Why Starting With A 3-Room HDB Flat Still Makes Sense In 2025

March 21, 2025

If you were in the property market a decade ago, either as a buyer or seller, you may recall being told to “start with the smallest resale 3-room flat you can afford.” This was repeated like a mantra, along with the term “property wealth progression.’ So it’s not surprising that, even today, some aspiring upgraders still adhere to it; and we still hear the occasional property agent dispensing this advice (though it’s far less common.) Even if this is the first time you’ve heard it, it may be interesting to grasp why it’s supposed to work:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s the basis of starting with the smallest 3-room resale flat?

The issue is less of the flat’s size, and more of its resale status. Let’s use a simplified example, just to illustrate the theory

If you were to buy a BTO flat with a four-year construction time, you would be waiting nine years (four years construction + five years MOP) before you can sell and upgrade. During the four extra years, there’s a risk that private property prices might rise higher and faster than flat prices; this could leave you with a gap that’s difficult to bridge.

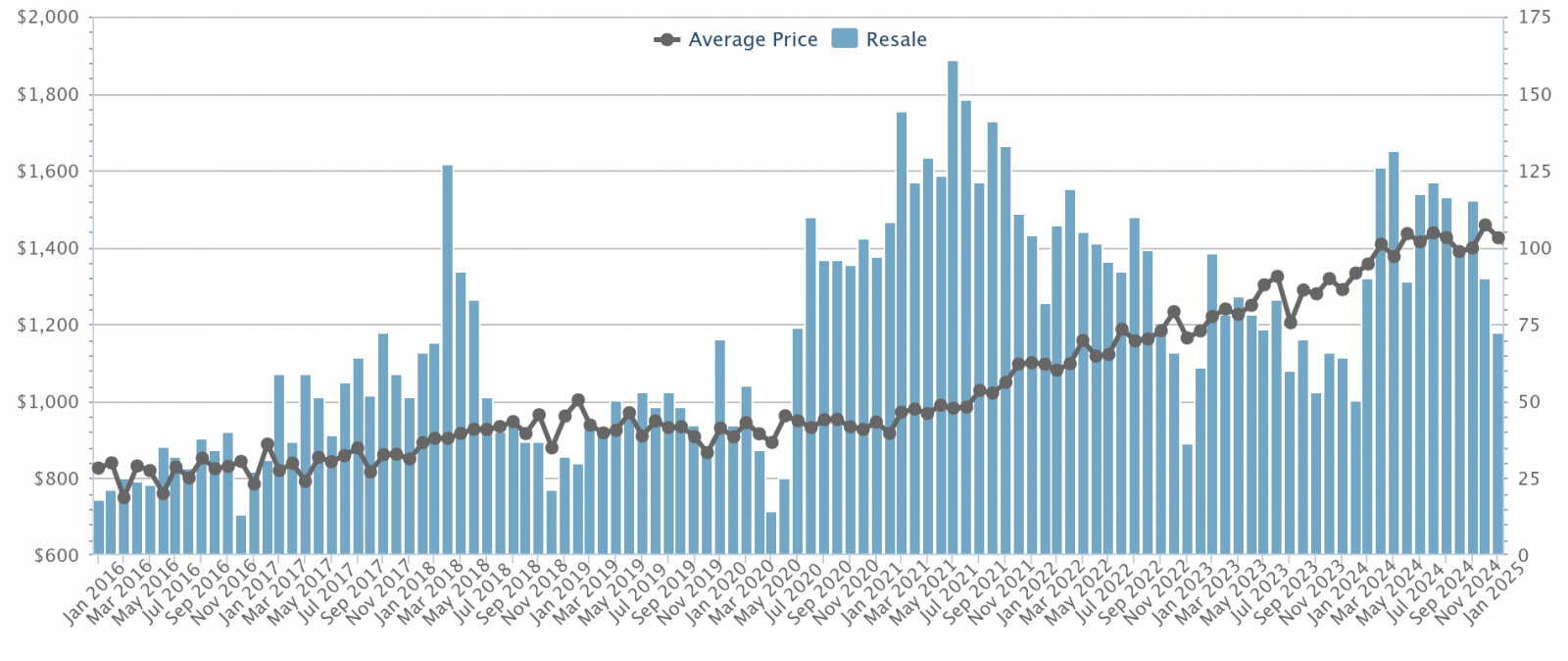

For example, between January 2016 to January 2025, resale condo prices in District 18 (let’s say Tampines) rose from $826 to $1,425 psf, an increase of 72.5 per cent:

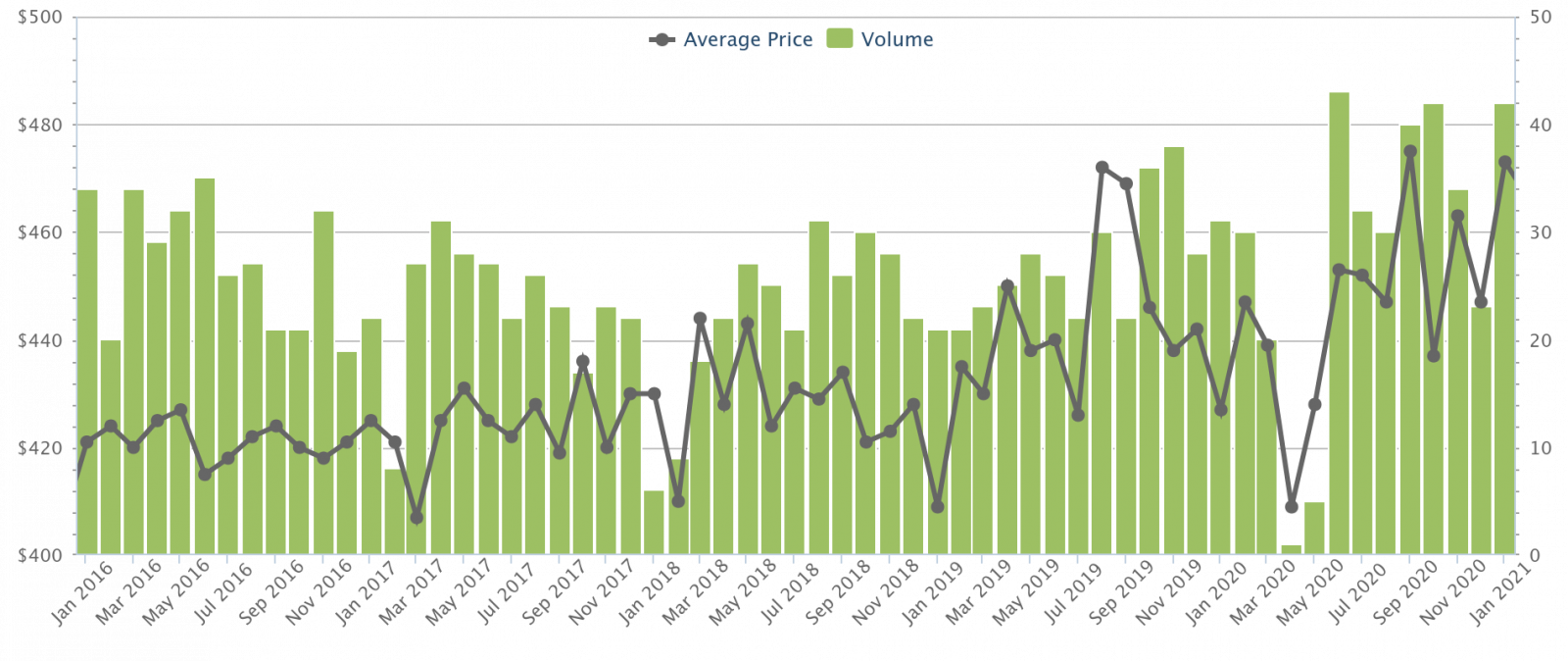

Over the same period, resale 3-room flats in Tampines rose from $421 to $684 psf, an increase of 62.4 per cent.

Let’s assume a typical size of 700 sq.ft. for a 3-room flat, and a size of 1,000 sq.ft. for a family-sized resale condo* (around a three-bedder):

Resale Condo (District 18, Tampines)

- 2016: $826 psf × 1,000 sq. ft. = $826,000

- 2025: $1,425 psf × 1,000 sq. ft. = $1,425,000

- Increase: $599,000

*We are looking at a move to a three-bedder condo unit, and not to an equivalent-sized two-bedder, because many upgraders intend to make the jump to a “full-sized” family unit rather than just a two-bedder.

3-Room BTO Flat (Tampines)

For this example, we’ll use Tampines GreenVerge, where the average 3-room flat BTO price in August 2016 was $227,500. While GreenVerge does not yet have resale prices as of 2025 (but will soon), we can look next door at Tampines GreenRidges, where 3-room flats have averaged $604,500 so far in 2025.

- 2016 BTO Price: $227,500

- 2025 Resale Price: $604,500

- Increase: $377,000

But what if you only had to wait five years?

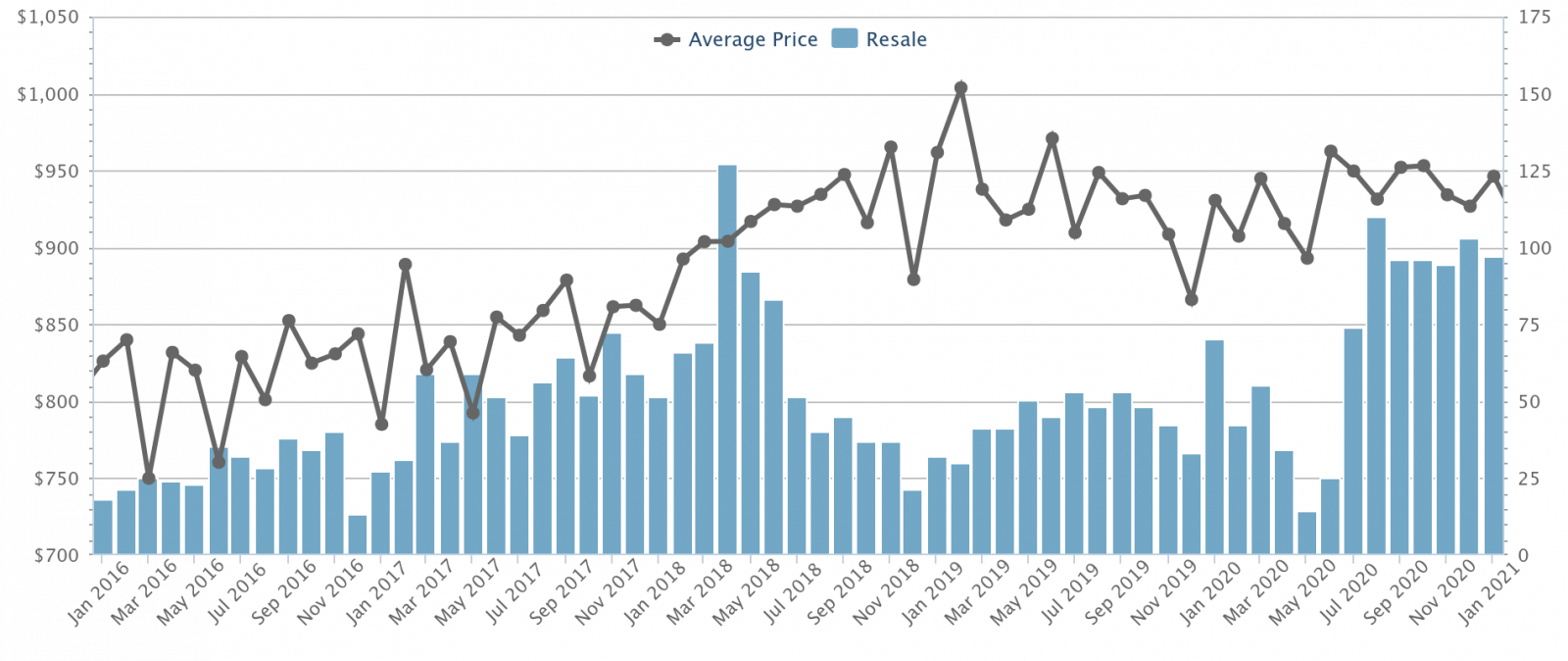

From January 2016 to January 2021, the prices of resale condos in Tampines (District 18) increased from $826 to $946 psf, or about 14.5 per cent:

At the same time, the prices of 3-room resale flats in Tampines increased from $421 to $473 psf, about 12.3 per cent:

What’s the gap after five years instead of nine?

Resale Condo (District 18, Tampines)

- 2016: $826 psf × 1,000 sq. ft. = $826,000

- 2021: $946 psf × 1,000 sq. ft. = $946,000

- Increase: $120,000

Resale 3-Room HDB Flat (Tampines)

- 2016: $421 psf × 700 sq. ft. = $294,700

- 2021: $473 psf × 700 sq. ft. = $331,100

- Increase: $36,400

Comparison to a nine-year wait

After five years (2016–2021), the price gap widened by $83,600. But after nine years (2016–2025), the gap widened by 222,000.

This is also the reason why Plus and Prime flats create a self-selecting market

Based on the above, you can probably see why Plus and Prime flats – with their 10-year MOPs and clawback – would almost never be considered by an upgrader. These projects could increase the total waiting time to around 14 years.

This is ultimately a benefit to upgraders though, as it means that those who don’t want to upgrade won’t be competing with them for flats.

But why a 3-room flat specifically?

It boils down to affordability and getting started quickly

A 3-room flat requires a lower cash outlay, and is more viable for a young home buyer. Waiting longer to afford a bigger flat would have the same issue of delay, and a widening price gap. Besides, when you’re not financially stretched, you’re better able to save and invest for the leap toward private property.

Some agents will also tell you that, because a 3-room flat has lower monthly repayments, you’re better able to service the loan with cash instead of CPF. This means that when you finally sell, you’ll need to refund a lot less to CPF – and you’ll have more cash in hand for the down payment, stamp duty, etc. on a condo.

But does this work the same way in 2025?

The fundamental idea, that you should start early and not wait too long, still makes sense. However, there are some changes to the market in 2025, which we need to take into consideration:

1. Resale flat prices have risen significantly since Covid

In a previous article, we observed that flat prices have, as a whole, jumped by 40 to 50 per cent over nine years. Even if you do want to start with a resale flat, the affordability isn’t what it used to be.

Resale flats are increasingly sold above valuation, and this excess amount – the Cash Over Valuation (COV) – isn’t covered by the loan or CPF. On top of that, resale flats tend to require more in the way of renovations, as compared to a ready-to-move-in BTO flat.

So even if you understand the theory, and want to start with a resale flat, it may not be practical. Starting with a BTO flat isn’t just cheaper: it also means no risk of COV, and likely lower monthly repayments (this matters because you need to meet the MSR limit).

For those who are going to need extra time anyway (e.g., you’ll still need more years of savings after selling your flat), all of this can mean a BTO sometimes becomes a better option. The numbers here are entirely dependent on your personal financial situation, so it’s best to reach out to an agent – or give us a shout out at Stacked – to help you work it out.

2. Construction times for BTO flats are faster

In 2023, HDB aimed to launch 2,000 to 3,000 Shorter Waiting Time (SWT) flats per year, starting from 2025. These are flats with shorter waiting times, possibly being under three years. This shorter waiting time could justify going for a BTO flat instead, once you also factor in the lower quantum, cheaper renovation, lack of COV, and so forth.

But not all flats are SWT flats; at least not yet. If we come to a future where all BTO flats can be built in under three years, then upgraders may see diminished benefits in paying higher resale prices.

3. Location still matters, and the appropriate resale flat may not be available

Condo aspirations and other big dreams aside, practicality tends to interfere. In 2025 especially, there are much fewer sellers in the market – this is due to the high cost of replacement properties, which limits the number of available choices.

The available resale 3-room flats may be too far from a certain Primary school, or too far from your parents to even get the Proximity Housing Grant. And whilst you’re only staying for five years, it can feel like an eternity when you’re travelling 90+ minutes each way to get to and from work.

Sometimes this necessitates spending more (e.g., you have to get a 4-room or 5-room instead, because the location works), or even just giving up and going the BTO route.

Agents also pointed out that not all resale 3-room flats appreciate the same way: the specific HDB town, the floor level, the remaining lease of the flat, and dozens of other factors can influence its appreciation. All of these need to be taken into account, when you have a specific upgrading “target.” In some cases, a bigger flat would serve the purpose better, even if it means a higher cash outlay.

Specifics matter, and can help even more with upgrading

One realtor shared a situation in Yishun where, upon reviewing resale prices, they discovered that the price difference between 4-room and 3-room flats in the area was very slim. This prompted the buyer to choose a 4-room flat instead: this had the added advantage of being easier to sell (most buyers prefer bigger flats), and also had stronger prospects for resale gains.

4. If you can afford it, it might make sense to start bigger

One opinion we encountered on the ground is that, if you have to stick to a tighter budget, a 3-room resale flat is fine. But if you can afford to go big, such as starting with a new Executive Condominium (EC), this could present even better chances of upgrading.

This depends on the EC in question though, and it’s also a matter of availability: there can be years with just one or two EC launches, so the opportunity may not exist. The profitability of an EC, when flipped after five years, can also vary. Some do spectacularly well, but that’s not a guarantee.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments