We Review The June 2024 BTO Launch Sites (Holland Village, Tanjong Rhu, Jurong East, Tampines, Woodlands, Yishun)

March 2, 2024

Well, with the February BTO in 2024 just concluded, it’s time to focus our attention on the next one coming our way. June’s BTO launch line-up is a very interesting one, as it includes Holland Village! At long last, public housing in a major District 10 location, and it’s been nearly a decade since we’ve last seen one in the area. We’re also seeing sites at Tanjong Rhu and Jurong East, so brace yourself for high demand (as well as another tooth-and-nail balloting fight) for the coming round.

Editor’s Note: Removed Pandan Primary under the Jurong East launch.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s available in the June BTO launch?

We’re looking at 6,830 new flats launched in six towns: Jurong East, Kallang/Whampoa, Queenstown, Tampines, and Woodlands. While HDB no longer uses the mature vs. non-mature designations, you’ll nonetheless notice that, except for Woodlands, all of these are mature areas; so interest is likely to be strong this time around.

| Number of flats | Flat types | |

| Kallang/Whampoa | 2,020 | 2,3, and 4-room |

| Queenstown | 330 | 2 and 4-room |

| Jurong East | 1,070 | 2,3,4, and 5-room |

| Tampines | 550 | 2,4, and 5-room |

| Woodlands | 1,590 | 2,3,4, and 5-room, plus some 3Gen units |

| Yishun | 1,270 | 2,3,4, and 5-room |

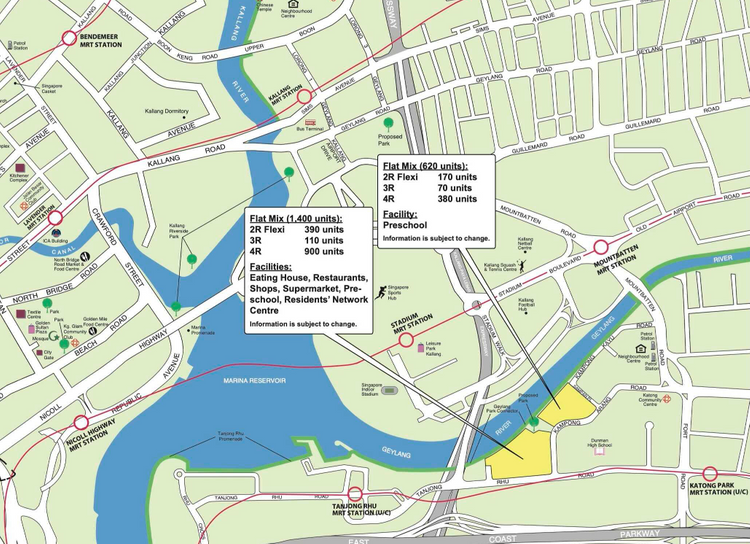

1. Kallang/Whampoa

This is two side-by-side plots near Tanjong Rhu Road, which will be familiar to Singapore Swimming Club (SSC) members or students of Dunman High; it’s just across from the school and club.

This area is currently not much to speak of (even some SSC members will tell you their club location is “ulu”), but it is seeing upgrades. Tanjong Rhu MRT and Katong Park MRT (TEL) will be up by the end of the year, fixing the current accessibility issue. The launch site is somewhat equidistant between both stations, so some blocks may be closer to one and some closer to the other.

The view is one of the big selling points here; the flats are peering over the Geylang River and at the Sports Hub in Kallang. This is a relatively quiet stretch, with a lot of high-end private housing nearby.

The main drawback will be the lack of immediate amenities. SSC is a private club, and the rest of the area is very light on anything beyond residential. That’s why the project itself will include a preschool, some shops, eateries, etc. Nonetheless, we do think most residents will be travelling out for more serious shopping or entertainment, while the area builds up.

In any case, Kallang Wave Mall and Leisure Park are relatively close enough to walk, where you’ll find your usual slew of shops, eateries and an NTUC FairPrice Xtra.

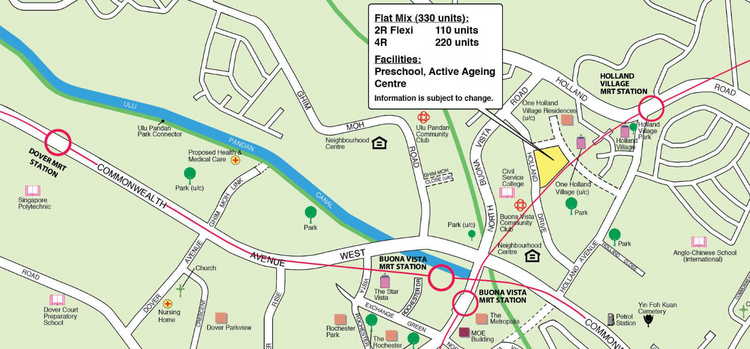

2. Queenstown

This is the one near Holland V, and it’s actually within walking distance of Holland Village MRT (CCL). It’s around where Holland Drive intersects with North Buona Vista Road.

We probably don’t need to explain that this is a crown jewel among the sites. It’s next to a major lifestyle node (One Holland Village has just been operational), has MRT access, is one stop from Buona Vista (where you can find The Star Vista megamall), and two stops from the One-North tech hub. Due to the proximity to Kent Ridge, some might also consider this conveniently close to NUS.

It’s practically guaranteed that this is going to be a Prime development though, so be ready for the 10-year MOP and Subsidy Recovery. We also wouldn’t put too much hope in the balloting, as with just 330 units, this will likely be oversubscribed through the roof.

3. Jurong East

This site is close to where Teban Gardens Road intersects with Jurong Town Hall Road. The Pandan Reservoir MRT station (TEL) will be almost next to the plot, and it will be up by 2027 (so maybe roughly the same time when the flats here are finished). This provides good MRT access to Jurong East Interchange, which would only be two stops away.

More from Stacked

SkyPeak @ Bukit Batok Review: Spacious Grounds + Good Amenities But Not Near An MRT

SkyPeak @ Bukit Batok is the 2nd "Sky" series of HDBs built in the Bukit Batok estate launched in 2013.…

This area is quite good for day-to-day amenities, as the Teban Gardens HDB enclave is well-developed. Beyond the usual small coffee shops, convenience stores, etc. the Teban Gardens Food Centre is nearby; and there’s also an NTUC FairPrice close to it.

However, the location seems to have limited school access. So far, there is just Commonwealth Secondary nearby, whilst other schools seem out of enrolment priority distance. Nonetheless, the convenience of the surroundings, plus the easy access to Jurong East, means some buyers may be willing to overlook this.

The location will also take advantage of the nearby Pandan Reservoir, which will provide a nice waterfront view for the higher-floor units here.

4. Tampines

This plot is around where Tampines Street 92 intersects with Tampines Avenue 1. This is just across SAFRA Tampines.

While this isn’t quite the rockstar of Tampines Central, we think the location is good nonetheless. It’s a very short walk from Tampines West MRT (DTL), which is just one train stop from Tampines Central. For some home buyers, this may be preferable to staying in Tampines Central itself, as that area has become a bit notorious for traffic congestion and noise.

Since it’s one stop away from a cluster of major malls and Grade A office spaces, the residents will have more peace and quiet, while broadly having the same amenities; quite a winning deal for most.

This area also has excellent school access, with St. Hilda’s Primary and Secondary, Junyuan Primary, Springfield Secondary, and Tampines Primary and Secondary all being within enrolment distance; and Junyuan and St. Hilda’s Primary might be a reasonable walking distance for some flats.

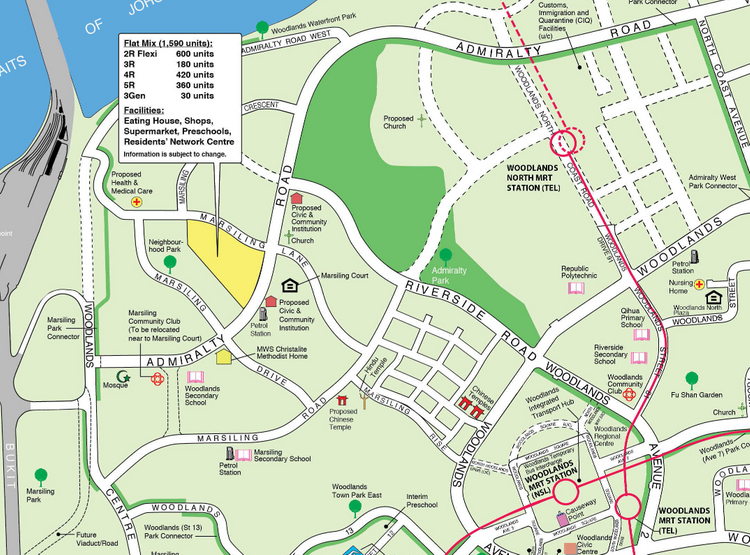

5. Woodlands

This site is where Marsiling Lane interests Admiralty Road. This is the only launch site offering 3Gen flats, for those who are interested; it’s also the next biggest in number after Kallang/Whampoa, so there are higher chances of balloting for a flat here.

This is still an area that still needs much development, but it will appeal to people who like quieter areas. Due to the location, we suspect some units may have a waterfront view from the Johor Strait, or a greenery view facing Admiralty Park. The existing HDB enclave nearby (Marsiling) has the usual assortment of convenience stores, coffee shops, and other heartland amenities; this will probably be the main source for day-to-day needs if you live here.

The chief drawback is the lack of MRT access. You’ll probably need a bus connection to get to Woodlands North or Woodlands train station.

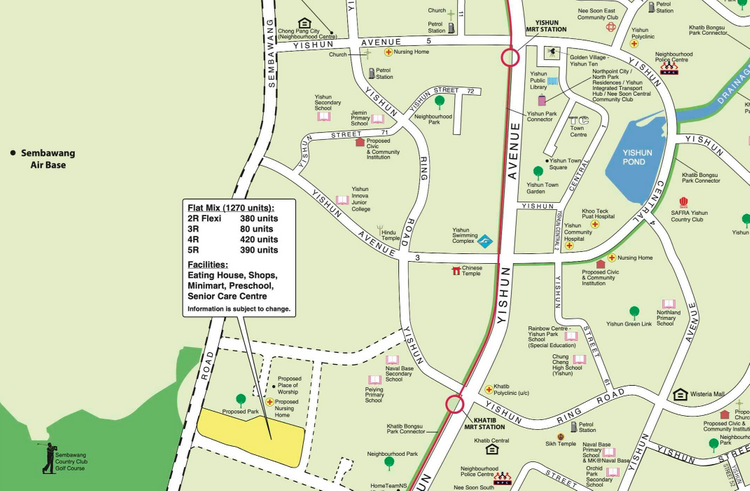

6. Yishun

This area is rather new and underdeveloped, so there’s not much to say about it yet. The plot does seem close to Naval Base Secondary and Peiying Primary, and residents will probably find their amenities among existing HDB clusters around Yishun Ring Road.

That said, it seems far from any MRT station, so you’ll probably need a bus to get to Khatib MRT (NSL). We do also wonder if bus services will be tweaked, to provide more routes for new residents in this area.

For now though, there doesn’t appear to be much of note in the area; so buy only if you’re ready to settle here for the long haul and just want to secure something in this period.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from BTO Reviews

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

0 Comments