The Rise Of Young Condo Owners: The Great Wealth Transfer In Singapore

July 16, 2023

While property prices seem to be on the high, I’m noticing something else that’s low – the age of condo buyers.

20-something condo buyers I initially chalked up as “crypto-millionaires” that I still see despite that scene having died down. This brings me to the subject of today’s newsletter – the great wealth transfer….

Either Singaporeans are getting rich younger, or…

The great wealth transfer may be happening sooner than we think.

Over the past three years, I’ve had many coffee shop talks with realtors; and while I don’t have the data neatly quantified, it’s quite clear that there are more and more young condo buyers.

I don’t mean people in their mid-30s who have done well. I mean buyers as young as 25 or under. And unless our youngest generation are financial prodigies, I doubt those purchases are from their own savings. Most of the time, condo ownership comes courtesy of a huge down payment, from the bank of Mum and Dad.

Singapore is ageing, and the previous generation is passing on its wealth. And unlike in the previous decade, we’re aging rapidly. It’s estimated that by 2030, almost a quarter of our population will be 65 and over.

This differs from the past, where the wealth of the previous generation is diluted among a larger populace. Instead, the wealth will be concentrated in the hands of fewer individuals.

What happens to the property market then? Speculatively speaking:

- There will be a burst of younger Singaporeans moving into the private market sooner, possibly even bypassing the step of getting a BTO or resale flat first. This could explain why condo sales have been brisk despite all the measures, at the time of transitioning.

- Most Singaporeans can’t inherit HDB flats from the previous generation. No one can own two flats at once. At the same time, foreigners can’t buy these HDB properties. This is likely to result in a deluge of vacant flats, limiting the future upside of HDB resale prices (unless there are new rules to circumvent this).

- If the government doesn’t step in to prevent the creation of a rentier economy, Singapore could lose its competitive edge.

Look, I love property as much as anyone; that’s why I write all this. But we can’t afford to have a situation where everyone uses their newfound wealth to buy condos and try to collect rental income.

Capital locked up in properties isn’t circulating into the stock market, new start-ups, helping to create new jobs, etc. We’re a small country and we need to keep that edge.

- Developers will need to adapt to cope with the new buyer demographic. Some of this is already happening: developers are more focused on sustainable buildings, for example; and this is a quality prioritised more by younger Singaporeans.

But a bigger change will likely occur with unit layouts. Singaporeans increasingly marry later and have fewer children, so we may see falling demand for the large four and five-bedder units, or 5-room or larger flats. Or we could also see the reverse, where wealthier Singaporeans purchase larger homes to knock down walls to create bigger living spaces.

Some of these things can be hard to see and accept right now. At the time I’m writing this, having too many empty flats is the exact opposite of the problem we have in 2023 (i.e., not enough flats). And most realtors will tell you buyers want larger homes, not smaller (because right now, we have a lot of HDB upgraders who are after family units).

But I suspect we may see a quicker reversal at some point in the coming decade, as more of the previous generation pass on their wealth.

Speaking of passing on, do you know what else has departed Singapore?

Our void deck culture. It’s nice that residents are now restarting mini-libraries in void decks; but there was a time the government had such initiatives.

I also remember, growing up in the ‘80s, that the void deck was the place where you learned to play Carrom, learned the C-chord fingering on a guitar, or played checkers with the old uncles.

More from Stacked

Collective Sale: 6 dead simple ways to spot en bloc potential

Is the collective sale fever dying out in Singapore? After warnings of possible oversupply in early 2018 and rising prices of luxury…

These days, void decks are mostly places for funerals, or where you stare at signs prohibiting you from playing ball games. Even setting up a resident’s corner seems like such a big chore.

That’s not to say that there haven’t been any efforts. Take the void deck at Alkaff Oasis for example, doesn’t it look so welcoming to come home to?

It’s unfortunate, because when you have an ageing population, what you want are residents (older ones especially) going out more and interacting. There’s also no point in enforcing a mix of rental flats, and ethnic quotas, if we’re not also going to encourage the meeting of different backgrounds.

And as for young people being noisy in the void deck, please – I’ll believe that’s an issue after we learn how to peel them away from a PS5.

Meanwhile, in other serious property news…

- We looked at the price differences between top-floor and bottom-floor units. Investors, take note before you put down a cheque.

- Our review of Pinetree Hill is up, so interested buyers, have a read before you swing by the show flat.

- In other new launch news, here’s a rundown of the three east-end giants: Tembusu Grand, Grand Dunman, and The Continuum.

- Check out the cheapest three-bedders under $1 million, and some are even freehold!

Weekly Sales Roundup (03 – 09 July)

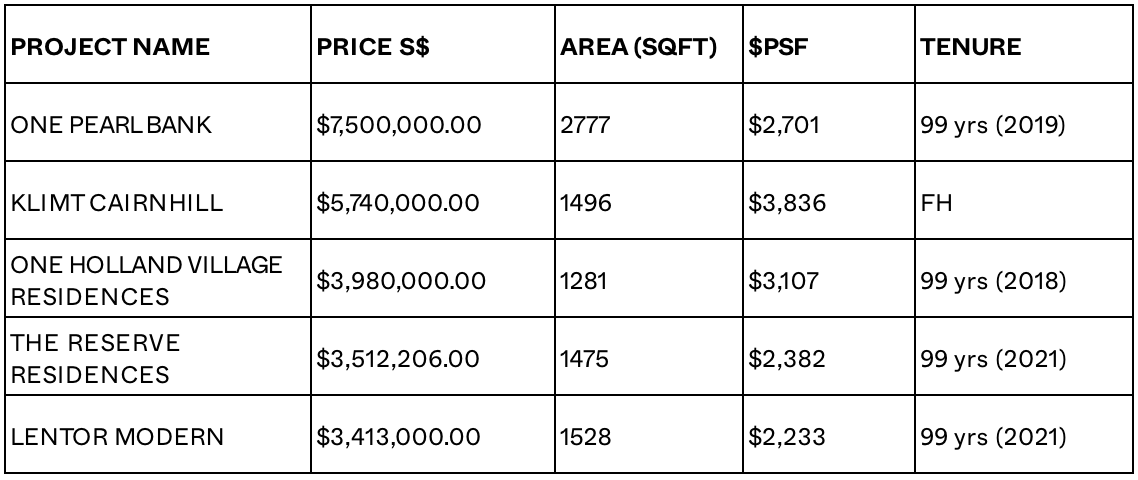

Top 5 Most Expensive New Sales (By Project)

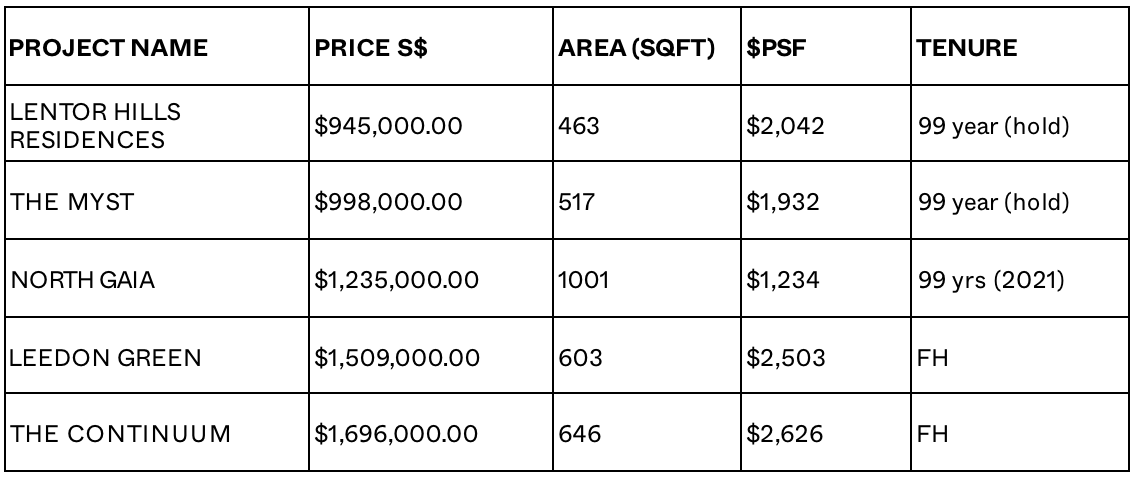

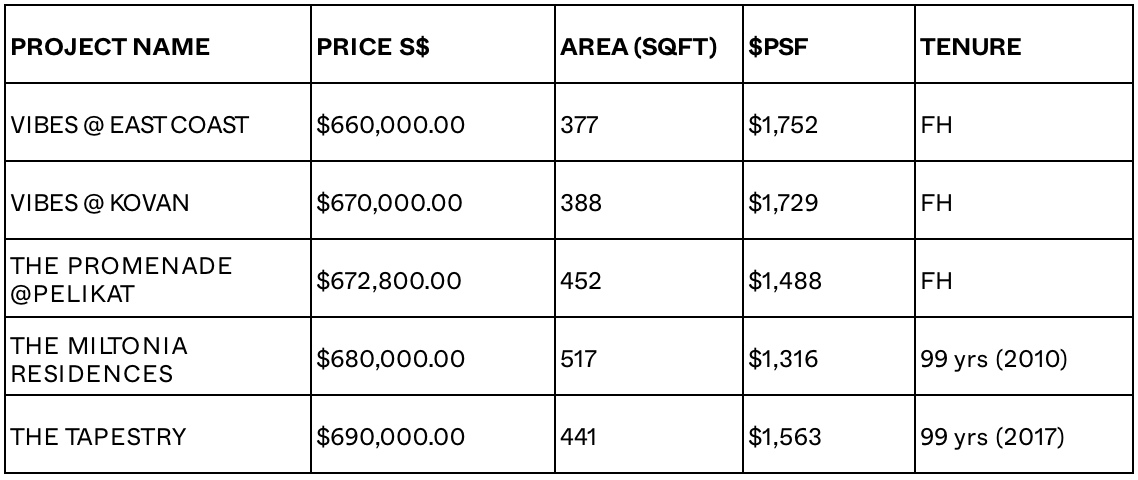

Top 5 Cheapest New Sales (By Project)

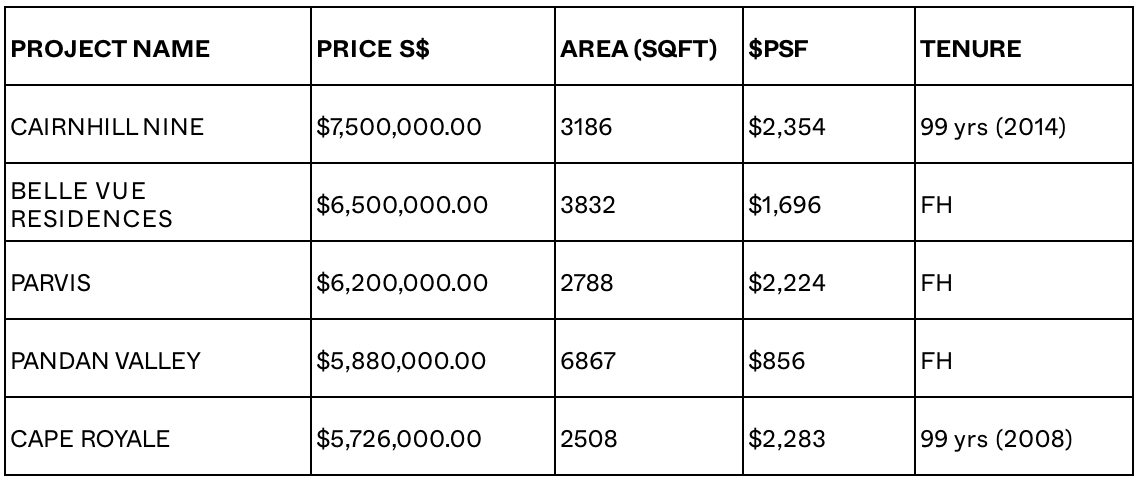

Top 5 Most Expensive Resale

Top 5 Cheapest Resale

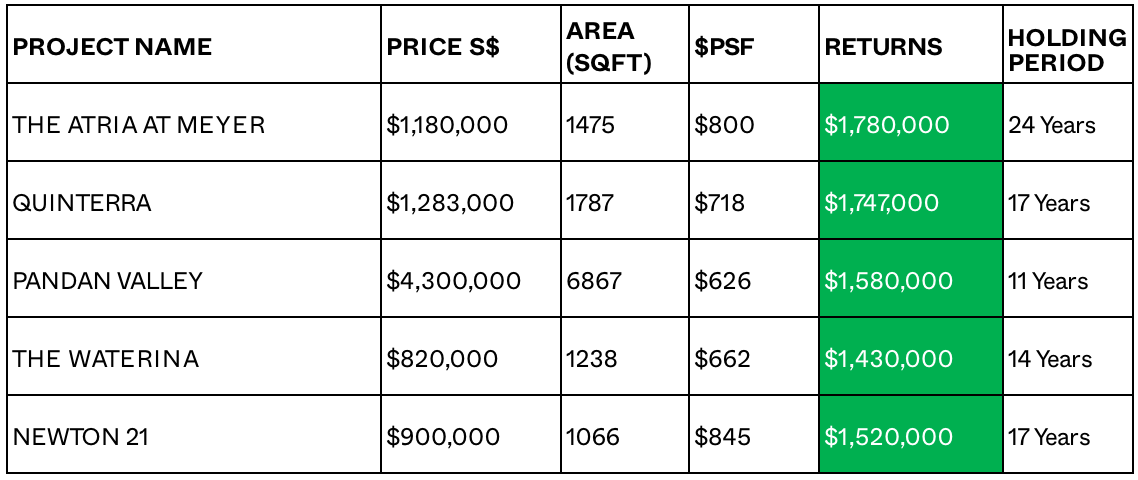

Top 5 Biggest Winners

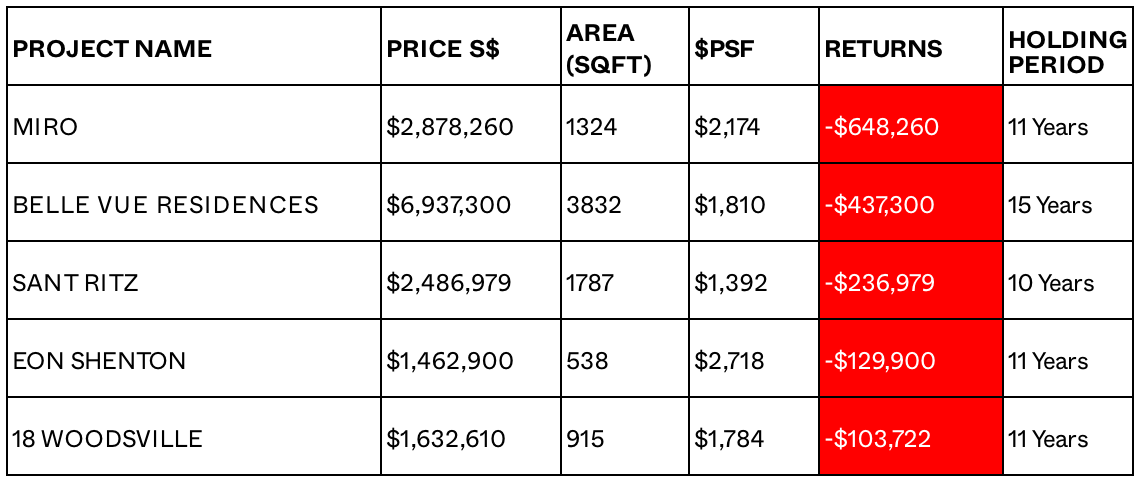

Top 5 Biggest Losers

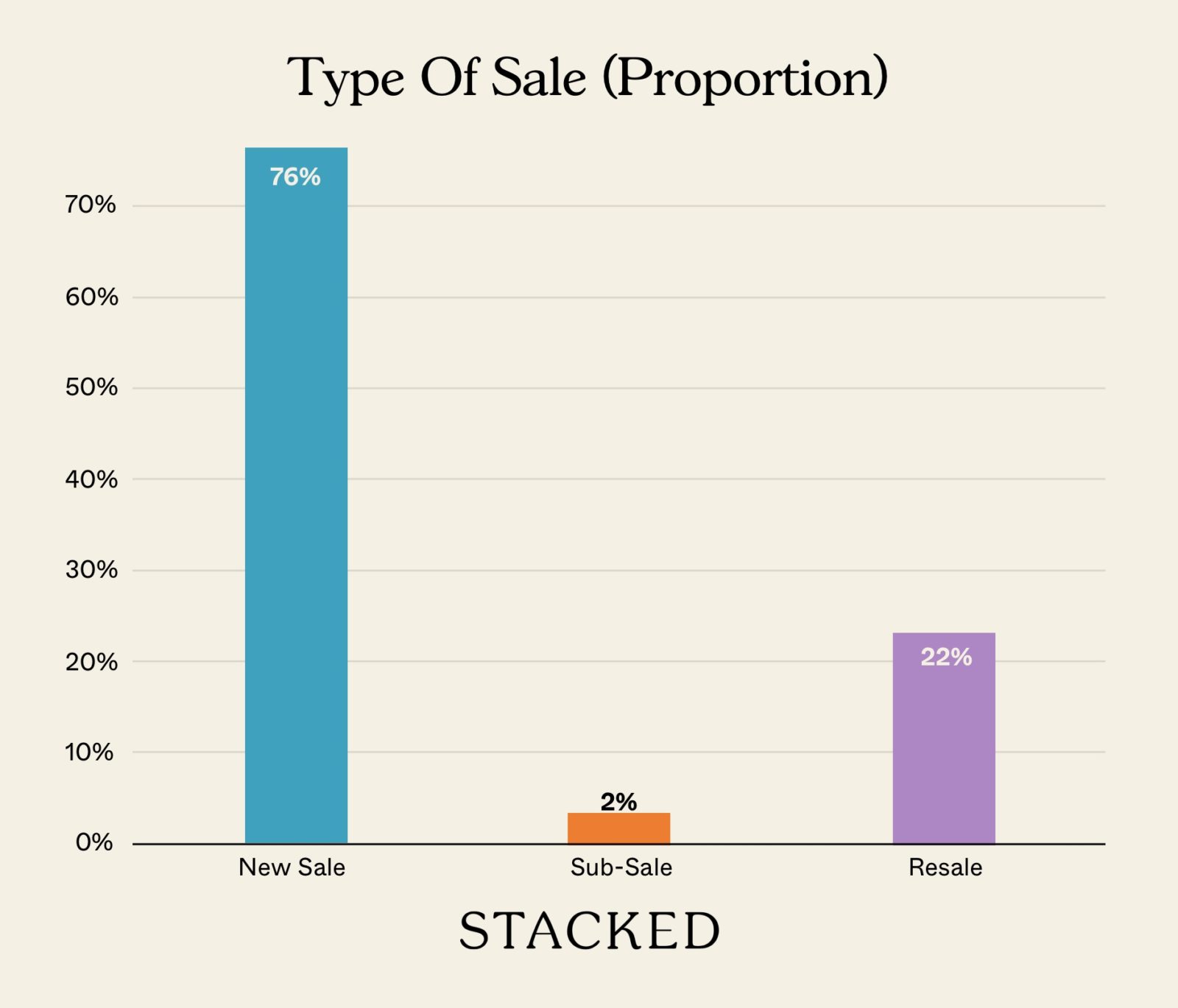

Transaction Breakdown

My Favourite Links of the Week

- A $2.3 billion sphere in Las Vegas

If you haven’t heard of it, it’s a globe-like structure that has 1.2 million LED lights stuck on its exterior.

That allows it to display 256 million different colours and eye-catching displays like this.

And this.

Let’s go through the numbers, 17,600 seats, 168,000 speakers, and the potential to make $25 million in annual advertising revenue alone. They are already building one in London, so would we see something similar in Singapore?

Orchard Road still needs a greater uplift, so I can imagine such lighting displays to really brighten and see it apart from all other areas in Singapore.

- MAS macroeconomic review 2023

Now that’s a whole chunk of text to go through, but for those of you who are just interested in the property market bits, here are some of the points that are worth highlighting:

- The yearly average private and public residential unit completions in 2020–2022 was ~20,000 units, about 22% lower than the average of ~26,000 units per annum over 2018–2019 and about 36% lower than the projected average of ~32,000 units per annum over 2023–2025.

- As a whole, almost 40,000 residential units will be completed across the public and private housing markets in 2023, which is the highest number of annual completions since 2017. This pace of completion will continue over the next two years, with close to 100,000 public and private residential units in total coming on-stream over the period 2023 to 2025.

So yes, as I last wrote about the first price drop in the last 3 years, it’s clear that all these measures are happenings and are now coming together to take effect on the property market. All eyes are on this weekend’s launch results too, as we take a look at how Grand Dunman and Pinetree Hill fares.

Follow us on Stacked for more news you can use on the Singapore property market, and for reviews of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more young people in Singapore buying condos at a young age?

How is Singapore's aging population affecting the property market?

What impact could the wealth transfer have on HDB flats in Singapore?

How might developer strategies change due to the rise of young condo buyers?

What cultural changes are happening in Singapore's void deck spaces?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments