

3. Eight Courtyards

Address: Canberra Drive (District 27)

Developer: Frasers Centrepoint Homes, Far East Organization

Lease: 99-years

TOP: 2014

Number of units: 656

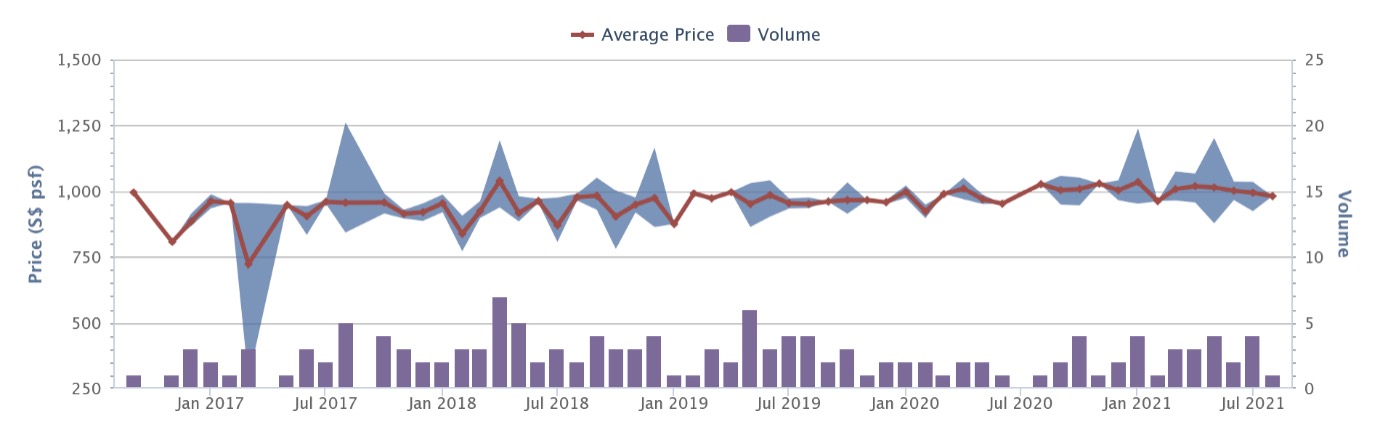

Current prices shows indicative pricing of $878 to $1,202 psf, with an average of $1,006 psf.

There have been 136 profitable transactions, with four unprofitable transactions.

Key points of comparison:

Eight Courtyards is across the road from 1 Canberrra (see above), so in terms of overall location, there’s not much difference.

As you’d expect, Eight Courtyards is priced higher than its neighbour, being a fully private condo. A 947 sq. ft. unit here, for instance, transacts at around $950,000 – around a $100,000 difference from an equivalent sized unit at 1 Canberra. Given that 1 Canberra is halfway to privatisation anyway, and requires no ABSD, we do feel HDB upgraders will be more inclined toward the neighbouring development.

The other differences are too subjective to quantify; and it will come down to your preference over layout and facilities.

In any case, both developments – 1 Canberra and Eight Courtyards – are less conveniently located than Watergardens, but are fairly priced to make up for it. So if you like the location but the price is the concern, view these two options.

More from Stacked

Units Of The Week Issue #77

This week on Units Of The Week, it's back to the theme of bigger more spacious units as the demand…

Property Market CommentaryNeighbourhood Of The Week: Yishun (District 27)

by Ryan J. Ong4. Yishun Emerald

Address: Canberra Drive (District 27)

Developer: Frasers Centrepoint Homes

Lease: 99-years

TOP: 2002

Number of units: 436

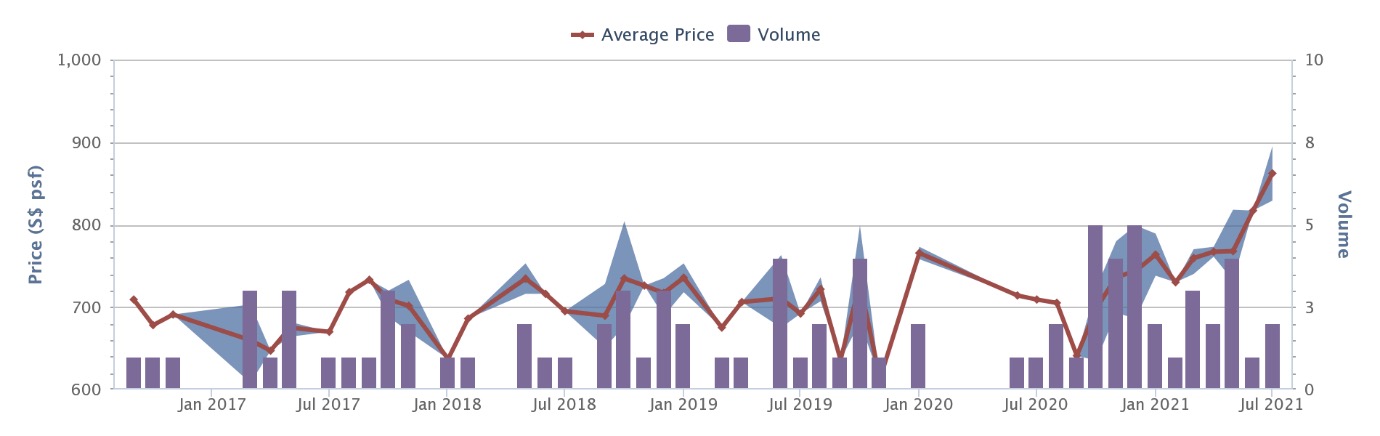

Current prices shows indicative pricing of $732 to $895 psf, with an average of $785 psf.

There have been 79 profitable transactions, with six unprofitable transactions.

Key points of comparison:

Yishun Emerald is getting on in years, and will be around 20 years old next year. As with many older resale condos, however, you get a degree of space that’s lacking in newer units.

The large, 1,432 sq. ft. units here, for instance, have seen transaction prices as low as $1.048 million; while 1,033 sq. ft. units have transacted at $845,000. It’s quite rare to find developments that are 10 minutes walk to the MRT station, and which also have 1,000+ sq. ft. units that are under $1 million today.

That said, Yishun Emerald is not the most aesthetically pleasing condo we’ve seen. It’s quite common to hear people comment that the blocks look like HDB projects (and fair enough, without the guard house and roof shapes we might have mistaken it for one). The facilities and façade, while well maintained, are clearly from an older era. What will annoy buyers today are the large planter boxes, which are found in a number of units.

While search engines suggest that Canberra MRT station is a very long walk away (sometimes stated as 15 minutes), residents have told us that’s only if you use the main gate – this condo has a side gate that cuts down the walking time to less than 10 minutes.

5. Yishun Sapphire

Address: Canberra Drive (District 27)

Developer: Frasers Centrepoint Homes

Lease: 99-years

TOP: 2001

Number of units: 380

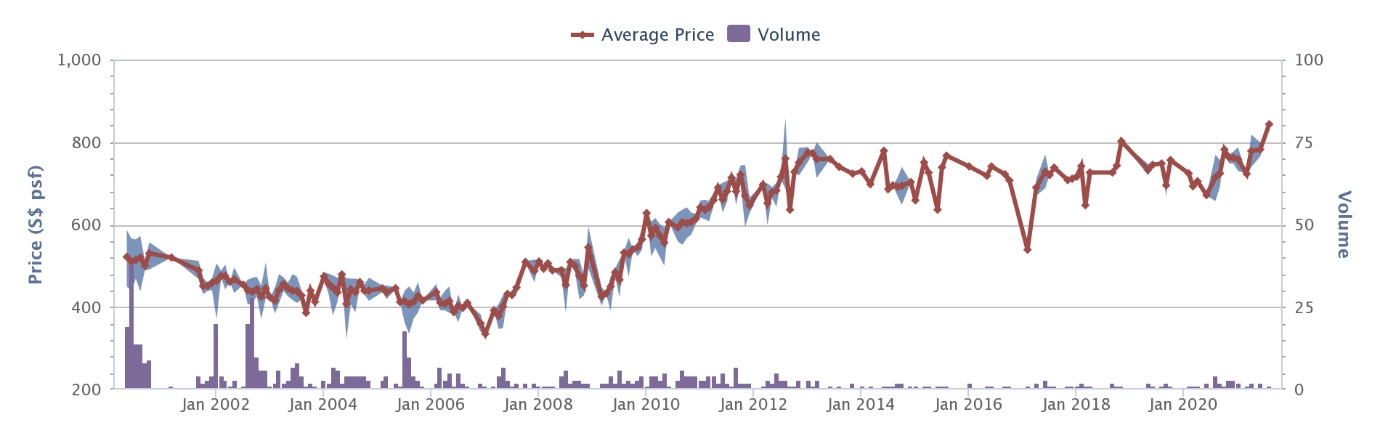

Current prices shows indicative pricing of $723 to $843 psf, with an average of $781 psf.

There have been 218 profitable transactions, with 47 unprofitable transactions.

Key points of comparison:

This is the oldest condo within walking distance of Watergardens, although it’s only a year older than its Yishun Emerald. Being so close, its location is more or less similar to Yishun Emerald as well.

Between the two, Yishun Sapphire was in a better state of maintenance when we last saw it (better upkeep of the pool and playground areas in particular). However, the MRT tracks pass a little close for comfort, and we suspect some units may be exposed to more track noise – be picky with your stack here, and try to avoid facing the train track directly.

As with Yishun Emerald, the MRT station is closer than online searches would suggest. From the side gate to Canberra MRT, it’s under a 10-minute walk.

As with Yishun Emerald, units are more spacious than newer counterparts – but they involve the same inefficiencies like planter boxes. Some of the ground floor units have quite large Private Enclosed Spaces (PES), which some buyers may dislike.

Even though they’re a bit further from Watergardens, we have to at least mention Provence Residence and Parc Canberra EC

We cover these two developments in some detail, in this earlier article. Both of these ECs also provide excellent access to the Canberra MRT station.

As an update, however, Parc Canberra appears to be sold out, whereas Provence Residence has moved about 66 per cent of its 413 units.

The presence of so many ECs close to Watergardens – and new ECs at that – is problematic. The lower price point of ECs can make Watergardens look very expensive by contrast, so buyers need to keep in mind the differences like the MOP, and resale restrictions for the first 10 years; buying at The Watergardens at Canberra means you won’t be subject to these, despite the higher price. For a detailed breakdown, we’ve compiled a comparison table neatly right here:

| Projects | Tenure | Completed | 1BR Price | Size Range | 2BR Price | Size Range | 3BR Price | Size Range | 4BR Price | Size Range |

| 1 Canberra | 99 yrs from 30/01/2012 | 2015 | $980,748 ($908 psf) | 936 – 1539 sqft | $1,472,907 ($810 psf) | 1442 – 2422 sqft | ||||

| Canberra Residences | 99 yrs from 08/09/2010 | 2013 | $601,667 ($939 psf) | 614 – 700 sqft | $815,000 ($889 psf) | 850 – 990 sqft | $1,149,278 ($864 psf) | 1076 – 1528 sqft | $1,495,000 ($778 psf) | 1905 – 1938 sqft |

| D’Banyan | 999 yrs from 26/03/1885 | 2005 | $620,000 ($993 psf) | 624 – 624 sqft | $899,000 ($788 psf) | 1119 – 1163 sqft | ||||

| Eight Courtyards | 99 yrs from 20/09/2010 | 2014 | $583,333 ($1,135 psf) | 452 – 549 sqft | $841,861 ($990 psf) | 753 – 893 sqft | $1,100,415 ($1,001 psf) | 947 – 1378 sqft | $1,530,000 ($974 psf) | 1572 – 1572 sqft |

| Seletaris | Freehold | 2001 | $1,020,450 ($869 psf) | 1119 – 1206 sqft | $1,205,750 ($875 psf) | 1324 – 1572 sqft | $1,576,500 ($878 psf) | 1615 – 1981 sqft | ||

| The Brownstone | 99 yrs from 28/04/2014 | 2017 | $783,000 ($1,070 psf) | 732 – 732 sqft | $970,629 ($952 psf) | 883 – 1130 sqft | $1,190,000 ($1,079 psf) | 1066 – 1141 sqft | ||

| The Nautical | 99 yrs from 29/08/2011 | 2015 | $559,667 ($1,219 psf) | 441 – 570 sqft | $806,700 ($1,049 psf) | 764 – 786 sqft | $1,085,523 ($936 psf) | 883 – 1389 sqft | $1,580,000 ($923 psf) | 1711 – 1711 sqft |

| The Sensoria | Freehold | 2007 | $934,500 ($880 psf) | 1001 – 1098 sqft | $1,324,500 ($898 psf) | 1152 – 2282 sqft | ||||

| The Visionaire | 99 yrs from 09/01/2015 | 2018 | $755,000 ($1,047 psf) | 721 – 721 sqft | $955,667 ($1,000 psf) | 850 – 1023 sqft | ||||

| Yishun Emerald | 99 yrs from 16/02/1998 | 2002 | $783,648 ($780 psf) | 958 – 1033 sqft | $925,143 ($767 psf) | 1152 – 1432 sqft | $968,105 ($728 psf) | 1206 – 1410 sqft | ||

| Yishun Sapphire | 99 yrs from 16/02/1998 | 2001 | $735,629 ($741 psf) | 958 – 1023 sqft | $914,000 ($775 psf) | 1152 – 1195 sqft | $960,167 ($744 psf) | 1206 – 1399 sqft |

For a more detailed price comparison, do check out our full-length review of The Watergardens at Canberra. You can also follow us on Stacked, to get updates on new and resale condos in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some affordable alternatives to The Watergardens at Canberra nearby?

How does the price of Yishun Emerald compare to Watergardens at Canberra?

Are there resale options close to Watergardens at Canberra that are cheaper?

What are the main differences between The Commodore and Watergardens at Canberra?

Is Yishun Emerald a good option for larger units at a lower price?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

2 Comments

Brownstone has already TOP-ed in 2017!