Will We Finally Have “Affordable” Homes In Singapore In 2024?

January 10, 2024

News reports, HDB block notice boards, and every other outlet seem to be putting out the message that prices are coming back down, supply is back up, etc. It’s almost like some big upcoming event is driving the need to assuage the public… but at this point, we’re sure that first-time home buyers are happy for any hint of relief. The post-Covid era has been harsh on this struggling demographic:

Will housing prices be capped by rising mortgage rates?

In a news article today, MND notes that mortgage rates are expected to be between 3.7 and 4.4 per cent, which could act as a cap on rising home prices. We do agree with this, and we’ve covered how much even “small” increases in the mortgage can truly amount to (check out the numbers below and in this article).

| Loan Amount | 1.00% | 1.50% | 2.00% | 2.50% | 3.00% | 3.50% | 4.00% | 4.50% | 5.00% | 5.50% | 6.00% | 6.50% | 7.00% |

| $300,000 | $1,131 | $1,200 | $1,272 | $1,346 | $1,423 | $1,502 | $1,584 | $1,667 | $1,754 | $1,842 | $1,933 | $2,026 | $2,120 |

| $400,000 | $1,507 | $1,600 | $1,695 | $1,794 | $1,897 | $2,002 | $2,111 | $2,223 | $2,338 | $2,456 | $2,577 | $2,701 | $2,827 |

| $500,000 | $1,884 | $2,000 | $2,119 | $2,243 | $2,371 | $2,503 | $2,639 | $2,779 | $2,923 | $3,070 | $3,222 | $3,376 | $3,534 |

| $600,000 | $2,261 | $2,400 | $2,543 | $2,692 | $2,845 | $3,004 | $3,167 | $3,335 | $3,508 | $3,685 | $3,866 | $4,051 | $4,241 |

| $700,000 | $2,638 | $2,800 | $2,967 | $3,140 | $3,319 | $3,504 | $3,695 | $3,891 | $4,092 | $4,299 | $4,510 | $4,726 | $4,947 |

| $800,000 | $3,015 | $3,199 | $3,391 | $3,589 | $3,794 | $4,005 | $4,223 | $4,447 | $4,677 | $4,913 | $5,154 | $5,402 | $5,654 |

| $900,000 | $3,392 | $3,599 | $3,815 | $4,038 | $4,268 | $4,506 | $4,751 | $5,002 | $5,261 | $5,527 | $5,799 | $6,077 | $6,361 |

| $1,000,000 | $3,769 | $3,999 | $4,239 | $4,486 | $4,742 | $5,006 | $5,278 | $5,558 | $5,846 | $6,141 | $6,443 | $6,752 | $7,068 |

| $1,100,000 | $4,146 | $4,399 | $4,662 | $4,935 | $5,216 | $5,507 | $5,806 | $6,114 | $6,430 | $6,755 | $7,087 | $7,427 | $7,775 |

| $1,200,000 | $4,522 | $4,799 | $5,086 | $5,383 | $5,691 | $6,007 | $6,334 | $6,670 | $7,015 | $7,369 | $7,732 | $8,102 | $8,481 |

| $1,300,000 | $4,899 | $5,199 | $5,510 | $5,832 | $6,165 | $6,508 | $6,862 | $7,226 | $7,600 | $7,983 | $8,376 | $8,778 | $9,188 |

| $1,400,000 | $5,276 | $5,599 | $5,934 | $6,281 | $6,639 | $7,009 | $7,390 | $7,782 | $8,184 | $8,597 | $9,020 | $9,453 | $9,895 |

| $1,500,000 | $5,653 | $5,999 | $6,358 | $6,729 | $7,113 | $7,509 | $7,918 | $8,337 | $8,769 | $9,211 | $9,665 | $10,128 | $10,602 |

| $1,600,000 | $6,030 | $6,399 | $6,782 | $7,178 | $7,587 | $8,010 | $8,445 | $8,893 | $9,353 | $9,825 | $10,309 | $10,803 | $11,308 |

| $1,700,000 | $6,407 | $6,799 | $7,206 | $7,626 | $8,062 | $8,511 | $8,973 | $9,449 | $9,938 | $10,439 | $10,953 | $11,479 | $12,015 |

| $1,800,000 | $6,784 | $7,199 | $7,629 | $8,075 | $8,536 | $9,011 | $9,501 | $10,005 | $10,523 | $11,054 | $11,597 | $12,154 | $12,722 |

| $1,900,000 | $7,161 | $7,599 | $8,053 | $8,524 | $9,010 | $9,512 | $10,029 | $10,561 | $11,107 | $11,668 | $12,242 | $12,829 | $13,429 |

| $2,000,000 | $7,537 | $7,999 | $8,477 | $8,972 | $9,484 | $10,012 | $10,557 | $11,117 | $11,692 | $12,282 | $12,886 | $13,504 | $14,136 |

| $2,500,000 | $9,422 | $9,998 | $10,596 | $11,215 | $11,855 | $12,516 | $13,196 | $13,896 | $14,615 | $15,352 | $16,108 | $16,880 | $17,669 |

| $3,000,000 | $11,306 | $11,998 | $12,716 | $13,459 | $14,226 | $15,019 | $15,835 | $16,675 | $17,538 | $18,423 | $19,329 | $20,256 | $21,203 |

| $3,500,000 | $13,191 | $13,998 | $14,835 | $15,702 | $16,597 | $17,522 | $18,474 | $19,454 | $20,461 | $21,493 | $22,551 | $23,632 | $24,737 |

| $4,000,000 | $15,075 | $15,997 | $16,954 | $17,945 | $18,968 | $20,025 | $21,113 | $22,233 | $23,384 | $24,563 | $25,772 | $27,008 | $28,271 |

| $4,500,000 | $16,959 | $17,997 | $19,073 | $20,188 | $21,340 | $22,528 | $23,753 | $25,012 | $26,307 | $27,634 | $28,994 | $30,384 | $31,805 |

| $5,000,000 | $18,844 | $19,997 | $21,193 | $22,431 | $23,711 | $25,031 | $26,392 | $27,792 | $29,230 | $30,704 | $32,215 | $33,760 | $35,339 |

| $6,000,000 | $22,612 | $23,996 | $25,431 | $26,917 | $28,453 | $30,037 | $31,670 | $33,350 | $35,075 | $36,845 | $38,658 | $40,512 | $42,407 |

| $7,000,000 | $26,381 | $27,996 | $29,670 | $31,403 | $33,195 | $35,044 | $36,949 | $38,908 | $40,921 | $42,986 | $45,101 | $47,265 | $49,475 |

| $8,000,000 | $30,150 | $31,995 | $33,908 | $35,889 | $37,937 | $40,050 | $42,227 | $44,467 | $46,767 | $49,127 | $51,544 | $54,017 | $56,542 |

| $9,000,000 | $33,919 | $35,994 | $38,147 | $40,376 | $42,679 | $45,056 | $47,505 | $50,025 | $52,613 | $55,268 | $57,987 | $60,769 | $63,610 |

| $10,000,000 | $37,687 | $39,994 | $42,385 | $44,862 | $47,421 | $50,062 | $52,784 | $55,583 | $58,459 | $61,409 | $64,430 | $67,521 | $70,678 |

However, we should add that Fed rate cuts may be on the way for 2024. The US Federal Reserve (the Fed) cuts interest rates in response to weak economic outlooks, which in turn lowers interest rates in Singapore.

More from Stacked

Every En Bloc sale in 2017/2018 (Updated)

Since late 2016, en bloc sales in Singapore have been spiking up. In 2017 alone there have been 26 successful…

The problem is the Fed’s direction for 2024 hasn’t been too clear. On the one hand, some rate cuts are expected, given weakening growth. But in recent weeks, we’ve begun to see more reports questioning the extent of the rate cuts. In any case, there’s at least a chance that home loan rates may dip in the coming year, and that may remove some of the disincentive for buyers.

As a matter of opinion: if the government really wanted to curb prices though, they could simply increase the floor rate used to calculate the Total Debt Servicing Ratio (TDSR). Right now it’s at four per cent, but the government could easily justify raising it, given that real interest rates have gone up a fair bit.

(The TDSR limits your home loan repayment amount, plus any outstanding loans, to a maximum of 55 per cent of your monthly income).

In any case, investment-oriented buyers are the ones most likely to be disincentivised, as the higher rates impact their bottom line. Genuine home buyers, though, tend to be less dissuaded by home loan interest rates; most of them shrug it off as an unavoidable evil (unless they’re willing to give up on private property entirely and buy an HDB flat… and that’s if they can get an HDB loan).

The housing supply crunch may be winding down

We can see the fevered pace of HDB construction may be slowing. There are, for instance, just three instead of four HDB launches this year. This is likely in response to moderation in the application rates of first-time buyers.

That said, it was a little strange how it was being promoted as a good thing for buyers (as quoted from HDB: applicants “will now be able to enjoy a higher chance of success in finding a flat that meets their budget and needs”). So although you do have a higher number of flat supply per launch, the total number launched for the year has still come down.

Besides, most market watchers were expecting HDB construction to wind down a bit this year anyway. This is because HDB went into overdrive in 2022 and 2023, ramping up production by 35 per cent in the past two years. Any more of this, and we may face a 1990’s style HDB supply glut. As much as first-time buyers want to happen, the broader market probably would rather things stay the same way.

However, we do think resale flat prices in some specific areas will still rise in 2024

2024 will see the introduction of Plus model housing. As was the case with Prime flats, it’s likely that resale flats close to the Plus and Prime areas (but are free of Plus and Prime drawbacks) will see a positive effect on their prices. As one realtor expressed: “Almost nobody will see the Prime or Plus flat right outside their window, and decide their price should still stay the same.”

Some realtors also noted that the 15-month waiting period* for some sellers, back in 2022, is coming to an end. Speculatively, this could push up prices in the usual hotspots (e.g., Queenstown, Bishan, Tanjong Pagar). This is because those who sold private properties are typically flush with cash, and can afford to indulge in higher Cash Over Valuation (COV) for the most desirable HDB locations.

*The 15-month waiting period was first imposed on 30th September 2022. Those who sell a private property must wait 15 months before they can buy a resale flat.

On the private housing side, we’re also seeing an end to the supply crunch. We’ve got around 38 upcoming launches this year, with around 11,600+ new units on the way; and the completion of some mega-projects last year (such as Treasure at Tampines, the largest condo development in Singapore with over 2,200 units) is also likely to soften the rental market.

Still, it’s tough to claim private home prices will come down much, as developers are too squeezed on margins; but developers will probably struggle, if they want to push past the current prices of around $2,100+ psf for mass-market new launches.

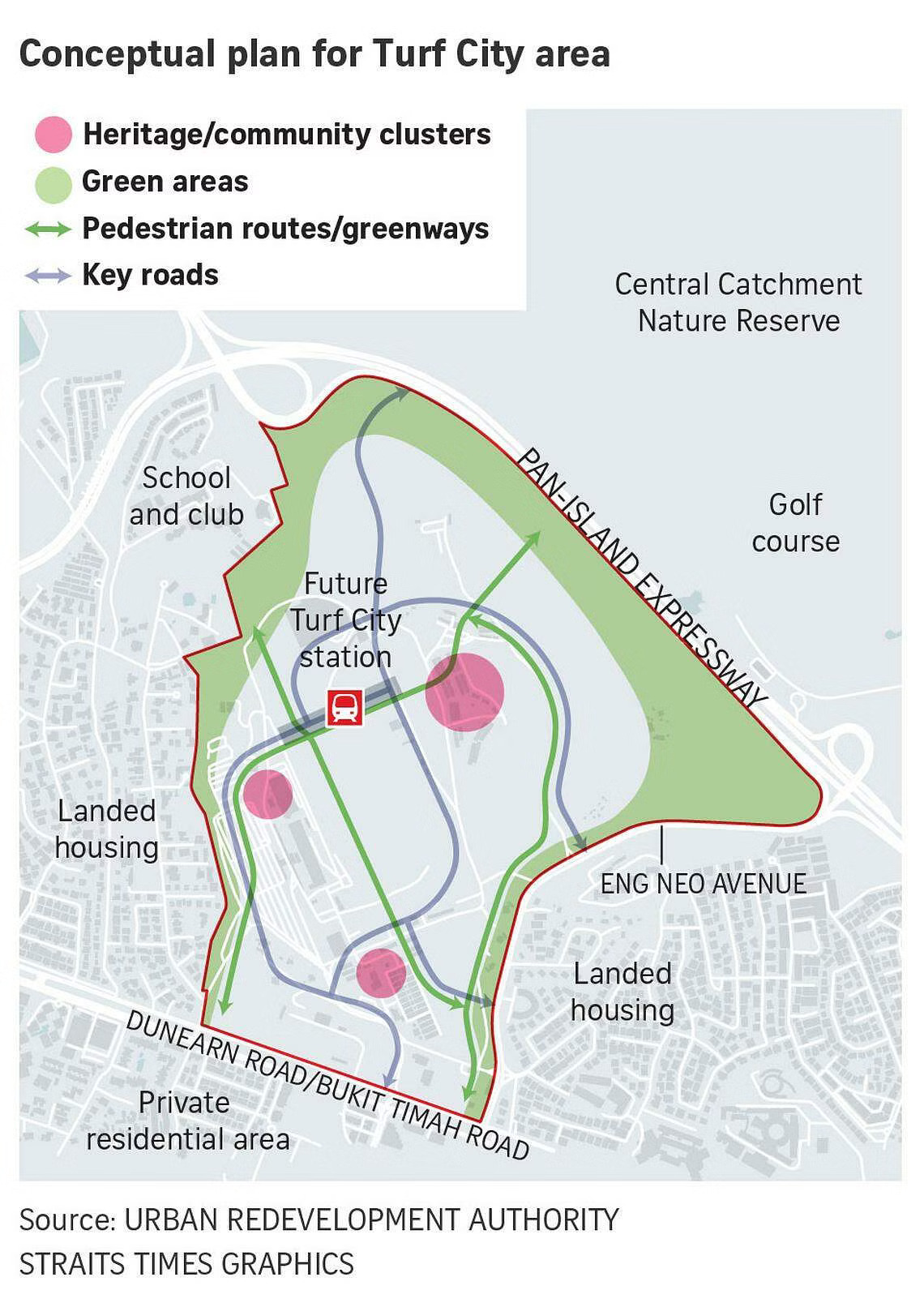

Bonus: Turf City plans will be the thing to watch in 2024

Turf City will feature in the Master Plans later this year, and the draft will show what’s planned for the almost 140-hectare site (almost 200 football fields). This will, again, add quite a bit to the stock of HDB flats.

Due to the Bukit Timah location, this site is bound to have fantastic greenery views; and it will be in high demand given the established prestige of the neighbourhood. But at the same time, this area hasn’t been the most convenient in terms of public transport; so it helps that there are confirmed plans for a Turf City MRT station on the Cross Island Line.

For those who expect to buy a flat in the next few years, this may be an interesting area to watch. There are some parallels to the Bayshore area, as this is a large HDB project being introduced into a primarily private enclave (and one that wasn’t the most accessible before).

The overall message is pretty clear: it’s assurance that what we saw in 2022 and ‘23 won’t see a repeat run this year. Given the importance of public opinion right now (certain key events are coming up), you can be sure that any unexpected price spikes in 2024 will bring cooling measures faster than ever. Regardless, it may be time for sellers to adjust their expectations.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Latest Posts

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

0 Comments