We Make $330k Per Year And Own An Executive HDB: Should We Buy A Resale Condo Or A Dual-Key 3 Bedder?

April 5, 2024

Hi Stackedhomes,

I’ve been a silent reader of your articles for the last 4-5 years. Your articles were unbiased and provided great insights and analysis of home purchases.

BACKGROUND.

My wife and I will be 42 & 43 respectively this year. We have 3 primary school going children and a helper. Our annual income adds up to about $330k. We are currently staying in HDB EA in Jurong area, with remaining loan of $270k. We plan to sell our house (hopefully to sell at $800k) to fund the next purchase. We would like to seek your advice on the following options:

1. Buy a resale leasehold 3 bedder condo (not more than 20 yrs old) + keep the cash profit and wait for better investment opportunities

2. Buy a resale leasehold 3 bedder condo (not more than 20 yrs old) + 1/2 bedder for investment (to sell in next 3-5 yrs).

3. Buy a 4/5 bedder dual key condo and rent out the studio side for the next 3-5 yrs.

4. Jointly buy a freehold 3/4 bedder in district 14/15.

Which option would be most recommended based? Or would there be an option 5?

I have forgotten to include our Available cash outlay is $100k and CPF OA is $210k.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thank you for reaching out. We appreciate the support, and I’m particularly happy to hear that the articles have been beneficial for you.

Let me introduce myself; I’m Aaron, one of the partner consultants with Stacked, and over the past few years, I’ve had the privilege of assisting numerous HDB owners like yourself in upgrading to private properties.

Given the demand for bigger HDB Executive Apartments like the one that you currently have, it’s only natural to be curious if this is the right time to let go to upgrade to a private property.

Before delving into the options, let’s first assess your affordability.

Affordability

These are some of the Executive Apartments transacted in Jurong West from January this year till date:

| Date | Block | Street | Level | Size (sqm) | Lease start year | Price |

| Mar 2024 | 671A | Jurong West St 65 | 10 to 12 | 125 | 2002 | $700,000 |

| Mar 2024 | 669B | Jurong West St 64 | 10 to 12 | 130 | 2000 | $683,000 |

| Mar 2024 | 626 | Jurong West St 65 | 01 to 03 | 130 | 2001 | $640,000 |

| Mar 2024 | 628 | Jurong West St 65 | 10 to 12 | 130 | 2001 | $716,888 |

| Mar 2024 | 607 | Jurong West St 65 | 10 to 12 | 133 | 2001 | $698,000 |

| Mar 2024 | 688 | Jurong West Ctrl 1 | 10 to 12 | 139 | 1998 | $800,000 |

| Mar 2024 | 334 | Kang Ching Rd | 10 to 12 | 139 | 1997 | $828,000 |

| Feb 2024 | 274C | Jurong West St 25 | 07 to 09 | 126 | 2002 | $620,000 |

| Feb 2024 | 665A | Jurong West St 64 | 13 to 15 | 130 | 2000 | $769,000 |

| Feb 2024 | 669C | Jurong West St 64 | 01 to 03 | 130 | 2000 | $635,000 |

| Feb 2024 | 630 | Jurong West St 65 | 10 to 12 | 130 | 2001 | $685,000 |

| Feb 2024 | 666A | Jurong West St 65 | 13 to 15 | 130 | 2000 | $748,000 |

| Feb 2024 | 666B | Jurong West St 65 | 04 to 06 | 130 | 2000 | $750,000 |

| Feb 2024 | 686A | Jurong West Ctrl 1 | 04 to 06 | 132 | 2000 | $778,000 |

| Feb 2024 | 656A | Jurong West St 61 | 10 to 12 | 132 | 2002 | $705,000 |

| Feb 2024 | 910 | Jurong West St 91 | 10 to 12 | 141 | 1988 | $670,000 |

| Jan 2024 | 671C | Jurong West St 65 | 07 to 09 | 125 | 2002 | $668,000 |

| Jan 2024 | 666B | Jurong West St 65 | 04 to 06 | 130 | 2000 | $695,000 |

| Jan 2024 | 605 | Jurong West St 62 | 13 to 15 | 133 | 2001 | $730,000 |

Without your address, I cannot determine whether a sale price of $800,000 is feasible. However, given that two units were sold at this price point, it may be achievable if your property is located in similar clusters. But to be more prudent, I will utilise the average transacted price of $711,520 for calculation purposes. Let’s round this to $712,000 for ease of calculation.

Selling

| Description | Amount |

| Selling price | $712,000 |

| Outstanding loan | $270,000 |

| Sales proceeds (CPF + cash) | $442,000 |

Buying

Combined affordability

| Description | Amount |

| Maximum loan based on combined annual income of $330K at the ages 42 and 43 with a 4.8% interest* | $2,463,190 (22-year tenure) |

| CPF + cash | $752,000 |

| Maximum purchase price assuming 25% down payment of $752,000* | $3,008,000 |

| BSD based on $3,215,190 | $120,080 |

| Estimated affordability | $2,887,920 |

*Assuming your incomes are evenly split

**Although your maximum loan quantum is at $2,463,190, due to the CPF + cash you have for the 25% down payment, your loan quantum is reduced

Individual affordability

Wife

| Description | Amount |

| Maximum loan based on a monthly fixed income of $13,750 at the age of 42 with a 4.8% interest | $1,262,421 (23-year tenure) |

| CPF + cash | $376,000 |

| Maximum purchase price assuming a 25% down payment of $752,000 | $1,504,000 |

| BSD based on $1,504,000 | $44,800 |

| Estimated affordability | $1,459,200 |

Husband

| Description | Amount |

| Maximum loan based on a monthly fixed income of $13,750 at the age of 43 with a 4.8% interest | $1,231,595 (22-year tenure) |

| CPF + cash | $376,000 |

| Maximum purchase price assuming a 25% down payment of $752,000 | $1,504,000 |

| BSD based on $1,504,000 | $44,800 |

| Estimated affordability | $1,459,200 |

In the above calculations, both your individual affordability are the same because I assumed that your incomes as well as the CPF + cash funds are equally split. Given that you have a rather considerable amount of CPF + cash funds, your budgets can be altered by adjusting the cash portions.

Now let’s run through the options you’re considering.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Option 1. Buy a resale leasehold 3 bedder condo and wait for other investment opportunities

I am presuming here that the 3-bedroom unit will be acquired under a single name. Given the current high prices and interest rates, if there’s no urgency to acquire a second property, you could spare the time to wait while allocating your additional funds to other investment opportunities.

Let’s assume that your wife purchases the 3-bedder since she is eligible for a higher loan. I will also put an additional $200,000 towards the purchase to increase her affordability and open up more options.

Wife’s revised affordability

| Description | Amount |

| Maximum loan based on a monthly fixed income of $13,750 at the age of 42 with a 4.8% interest | $1,262,421 (23-year tenure) |

| CPF + cash | $576,000 |

| Total loan + CPF + cash | $1,838,421 |

| BSD based on $1,838,421 | $61,521 |

| Estimated affordability | $1,776,900 |

With a budget nearing $1.8M, you’ll find a variety of options for 3-bedroom properties under 20 years old, depending on your desired location. When choosing a property, it’s crucial to consider your intended holding period. Since this wasn’t specified, I will just assume a 10-year horizon for calculation purposes. Let’s explore the potential expenses if your wife acquires a unit priced at $1.7M.

| Description | Amount |

| Purchase price | $1,700,000 |

| BSD | $54,600 |

| CPF + cash | $576,000 |

| Loan required | $1,178,600 |

| Description | Amount |

| BSD | $54,600 |

| Interest expense (Assuming 4% interest with a 23-year tenure) | $400,328 |

| Property tax | $25,800 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Total costs | $522,728 |

Let’s also examine the potential profits. I will assume that the property appreciates at the same average growth rate as all non-landed private properties over the last decade, which is 2.9% annually.

| Time period | Price | Gains |

| Starting point | $1,700,000 | $0 |

| Year 1 | $1,749,300 | $49,300 |

| Year 2 | $1,800,030 | $100,030 |

| Year 3 | $1,852,231 | $152,231 |

| Year 4 | $1,905,945 | $205,945 |

| Year 5 | $1,961,218 | $261,218 |

| Year 6 | $2,018,093 | $318,093 |

| Year 7 | $2,076,618 | $376,618 |

| Year 8 | $2,136,840 | $436,840 |

| Year 9 | $2,198,808 | $498,808 |

| Year 10 | $2,262,573 | $562,573 |

I will also assume that the remaining $176,000 (of CPF + cash) is in your husband’s CPF and accumulates a 2.5% interest annually.

| Time period | CPF funds | Interest earned |

| Starting point | $176,000 | $0 |

| Year 1 | $180,400 | $4,400 |

| Year 2 | $184,910 | $8,910 |

| Year 3 | $189,533 | $13,533 |

| Year 4 | $194,271 | $18,271 |

| Year 5 | $199,128 | $23,128 |

| Year 6 | $204,106 | $28,106 |

| Year 7 | $209,209 | $33,209 |

| Year 8 | $214,439 | $38,439 |

| Year 9 | $219,800 | $43,800 |

| Year 10 | $225,295 | $49,295 |

Without having your specific figures, it’s hard to give accurate advice. But if the remaining funds consist of cash, there’s potential for higher returns as you could invest it in other avenues.

Total gains if you were to take this pathway: $562,573 + $49,295 – $522,728 = $89,140

Option 2. Buy a resale leasehold 3 bedder condo and another 1 or 2 bedder for investment

| Pros | Cons |

| Rental income | Higher upfront cost |

| Diversification of property portfolio | Financing and managing two properties |

This option may be better suited for those who are looking for an additional income stream and are comfortable with tenant management.

Seeing as you will need the CPF + cash for the purchase of the investment property, in this scenario, I will allocate just $100,000 more towards the purchase of the own stay property under your wife’s name.

Wife’s revised affordability

| Description | Amount |

| Maximum loan based on a monthly fixed income of $13,750 at the age of 42 with a 4.8% interest | $1,262,421 |

| CPF + cash | $476,000 |

| Total loan + CPF + cash | $1,738,421 |

| BSD based on $1,738,421 | $56,521 |

| Estimated affordability | $1,681,900 |

Let’s take a look at the costs involved should your wife purchase a unit at $1.6M.

| Description | Amount |

| Purchase price | $1,600,000 |

| BSD | $49,600 |

| CPF + cash | $476,000 |

| Loan required | $1,173,600 |

| Description | Amount |

| BSD | $49,600 |

| Interest expense (Assuming 4% interest with a 23-year tenure) | $398,630 |

| Property tax | $22,800 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Total costs | $513,030 |

Husband’s revised affordability

| Description | Amount |

| Maximum loan based on a monthly fixed income of $13,750 at the age of 43 with a 4.8% interest | $1,231,595 |

| CPF + cash | $276,000 |

| Maximum purchase price assuming a 25% down payment of $752,000 | $1,104,000 |

| BSD based on $1,104,000 | $28,760 |

| Estimated affordability | $1,075,240 |

Let’s assume a purchase price of $1M and a rental yield of 3% for the investment property.

| Description | Amount |

| Purchase price | $1,000,000 |

| BSD | $24,600 |

| CPF + cash | $276,000 |

| Loan required | $748,600 |

| Description | Amount |

| BSD | $24,600 |

| Interest expense (Assuming 4% interest with a 22-year tenure) | $251,125 |

| Property tax | $36,000 |

| Maintenance fees (Assuming $250/month) | $30,000 |

| Rental income | $300,000 |

| Agency fee (Payable once every 2 years) | $13,500 |

| Total costs | $55,225 |

For calculation purposes, I will presume that both properties grow at the same rate of 2.9%.

| Time period | Total property value | Gains |

| Starting point | $2,600,000 | $0 |

| Year 1 | $2,675,400 | $75,400 |

| Year 2 | $2,752,987 | $152,987 |

| Year 3 | $2,832,823 | $232,823 |

| Year 4 | $2,914,975 | $314,975 |

| Year 5 | $2,999,509 | $399,509 |

| Year 6 | $3,086,495 | $486,495 |

| Year 7 | $3,176,003 | $576,003 |

| Year 8 | $3,268,108 | $668,108 |

| Year 9 | $3,362,883 | $762,883 |

| Year 10 | $3,460,406 | $860,406 |

Total gains if you were to take this pathway: $860,406 – $513,030 – $55,225 = $292,151

Option 3. Jointly purchase a 4 or 5 bedroom dual key unit and rent out the studio

| Pros | Cons |

| Live-in investment – owner-occupied property tax is lower than a non-owner occupied unit | Higher purchase price |

| Rental income | Dual key units may be harder to dispose of in the future |

This option could be more suitable for families seeking additional space and also desiring a source of supplemental income.

We have previously done a piece discussing the profitability of dual key units which you can read here.

Our analysis indicates that, generally, dual key units tend to experience a lower appreciation rate compared to regular units within the same development. However, it’s important to note that there are fewer transactions involving dual key units, which may skew the results. Additionally, dual key units may have been more popular with investors, so most owners would have generated income through rental yields, reducing the pressure to sell at a significant appreciation.

With a combined affordability of $2.8M, you have a decent range of options for 4-bedroom dual key units. Let’s consider a scenario where you purchase a unit for $2.5M and rent out the studio for $2,500 per month.

| Description | Amount |

| Purchase price | $2,500,000 |

| BSD | $94,600 |

| CPF + cash | $752,000 |

| Loan required | $1,842,600 |

| Description | Amount |

| BSD | $94,600 |

| Interest expense (Assuming 4% interest) | $618,118 |

| Property tax | $60,800 |

| Maintenance fees (Assuming $500/month) | $60,000 |

| Rental income | $300,000 |

| Agency fee (Payable once every 2 years) | $13,500 |

| Total costs | $547,018 |

As before, assuming a 2.9% growth rate annually:

| Time period | Total property value | Gains |

| Starting point | $2,500,000 | $0 |

| Year 1 | $2,572,500 | $72,500 |

| Year 2 | $2,647,103 | $147,103 |

| Year 3 | $2,723,868 | $223,868 |

| Year 4 | $2,802,861 | $302,861 |

| Year 5 | $2,884,144 | $384,144 |

| Year 6 | $2,967,784 | $467,784 |

| Year 7 | $3,053,850 | $553,850 |

| Year 8 | $3,142,411 | $642,411 |

| Year 9 | $3,233,541 | $733,541 |

| Year 10 | $3,327,314 | $827,314 |

Total gains if you were to take this pathway: $827,314 – $547,018 = $280,296

Option 4. Jointly purchase a freehold 3 or 4 bedder in District 14/15

| Pros | Cons |

| Potential for long-term appreciation with a freehold property | Higher cost |

This option may be better suited for those prioritising property value retention and long-term investment.

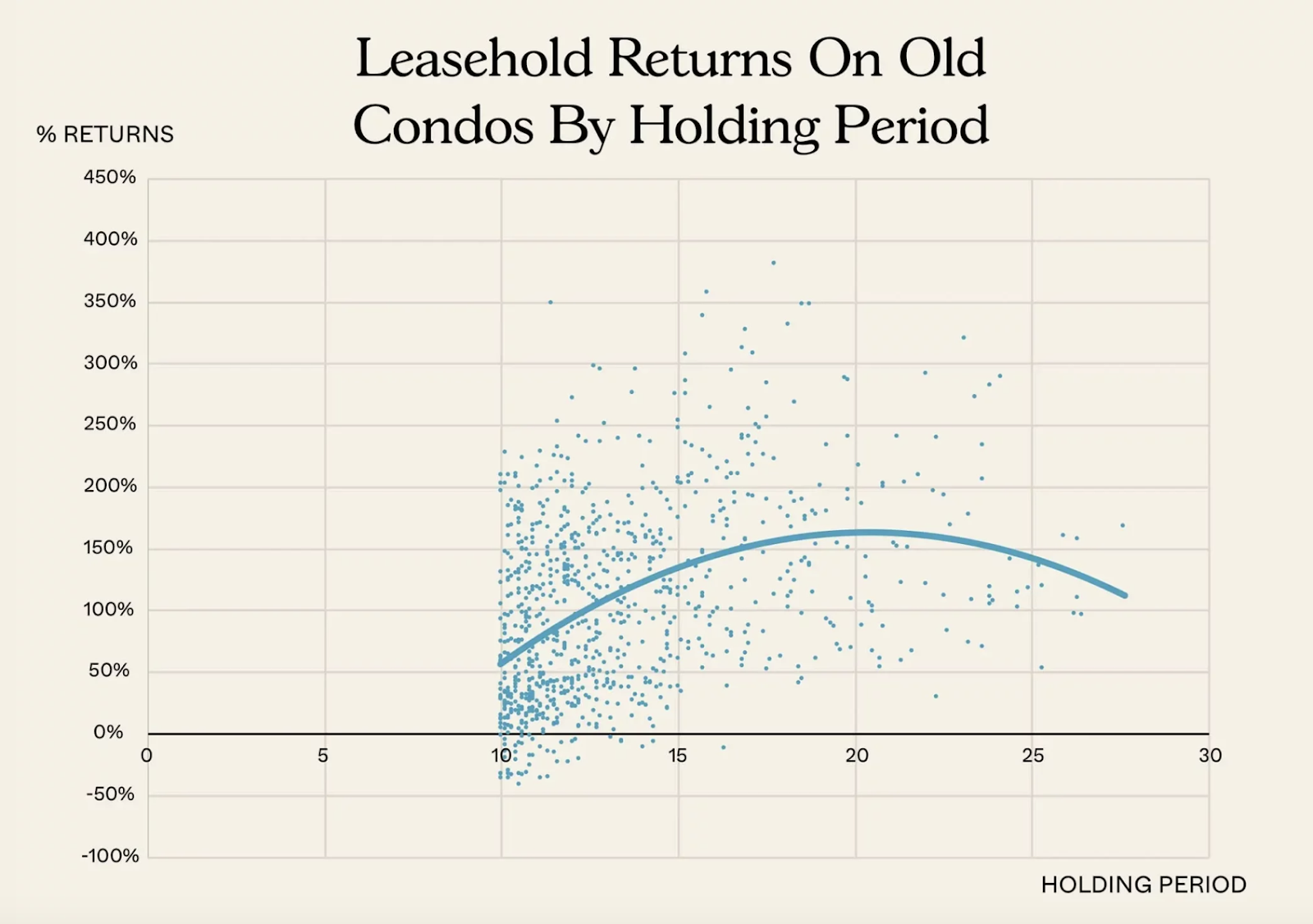

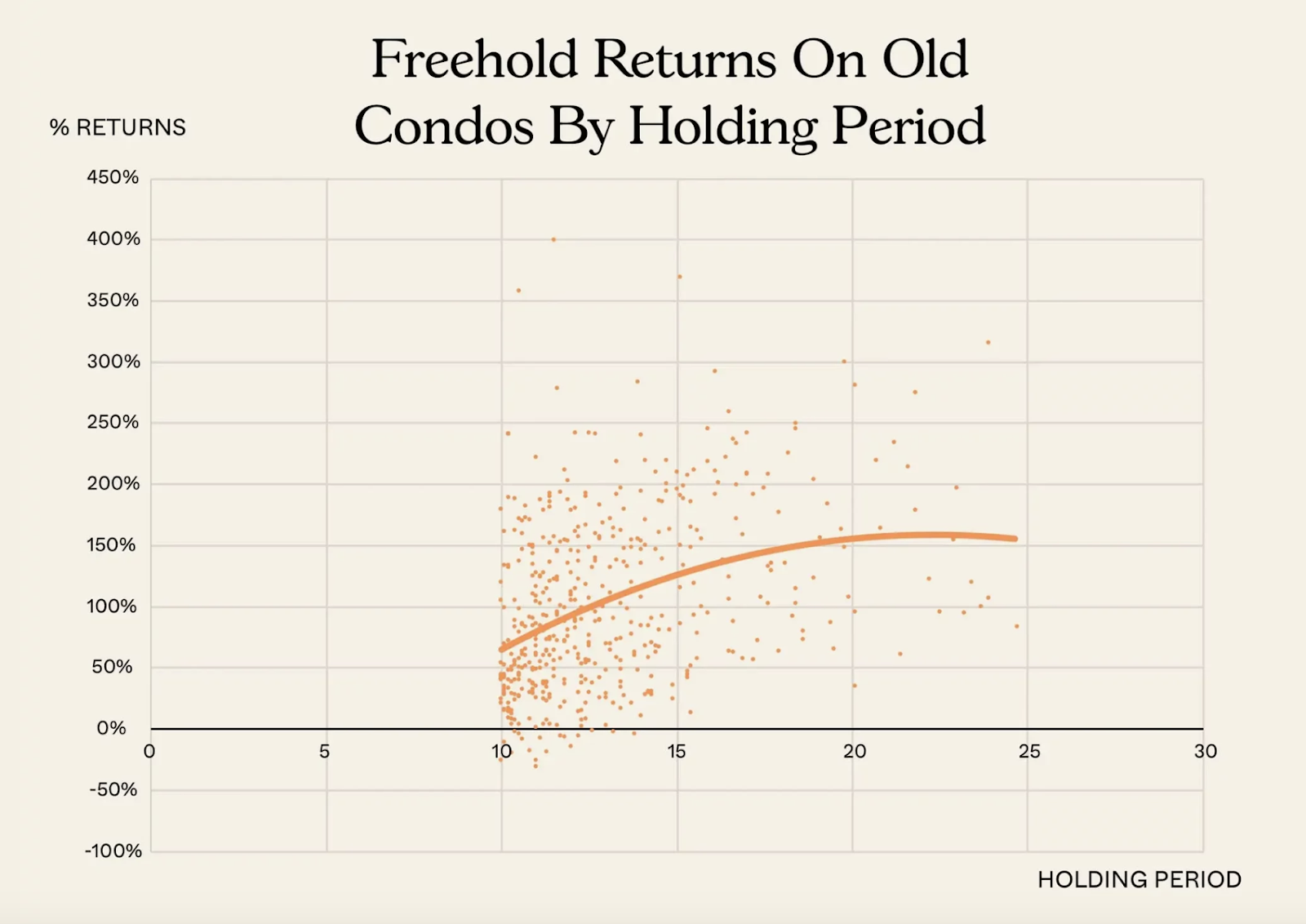

In another article we did, we found that both leasehold and freehold properties exhibited increasing returns in the initial years. However, as expected, over an extended holding period, freehold properties demonstrated more resilience in terms of price appreciation compared to their leasehold counterparts.

The suitability of this option hinges on your intended holding period. For a shorter hold, considering a leasehold property may make more sense due to lower overall costs and potentially better growth rates compared to freehold properties. However, if you’re looking at a longer holding period, this could be a viable choice.

With a budget of $2.8M, you have numerous options in Districts 14 and 15. However, it’s worth noting that many of these projects are boutique developments. In addition, the lower transaction volumes associated with freehold properties might require some waiting time.

Let’s look at the costs involved should you purchase a freehold unit at $2.8M.

| Description | Amount |

| Purchase price | $2,800,000 |

| BSD | $109,600 |

| CPF + cash | $752,000 |

| Loan required | $2,157,600 |

| Description | Amount |

| BSD | $109,600 |

| Interest expense (Assuming 4% interest) | $723,787 |

| Property tax | $78,800 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Total costs | $954,187 |

Assuming that the property grows at the same rate of 2.9% annually:

| Time period | Total property value | Gains |

| Starting point | $2,800,000 | $0 |

| Year 1 | $2,881,200 | $81,200 |

| Year 2 | $2,964,755 | $164,755 |

| Year 3 | $3,050,733 | $250,733 |

| Year 4 | $3,139,204 | $339,204 |

| Year 5 | $3,230,241 | $430,241 |

| Year 6 | $3,323,918 | $523,918 |

| Year 7 | $3,420,311 | $620,311 |

| Year 8 | $3,519,500 | $719,500 |

| Year 9 | $3,621,566 | $821,566 |

| Year 10 | $3,726,591 | $926,591 |

Total losses if you were to take this pathway: $926,591 – $954,187 = -$27,596

What should you do?

Let’s take a quick look again at the potential costs and gains for each of the options:

| Options | Potential costs | Potential gains (after deducting costs) | Number of properties held |

| 1. Buy a resale leasehold 3 bedder condo and wait for other investment opportunities | $522,728 | $89,140 | 1 |

| 2. Buy a resale leasehold 3 bedder condo and another 1 or 2 bedder for investment | $568,255 | $292,151 | 2 |

| 3. Jointly purchase a 4 or 5-bedroom dual-key unit and rent out the studio | $547,018 | $280,296 | 1 |

| 4. Jointly purchase a freehold 3 or 4 bedder in District 14/15 | $954,187 | -$27,596 | 1 |

Before concluding, I’d like to point out that the cash and CPF outlay for scenario 1 is lower than those in 2-4. This means that you would have to factor in investing the cash/CPF that you would’ve used in scenarios 2-4 to make it a fairer comparison.

This difference amounts to $176,000 ($752,000 less $576,000). As such, I’ll assume a 4% investment year-on-year return. This is typically lower than the 7% one could expect from equities, however, the scenario considers saving up for an investment property later, so I would assume a lower return from a less risky investment such as bonds. In this case, the extra gain from investment is as follows:

| Period | Balance |

| 1 | $176,000 |

| 2 | $183,040 |

| 3 | $190,362 |

| 4 | $197,976 |

| 5 | $205,895 |

| 6 | $214,131 |

| 7 | $222,696 |

| 8 | $231,604 |

| 9 | $240,868 |

| 10 | $250,503 |

| Gains | $74,503 |

The extra $74,503 gained over 10 years results in an overall gain of $163,643 which is still lower than the gains in scenarios 2 and 3.

Now since the potential gains are unpredictable and rely heavily on the specific development(s) you choose, let’s focus on examining the potential costs involved.

Except for Option 4, the costs associated with the other four options are fairly comparable. The decision will ultimately hinge on your purchase objectives and intended holding period.

While Option 3 does generate rental income, historical data indicating slower appreciation for dual key units and potential challenges in selling the unit down the line make it a less ideal choice.

If your plan is to hold the property for an extended period, say 20 to 30 years, Option 4 would be suitable, as prices of freehold properties typically hold up better over time. However as mentioned, it may not be the best choice for the short-term, given its higher entry price, resulting in substantially higher costs, with no guarantee of better appreciation compared to a leasehold property.

Option 1 offers the most flexibility and liquidity, which could be crucial for a family with three school-going children and a helper.

However, if your focus leans more towards property investment and generating rental income, only Option 2 allows for the ownership of two properties concurrently.

This is advantageous as it keeps your residence and investment property separate and offers potential capital appreciation for both.

The rental income earned also helps offset expenses. If you prefer staying in the West, consider exploring newer resale Executive Condominium (EC) units, as they are more affordable and there has been a steady stream of new ECs launched in the west, potentially supporting price stability.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Aaron Leong

With three enriching years in real estate, Aaron is on a mission to help clients, regardless of their backgrounds, make the most out of their property portfolios. He takes pride in breaking down the complexity of financial calculations and market analysis, l presenting options with transparency, so his clients can navigate their property journey with confidence. Aaron's roots run deep in Districts 25, 27, and 18, where he has lived and breathed the essence of these areas for many years. Drawing from his experience as an inflight manager for an international airline, Aaron brings a unique skill set to his real estate practice. Interacting with a diverse clientele globally has taught him to understand and cater to various needs, ensuring every client feels valued and heard. Aaron is here to make the buying or selling process as seamless and stress-free as possible, drawing from his experience in creating delightful experiences. Aaron's achievements, including recognition as one of the Top 50 PropNex Gen agents in 2021, and placing in the Top 10% and Top 5% in 2022 and 2023, underscore his dedication to excellence. During leisure time, you'll likely find him enjoying a game of soccer or strumming melodies on his guitar.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments