In a Weak Economy, This Policy Hurts Singaporean Homeowners Most

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

The 15-month wait-out period might soon be on the chopping block, and I can’t wait for it to happen.

This policy was introduced back in September 2022 and is still in place for now. Unless you’re aged 55 or older and rightsizing to a 4-room or smaller flat, you need to wait 15 months between the sale of your private property, and the purchase of a resale flat.

(Trying to get a BTO flat is even worse; you need to wait 30 months to apply for a BTO flat after selling a private home.)

This could, in theory, slow the number of million-dollar flats entering the market, from those who are capitalising on strong gains from their private property purchases: prices rose significantly in the aftermath of COVID, and someone with a $1.6 million condo unit to sell can afford premium flats like Pinnacle @ Duxton, SkyTerrace @ Dawson, and so forth.

But the truth is, the policy hasn’t moved the needle

In the linked report, it does say that from “From Jan 1 to Sept 29 in 2022, this group made up about 34 per cent of people who bought million-dollar flats. After the wait-out period was implemented, the proportion dropped to 12 per cent between January and November in 2024.”

And I salute that. But let’s look at the practical, overall changes in the resale flat market:

In 2022, when the policy came into being, we had 370 flats that sold for $1 million or more. In 2023, the number rose to 470 units; and by 2024, the number had reached 1,035.

Of course, I don’t expect the waiting-out period to solely stop the rise in million-dollar flats; but it clearly hasn’t done much either. And if it’s not working, what’s the point of keeping it?

I’m not sure why the government still has to review it to consider lifting it. It’s really best that this waiting period go away now, for one important reason:

Right now, the economy isn’t in great shape.

Our growth outlook has turned cautious, and there are storm clouds for manufacturing and financial services. This is also against a backdrop of more layoffs in tech and reports of former employees facing difficult job hunts.

I’ve encountered a number of readers and friends who did well in the aftermath of COVID, upgraded to a condo, and are now being squeezed by the mortgage. Some industry professionals will say we’re “safe” because of measures like the Total Debt Servicing Ratio (TDSR), but that’s an abstraction: when you lose your job and currently need to deliver food, it’s immaterial whether your mortgage was 55 per cent, 30 per cent, etc. of your former income.

You will need to sell, and having a 15-month wait time, during which you may need to rent, is just a cruel extra hurdle.

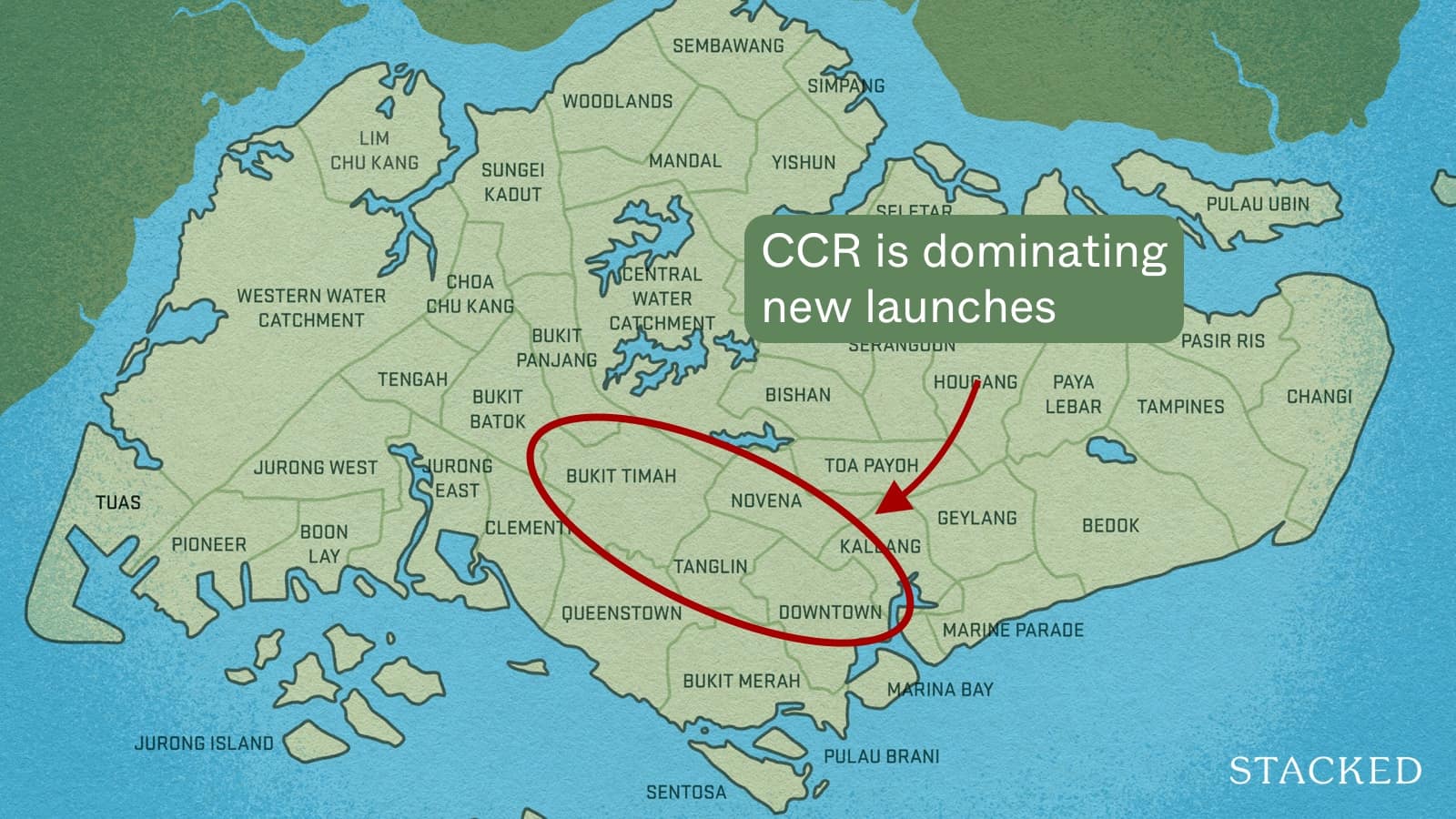

On top of this, resale supply is going to be more important than ever, as we pivot to the Core Central Region (CCR)

More than half of the remaining launches for the year (14 out of 22) are going to be in the CCR.

More from Stacked

Why Buying A Home You Love (Not One For Profit) May Be A Better Bet In Singapore

When you say you're not concerned about upgrading and just want a place to enjoy, the response is sometimes eye-rolling…

Despite the many excited sales pitches about the CCR being undervalued (true in most cases), the reality is that most families can’t afford a CCR property. At least not unless they’re willing to squeeze into a small unit, like a two-bedder.

And yet, this is what they may be forced into, because resale condo supply is at a serious low. Sellers are few and far between because the cost of a replacement property is posing an obstacle. So, in light of this, allowing sellers to right-size quickly – whether or not they’re 55 or older – could see more resale condos released into the market this year.

It’s time to retire this policy.

The market has changed. The rationale behind the wait-out period is well-founded, but the practical effects haven’t panned out. And in the current era of trade wars and uncertainty, it could end up unnecessarily hurting younger Singaporean families, who need to downsize and contain their costs.

Meanwhile in other property news…

- We located some of the most affordable 4-room flats in central Singapore, starting from just $495,000.

- Older leasehold condos are shunned by many Singaporeans; and yet we found some prudent homeowners who chose these units, with no regrets.

- Looking for a new condo a few years down the road? Here are some potentially interesting en-bloc sites to watch…if they succeed, that is.

- Affinity at Serangoon is a mega-development that made headlines when it launched – but how has this giant project fared against its smaller neighbour, The Garden Residences? Here’s a Stacked Pro deep dive.

Weekly Sales Roundup (19 May – 25 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 32 GILSTEAD | $15,100,000 | 4209 | $3,588 | FH |

| WATTEN HOUSE | $7,968,000 | 2368 | $3,365 | FH |

| CANNINGHILL PIERS | $7,485,000 | 2788 | $2,685 | 99 yrs (2021) |

| PINETREE HILL | $4,614,000 | 1733 | $2,662 | 99 yrs (2022) |

| NAVA GROVE | $4,329,100 | 1722 | $2,514 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,252,445 | 420 | $2,983 | 99 yrs (2023) |

| THE COLLECTIVE AT ONE SOPHIA | $1,283,000 | 452 | $2,838 | 99 years |

| LUMINA GRAND | $1,417,000 | 936 | $1,513 | 99 yrs (2022) |

| BLOOMSBURY RESIDENCES | $1,425,000 | 570 | $2,498 | 99 yrs (2024) |

| NOVO PLACE | $1,456,000 | 883 | $1,650 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| YONG AN PARK | $7,000,000 | 3111 | $2,250 | FH |

| MARINA ONE RESIDENCES | $6,400,000 | 2250 | $2,845 | 99 yrs (2011) |

| PEBBLE BAY | $5,500,000 | 2626 | $2,094 | 99 yrs (1994) |

| CAIRNHILL CREST | $4,700,000 | 1981 | $2,373 | FH |

| THE MARBELLA | $3,999,999 | 1625 | $2,461 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| VIVA VISTA | $680,000 | 355 | $1,914 | FH |

| THE WATER EDGE | $750,000 | 431 | $1,742 | FH |

| LE REGAL | $760,000 | 689 | $1,103 | FH |

| EIGHT RIVERSUITES | $825,000 | 441 | $1,869 | 99 yrs (2011) |

| THE GARDEN RESIDENCES | $830,000 | 452 | $1,836 | 99 yrs (2017) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PEBBLE BAY | $5,500,000 | 2626 | $2,094 | $3,345,000 | 29 Years |

| THE MARBELLA | $3,999,999 | 1625 | $2,461 | $2,754,999 | 22 Years |

| EURO-ASIA COURT | $3,380,000 | 1668 | $2,026 | $2,130,000 | 26 Years |

| PANDAN VALLEY | $2,750,000 | 1668 | $1,648 | $1,751,000 | 29 Years |

| THE CALROSE | $2,650,000 | 1389 | $1,908 | $1,695,000 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HILLTOPS | $3,300,000 | 1270 | $2,598 | -$800,000 | 12 Years |

| MARINA ONE RESIDENCES | $6,400,000 | 2250 | $2,845 | -$703,250 | 8 Years |

| DEVONSHIRE RESIDENCES | $1,075,000 | 495 | $2,171 | -$169,000 | 14 Years |

| ONE PEARL BANK | $1,398,000 | 560 | $2,498 | -$83,000 | 6 Years |

| FOURTH AVENUE RESIDENCES | $1,168,000 | 506 | $2,309 | -$69,000 | 4 Years |

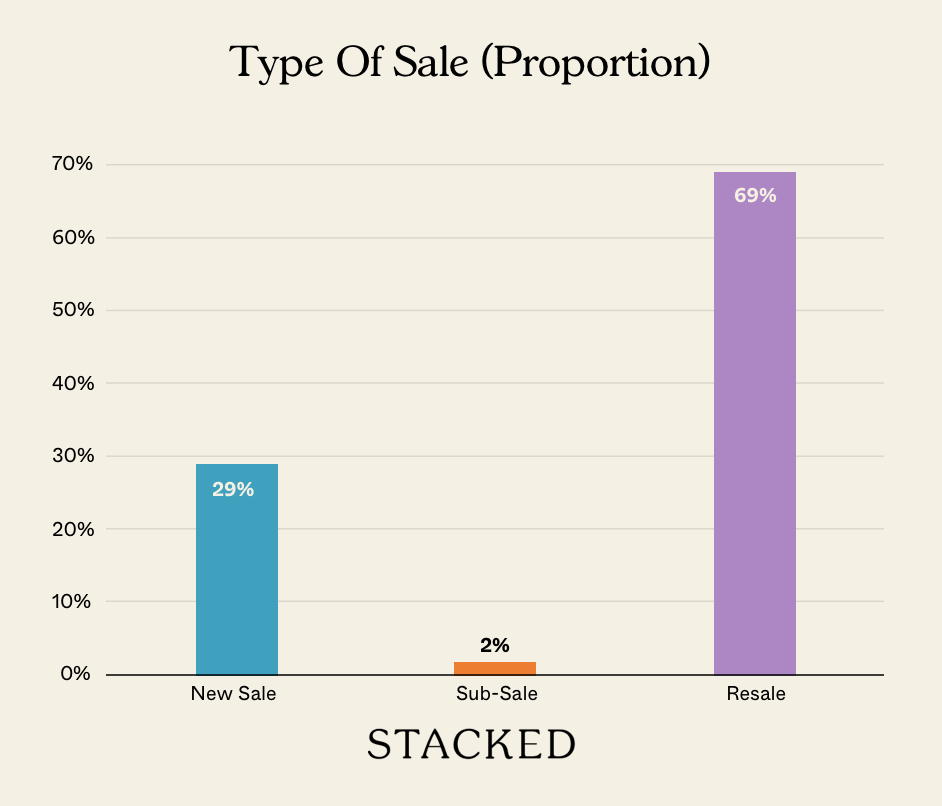

Transaction Breakdown

For more on the Singapore property market, as well as reviews of new and resale condos alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News When Property Listings Are Accurate — But Still Misleading

Singapore Property News Narra Residences Sets a New Price Benchmark for Dairy Farm at $2,180 PSF — and the sales breakdown offers

Singapore Property News Newport Residences Sells 57% at Launch Weekend — But the Real Surprise Came From the Large Units

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention

Latest Posts

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

On The Market Here Are The Rare HDB Flats With Unblocked Views That Hardly Come Up for Sale

Pro Where HDB Flats Continue to Hold Value Despite Ageing Leases

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Editor's Pick We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Pro What Happens When a “Well-Priced” Condo Hits the Resale Market

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Editor's Pick We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

Editor's Pick Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat