What Buyers Overlook When Purchasing Older Condos (Until It’s Too Late)

August 10, 2025

I noticed that condo maintenance issues are in the news again, and this time, Fernwood Towers was mentioned.

Update: Recently, we received an irate letter from Fernwood Towers’ management, for a reference to a Straits Times article about maintenance issues. We previously linked the to Straits Times article here, and we notice the Straits Times also changed its article subsequently.

The claim by the management is as follows: “Fernwood Towers successfully resolved its lift issues in 2024, strengthened its financial reserves, and completed significant infrastructure upgrades.”

So we’re going to take their word for it, and say there is no problem at Fernwood Towers regarding its maintenance, exactly as they claim.

Now to get back to it:

Maintenance in older condos is hardly a recent issue: before Pearl Bank Apartments (now One Pearl Bank) was demolished, it was the most notorious example of a condo deteriorating from lack of maintenance funds. One of the issues was that the development used old-school cast-iron waste pipes, which caused leaks from upper to lower units all the time. At one AGM, the council proposed a special levy (about $$300–$1,000 per month per unit for two years) to fix the situation. The owners voted down the proposal because it was too expensive.

Then there’s the more current example of Neptune Court. This was a former HUDC estate from the mid-1970s, and in January 2025, both lifts in a 21-storey block went down for 12 days. If someone was elderly, wheelchair bound, etc., then it wasn’t just inconvenient, it was a health and safety issue. Also, one of the 70-year-old residents had to climb 400 steps per day to get home, so he should at least get $500 for honorary IPPT gold. This is what happens when constant replacement and maintenance are no longer affordable.

Pandan Valley – which has been around since 1978 – has held up nonetheless; and from word on the ground, I’m told it’s because the MCST is more organised: they make piecemeal improvements, rather than waiting for things to get really bad and then proposing a huge repair/replacement bill all at once. I’m told they did manage to have all the original lifts replaced and upgraded by 2010, for example, and several newer condos still haven’t managed that.

Singaporeans tend to be quite presumptuous about all this though.

As I wrote a while ago, many resale buyers don’t even bother to check the sinking fund, even if they’re buying into a much older condo. This is because up till now, we haven’t actually seen a condo go bankrupt and maintenance ground to a halt.

Part of the reason is that most condos only last 19 to 24 years before an en-bloc sale happens. Most will never reach the age of condos like Pandan Valley, Neptune Court, etc. As such, the long-term maintenance issues that can happen in year 30, 40, or 50+ never have a chance to bare their teeth – but if we did hold on to our properties longer, well, who knows how many condo blocks might be without working lifts, or how many pools would be disgusting sludge pits.

But for buyers who purchase very old projects, such as those already pushing 30 years old and beyond, an en-bloc sale cannot be taken for granted. Along with that, they also cannot take for granted the continued maintenance of the condo project – and these buyers really owe it to themselves to look at the books.

Here’s a quick how-to guide, if you’re buying a very old resale condo

- Ask the Seller or Agent for MCST Financial Statements

Request recent audited accounts from the MCST, which should detail the balance and usage of the sinking fund. - Speak to the Managing Agent or MCST Committee

They may provide clarity on the fund’s sufficiency, any projected upcoming capital works, and whether past sums have been satisfactory. - Check for Special Levies or Financial Alerts

Be alert to recent or recurring special assessments, because if the sinking fund has been insufficient, the MCST may levy additional charges on owners. - Consult Your Bank or Valuer

Occasionally, banks may flag if a development is financially unstable (e.g., facing litigation or acute sinking fund stress) during loan processing; valuer reports might also highlight these concerns

Newer condo projects may have fewer such problems because of factors like CONQUAS

More from Stacked

Will Increased Housing Grants End Up Making HDB Resale Flats Pricier?

Budget 2023 increased the possible grants for resale flats, by another $30,000. This may benefit over 10,000 first-time homebuyers in…

BCA’s CONQUAS score rates project quality, but it’s along with more long-term considerations now. Previously, developers didn’t really care about what happened downstream – they would make features that are high maintenance, or designs that are really tough for cleaning crews (thus raising your costs) because it wasn’t their problem once the condo was sold.

In fact, speaking on condition of anonymity, an engineer from a government body once told me that – in the 2000s or earlier – some condos’ maintenance costs over a 10 to 15 year period could be several times the cost of initial construction.

Whether CONQUAS does help newer projects to avoid long-term high maintenance issues, however, is something we’ll only see much further down the road. And it’s not of much help if you’re purchasing a very old resale condo; so do check the sinking fund and state of the common areas.

Remember that even freehold status is useless if the condo is a wreck.

Meanwhile in other property news…

- Some condo layouts are proving unpopular of late, and these are the ones to watch out for.

- Is decoupling to avoid ABSD legal or not? Recent legal moves have left the situation more confused, and this is why.

- Looking to buy a condo in JB? Here’s our first stab at a small condo tour, Summer Suites, which is near the RTS.

- Join our Stacked Pro readers as we uncover the price gap between new launch and resale condos in District 9. The results are not what you might think, and will make you question some old assumptions.

Weekly Sales Roundup (27 July – 03 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $21,060,160 | 4489 | $4,692 | FH |

| UPPERHOUSE AT ORCHARD BOULEVARD | $7,405,000 | 2056 | $3,602 | 99 yrs (2024) |

| PROMENADE PEAK | $6,584,600 | 1884 | $3,496 | 99 yrs |

| THE RESERVE RESIDENCES | $5,280,000 | 2250 | $2,347 | 99 yrs (2021) |

| THE ROBERTSON OPUS | $5,120,000 | 1539 | $3,326 | 999 yrs |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANBERRA CRESCENT RESIDENCES | $880,000 | 409 | $2,151 | 99 yrs |

| RIVER GREEN | $1,164,000 | 420 | $2,773 | 99 yrs |

| LUMINA GRAND | $1,417,000 | 936 | $1,513 | 99 yrs |

| PROMENADE PEAK | $1,417,600 | 527 | $2,688 | 99 yrs |

| OTTO PLACE | $1,429,000 | 872 | $1,639 | 99 yrs |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE SOVEREIGN | $8,400,000 | 3305 | $2,542 | FH |

| WATERFALL GARDENS | $8,080,000 | 4037 | $2,002 | FH |

| TANGLIN RESIDENCES | $5,500,000 | 2530 | $2,174 | FH |

| REFLECTIONS AT KEPPEL BAY | $4,320,000 | 2659 | $1,625 | 99 yrs (2006) |

| ST PATRICK’S RESIDENCES | $4,045,000 | 2562 | $1,579 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HIGH PARK RESIDENCES | $650,000 | 398 | $1,632 | 99 yrs (2014) |

| VIBES@UPPER SERANGOON | $665,000 | 388 | $1,716 | FH |

| KINGSFORD WATERBAY | $705,000 | 474 | $1,489 | 99 yrs (2014) |

| JOOL SUITES | $740,000 | 409 | $1,809 | FH |

| SOHO 188 | $742,000 | 420 | $1,768 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| WATERFALL GARDENS | $6,222,400 | 4037 | $1,542 | $1,857,600 | 18 Years |

| THE WINDSOR | $1,390,000 | 1991 | $698 | $1,758,000 | 16 Years |

| AMARANDA GARDENS | $1,590,000 | 1464 | $1,086 | $1,626,800 | 14 Years |

| PARC PALAIS | $1,185,300 | 1485 | $798 | $1,484,700 | 29 Years |

| TANGLIN VIEW | $975,469 | 1249 | $781 | $1,412,531 | 26 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY RESIDENCES | $4,057,280 | 1636 | $2,480 | -$496,169 | 15.3 Years |

| ONE DRAYCOTT | $2,262,000 | 732 | $3,090 | -$412,000 | 3.7 Years |

| THE RESERVE RESIDENCES | $5,690,353 | 2250 | $2,529 | -$410,353 | 2 Years |

| REFLECTIONS AT KEPPEL BAY | $4,700,000 | 2659 | $1,768 | -$380,000 | 9.3 Years |

| SUITES AT ORCHARD | $3,004,000 | 1550 | $1,938 | -$239,000 | 14.6 Years |

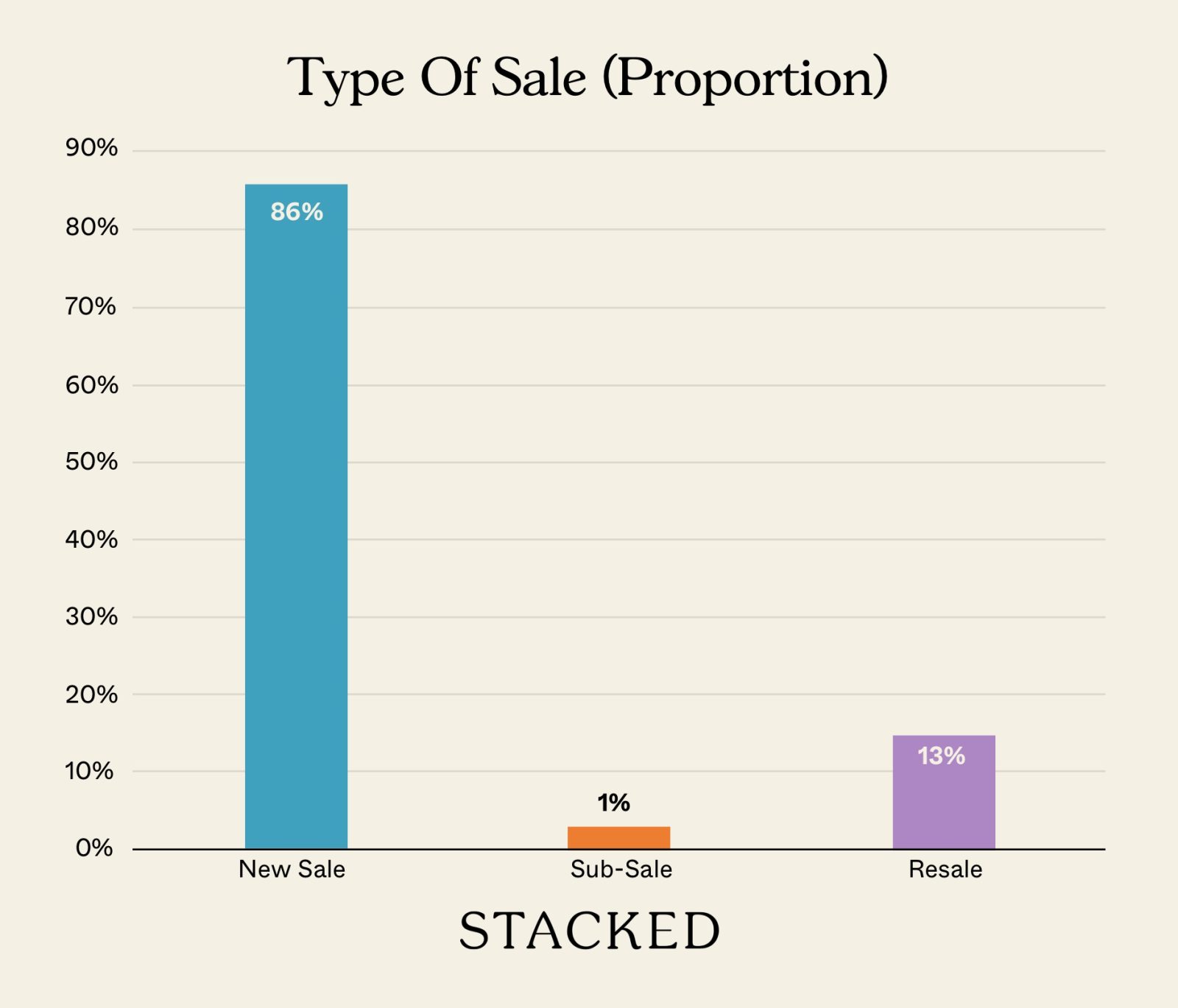

Transaction Breakdown

Follow us on Stacked for updates and reviews in the Singapore property market, and more.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I check before buying an older condo in Singapore?

Why is it important to review the sinking fund when purchasing an old condo?

How do newer condos compare to older ones regarding maintenance issues?

Can a condo's freehold status guarantee good condition?

What are some signs of financial instability in a condo development?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

0 Comments