The Untold Mystery Of The Luxury Condo That Was Never Built In Singapore: The Ferrari-Themed Ferra In Orchard

December 22, 2022

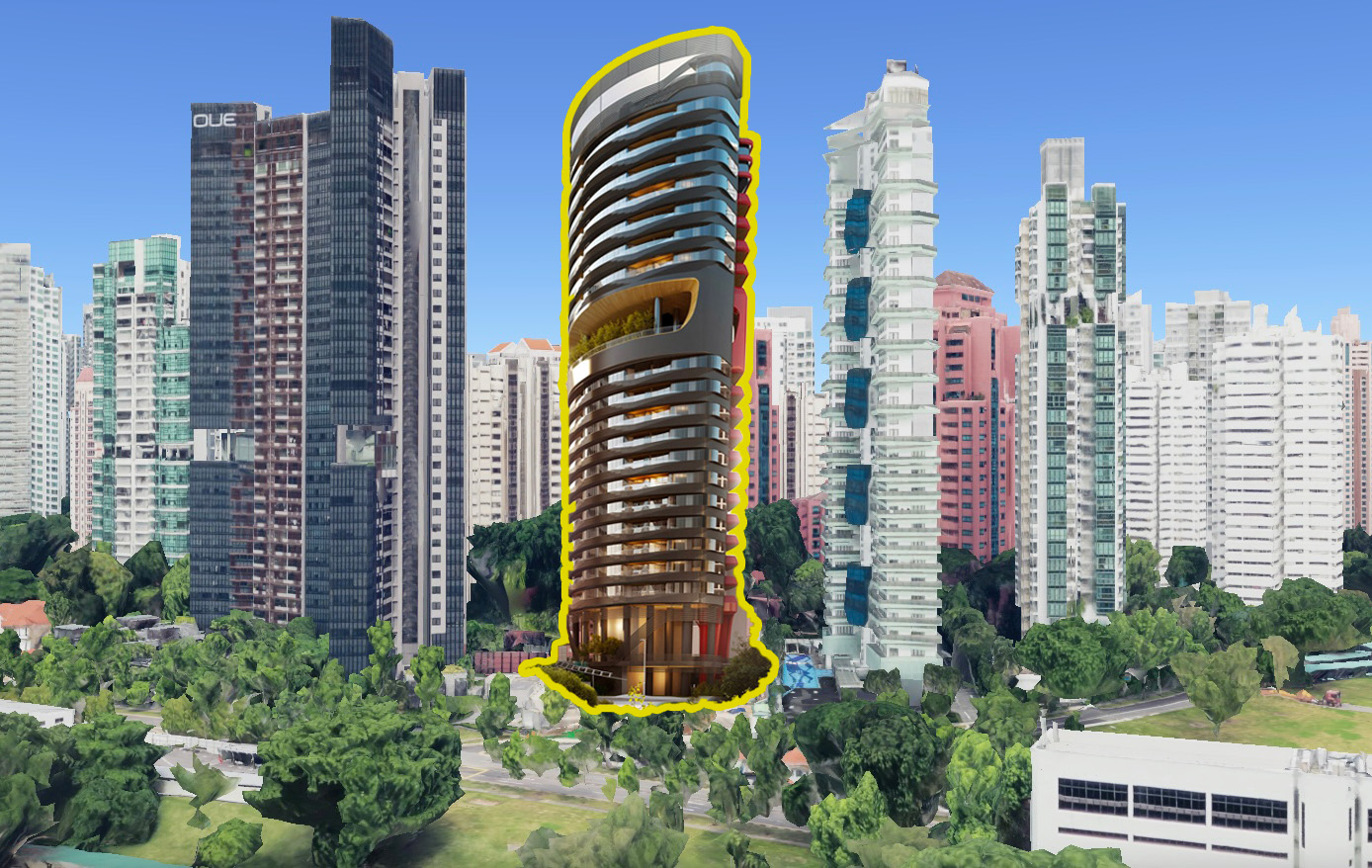

Singapore’s property development scene has a nearly 100 per cent rate of successfully completed projects. It’s a rare occasion when a developer can’t follow through, or willingly abandons a project midway (and perhaps even more so when it’s with one of the largest developers in Singapore). This makes the mystery of Ferra an enticing one: a high-end, central region condo with ties to legendary Italian car designer Pininfarina no less; and a condo that, despite having recorded transactions, was never built. Look up Ferra on Google and you’ll see that most property portal sites classify it as completed in 2017, but visit the actual site and you’ll see that the gaping hole between The Lumos and OUE Twin Peaks still remains:

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What was Ferra?

Ferra was an interesting collaboration between Far East Organization, and Pininfarina (Pininfarina designs many products from travel coaches to airlines, but they’re best known for designing cars for Ferrari, Maserati, Alfa Romeo etc.) This was back in 2013, the last peak of the property market.

The two organisations were supposed to build a sports-car-themed residential tower called Ferra. To use their own description:

“The uniqueness of Ferra’s identity finds its origins in aesthetic elements coming from the Pinafarina car design heritage that, reinterpreted, represent a breakthrough in the architectural language.”

On the surface, it was easy to see why this collaboration would have been a success. Pininfarina was the one designing every Ferrari car from the 1950s until 2013, and supercar enthusiasts would seemingly be drawn to such branding.

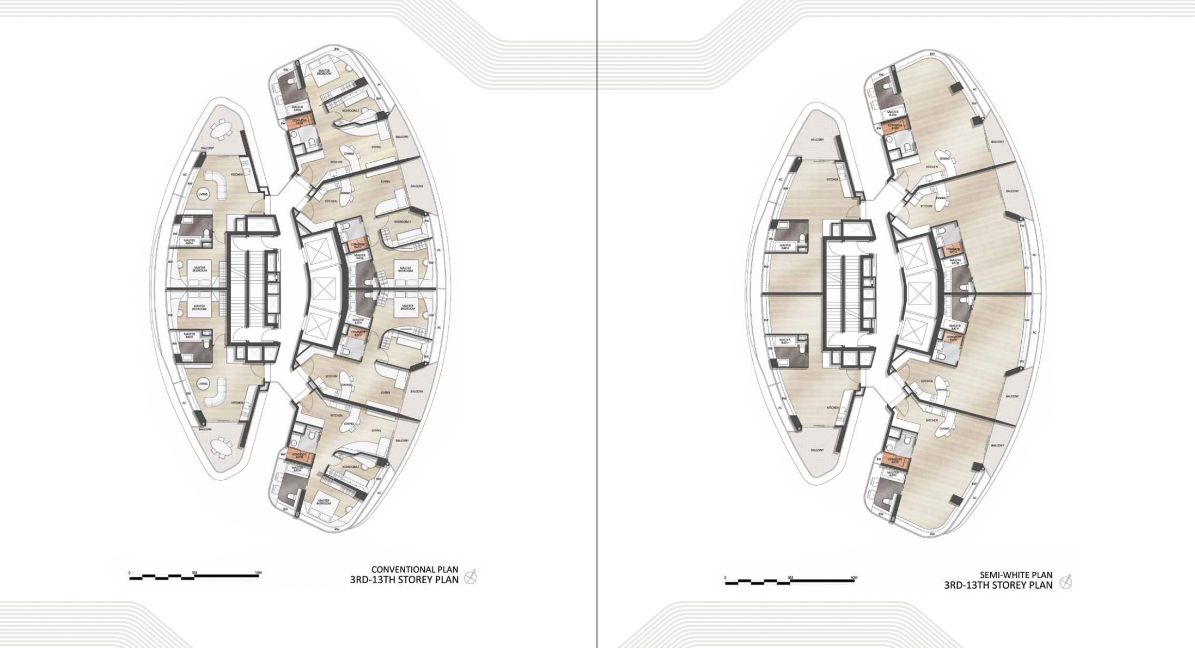

The development would have been at 1 Leonie Hill in the Orchard area. This would have been a 102-metre-tall tower (22 storeys) with 104 units. 102 of the units would have ranged between 732 to 893 sq. ft. (roughly two bedders in size, or perhaps a 2+1), with two penthouse units at 2,013 sq. ft.

While the land on which Ferra would be built was freehold, Far East made the project a 103-year leasehold property (it is permissible for owners of freehold land to lease it for 99 years, 103 years, etc). They’ve done this a couple of times already, with projects like The Scotts Tower, and Parksuites).

Surprisingly, the website for Ferra is still up and running, so you can have a look at it here.

Ferra sported novel concepts, that could have been the first in the market

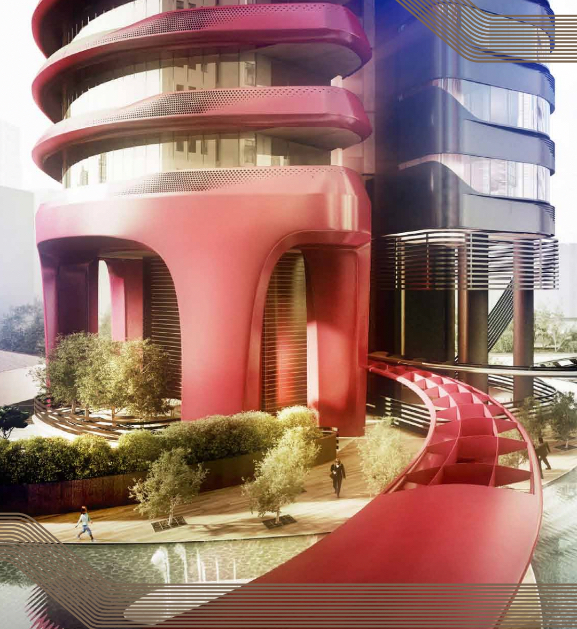

Apart from the unique red-and-black aesthetic (one side is dark, and the other side is entirely red), which would have stood out against the more traditional white facades of Leonie Hill condos, Ferra was… well, different.

The project would feature unique tracks leading to the car park, described as “arcing and twisting trellis tracks” which would weave over pools and curve around the towers. The car park even had a unique lighting system to mimic car showrooms and put your vehicle in the best light.

Interior-wise, there was an option for high-end Gaggenau kitchen fittings, from ovens to wine chillers. The project promised the use of wood and leather like what you’d expect from the interior of high-end cars.

There was also a pool on the 14th floor sky garden, which would have looked out over the Orchard area (but we don’t know if this was or would have stayed unimpeded, given subsequent developments within Leonie Hill).

We think the layout of the units would have been controversial – there’s a distinct curve to the walls, as opposed to the squarish or rectangular 90-degree angles that homeowners tend to prefer. But there was flexibility, as the developer used a semi-white plan, and buyers could customise how they wanted the walls and partitions to be placed. Pinafarina also designed a set of themes they could have chosen from.

Sadly, we’ll never be able to do an in-depth Ferra review, since all of this was never built.

How would Ferra have fared in today’s market?

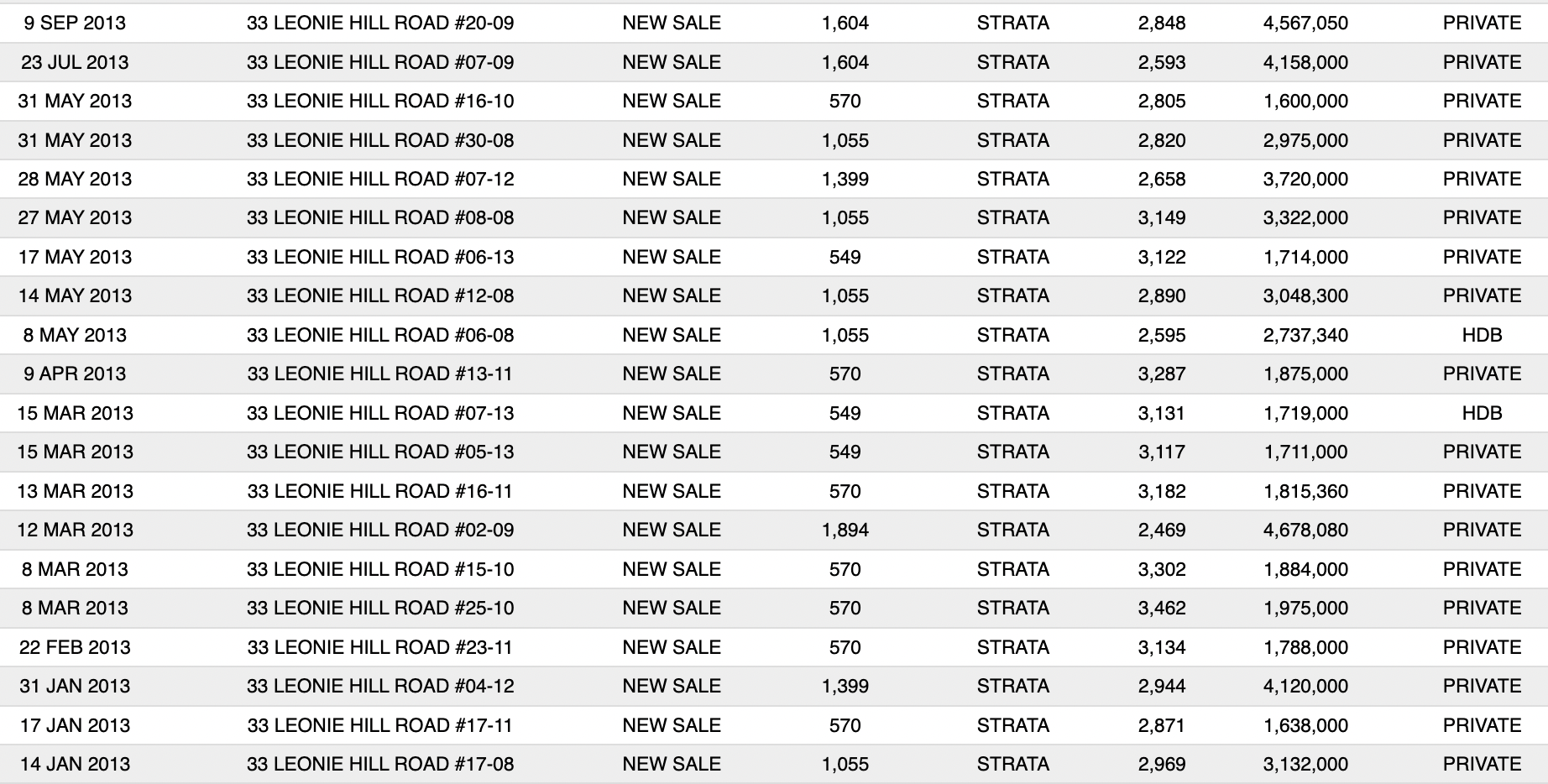

Despite Ferra never being built, transactions were lodged and units were sold. The following can be seen on Square Foot Research:

| Date | Size | Price PSF | Price |

| 23 May 2013 | 893 sq. ft. | $3,283 | $2,933,180 |

| 28 May 2013 | 732 sq. ft. | $3,116 | $2,280,765 |

| 10 June 2013 | 893 sq. ft. | $3,273 | $2,924,500 |

While we didn’t see other transactions lodged, old reports from The Business Times say that 30 units were launched in the first phase and that seven of these units were bought; but some appear to have been returned later (see below).

We made a comparison to some other similar properties in the same area, and here’s what we found:

More from Stacked

Confessions Of A Property Agent In Singapore: Why I Had To Drop My Worst Client Ever

We've all heard the terrible agent stories.

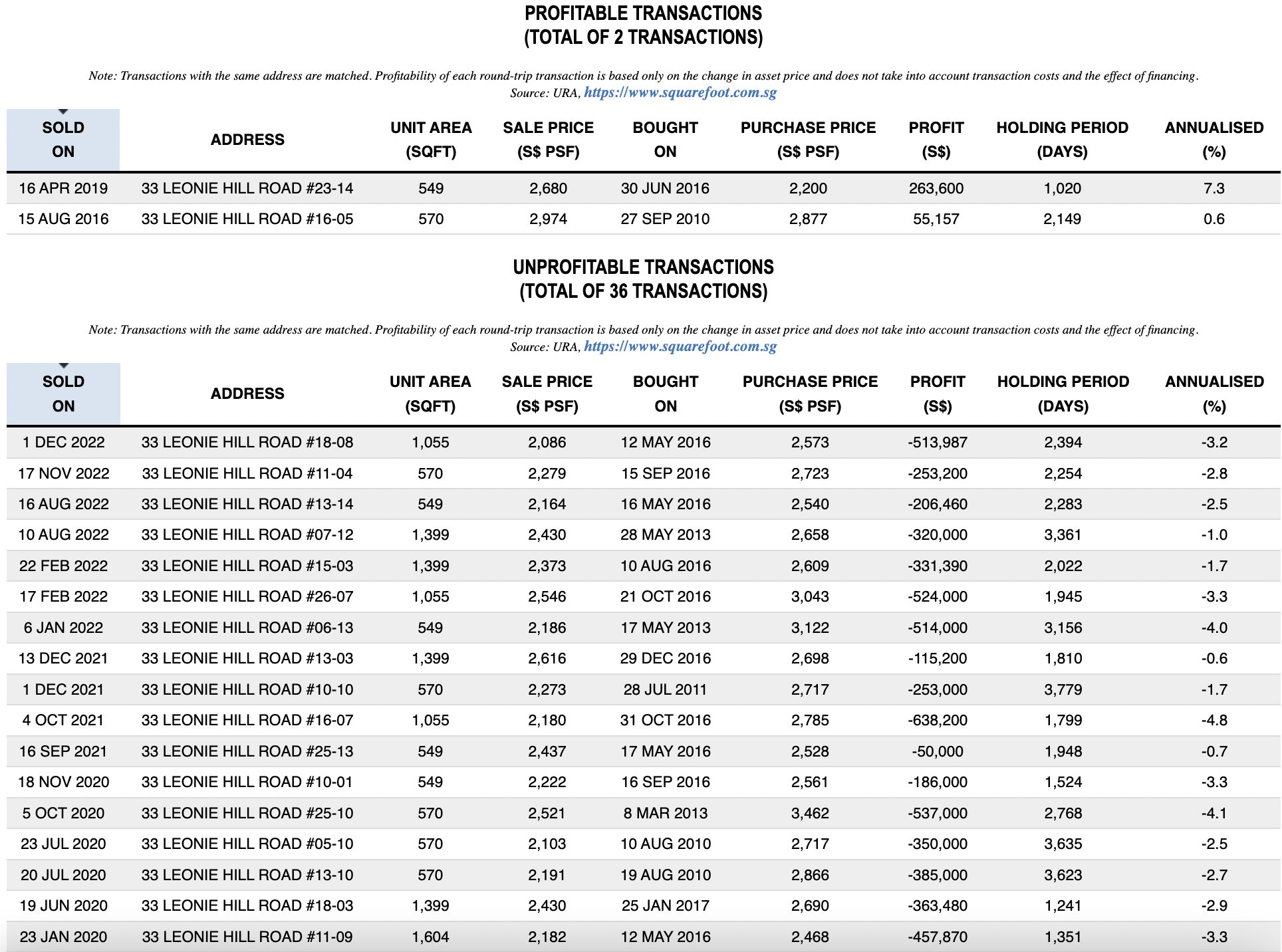

If we look at OUE Twin Peaks, we can see that its units also reached around $3,100+ psf during the same year (the ones that are $2,500+ psf are the larger 1,604 sq. ft. units, so it’s normal that the price psf will be lower).

Since then, most of the buyers there have faced quite heavy losses.

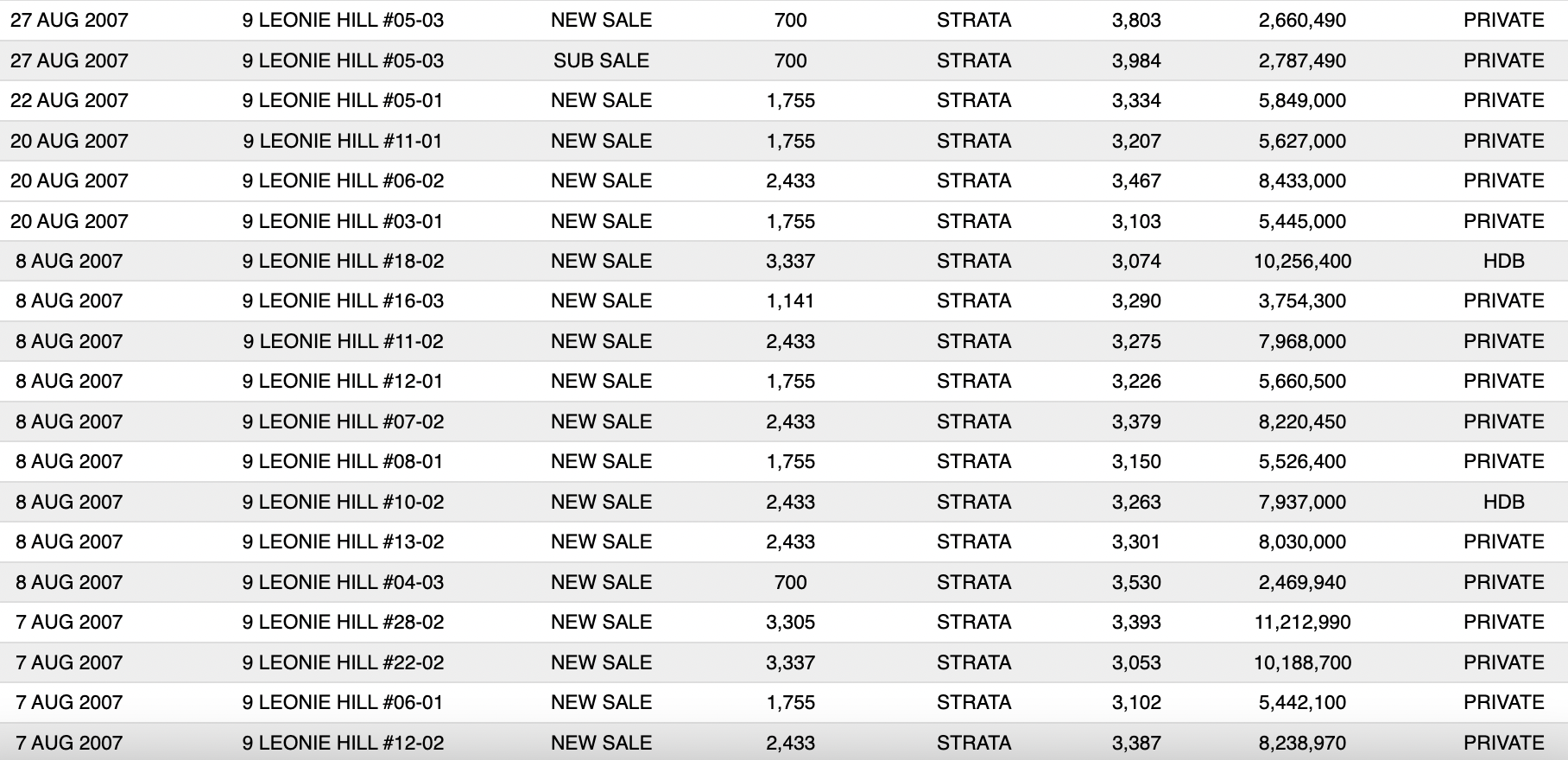

This is what the prices for Lumos looked like (which faced its own issues as well, bulk sales because of poor sales, turned into co-living, etc).

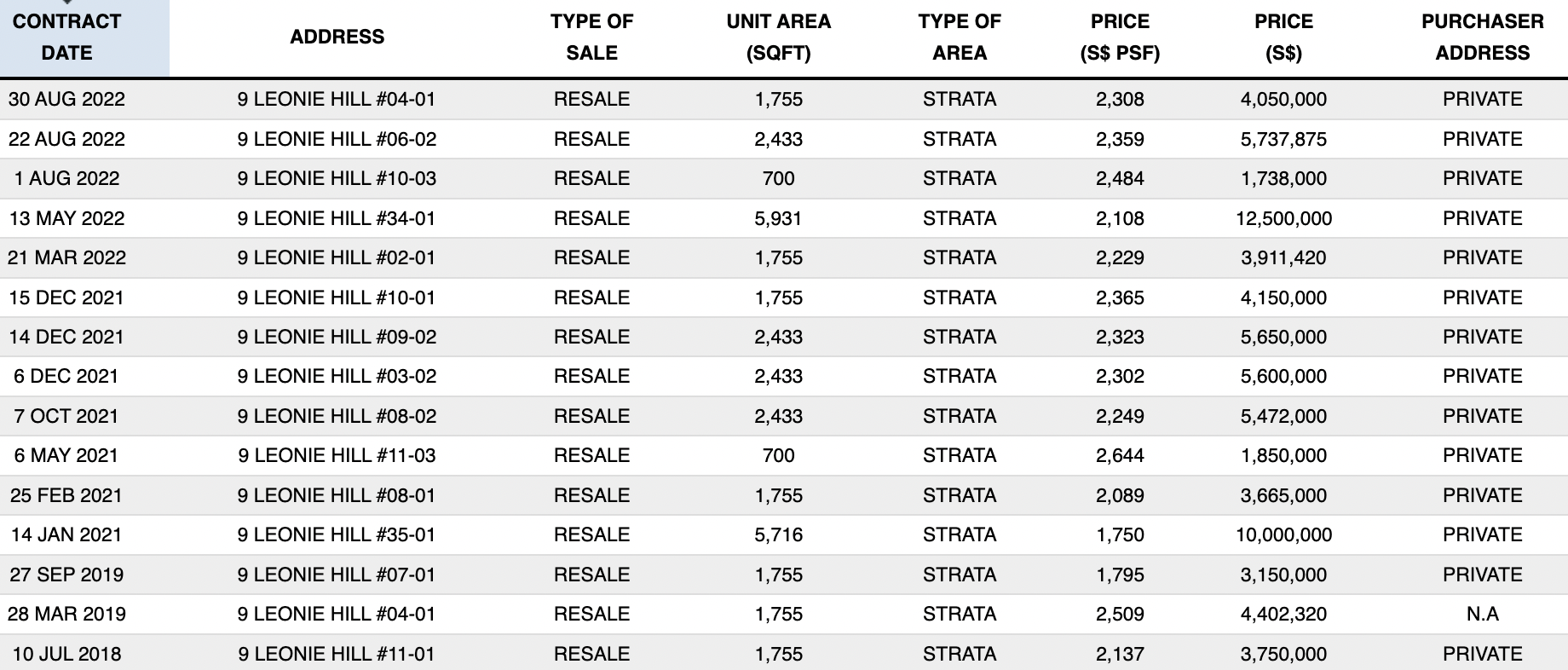

Here’s what the current prices are now:

Look how much prices have dropped since its launch. But does this suggest problems with the location? We look to the newest condo in the immediate area (besides Irwell Hill Residences), New Futura to see how it has fared:

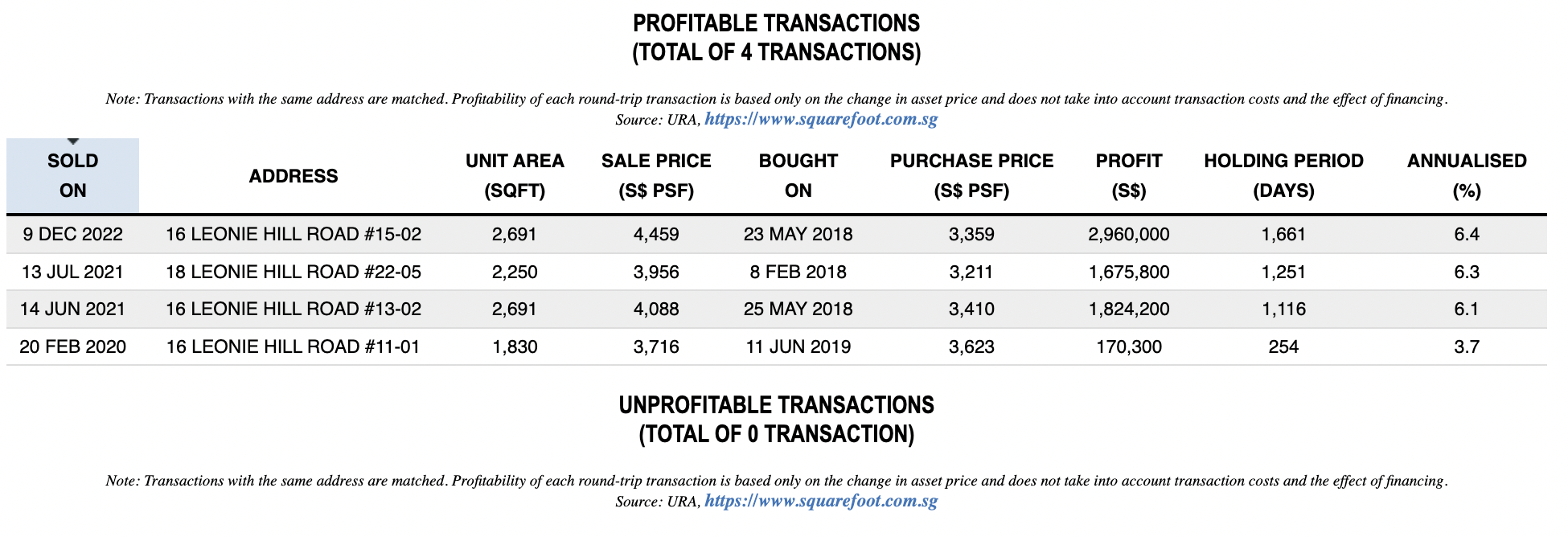

While there have been few resale transactions so far, they’ve all been profitable (and quite mightily so). Perhaps this boils down to the size of the units (typical buyers in this segment would prefer larger units), and the overall feel of the project itself – which is hard to quantify.

There is also the question of timing. To be fair though, 2013 was the peak of the property market, and subsequent cooling measures would have significantly dragged down the price. We can see that ultra-luxury properties close by such as New Futura, which was launched later, but at a similar price point – have performed much better since.

In any case, perhaps the buyers of Ferra may have dodged a bullet, by not buying such a luxury property just before the coming market downturn.

The final question: why wasn’t Ferra finished?

From what we understand, buyers were all refunded, and the developer has other plans for the site (probably serviced apartments). But as to why this happened, well, here are some of the reasons that we can think of.

Lack of financing is almost certainly not the issue, as the Far East is one of the biggest developers, and is well-capitalised.

The most probable reason is that the developer was unhappy with the launch show, with only seven of the 30 units being picked up; and then apparently two being returned afterwards. We found an old report saying that:

“Far East Organization’s luxury development Ferra also saw three units returned during June, with a spokesperson clarifying: “I can confirm that the number of Ferra units sold as of mid-May was 8. As of July 29 the number of Ferra units sold is five. The spokesperson declined to provide further details or reasons why units were returned.”

To be clear, high-quantum, luxury units are always expected to move more slowly; but even then, it’s worrying when five out of 30 sell at launch, and little else is heard afterwards.

In our experience, new launch condos will keep appearing in various mentions and reports, over the course of their sales (e.g., top sellers of the month, the highest transaction for the month, and so forth). There is an almost complete absence of mention for Ferra, suggesting sales had flatlined after launch.

Realtors we spoke to speculated that a softening rental market, which began in 2013, could have affected demand.

One realtor, who specialises in District 9, speculates that the composition of small units in Ferra would mean it was catered to investors in the form of landlords, and not home buyers. He says that, by around 2013, the trend of buying small units to rent (the shoebox craze) was already dying down. This could have made Ferra less appealing.

Finally, there’s the “small” matter of construction costs to think about. Construction costs have always been a sticky point in Singapore, and it probably didn’t help that Ferra would have cost a bomb to construct. With the interplay of red and black on the outside, steel exterior, and lighting systems to mimic car showrooms – the costs combined with the tepid sales were the more likely reasons for such a project to not materialise.

While we’ll probably never get an official answer, Ferra did promise something novel at the time. We hope it’s just a matter of timing, rather than a sign that market realities disincentivise innovation. If developers interpret it as the latter, we shouldn’t be surprised that so many condos are “cookie-cutter” replicas of one another.

To be updated on both obscure phenomena and big trends in the Singapore private property market, follow us on Stacked. We do deep dives and thorough reviews of both new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What was the Ferra project in Singapore supposed to be?

Why was the Ferra condominium never completed?

Did any units of Ferra get sold before it was abandoned?

How did the prices of units in Ferra compare to nearby properties?

What were some of the unique features planned for Ferra?

Could Ferra have succeeded if it was completed today?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments