Singapore Property News Why Old Run-Down Malls Make Neighbourhoods Better In Singapore

-

-

Ryan J. Ong

October 12, 2025 5 min read

What we like

What we don't like

I get a lot of weird looks when I say I LIKE old, slightly run-down strata-titled malls.

The presence of these old malls explains some of my favourite places. Take the Katong/Joo Chiat stretch for instance: having i12 Katong and Parkway Parade there are nice. But what do I especially like in the area? Roxy I & II, or Katong Shopping Centre. And it’s not just some sense of nostalgia, or the near-universal fascination with old and emptying malls (of which there are whole YouTube series by the way).

In fact, The Straits Times recently ran a piece on how Katong Shopping Centre went from a shopping paradise to a building dominated by maid agencies, a good reminder of how these strata malls evolve over time, and why their mix of “random but useful” services is so hard to replicate in gleaming new complexes.

I’m a firm believer that areas with mixed-age construction (i.e., some old, some new) are the best for daily living. The simple fact is, there are useful shops and services you can find in old strata-titled malls that will almost never appear in shiny new ones.

New malls are expensive, and a certain amount of rental income is vital. This means that certain businesses are practically impossible in these malls:

- Most tuition and enrichment centres, as well as martial arts schools

- Specialist hobby shops (comics, trading cards, numismatic shops, etc.)

- Less fancy but more personal hair/nail salons

- Small, family-run restaurants and cafes

- Niche boutiques

What adds to the charm is that these businesses lack the “cookie cutter” quality of newer malls.

I have nothing against easy access to yet another Din Tai Fung, Uniqlo or Starbucks, but it gets repetitive. In strata-titled malls, you find more personalised, sometimes quirky shops where the same proprietors have run their business for decades.

These are malls where you can expect the business owners to know your name, and where people still drop by for actual conversation – not simply to buy something and then leave.

Also, some of these old malls are behind surprising innovations in the retail scene. I’m told, for instance, that Katong Shopping Centre was one of the first fully air-conditioned malls in Singapore.

There are drawbacks, to be sure

Mainly in the form of seedy massage parlours / KTVs that sometimes pop up; and some may complain about the practice of payday lenders (licensed moneylenders). And perhaps the greatest atrocity is the toilets you find in some of these malls, which are a sliver away from being human rights violations.

There’s also the issue of maintenance. A decently maintained strata-titled mall is admittedly less common than a run-down one; and once it gets too far, it can degenerate into something of an eyesore. This used to be a major complaint with the old Peace Centre (the mall component of Peace Mansion), which today has been redeveloped into The Collective at One Sophia.

But every now and then, a strata-titled mall can undergo a sudden revival that benefits the surroundings

One of the most recent cases is Fortune Centre (which, at one point, was also called the vegetarian food hub of Singapore). This mall was mainly known for its vegetarian eateries, Buddhist paraphernalia shops, and the occasional hobby store. But in the past few years, the tenant mix has shifted: young F&B entrepreneurs are moving in, opening izakaya, wine bars, and indie restaurants.

You now find places like Paraphrase, Laut, Pasta & Co, and Tsumiki bakery alongside the vegetarian stalls – a lineup that wouldn’t feel out of place in Amoy Street or Tras Street.

Why? The simple reason is rent. Right now, rent spikes are killing businesses like F&B; but rents in Fortune Centre are reportedly still at an affordable enough range. Couple that with steady footfall from upstairs offices, and this has now become one of our more interesting food enclaves. It’s proof that an old strata-titled mall doesn’t just have to limp along – sometimes, it can reinvent itself in ways that gleaming new malls never could.

Now Bencoolen’s growing trendiness – ranked 20th among the world’s coolest neighbourhoods in Time Out’s 2025 list – has also grown traffic. And whilst some may say that explains Fortune Centre’s new popularity, I believe it’s the other way around: it’s the quirky, offbeat vibes of the strata-titled malls near Bencoolen that made it trendy. From the nearby Bras Basah Complex to Parklane and Sunshine Plaza, the malls here lack the “same old, same old” quality you find in newer commercial spaces.

This does have implications for residential real estate as well

Areas with strata-titled malls often build up a kind of “sticky” neighbourhood identity – one that adds a layer of lifestyle appeal. Coronation Plaza, for instance, or the former King Albert Park, which are neighbourhood hang-outs.

Beyond the fundamentals – like proximity to MRT stations or schools – a good mix of old strata-titled malls with newer ones gives a neighbourhood depth. It means there are both reliable anchors (your supermarket, your pharmacy), plus the oddball businesses that make a place memorable; like the salon owner who’s pretty much a personal friend by this point.

This does matter to buyers and tenants, as it lends a mix of convenience, character, and continuity. This, by the way, is yet another quality that I feel is lacking in areas like Marina Bay: an area with only shiny new malls lacks this kind of warmth and homeliness.

Meanwhile in other property news…

- Property generally takes time to bring you gains; but some of these sellers managed up to $700,000 in profit in just around five years.

- Penrith is the newest condo making waves in Queenstown, and we have the full review here.

- On a related note, if you’re already considering Penrith, join our Stacked Pro readers in seeing how well it compares to alternatives, price-wise.

- Alternatively, if you prefer a CCR condo in a famous location like Holland V, Skye at Holland will probably surprise you with its price point.

Weekly Sales Roundup (29 – 05 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $22,700,000 | 4489 | $5,057 | FH |

| UPPERHOUSE AT ORCHARD BOULEVARD | $7,209,000 | 2056 | $3,506 | 99 yrs (2024) |

| ONE MARINA GARDENS | $5,118,277 | 1647 | $3,108 | 99 yrs (2023) |

| THE CONTINUUM | $4,875,000 | 1690 | $2,885 | FH |

| GRAND DUNMAN | $4,610,000 | 1787 | $2,580 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SPRINGLEAF RESIDENCE | $1,202,000 | 527 | $2,279 | 99 yrs (2024) |

| HILL HOUSE | $1,298,000 | 431 | $3,015 | 999 yrs (1841) |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,509,000 | 474 | $3,186 | 99 yrs (2024) |

| OTTO PLACE | $1,528,000 | 872 | $1,753 | 99 yrs (2024) |

| KASSIA | $1,563,000 | 753 | $2,074 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NASSIM LODGE | $14,500,000 | 4176 | $3,472 | FH |

| SOUTH BEACH RESIDENCES | $7,500,000 | 2121 | $3,537 | 99 yrs (2007) |

| FONTANA HEIGHTS | $6,000,000 | 3455 | $1,736 | FH |

| LEONIE PARC VIEW | $5,628,000 | 2013 | $2,796 | FH |

| HALLMARK RESIDENCES | $4,860,000 | 2960 | $1,642 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CENTRA STUDIOS | $675,888 | 377 | $1,794 | FH |

| LOFT @ NATHAN | $788,000 | 377 | $2,092 | FH |

| SOL ACRES | $803,000 | 495 | $1,622 | 99 yrs (2014) |

| HILLION RESIDENCES | $820,000 | 463 | $1,772 | 99 yrs (2013) |

| SIMS URBAN OASIS | $830,000 | 463 | $1,793 | 99 yrs (2014) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SIXTH AVENUE VILLE | $3,100,000 | 1550 | $2,000 | $1,830,000 | 25 Years |

| MANDALAY MANSION | $2,828,888 | 2088 | $1,355 | $1,793,888 | 28 Years |

| THE SPRINGBLOOM | $2,800,000 | 1647 | $1,700 | $1,740,000 | 18 Years |

| THE PARC CONDOMINIUM | $2,900,000 | 1421 | $2,041 | $1,621,100 | 16 Years |

| THE TOPIARY | $2,955,888 | 2013 | $1,468 | $1,598,060 | 13 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,200,000 | 657 | $1,828 | -$1,317,000 | 13 Years |

| THE BERTH BY THE COVE | $2,015,000 | 1453 | $1,387 | -$789,290 | 15 Years |

| HALLMARK RESIDENCES | $4,860,000 | 2960 | $1,642 | -$450,000 | 11 Years |

| THE SAIL @ MARINA BAY | $1,068,000 | 657 | $1,627 | -$113,000 | 15 Years |

| OXLEY EDGE | $1,810,000 | 1184 | $1,529 | -$93,700 | 12 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE SUNNY SPRING | $1,688,000 | 1001 | $1,686 | 244% | 22 Years |

| MANDALAY MANSION | $2,828,888 | 2088 | $1,355 | 173% | 28 Years |

| ICON | $1,180,000 | 700 | $1,687 | 170% | 22 Years |

| THE SPRINGBLOOM | $2,800,000 | 1647 | $1,700 | 164% | 18 Years |

| THE RIVERVALE | $1,440,000 | 1259 | $1,143 | 152% | 26 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,200,000 | 657 | $1,828 | -52% | 13 Years |

| THE BERTH BY THE COVE | $2,015,000 | 1453 | $1,387 | -28% | 15 Years |

| THE SAIL @ MARINA BAY | $1,068,000 | 657 | $1,627 | -10% | 15 Years |

| HALLMARK RESIDENCES | $4,860,000 | 2960 | $1,642 | -8% | 11 Years |

| OXLEY EDGE | $1,810,000 | 1184 | $1,529 | -5% | 12 Years |

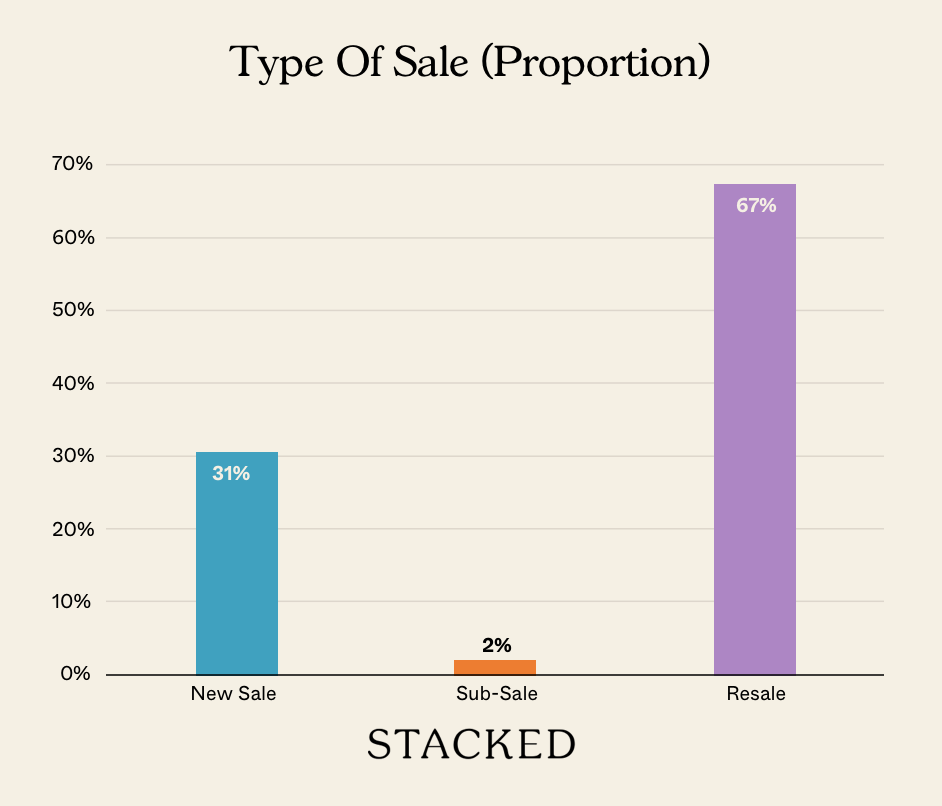

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

0 Comments