We Analysed 96 New Launch Condos. Here’s What We Learnt.

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.

Despite the Coronavirus showing no signs of abating around the world, it does seem like there is no separating Singapore from its love of property. Just last weekend, the M has sold a quite frankly astonishing 75 percent of its units, while Luxus Hills managed to sell out its final phase as well – and even managed to set a new benchmark for pricing along the way.

So is there a reason why certain new launch condos do well – even with the current uncertain climate that they are launched in?

Is it always about selling price?

Or do other factors like the size of the development have a big role to play in the performance of the new launch?

In this article, we’ve taken the data from our new launch 2020 cheat sheet to analyse and see if there is any commonality in the data.

As always, let me just lay out the disclaimer first.

There were only 96 new launches that we’ve accounted for – so truthfully, it is a small sample size to really glean anything statistically sound.

For example, certain districts might really only have one new launch, so comparing it wouldn’t exactly be fair.

Let’s start with a couple of highlights.

Highlights: Key pointers

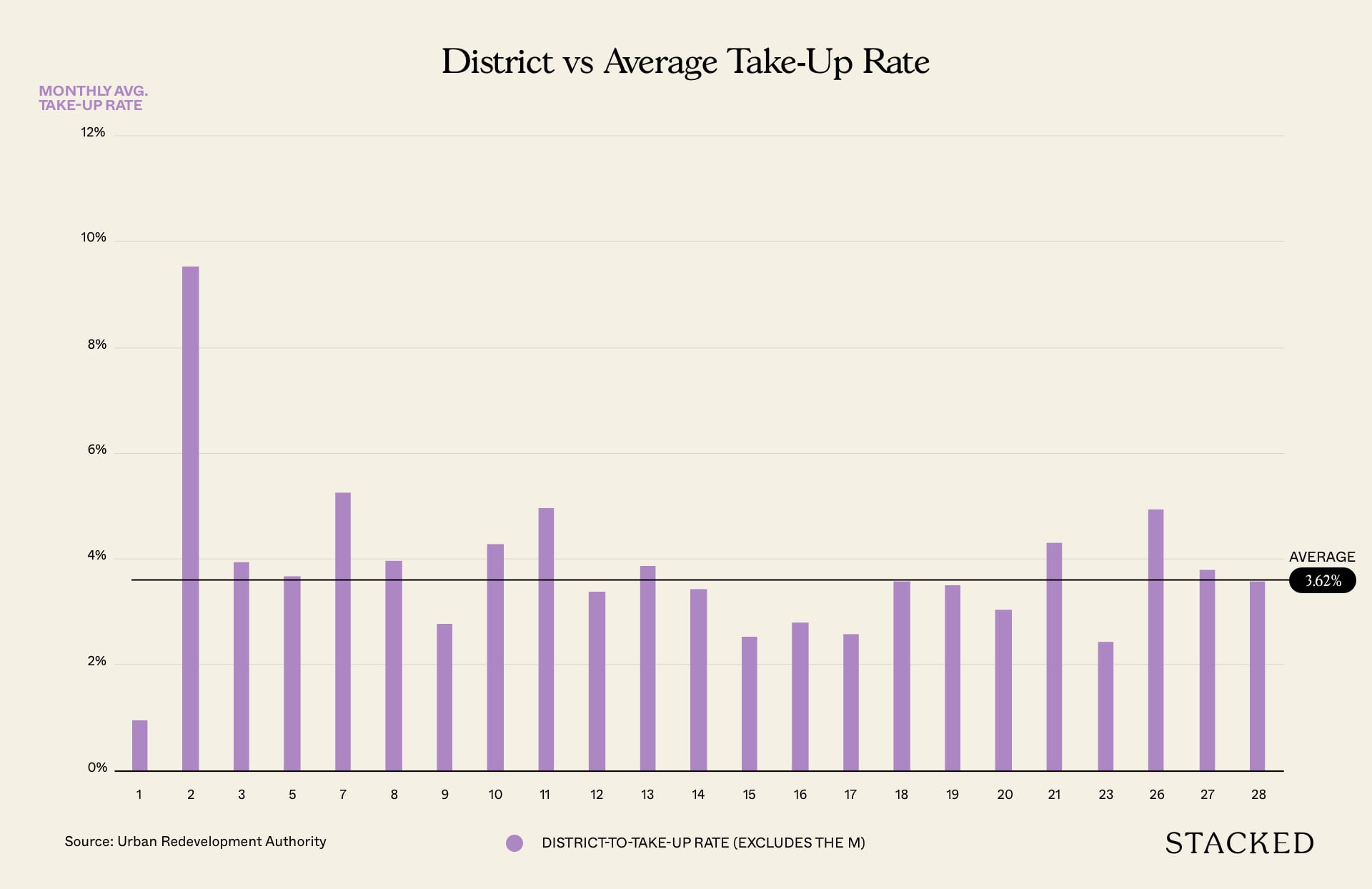

- The average take-up rate for all new launches is at 3.62%. This means most new launch condos sell an average of 3.62% of its total units every month.

- The M has sold a staggering 392 of its 522 units – in 2 weeks. Because of that, it has been an anomaly in all the data such that we’ve taken it out of all except the comparison in districts.

- (If you don’t account for the M) District 2 surprisingly had an average take-up rate of 9.54% – almost 3 times the average take-up rate.

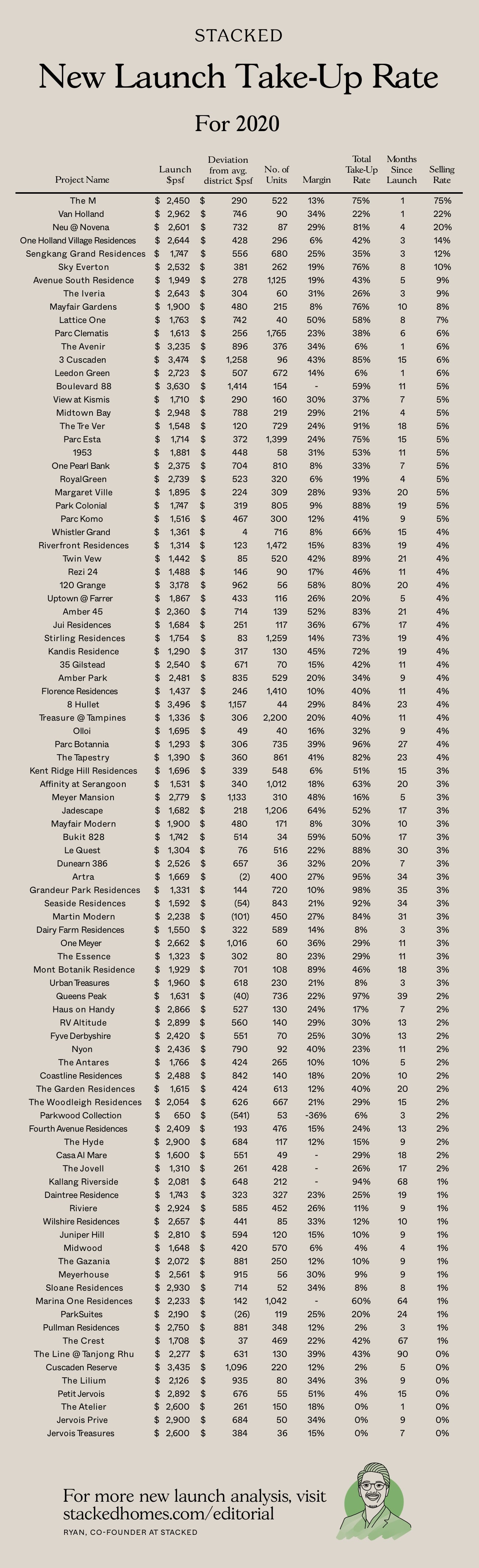

New Launch Condos Take-Up Rate 2020

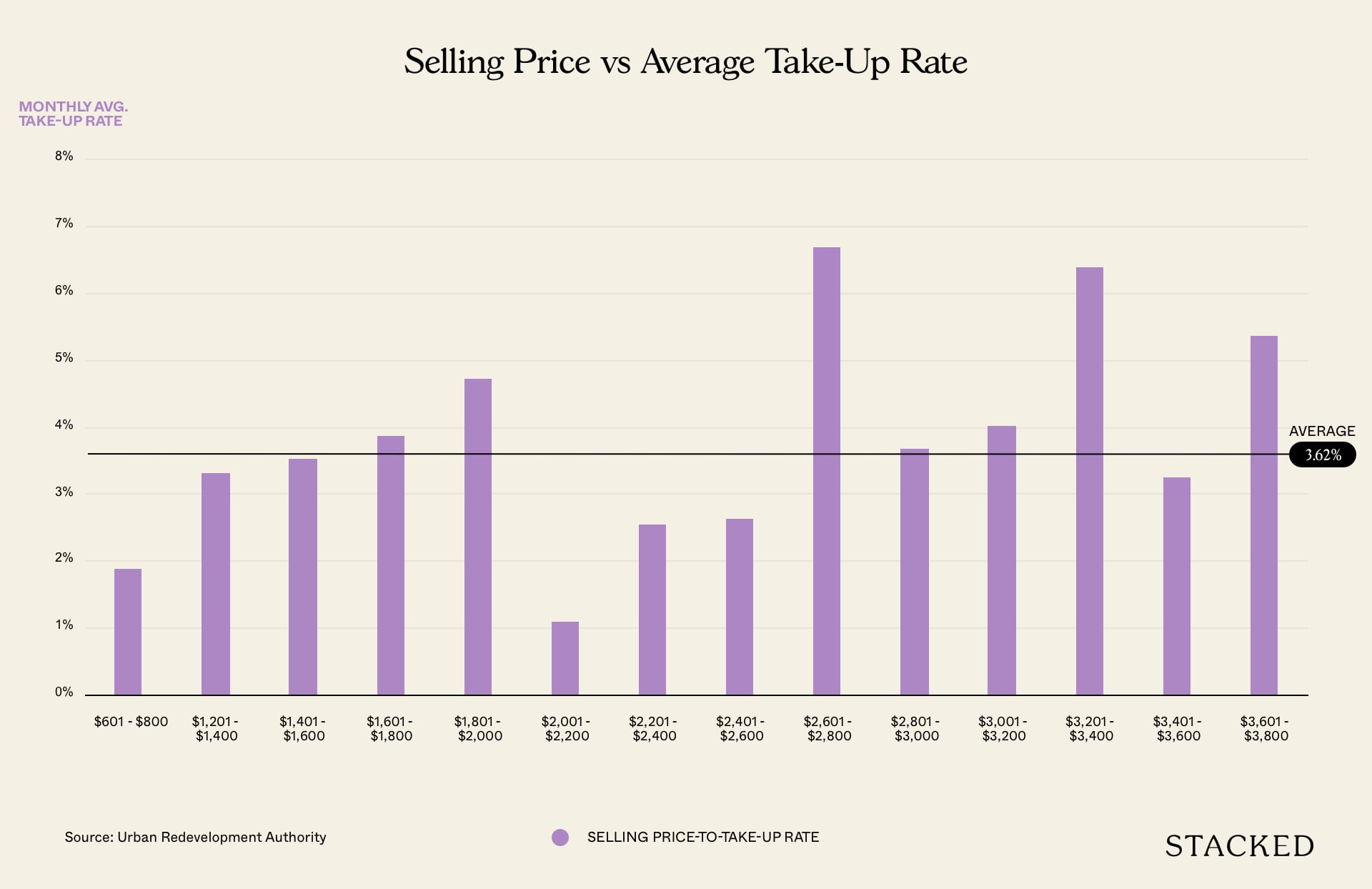

Selling Prices vs Average Take-Up Rate

This was an interesting one for us. Ask anyone prior to this and most people would think that a lower selling price means a faster take-up rate.

Well, from the chart you can see that that isn’t the case at all.

In fact, properties in the luxury market sold faster – with new launch condos in the $2601 to $2,800 PSF category achieving a 6.69% monthly average take-up rate. Properties in the $3,201 to $3,400 PSF category weren’t far off at all too at 6.4%.

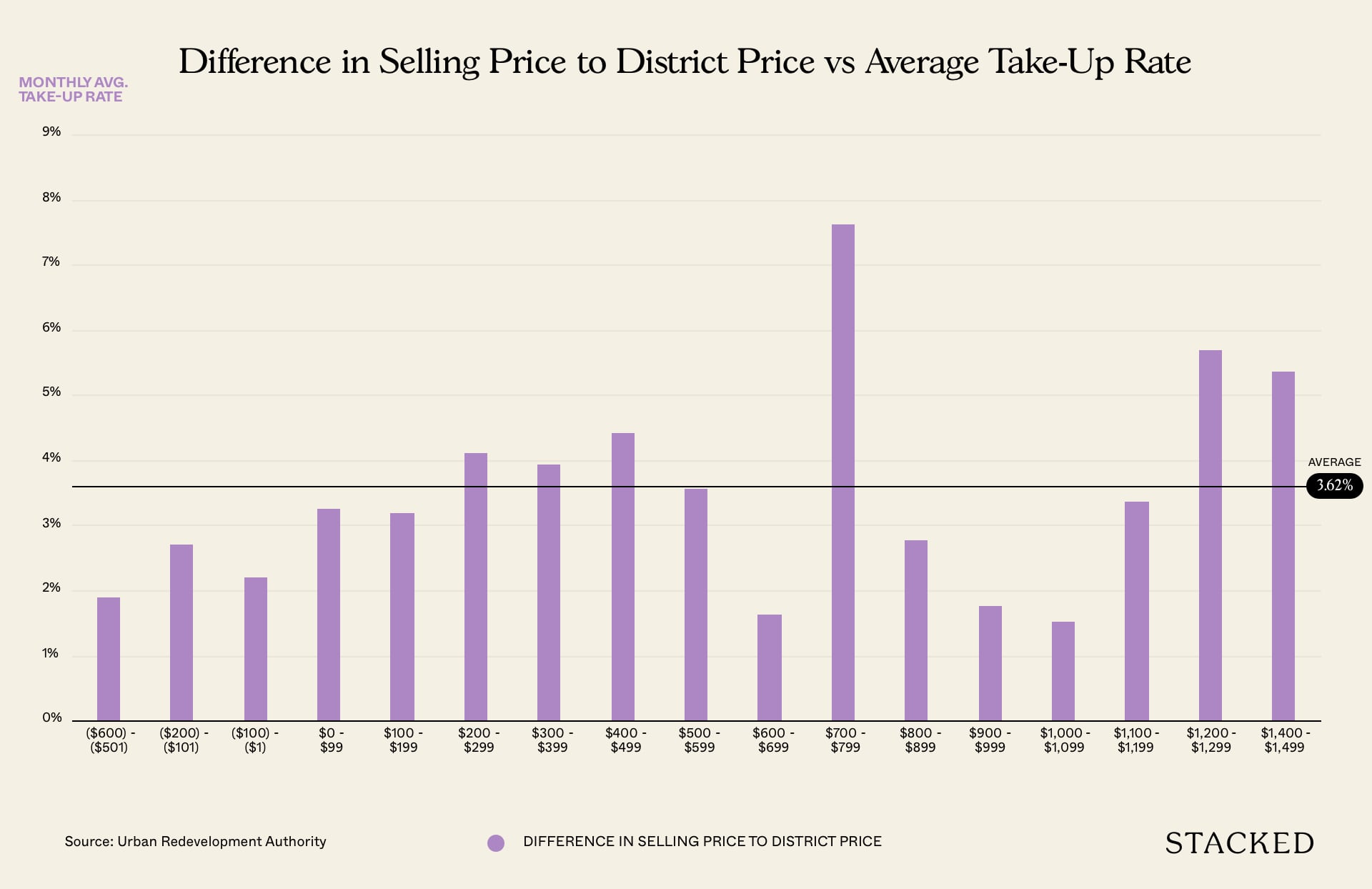

Difference in Selling Price to District Price vs Average Take-Up Rate

Quite a mouthful of a header here, but it’s quite simple really. We wanted to find out if there was a relationship between new launch condos that were priced under and over the district average PSF.

In a similar story to the above selling prices category, one might expect that new launch condos priced under the district average PSF to sell through faster. But that’s not the case at all – with the sweet spot for selling prices at $700 – $799 above the district average PSF doing well at 7.62%.

More from Stacked

Will The 846-Unit Emerald Of Katong Be Priced Cheaper? Here’s All You Need To Know About This Upcoming New Condo

For everyone who thought District 15 was facing an oversupply of new launches (Grand Dunman, Tembusu Grand, and The Continuum),…

You’ll see from the graph too that the highest category at $1,400 to $1,499 has done rather well with an above-average 5.37% take-up rate. But it’s worth noting that this is solely based on the performance of the Boulevard 88 – the only one in this category. Like we mentioned earlier, it’s a small sample size so don’t read too much into this one!

New Launch Condo ReviewsBoulevard 88 Review: Infinity Sky Pool In Prime Orchard Boulevard

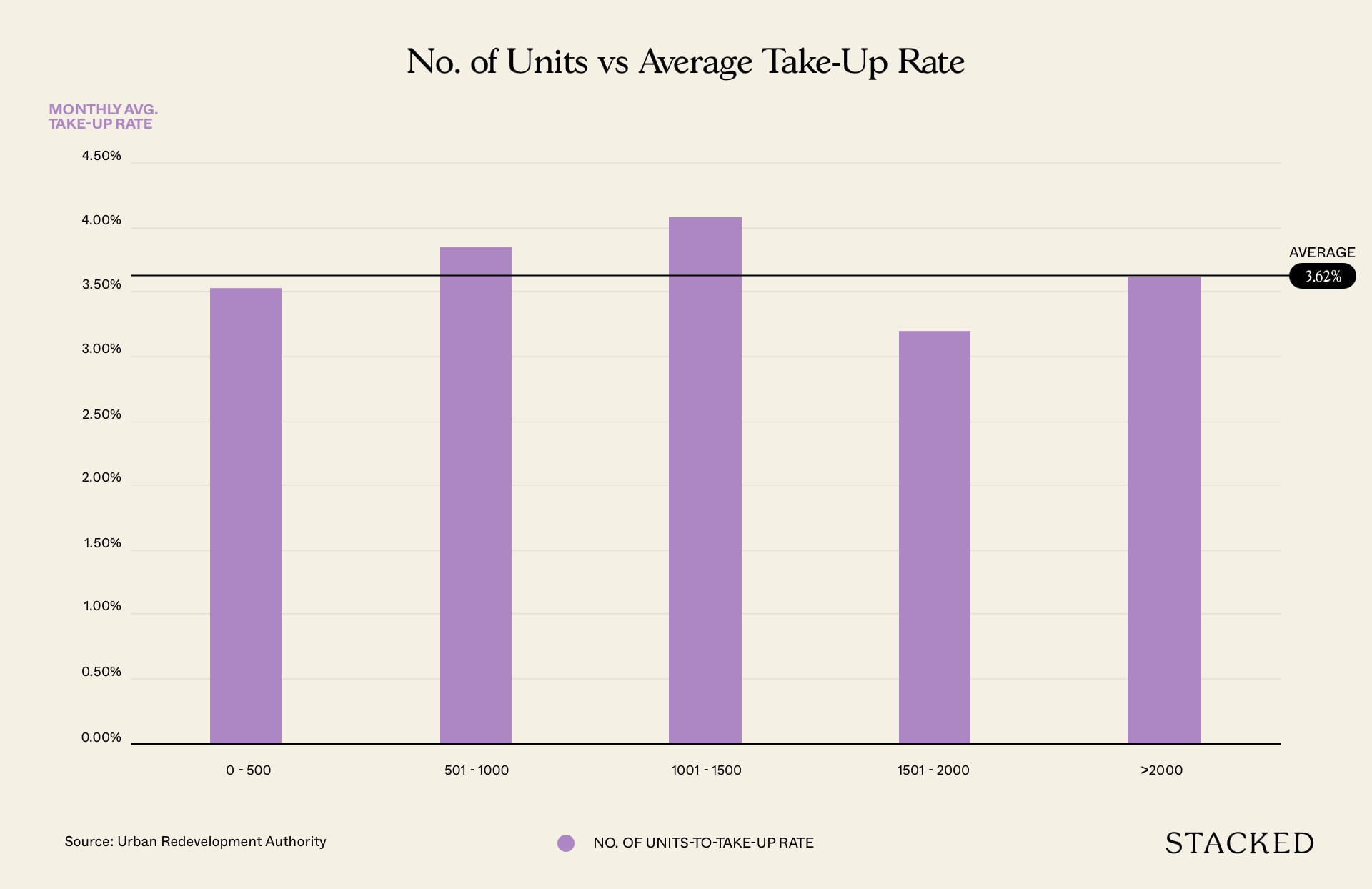

by ReubenNumber of Units vs Average Take-Up Rate

As you can see, this was quite the dud as on the surface it seems as if there is no real correlation between the number of units and the average take-up rate at all.

To be fair in this case, it is hard to come up with any meaningful conclusion given that 66 of the 96 condos in this list came under the 0 to 500 unit category. There was only one in the above 2,000 units – Treasure at Tampines. Perhaps if there were more launches in the larger categories we could see something more concrete, but that would be something hard to achieve given these are generally seen to be more risky to developers.

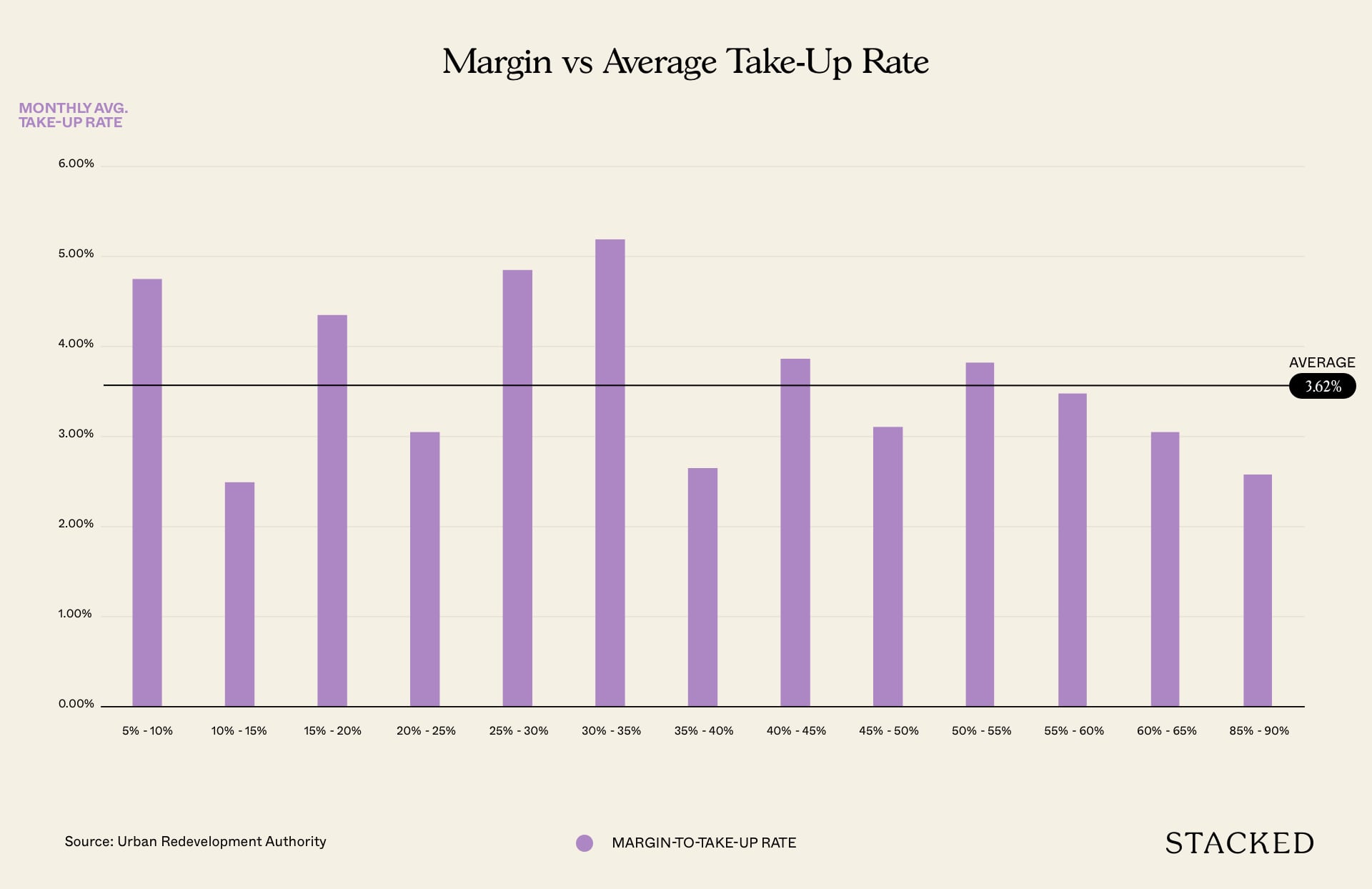

Margin vs Average Take-Up Rate

Before we go into this, it must be said that the margins for these are all based on an estimation of costs to the developer such as construction, land financing, legal fees, and marketing. The only figures that are certain are GFA and the cost of the land.

Again, this was quite a surprise as we thought there might be some correlation here too. But the results appear to be quite even across the board. Of course, this could change if units do not move as those new launch condos with higher margins can afford to spend more on marketing, incentivise agents with more commissions, or simply lower the price (worst case scenario).

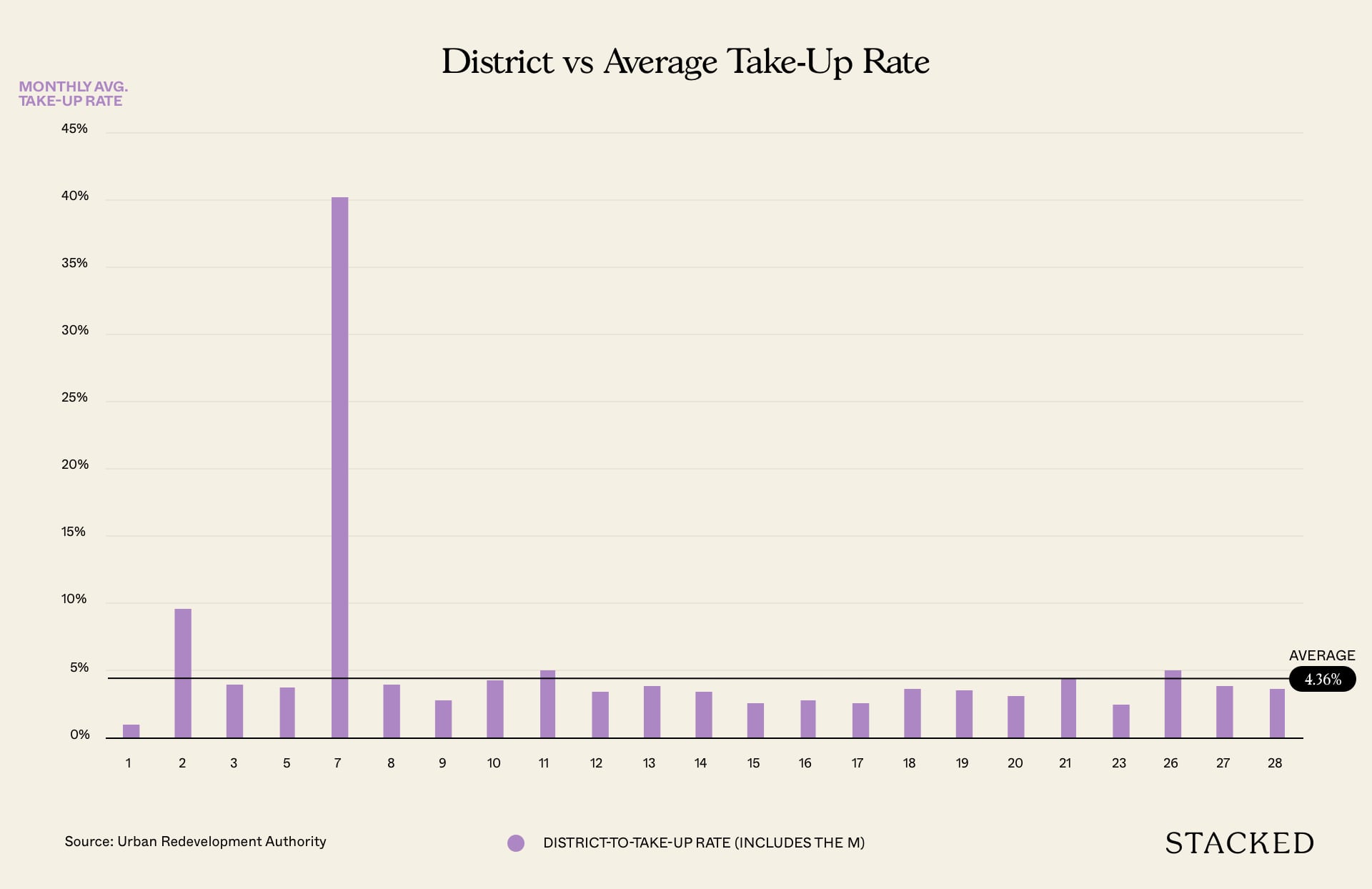

District vs Average Take-Up Rate

Last but not least, we wanted to see if the popularity or future potential of a district can play a role in the average take-up rate.

This is the only chart that we’ve decided to include the M into the findings, and as you can see, it has clearly skewed the data – with a 40.13% average take-up rate.

If we were to take out the M, it drops to second place, with District 2 overtaking it.

Final Words

Ultimately, these statistics are based on correlation, not causation.

And while the final data hasn’t really provided anything out of the ordinarily interesting we can still draw one major conclusion from this:

There is never just one major reason for a new launch doing well.

It is always due to a combination of factors that cannot be ignored.

Buying real estate is not like choosing the best fridge for your kitchen – it isn’t an easy decision at all and there are a ton of factors that come into play.

Need help in choosing a new launch condo for yourself? Feel free to reach out to us at hello@stackedhomes.com!

Sean

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Read next from Property Investment Insights

Property Investment Insights Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Investment Insights We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Property Investment Insights Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

Latest Posts

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Interesting piece. I’d like to make a further suggestion – you can do a multivariate regression using the take-up rate as the dependent variable. Then you will at least see which factors are statistically significant to the take-up rate, and whether your sample size is significant now.