Which HDB Towns Are Getting Close To Condo Prices In 2025?

October 29, 2025

In 2025, some resale flats are hitting prices once thought impossible. A handful of towns now see 4-room, 5-room, and even Executive units transacting at well over $1 million. Case in point: last year, roughly 39 per cent of Bukit Timah flats, 26 per cent of Central Area flats, and 21 per cent of Bishan flats sold above $1 million. At these levels, buyers can’t help but compare: for a little more, you could already step into a resale condo, or maybe even a compact new launch unit.

(And yes, some retirees with profitable flats do right-size into a one or two-bedder condo unit, not necessarily a smaller flat.)

So whether it’s Queenstown, Toa Payoh, Bishan, or Bukit Merah, resale flats in these areas are so close to condo prices, buyers might seriously consider if it’s worth going private, especially if the pricey flats are also among the older ones.

To give some clarity, we pulled the transaction data from 2024 to mid-2025. Here, we identified the towns where HDB resale prices are so high, they are closing in on condo territory (to be clear, Executive Condos are included here):

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Let’s start by looking at three-bedder condo prices across various regions

| Region | Average price of new 3-bedders | Min. price of new 3-bedders |

| CCR | $4,063,601 | $2,190,000 |

| RCR | $2,696,626 | $1,866,000 |

| OCR | $1,954,093 | $1,158,000 |

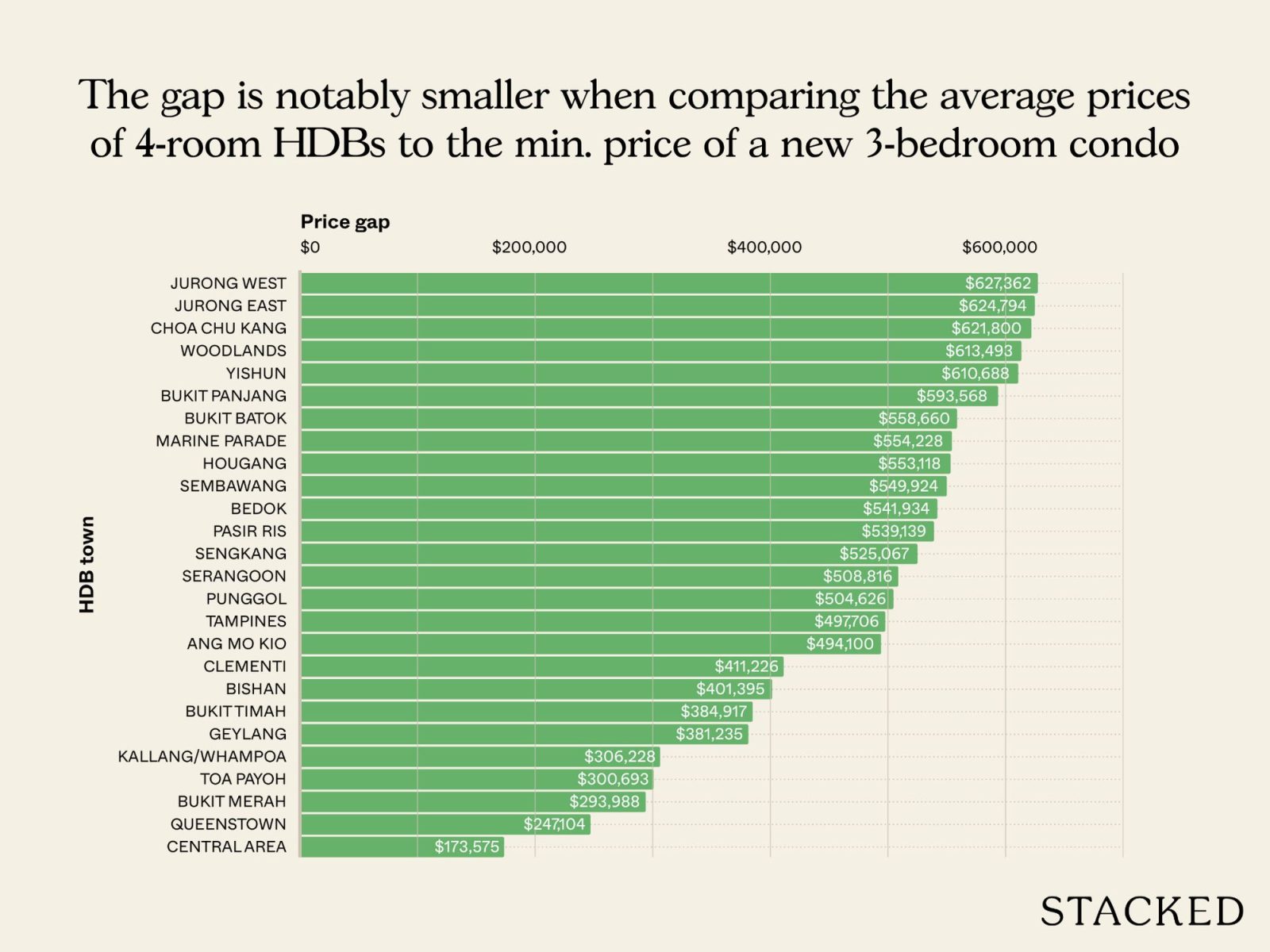

We’ll consider three-bedder condo units to be roughly equivalent to 4-room flats. Besides both having three bedrooms, they tend to share the same general size (a three-bedder condo unit is generally upward of 900 sq ft, whilst most 4-room flats are 960 to 1,000 sq ft)

Now, let’s compare the three-bedder condo prices to the 4-room flat prices

4-room HDB (prices sorted from lowest to highest)

| HDB town | Average price of 4-room HDBs | Price gap between 4-room HDB and lowest average price of a new 3-bedder | Price gap between 4-room HDB and minimum price of a new 3-bedder |

| JURONG WEST | $530,638 | $1,423,455 | $627,362 |

| JURONG EAST | $533,206 | $1,420,887 | $624,794 |

| CHOA CHU KANG | $536,200 | $1,417,893 | $621,800 |

| WOODLANDS | $544,507 | $1,409,586 | $613,493 |

| YISHUN | $547,312 | $1,406,781 | $610,688 |

| BUKIT PANJANG | $564,432 | $1,389,661 | $593,568 |

| BUKIT BATOK | $599,340 | $1,354,753 | $558,660 |

| MARINE PARADE | $603,772 | $1,350,321 | $554,228 |

| HOUGANG | $604,882 | $1,349,210 | $553,118 |

| SEMBAWANG | $608,076 | $1,346,016 | $549,924 |

| BEDOK | $616,066 | $1,338,027 | $541,934 |

| PASIR RIS | $618,861 | $1,335,232 | $539,139 |

| SENGKANG | $632,933 | $1,321,160 | $525,067 |

| SERANGOON | $649,184 | $1,304,909 | $508,816 |

| PUNGGOL | $653,374 | $1,300,719 | $504,626 |

| TAMPINES | $660,294 | $1,293,799 | $497,706 |

| ANG MO KIO | $663,900 | $1,290,193 | $494,100 |

| CLEMENTI | $746,774 | $1,207,319 | $411,226 |

| BISHAN | $756,605 | $1,197,487 | $401,395 |

| BUKIT TIMAH | $773,083 | $1,181,010 | $384,917 |

| GEYLANG | $776,765 | $1,177,328 | $381,235 |

| KALLANG/WHAMPOA | $851,772 | $1,102,321 | $306,228 |

| TOA PAYOH | $857,307 | $1,096,786 | $300,693 |

| BUKIT MERAH | $864,012 | $1,090,080 | $293,988 |

| QUEENSTOWN | $910,896 | $1,043,197 | $247,104 |

| CENTRAL AREA | $984,425 | $969,667 | $173,575 |

If we compare the average prices of 4-room flats with the average prices of new three-bedders, the gap is still quite wide. Even the most expensive HDB zone (Central Area) is only averaging $984,425. That’s almost a full million dollars below a new launch three-bedder in the cheapest region, the OCR.

But when you compare 4-room flat averages against the minimum entry price of a new three-bedder, the price gap is surprisingly narrow.

Take the Central Area again: the average 4-room flat there is $984,425, while the cheapest new three-bedder in the Outside of Central Region starts at $1,158,000. The difference is less than $200,000.

As an example, consider these two new* Executive Condominiums (ECs):

| Project | Sale price | Unit size (sqft) | Floor level |

| TENET | $1,158,000 | 893 | #06 |

| NORTH GAIA | $1,183,000 | 969 | #02 |

*Because these ECs are new, income ceilings would have applied to the buyers

This means that resale 4-room flats – in towns like Queenstown, Bukit Merah, Toa Payoh, and even the Central Area – are now closing in on the prices of new ECs. That said, these new ECs are further away and are in less developed areas than some of these high-priced flats.

That’s significant because ECs were designed to be a whole tier above public housing, with full condo facilities and eventual privatisation. If resale flats are already brushing against EC territory, it highlights just how far HDB prices have climbed.

Now, let’s look at the average and minimum price of new three- and four-bedder condos in the various regions

| Region | Average price of new 3-bedders | Min. price of new 3-bedders | Average price of new 4-bedders | Min. price of new 4-bedders |

| CCR | $4,063,601 | $2,190,000 | $6,930,059 | $3,448,000 |

| RCR | $2,696,626 | $1,866,000 | $3,520,611 | $2,359,000 |

| OCR | $1,954,093 | $1,158,000 | $2,390,913 | $1,577,000 |

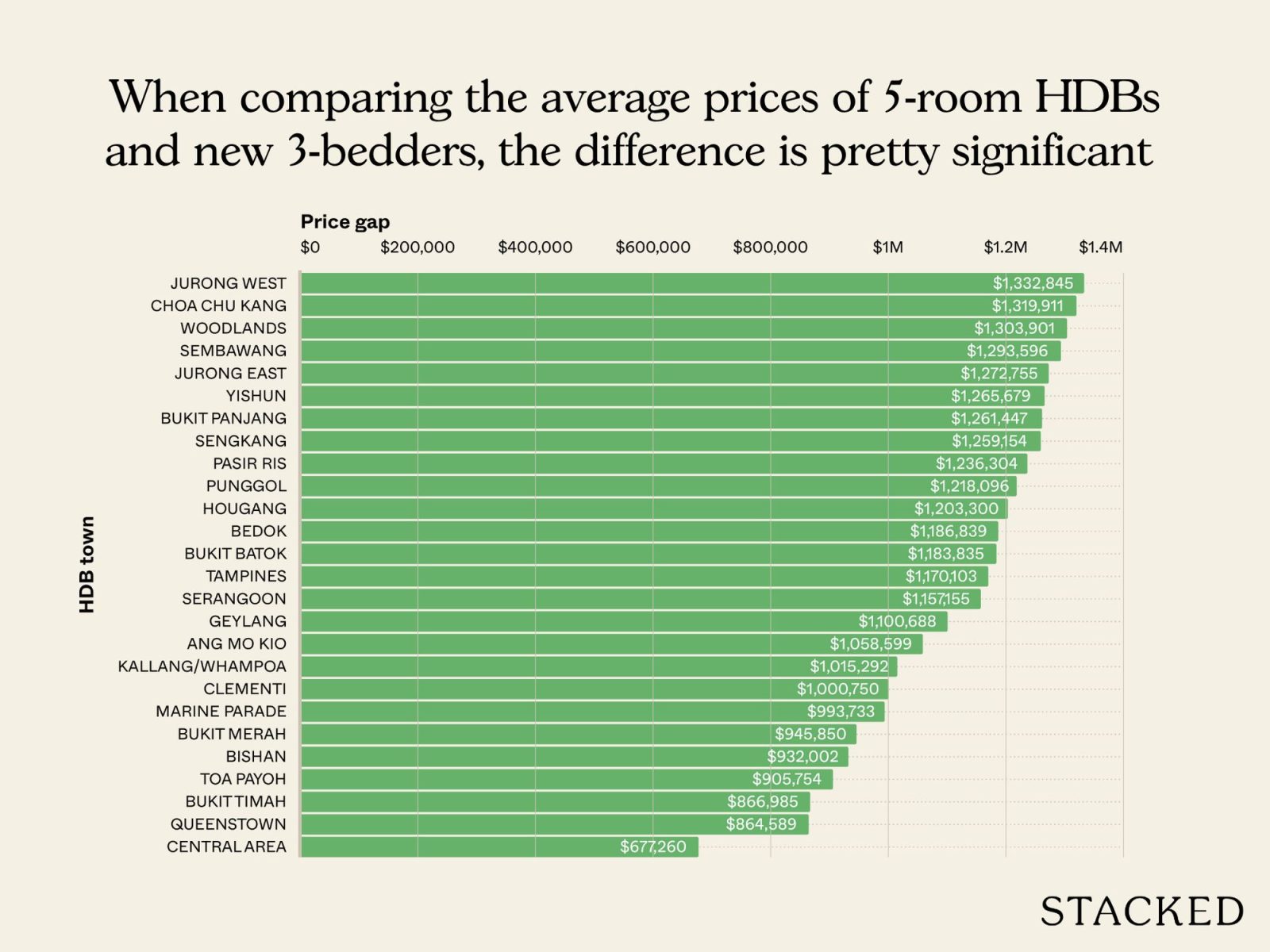

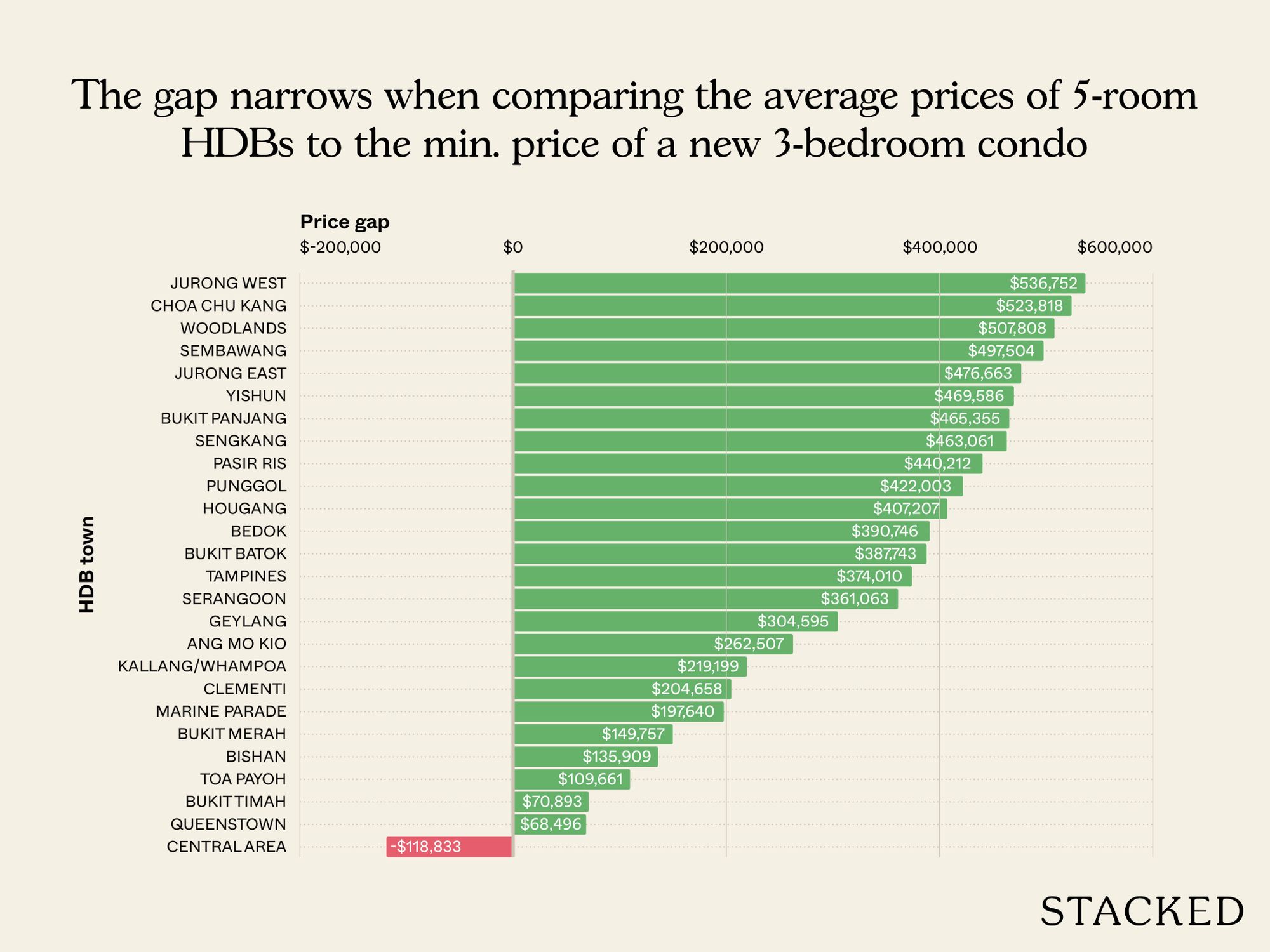

We will compare these to 5-room flats, as most 5-room flats range between 1,184 to around 1,300 sq ft (some older ones may go up to 1,400 sq ft). This is roughly analogous to four-bedder condo units in the current market.

5-room HDB (prices sorted from lowest to highest)

| HDB town | Average price | Price gap between 5-room HDB and lowest average price of a new 3-bedder | Price gap between 5-room HDB and minimum price of a new 3-bedder | Price gap between 5-room HDB and lowest average price of a new 4-bedder | Price gap between 5-room HDB and minimum price of a new 4-bedder |

| JURONG WEST | $621,248 | $1,332,845 | $536,752 | $1,769,665 | $955,752 |

| CHOA CHU KANG | $634,182 | $1,319,911 | $523,818 | $1,756,731 | $942,818 |

| WOODLANDS | $650,192 | $1,303,901 | $507,808 | $1,740,721 | $926,808 |

| SEMBAWANG | $660,496 | $1,293,596 | $497,504 | $1,730,417 | $916,504 |

| JURONG EAST | $681,337 | $1,272,755 | $476,663 | $1,709,576 | $895,663 |

| YISHUN | $688,414 | $1,265,679 | $469,586 | $1,702,500 | $888,586 |

| BUKIT PANJANG | $692,645 | $1,261,447 | $465,355 | $1,698,268 | $884,355 |

| SENGKANG | $694,939 | $1,259,154 | $463,061 | $1,695,974 | $882,061 |

| PASIR RIS | $717,788 | $1,236,304 | $440,212 | $1,673,125 | $859,212 |

| PUNGGOL | $735,997 | $1,218,096 | $422,003 | $1,654,917 | $841,003 |

| HOUGANG | $750,793 | $1,203,300 | $407,207 | $1,640,121 | $826,207 |

| BEDOK | $767,254 | $1,186,839 | $390,746 | $1,623,660 | $809,746 |

| BUKIT BATOK | $770,257 | $1,183,835 | $387,743 | $1,620,656 | $806,743 |

| TAMPINES | $783,990 | $1,170,103 | $374,010 | $1,606,924 | $793,010 |

| SERANGOON | $796,937 | $1,157,155 | $361,063 | $1,593,976 | $780,063 |

| GEYLANG | $853,405 | $1,100,688 | $304,595 | $1,537,509 | $723,595 |

| ANG MO KIO | $895,493 | $1,058,599 | $262,507 | $1,495,420 | $681,507 |

| KALLANG/WHAMPOA | $938,801 | $1,015,292 | $219,199 | $1,452,113 | $638,199 |

| CLEMENTI | $953,342 | $1,000,750 | $204,658 | $1,437,571 | $623,658 |

| MARINE PARADE | $960,360 | $993,733 | $197,640 | $1,430,554 | $616,640 |

| BUKIT MERAH | $1,008,243 | $945,850 | $149,757 | $1,382,670 | $568,757 |

| BISHAN | $1,022,091 | $932,002 | $135,909 | $1,368,823 | $554,909 |

| TOA PAYOH | $1,048,339 | $905,754 | $109,661 | $1,342,574 | $528,661 |

| BUKIT TIMAH | $1,087,107 | $866,985 | $70,893 | $1,303,806 | $489,893 |

| QUEENSTOWN | $1,089,504 | $864,589 | $68,496 | $1,301,410 | $487,496 |

| CENTRAL AREA | $1,276,833 | $677,260 | -$118,833 | $1,114,081 | $300,167 |

More from Stacked

Is It Worth Paying ABSD To Keep Your HDB Flat And Own A Condo In 2025?

If you want to retain your flat – even after you buy a condo unit – it often means paying…

The HDB cluster with the highest average price for 5-room flats is the Central Area, at $1,276,833. If we compare that to private housing, the lowest average for a new three-bedder condo is in the OCR at $1,954,093. The gap between those two is close to $700,000; so this seems quite distant.

But what happens if we compare the 5-room flat averages against the minimum entry prices of new launches, as we did above with 4-room flats?

In this case, we again see that the gap narrows considerably.

The Central Area’s average 5-room flat price of $1,276,833 is actually higher than the cheapest new three-bedder in the OCR ($1,158,000). That means on average, a Central Area 5-room flat costs more than the lowest-priced new three-bedder available today.

If we extend the same comparison to new four-bedder condos, the Central Area’s 5-room average is about $300,000 lower than the cheapest new four-bedders. As an example:

The two new EC launches with some of the lowest four-bedroom prices are Lumina Grand and Novo Place. Here are their cheapest transacted units:

| Project | Sale price | Unit size (sqft) | Floor level |

| LUMINA GRAND | $1,577,000 | 1141 | #13 |

| NOVO PLACE | $1,604,000 | 1012 | #01 |

You’ll notice that the larger 5-room flats in towns like Queenstown, Bukit Timah, and the Central Area are now priced within a few hundred thousand dollars of these EC units. Even though ECs are cheaper than private condos, they’re still intended to be a whole different tier of housing; so some may find it alarming that the flats brush so close.

So while a gap still exists, that gap is again smaller than the million-dollar gulf you’d expect between public and (semi) private housing.

Now let’s look at the average and minimum prices of new four- and five-bedders in the various regions

| Region | Average price of new 4-bedders | Min. price of new 4-bedders | Average price of new 5-bedders | Min. price of new 5-bedders |

| CCR | $6,930,059 | $3,448,000 | $11,727,778 | $7,678,000 |

| RCR | $3,520,611 | $2,359,000 | $4,444,056 | $3,480,000 |

| OCR | $2,390,913 | $1,577,000 | $2,840,929 | $2,141,000 |

The size equivalences are admittedly looser at this level, but for comparison, we will use Executive and multi-generation HDB flats. These typically come with four bedrooms, and in some cases even more; so they are the closest HDB equivalents to these larger condo layouts.

Executive and multi-gen (prices sorted from lowest to highest)

| HDB town | Average price | Price gap between Executive/ Multi-gen HDB and lowest average price of a new 4-bedder | Price gap between Executive/ Multi-gen HDB and minimum price of a new 4-bedder | Price gap between Executive/ Multi-gen HDB and lowest average price of a new 5-bedder | Price gap between Executive/ Multi-gen HDB and minimum price of a new 5-bedder |

| SEMBAWANG | $722,992 | $1,667,921 | $854,008 | $2,117,937 | $1,418,008 |

| JURONG WEST | $761,264 | $1,629,650 | $815,736 | $2,079,665 | $1,379,736 |

| PUNGGOL | $783,324 | $1,607,589 | $793,676 | $2,057,605 | $1,357,676 |

| CHOA CHU KANG | $796,023 | $1,594,890 | $780,977 | $2,044,906 | $1,344,977 |

| SENGKANG | $804,005 | $1,586,908 | $772,995 | $2,036,924 | $1,336,995 |

| BUKIT PANJANG | $854,631 | $1,536,282 | $722,369 | $1,986,298 | $1,286,369 |

| BUKIT BATOK | $864,531 | $1,526,383 | $712,469 | $1,976,399 | $1,276,469 |

| PASIR RIS | $880,429 | $1,510,485 | $696,571 | $1,960,501 | $1,260,571 |

| YISHUN | $882,996 | $1,507,917 | $694,004 | $1,957,933 | $1,258,004 |

| WOODLANDS | $883,141 | $1,507,772 | $693,859 | $1,957,788 | $1,257,859 |

| JURONG EAST | $893,999 | $1,496,915 | $683,001 | $1,946,931 | $1,247,001 |

| TAMPINES | $937,535 | $1,453,378 | $639,465 | $1,903,394 | $1,203,465 |

| HOUGANG | $946,591 | $1,444,322 | $630,409 | $1,894,338 | $1,194,409 |

| GEYLANG | $988,660 | $1,402,253 | $588,340 | $1,852,269 | $1,152,340 |

| BEDOK | $992,387 | $1,398,526 | $584,613 | $1,848,542 | $1,148,613 |

| SERANGOON | $1,035,132 | $1,355,782 | $541,868 | $1,805,797 | $1,105,868 |

| KALLANG/WHAMPOA | $1,037,894 | $1,353,019 | $539,106 | $1,803,035 | $1,103,106 |

| CLEMENTI | $1,050,873 | $1,340,040 | $526,127 | $1,790,056 | $1,090,127 |

| TOA PAYOH | $1,079,837 | $1,311,076 | $497,163 | $1,761,092 | $1,061,163 |

| ANG MO KIO | $1,106,147 | $1,284,767 | $470,853 | $1,734,783 | $1,034,853 |

| BISHAN | $1,244,679 | $1,146,235 | $332,321 | $1,596,251 | $896,321 |

| QUEENSTOWN | $1,307,389 | $1,083,524 | $269,611 | $1,533,540 | $833,611 |

| BUKIT TIMAH | $1,330,444 | $1,060,469 | $246,556 | $1,510,485 | $810,556 |

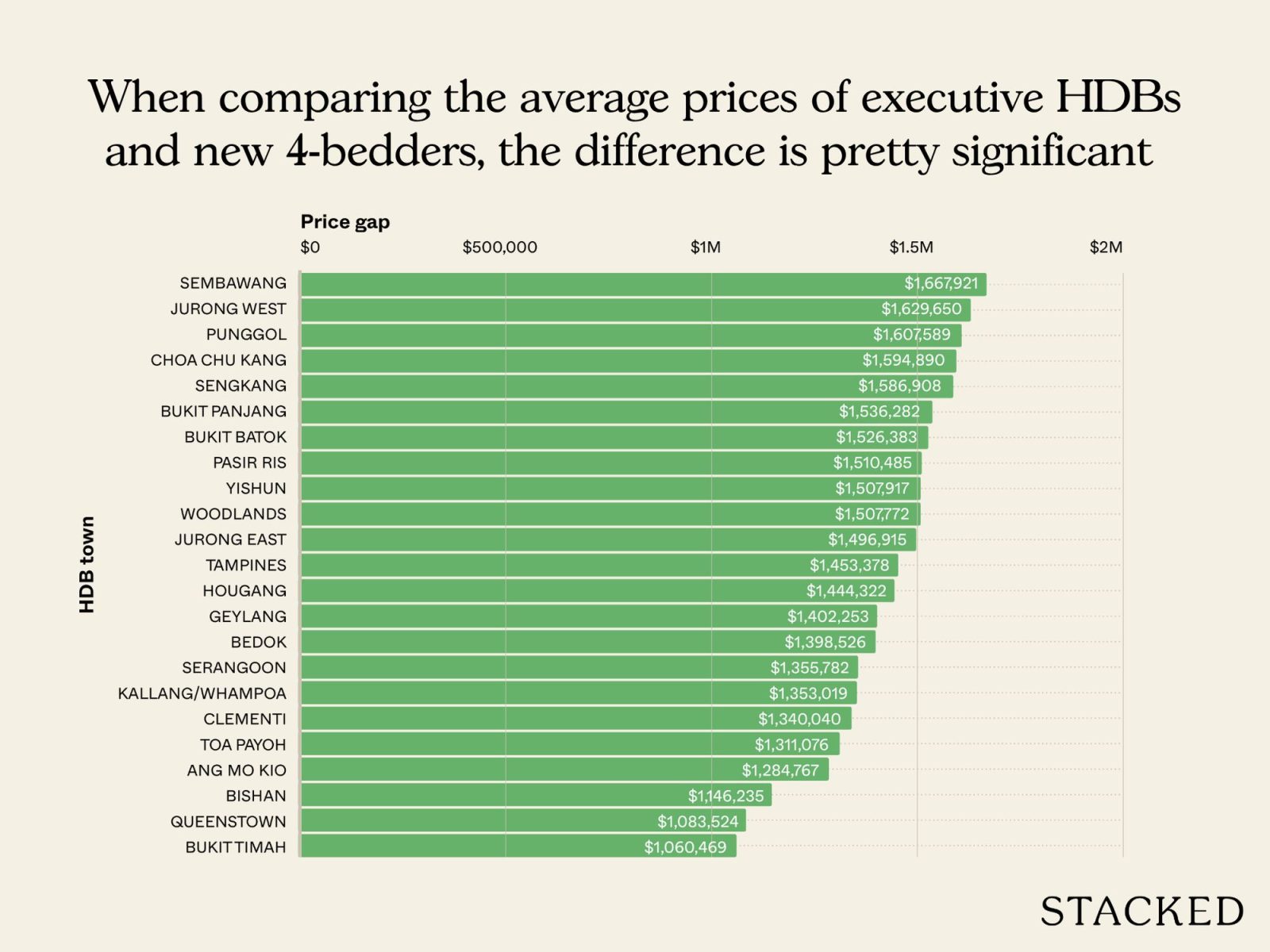

By now, you can probably guess the pattern we’re going to see; and yes, it’s not too different from what we have above.

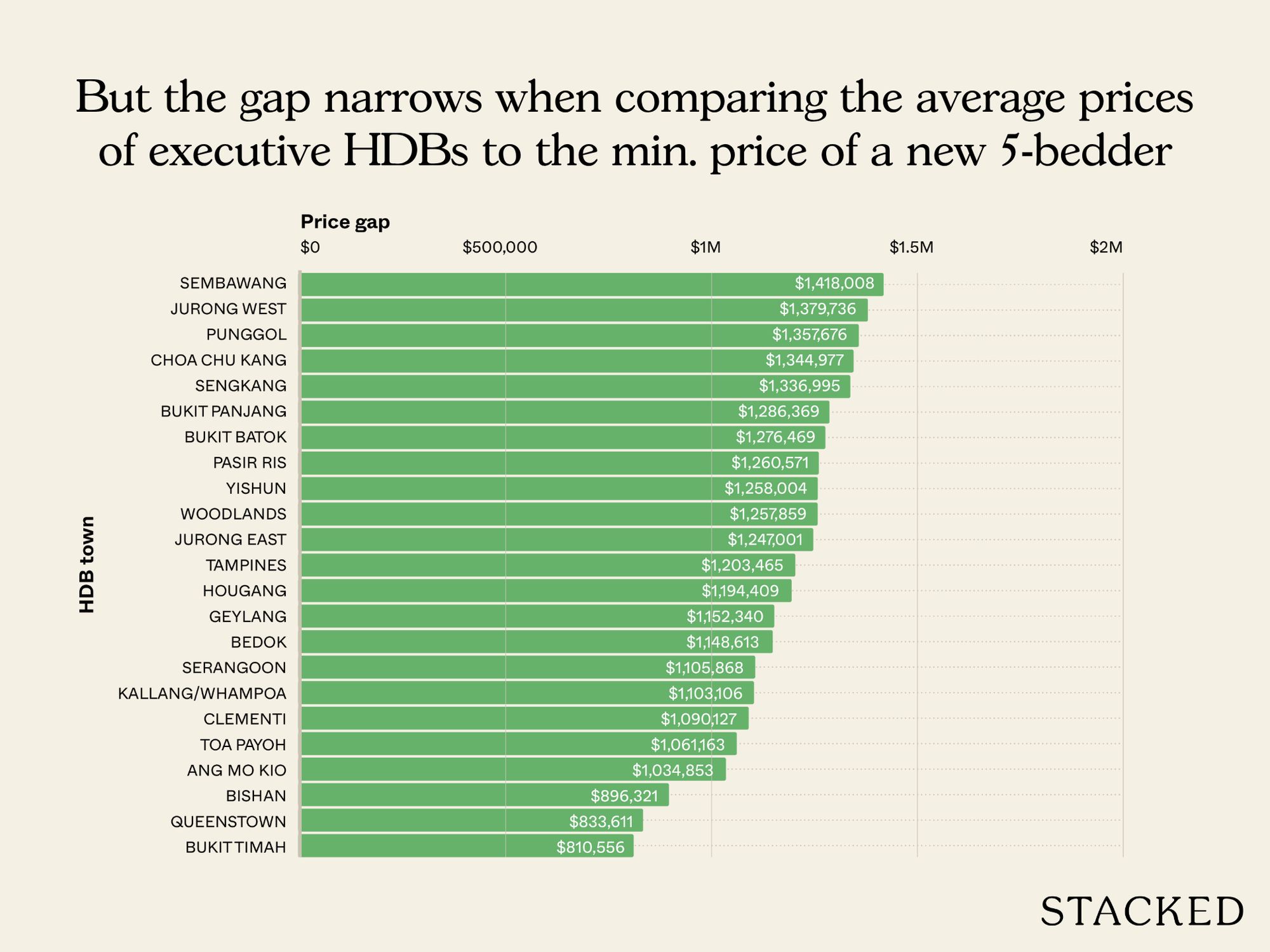

Just as with the other unit types, if we compare the average prices of Executive and 3Gen flats with new four- and five-bedder condos, the difference remains large. The HDB town with the highest average price for Executive and multi-gen flats is Bukit Timah at $1,330,444, while the lowest average price for a new four-bedder condo is in the OCR at $2,390,913. The gap between those two is slightly over $1 million.

If you compare Bukit Timah’s Executive and 3-Gen flats to the lowest average price of a new five-bedder condo in the OCR, the difference stretches past $1.5 million.

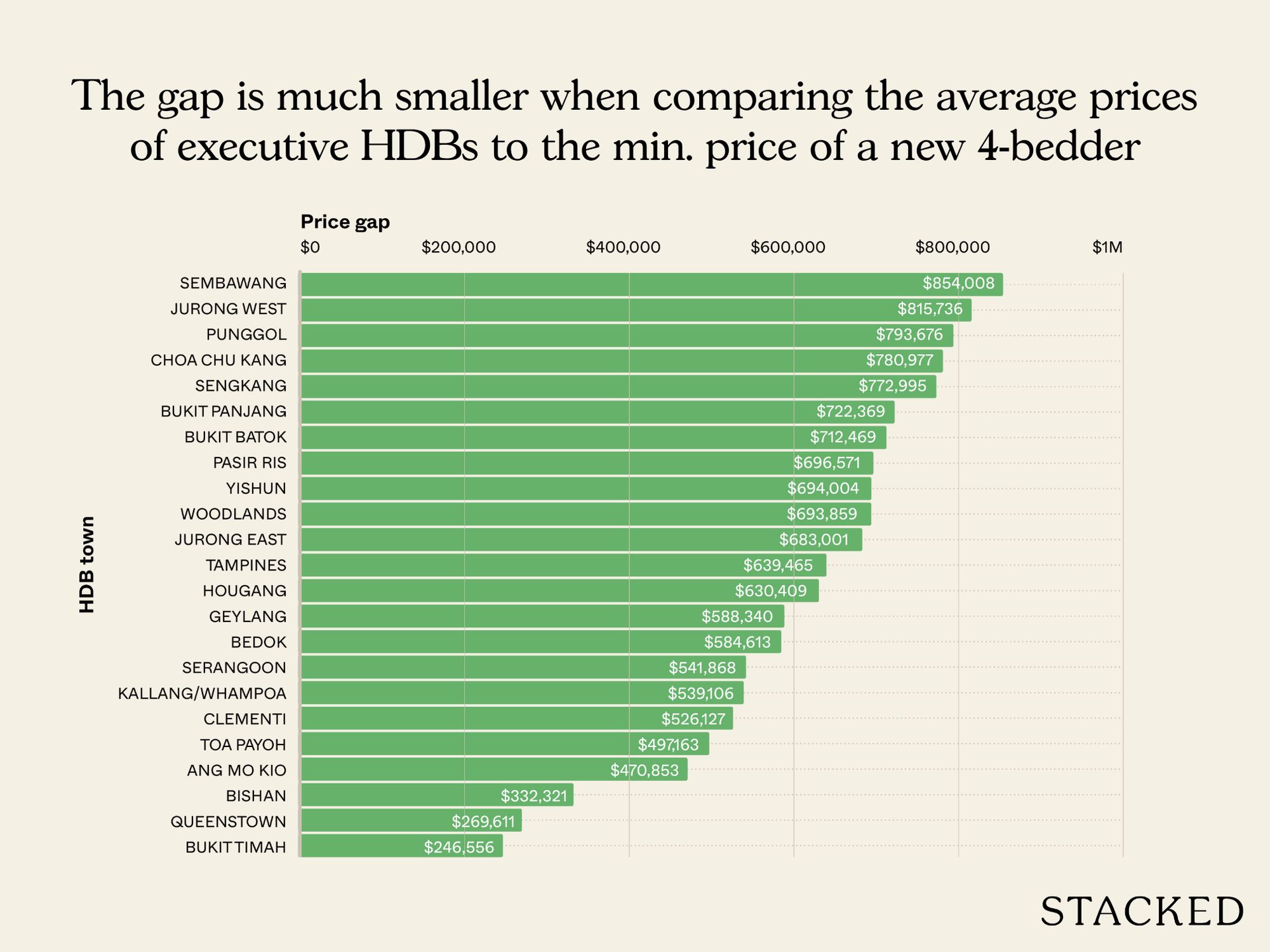

However, when we look at average flat prices against the minimum entry prices of new launches, we again see a distinct narrowing.

Bukit Timah’s Executive and 3-Gen flats at $1,330,444 are not far off from the cheapest new four-bedder in the OCR, at $1,577,000. The difference here is only about $250,000.

If we compare Bukit Timah’s Executive and multi-gen flats to the minimum price of a new five-bedder in the OCR, the gap is a little over $800,000. While still substantial, this is much smaller than the million-dollar gaps we had expected (and which, we suspect, most Singaporeans would also assume.)

As always, here’s an example:

The three new EC launches with some of the lowest five-bedroom prices are Lumina Grand, North Gaia, and Altura:

| Project | Sale price | Unit size (sqft) | Floor level |

| LUMINA GRAND | $2,141,000 | 1496 | #03 |

| NORTH GAIA | $2,214,112 | 1593 | #02 |

| ALTURA | $2,227,000 | 1539 | #03 |

These transactions show that the entry point for new five-bedders is just over $2.1 million. Meanwhile, the Executive and 3Gen flats in Bukit Timah, Queenstown, and Bishan now average between $1.2 million and $1.3 million. While still cheaper, the gap has narrowed to well under $1 million in some cases.

This shows that resale flat prices have begun to brush up against the cheaper end of private housing. It’s not yet to the point where we can truly say the lines are blurred; but the post-COVID boom has taken resale flat prices to new levels.

This being said, we do think that condo prices are likely to pull ahead again in the future

This is partly because HDB has ramped up the supply of flats in recent years; that has delivered results like the massive launch of 9,100 new flats in our next BTO exercise (October 2025). The pace of new condo launches can’t keep up with that, and supply in the private segment will be much more limited.

Another consideration is the recent end of SERS. It’s now clear that, even in highly desirable towns like Queenstown, Toa Payoh, Bishan, etc., the end-point of older flats will not be a generous, government-funded relocation. Rather, it will conclude with the much less beneficial VERS (which may not even succeed). This will eventually bring down the average in high-priced HDB towns.

In the present, however, we are seeing cases where the prices of some resale flats and condos brush up closer than ever before. But it’s uncertain how long that will last.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Which towns have resale flat prices close to condo prices in 2025?

How do resale flat prices compare to new condo prices in high-end towns?

Are resale flats in some areas becoming as expensive as private condos?

What is the significance of resale flats approaching condo prices?

Will condo prices continue to outpace resale flat prices in the future?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments