5 Fast-Selling New Launches That Were Surprisingly Unprofitable Later (Some 0 Profitable Transactions)

July 20, 2022

Nothing charges up a condo show flat like a “selling fast” sign, or hyped-up news of how it sold out over a weekend. But as we’re about to see, not every condo that had a great launch ended up performing well. Below are some condos that sold fairly quick (most units gone within six months), but ended up with resale numbers that are a bit lacklustre:

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How we picked the condos on this list

The following is based on new launches from 2012. Only new launches that have registered at least one resale transaction, up to May 2022, are considered. All of the following properties were able to sell out at least 90 per cent of their total units, within the first six months of their launch (like what we did here). Then we ranked them by the proportion of gains, considering them to have “done poorly” later on if more than 30% of all buyers made a loss (all type of sales).

| Project | Total Units | How Many Sold In 6 Months? | Proportion Sold | Tnx (Gains) | Average Gain | Tnx (Loss) | Average Loss | Tnx (Breakeven) | Total Tnx | Proportion Losers |

| 8 BASSEIN | 74 | 71 | 96% | 0 | $ – | 11 | -$110,046 | 0 | 11 | 100% |

| STELLAR RV | 120 | 113 | 94% | 0 | $ – | 17 | -$129,639 | 0 | 17 | 100% |

| EDENZ SUITES | 34 | 33 | 97% | 1 | $9,204 | 11 | -$36,669 | 0 | 12 | 92% |

| GAMBIR RIDGE | 77 | 75 | 97% | 3 | $39,867 | 9 | -$85,656 | 0 | 12 | 75% |

| NEWEST | 136 | 129 | 95% | 8 | $109,323 | 11 | -$161,773 | 0 | 19 | 58% |

| SMART SUITES | 72 | 69 | 96% | 6 | $22,226 | 5 | -$43,232 | 0 | 11 | 45% |

| NESS | 62 | 59 | 95% | 16 | $56,326 | 9 | -$44,700 | 1 | 26 | 35% |

| THREE 11 | 65 | 63 | 97% | 7 | $149,429 | 4 | -$84,750 | 0 | 11 | 36% |

| KAP RESIDENCES | 142 | 136 | 96% | 9 | $68,933 | 5 | -$76,560 | 0 | 14 | 36% |

| 1919 | 75 | 70 | 93% | 13 | $65,627 | 7 | -$87,014 | 0 | 20 | 35% |

| KATONG REGENCY | 244 | 230 | 94% | 27 | $190,773 | 12 | -$69,935 | 0 | 39 | 31% |

| THE PROMENADE@PELIKAT | 164 | 154 | 94% | 28 | $42,861 | 12 | -$29,684 | 0 | 40 | 30% |

You may notice that many of the condos on this list are small or boutique developments. Note that this can contribute to their underperformance: when your project has only 50 units, for instance, there may only be one or two transactions a year. In these cases, a single, below-value transaction can send the average plummeting.

Do note that all transactions are based on URA records. There may be transactions that were not recorded by URA that we have no access to.

1. Gambir Ridge

Location: 16 Gambir Walk (District 19)

Developer: Meadows Investment Pte. Ltd.

Lease: Freehold

TOP: 2015

Number of units: 77

Percentage of units sold within six months of launch: 97%

Percentage of profitable resale transactions: 25% (3 gains, 9 losses)

Average gain: $39,866.67

Average loss: $85,655.56

Gambir Ridge was redeveloped from the former Bartley Terrace. Interest in the location rose from a number of en-bloc sales in the Barley area at the time: besides Bartley Terrace, Bartley Grove and several other terrace houses also went up for collective sale. At the time, the various en-bloc sales in the area set a new benchmark for District 19.

The area saw renewed interest because of the introduction of Bartley MRT station, around three years prior. This solved longstanding accessibility issues: the area now coupled low-density housing (it’s a landed enclave), with access to Maris Stella High School as well as the MRT. On top of that, NEX megamall opened in late 2010. This major retail hub would be just a 10-minute drive.

By the time the land plots were redeveloped, buyers seemed convinced this was the next up-and-coming area. As the above report mentions, Casa Cambio and Bartley Residences – also nearby new launches – saw brisk sales. Gambir Ridge itself manage to sell out in just three days (it does help that the unit count is small, at just 77 units).

However, interest in the area has cooled significantly. We noted that The Lilium saw slow sales, by the time of its launch. In recent years, buyers have also seen Bartley Vue and The Gazania as alternatives – these newer developments are only about eight-minutes from Gambir Ridge, so this project faces a lot of recent competition.

2. Edenz Suites

Location: 21 Lorong 28 Geylang (District 14)

Developer: Admin Holdings Pte. Ltd.

Lease: Freehold

TOP: 2015

Number of units: 34

Percentage of units sold within six months of launch: 97%

Percentage of profitable resale transactions: 8% (1 gains, 11 losses)

Average gain: $9,204

Average loss: $36,668.91

This development is angled at a pure rental strategy, for landlords with a high-risk appetite. Edenz Suites is perilously close to the red-light Lorongs in Geylang; perhaps close enough to incur financing issues.

Many banks do not provide home loans, or provide only limited loans, for properties too close to these vice areas. Interested buyers will probably contend with high upfront payments.

The brisk initial sales are not surprising – this is a boutique property, with only 34 units to move. At launch, prices were only around $1,329 psf, with these shoebox units (below 500 sq. ft.) going for around $650,000 or under. Every unit here is a 1 bedroom unit, so as you might expect, it also has a very niche audience in the resale market.

Of the resale transactions, just one has been “profitable”. But given the gross profit recorded was actually just $9,204, after accounting for selling costs you could just consider this as a loss overall as well. That said to be fair, most of the losses here have been quite minimal as well.

The Geylang area has long been a hotspot for foreign workers, and rental yields can be impressive. The average gross rental yield for Edenz Suites is 3.6%, with some able to achieve above 4% – which is pretty good for the Singapore market. However, small apartments near a red-light area have slim resale prospects. Edenz Suites – and the nearby Edenz Loft – are best left to veteran investors.

3. 8 Bassein

Location: 8 Bassein Road (District 11)

Developer: World Class Developments (City Central) Pte. Ltd.

Lease: Freehold

TOP: 2015

Number of units: 74

Percentage of units sold within six months of launch: 96%

Percentage of profitable resale transactions: 0% (11 losses)

Average gain: N/A

Average loss: $110,046.09

8 Bassein saw brisk sales at launch, because of its proven location. Novena was, and still is, a hotspot for landlords. There seem to be two main issues afflicting it:

More from Stacked

High Park Residences vs Parc Botannia: A Data-Driven Look At Mega vs Mid-Sized Condo Performance

In this Stacked Pro breakdown:

8 Bassein is surrounded by many other boutique freehold condos, and buyers have no shortage of options. Some of these are even closer to the train station.

Novena Suites, for instance, is just a three-minute walk to Novena MRT, whereas 8 Bassein is a much longer 13-minute walk. Even the older Novena Ville is just a seven-minute walk, and is priced much lower on account of age (you can find out more about it here).

We can name quite a few other options as well, including The Ansley and Pavilion 11. Simply put, sellers and landlords have to fight tooth and nail to get attention in the Novena area.

The second issue is the unit mix. Aside from three 3-bedroom penthouse units (above 2,000 sq. ft.), and a couple of 3-bedroom units at 872 sq. ft, the majority of the units (86%) at 8 Bassein are shoeboxes, at below 500 sq. ft. Shoebox units are generally better for rental gains, but are tougher at resale: we have a detailed explanation of the reasons in this article.

Property Investment InsightsShoebox Units: A Performance Review Over The Past 10 Years

by Ryan J. OngThey did try to push the SOHO concept (much like The Tennery), but while it seemed like it made sense on paper, the reality didn’t seem to impress the general market. While the small size of the 1-bedroom units seems to encapsulate more usability on paper due to the higher 3.4 metre ceiling height with the bedroom forming a study and the bed placed on a platform. But the real-world use wasn’t really there. At that height, it’s really not tall enough for you to stand on, and to move up and down daily on such a platform was probably not feasible for most buyers.

A final, but small point. 8 Bassein has 58 mechanical car park lots, which is often seen as a major drawback for car owners.

4. KAP Residences

Location: 11 King Albert Park (District 21)

Developer: Oxley Sanctuary Pte. Ltd.

Lease: Freehold

TOP: 2016

Number of units: 142

Percentage of units sold within six months of launch: 96%

Percentage of profitable resale transactions: 64% (9 gains, 5 losses)

Average gain: $68,933.33

Average loss: -$76,560

We can’t blame buyers if they’re disappointed by the performance at KAP – at the time of launch, we would have had much higher expectations too.

King Albert Park was at the heart of this area; we don’t think we’ve ever seen Singaporeans so upset at the closing of a McDonald’s for the redevelopment. When KAP Residences launched, the expectation was a revival of the immediate area – it would be renewed, but still, the amenities hub where students, elderly residents, etc., met and mingled.

Then when KAP Residences was complete, what greeted tenants was… more or less a ghost mall. No McDonald’s, no supermarket, no promised anchor tenants. At one point, there was almost a bitter lawsuit over this. It got so bad that residents had to take control of matters themselves.

The good news is, KAP Mall has improved. The mix of shops here is getting better and there’s a cinema now. However, the lacklustre resale figures reflect the rough patch KAP went through. We have to say someone really dropped the ball here: this project squandered a lot of its potential.

That said, there are things looking up in the area too. With the sales of new launches in the area like Mayfair Modern and Mayfair Gardens, to the Linq @ Beauty World – prices may be propped up once more of these units come on the market.

5. Stellar RV

Location: 408 River Valley Road (District 10)

Developer: Alliance Land Pte. Ltd.

Lease: Freehold

TOP: 2015

Number of units: 120

Percentage of units sold within six months of launch: 94%

Percentage of profitable resale transactions: 0% (17 losses)

Average gain: N/A

Average loss: -$129,638.59

Stellar RV, like 8 Bassein, suffered from the decline of the shoebox craze after 2012. Most of the units average 500 sq. ft., and top out at around 900 sq. ft.

This provides not-so-good resale prospects in the current market: the majority of condo buyers today are HDB upgraders, and these are mainly families; they have no use for a single-bedder. This leaves few buyers for shoebox units, besides investors (currently hit by higher ABSD rates), or singles (often on a tight budget).

This issue was not apparent at the time of launch, however – we recall that, when Stellar RV first came about, buyers were thrilled with the idea of a River Valley condo at as low as $1.05 million.

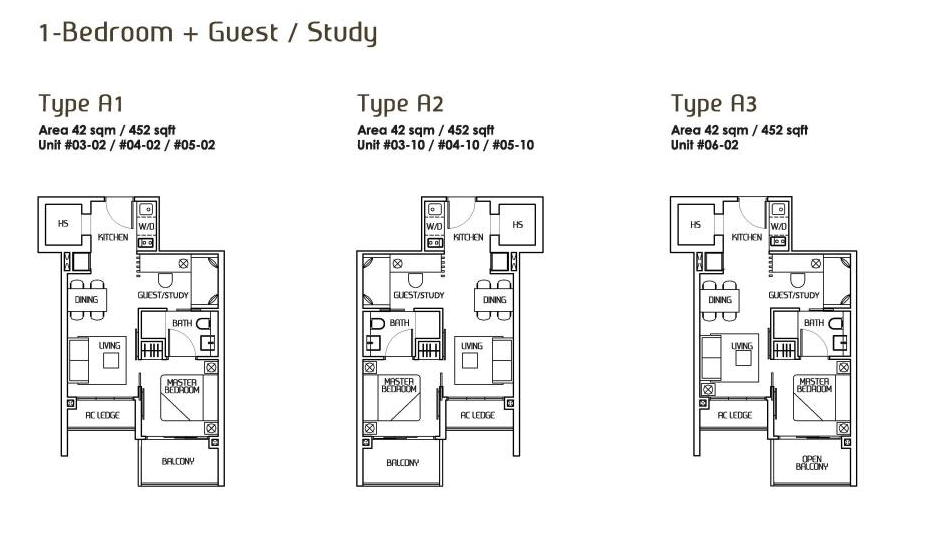

We did do a write-up on why it hasn’t performed as well in the resale market, and it mainly comes down to: the timing issue, the internal floor plans, and the rental yield (at least, at that point in March 2021).

Take a look at the floor plan and you’d see what we mean.

We don’t go too much into detail here, but one of the main issues that we can see is the placement of the AC ledge outside of the living instead of the bedroom. The half-height wall here would naturally make the space feel smaller as there’s less light coming in – there’s a reason why this arrangement is rare to see in the market today.

That said, Stellar RV owners might stand to benefit from the uptick in the rental market; and their yields might make up for the lack of resale gains.

Other condos that did well at launch, but underperformed for resale

You may notice that many of the condos on this list are small or boutique developments. Note that this can contribute to their underperformance: when your project has only 50 units, for instance, there may only be one or two transactions a year. In these cases, a single, below-value transaction can send the average plummeting.

This is a factor worth considering sometimes, even if smaller developments offer more exclusivity.

For more on the Singapore private property market, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did some condos sell quickly but end up with poor resale performance?

What are common reasons for condos to have no profitable resale transactions?

How does the size of units affect resale prospects in condos like 8 Bassein or Stellar RV?

What impact does location and amenities have on the resale performance of condos like KAP Residences?

Are new condo launches always profitable in the resale market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments