A Holland Village New Launch Just Sold 98.8% Of Its Units In One Weekend — Here’s Why Everyone Rushed In

October 13, 2025

Skye at Holland was one of the top launches not only in the past weekend, but possibly one of the best this year (2025). This Holland V condo, slated to be the tallest in the area, managed to hit the sweet spot with its pricing; enough that buyers were willing to overlook smaller sizes. To some, it was a foregone conclusion, given the lower quantum; but to some it came as a surprise, such as those who expected a repeat of One Holland Village’s more modest sales. Here’s what went down and what it means:

What happened at the Skye at Holland launch?

Over the weekend of its official launch, Skye at Holland sold 658 out of 666 units. That translates to a take-up rate of 98.8 per cent, making it the most successful launch in the Core Central Region (CCR) this year. From word on the ground, about 8,000 people had already viewed the showflat during the preview period – once actual bookings opened, the queues were ongoing from morning till night.

Larger units, contrary to expectations (but in line with what we’ve been seeing from recent launches), performed well: every three- and four-bedder unit was sold, while close to 90 per cent of the five-bedders were taken up. Realtors noted that buyers who initially came for mid-sized (three-bedder) units were willing to upgrade quickly; they grabbed four- or even five-bedroom units as the smaller ones became unavailable. This reversed conventional market expectations, where the smallest units are expected to sell out sooner.

The average price achieved across the project was about $2,953 per square foot. For reference, the indicative starting price was an average of around $2,598 psf.

Almost all buyers were Singaporeans or permanent residents, with a mix of investors and owner-occupiers.

What made Skye at Holland sell so well?

Some of the main factors were:

- High $PSF but unexpectedly low quantum for Holland V

- Momentum didn’t slow because the developers didn’t hike prices

- Higher-priced, integrated first-mover made it look even more affordable

- Leasehold factor is no longer really a drawback

1. High $PSF but unexpectedly low quantum for Holland V

An average price of $2,953 psf seems high, but the magic comes from the quantum. Skye at Holland was built with smaller units, thus resulting in these overall prices:

- Two-bedroom (581 sq ft): From $2,598 psf, or $1.51 million

- Two-bedroom premium (667–678 sq ft): From $2,637 psf, or $1.76 million

- Three-bedroom (915 sq ft): From $2,623 psf, or $2.4 million

- Four-bedroom (1,238 sq ft, with private lift): From $2,698 psf, or $3.34 million

You can also see the size rankings compared to the nearby developments, in this example, we look at the 3-bedroom units.

3-bedroom units

| Project | Min. size (sq ft) |

| MOOI RESIDENCES | 850 |

| SKYE AT HOLLAND | Starting from 915 |

| ONE HOLLAND VILLAGE RESIDENCES | 1,098 |

| THE FORD @ HOLLAND | 1,109 |

| LEEDON 2 | 1,109 |

| URBAN EDGE @ HOLLAND V | 1,227 |

| THE MERASAGA | 1,346 |

| HOLLAND RESIDENCES | 1,356 |

| PARVIS | 1,701 |

| YGK GARDEN | 2,067 |

| WARNER COURT | 2,637 |

In contrast, comparable resale units in the same area – such as at One Holland Village Residences or Holland Residences – were often listed between $2.8 million and $3.5 million, for their two- to three-bedroom units (see here for a full Stacked Pro pricing review.)

The lower quantum was managed due to the smaller units, but it was enough to create the needed psychological impact. Even though buyers knew they were getting less space, many still saw Skye at Holland as a “value buy,” in a neighbourhood where resale condos had drifted well above $2.5 million.

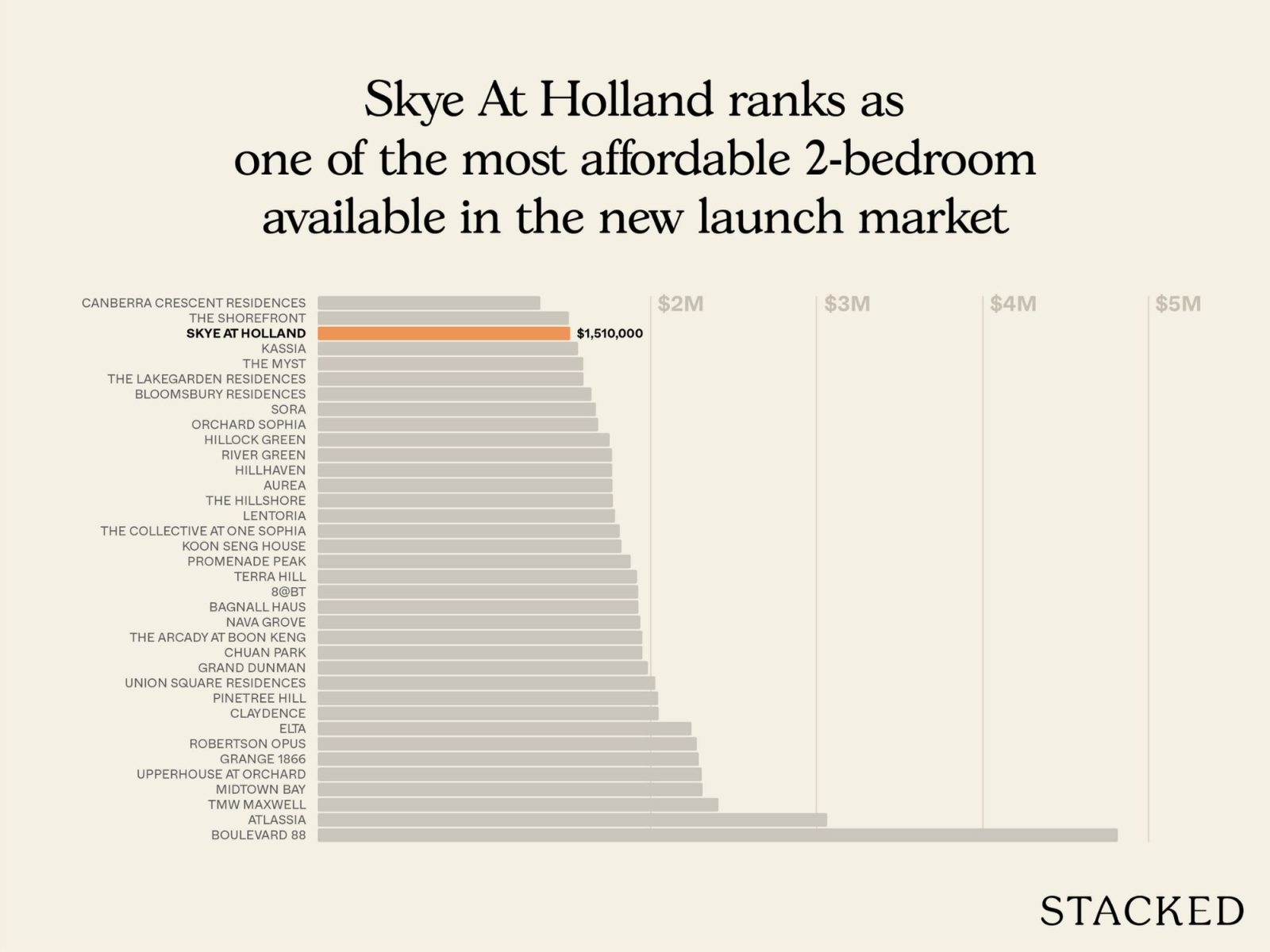

The low quantum also attracted owner-occupiers, who might otherwise have had to look in the Rest of Central Region (RCR) districts at that price point. For reference, the “typical” new launch two-bedder today (2025) is between $1.8 million to $2 million. As such, many buyers saw Skye at Holland as a rare foothold to enter into the CCR market.

2. Momentum didn’t slow because the developers didn’t hike prices

It’s a common practice for developers to raise prices, as units start selling out fast; one example being the notorious Pasir Ris 8 incident, where a certain layout saw eight price hikes. As the developer raises prices, sales tend to taper off.

But for whatever reasons, the developers of Skye at Holland (UOL Group, Singapore Land Group, CapitaLand Development, and Kheng Leong) didn’t do this. Realtors said there was no apparent price increase, despite this being one of the most oversubscribed projects of the year.

More from Stacked

I Lived In Bayshore When It Was ‘Ulu’. Here’s How Much It Has Changed

When I told people I used to live in the Bayshore neighbourhood in East Coast, the usual response used to…

As such, there was no loss of momentum across the launch weekend, and only eight units were left by Sunday evening.

3. Higher-priced, integrated first-mover made it look even more affordable

Another key reason for Skye at Holland’s success was its proximity to One Holland Village Residences, the earlier integrated project nearby.

Integrated projects, which combine residential units with retail, dining, community and office components, are almost always priced at a premium (a little more details here.) One Holland Village was no exception – it even set a benchmark for Holland V pricing, with resale listings of two- and three-bedroom units ranging between about $3.2 million and $3.7 million.

By comparison, Skye at Holland launched with two-bedroom units from $1.51 million and three-bedroom units from $2.4 million. This contrast made Skye at Holland appear like an unusually good deal for the same location, especially since it offered the advantage of being a pure residential development.

The timing also worked perfectly. One Holland Village was already built and providing amenities to the area (including Skye at Holland), but its higher entry price placed it beyond the reach of many buyers. This all lined up to make Skye at Holland a suitable alternative.

4. Leasehold factor is no longer really a drawback

Being a leasehold property in a predominantly freehold area, such as District 10, was traditionally seen as a drawback. But Skye at Holland happened to launch at a point where that mentality has been changing.

Of late, several of the CCR’s top-selling projects have been leasehold – from Irwell Hill Residences to River Green. Buyers today seem less concerned with tenure and more with quantum and location.

At the same time, being leasehold also means the project is cheaper (no freehold premium), which further ties in to the attractive price point. If this is reflective of the longer-term trend, then we should consider whether freehold will continue to have the same meaning it had before.

As a final consideration, many of the resale projects in Holland V are much older. They may be freehold, and they may have been considered “luxury” in their prime; but by today’s standards, even the facilities of many mass-market condos can match or exceed the facilities of a condo built in the ‘00s or earlier. Newer projects like Skye at Holland have features such as big swimming pools, landscaped decks, wellness zones, etc. that older developments rarely have.

What the older surrounding projects have going for them is space: sheer square footage. But as we’ve seen, that advantage also prices out more buyers. So for buyers who are intent on a Holland V address, all of this makes Skye at Holland attractive, even if it weren’t also more affordable. This is a project that succeeded in all the key areas to drive a successful launch.

Interestingly, this also reflects a broader shift in how developers approach launches today. There was once a time when selling out on launch weekend was seen as leaving money on the table. After all, developers had five years to sell, and could have staged price increases to maximise profits over time. But in today’s market, speed has become the new measure of success. It seems that many developers now prioritise clearing their inventory quickly, even if it means accepting slimmer margins, and moving on to the next project with reduced holding risks.

And as we’ve seen with Rivergreen and now Skye at Holland, this mindset is shaping the kinds of projects being built. Expect to see more new launches in the traditional prime districts that undercut their older neighbours on both size and price, catering to a new generation of buyers who value location and liveability, but within a more attainable quantum.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments