Why This New Condo Rule Makes New Launch Condos More “Expensive”: GFA Harmonisation Explained

October 31, 2024

As we get more and more new launches with the new Gross Floor Area (GFA) harmonisation in effect, it may get more confusing for new buyers as they try to make sense of the new changes. On the surface, it looks like a simple change in technical definitions; but in reality, it could make condo floor plans more efficient; even as it has a distorting effect on price psf.

So how does this new change really work? Here’s what you need to know:

What is GFA harmonisation?

On paper, this is just a way to standardise how GFA is measured by different government agencies like URA, SLA, BCA, and so forth. Prior to this, the methods used were all different. Beyond this, however, GFA harmonisation matters because it fixed two big issues:

First, developers can no longer squeeze extra dollars out of buyers, with tricks like huge planter boxes, oversized air-con ledges, or other space-wasting features that add to the square footage they can sell.

Second, strata void space – which is measured vertically from for to ceiling – is gone; a move that might revive the popularity of high-ceiling units, as buyers no longer feel they need to pay for “empty air.”

How it’s already taken effect

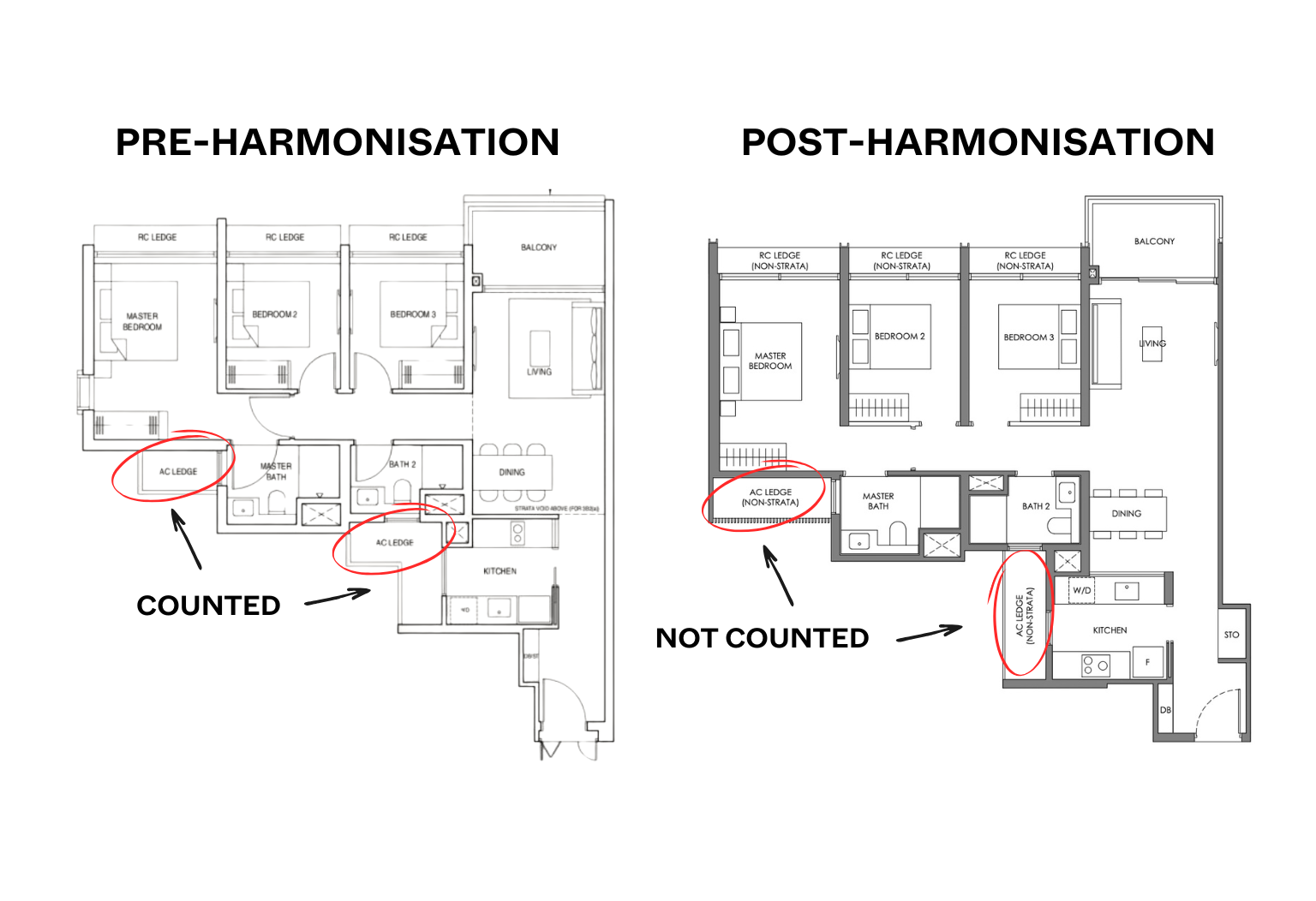

Lentor Mansion has the honour of being the first new launch to follow the GFA harmonisation rules. You can already see how it’s affected the floor plans, in the linked review: notice that all the usual shenanigans, like big bay windows, are gone (while some units have balconies, they’re not monstrously oversized). We previously showed how this matters in terms of price comparison:

Even if the actual square footage of the unit is smaller, you might be getting more space than you’d find at, say, The Line or these two other condos, because every square foot is actual, usable space. There’s no point having an extra 100 sq. ft. if it’s just taken up by protruding bay window ledges.

As we’ve already seen, a common sales pitch is how much more value for money you’re getting, between recent launches and the older 2000s-era condos. Now, we will see more sales pitches highlighting why a new condo with the GFA harmonisation is better than even the recent new condos on the market. One example would be the about-to-launch Nava Grove (that has the new GFA harmonisation in effect), as compared to Pinetree Hill next door.

A look at how GFA harmonisation is affecting pricing

More from Stacked

5 Dirty Truths About The Singapore Property Market You Should Know About In 2024

While regulations on property agents have been tightened, there are a lot of players in this industry - from mortgage…

Due to the changes made, pricing in the current market can get a bit distorted. You’ll find the older and less efficient layouts will end up looking much cheaper, although they’re not. Let’s consider a theoretical three-bedder condo unit:

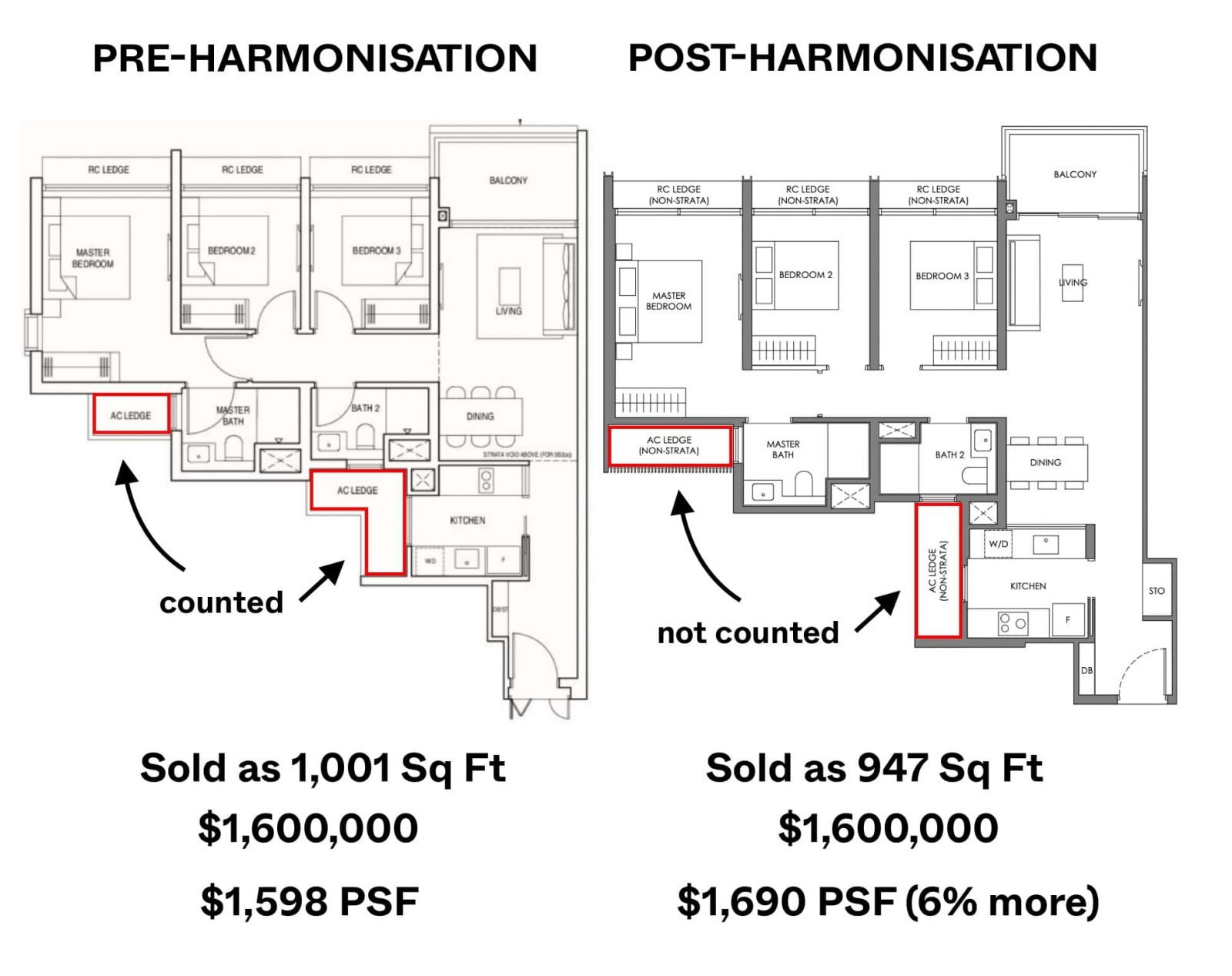

If this condo were launched pre-harmonisation, it might be sold as 1,001 sq. ft., inclusive of features like air-con ledges, void space, etc. The price tag is $1.6 million, so that comes to about $1,598 psf.

Next, let’s look at a similar unit, but post-harmonisation. Once we deduct the air-con ledge, void spaces, etc., the actual square footage drops to 947 sq. ft. The price is the same, at $1.6 million. But this would come to about $1,690 psf, which appears to be much more expensive.

This can have quite an impact on how buyers perceive new launches. It is, for instance, a norm for new launches to be priced at $2,200+ psf these days. However, if you factor in the inefficiencies of pre-harmonisation projects, the price discrepancy might be a little less shocking.

There’s also some concern over older resale projects, where the square footage data hasn’t been properly updated.

It’s only been around two years, and there’s quite a number of resale condos out there. Some of the projects may still be using older data. For example, a high-ceiling unit, which was built in 2010, may still be marketed with the strata void space factored in. This may not be out of any intent to cheat you; the seller may just be following the old specifications from when the unit was bought.

So again, when comparing between pre and post-harmonisation units, bear in mind the pre-harmonisation ones might look deceptively cheaper.

For these reasons, we’d suggest you look beyond simplified comparisons of price psf: pay more attention to the floor plan and quantum, to get a sense of actual value. This is a good idea in general anyway, as certain unit variations – such as dual-key layouts – also cause distortions in price on a per-square-foot basis.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is GFA harmonisation in condo development?

How does GFA harmonisation affect the pricing of new condos?

Why might older resale condos seem cheaper even if they are similar in size to new launches?

How has GFA harmonisation impacted condo floor plans?

What should buyers consider when comparing condo prices post-GFA harmonisation?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

3 Comments

Hi there, thanks for this article. But you’ve a typo. The first GFA harmonization condo is Lentor MANSION, not Lentor Modern. Please kind amend. Thanks!

how does it affect in future enbloc on those older units with roof terraces and void space for example? Don’t really see any write ups? what should the discount on these voids/roof terraces on valuation as most if not all has been included into GFA now.

Many older folks or people will buy older units will be concern if its a happy or sad problem by owning one of those.

Appreciated if any write ups on it.