The Influence Of Landed Homes On New Launch Condos: What Buyers Should Know

January 8, 2025

Chuan Park raised some eyebrows when it sold 70 per cent of its units on the launch weekend, on 10th November 2024. While there are several reasons for this – including pent-up demand from around 14 years without a new launch – an overlooked factor may be the landed enclaves nearby. While we tend to look toward HDB enclaves as potential sources of buyers, it’s easy to forget that a landed cluster can also make a difference. Here’s a look at why:

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

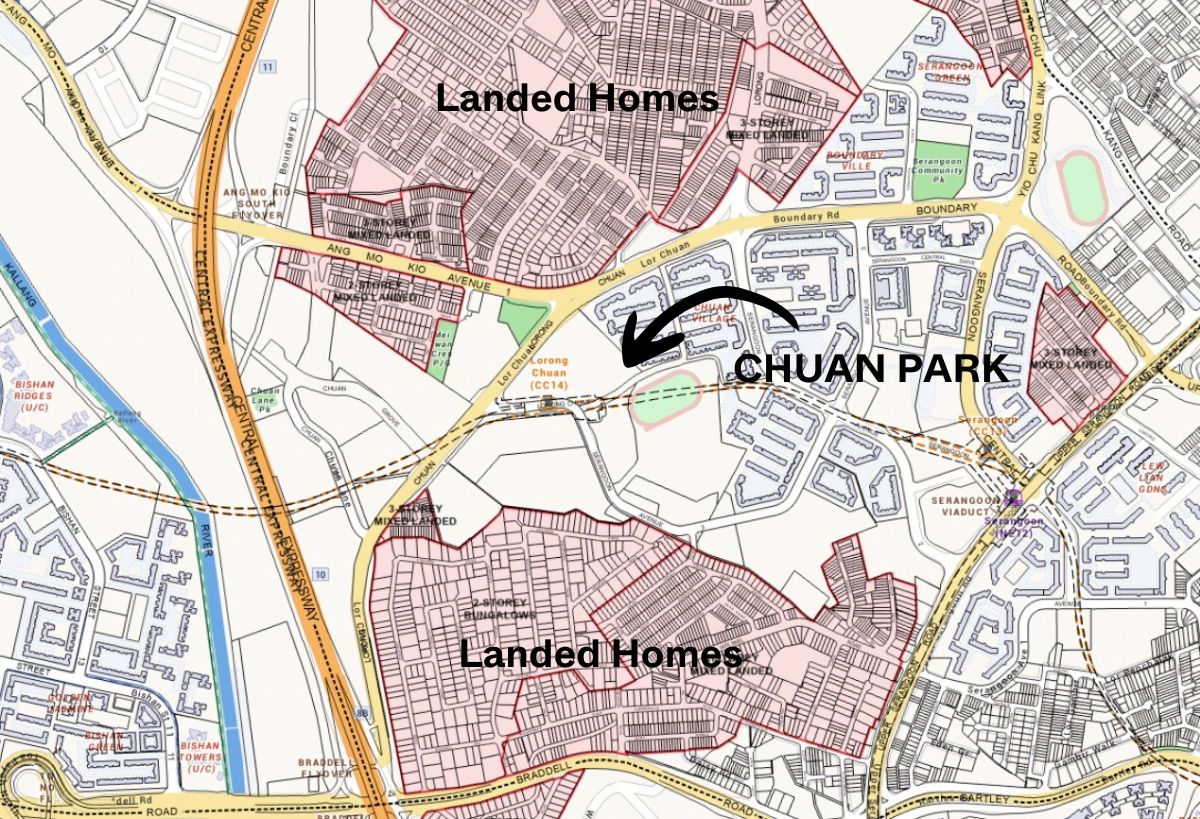

There’s a substantial cluster of landed homes near Chuan Park

Simple availability is sometimes a factor. In some neighbourhoods, particularly areas that have maintained low-density housing for some time. In these situations, buyers who want to be in that location will be quick to snap up available condo units, which even as new launches, can be cheaper than landed options.

With that in mind, let’s consider the landed enclaves around Chuan Park:

There’s a sizeable number of landed homes in the surrounding area; roughly over 5,500 landed properties on this map. Now let’s compare it to the number of three-bedder or larger condo units nearby (we’ll skip the smaller one and two-bedders to focus on the main demographic, which is family buyers):

| Chuan Park Area | 3 bedders and above |

| Cardiff Residence | 7 |

| The Chuan | 85 |

| The Springbloom | 256 |

| Chiltern Park | 219 |

| The Scala | 146 |

| Golden Heights | 35 |

| Amaranda Gardens | 169 |

| The Sunnydale | 56 |

| Sunglade | 276 |

| The Yardley | 55 |

| The Acacias | 47 |

| Total | 1351 |

We estimate only around 1,351 units that are three-bedders or larger. This means the number of landed homes in the area is roughly four times higher than the number of condo options. If you’re searching for homes in this area, you’re going to find many of them are high-quantum landed units.

Next, let’s do a quick price comparison of condos versus landed homes in this area:

| Area | Average Price |

| Serangoon | $5,080,614 |

| Detached House | $12,325,662 |

| Semi-Detached House | $5,506,847 |

| Terrace House | $4,115,420 |

This is based on transactions for 2024. The average transacted price for landed homes is about $5.08 million, although detached houses are a notable departure.

Here are the prices for nearby condos:

| Lorong Chuan Area | 3BR | 4BR | 5BR |

| SUNGLADE | $1,790,535 | $2,400,000 | |

| THE SCALA | $1,806,000 | $2,600,000 | |

| THE SUNNYDALE | $1,820,000 | ||

| CHILTERN PARK | $1,902,000 | ||

| THE SPRINGBLOOM | $2,111,296 | $2,674,000 | |

| AVERAGE | $2,118,530 | $2,804,041 | |

| THE ACACIAS | $2,230,000 | ||

| THE YARDLEY | $2,232,500 | ||

| AMARANDA GARDENS | $2,460,000 | $3,176,290 | |

| CHUAN PARK | $2,597,988 | $3,468,721 | $4,037,212 |

| THE CHUAN | $3,047,000 | $3,430,000 |

The average price of a three-bedder in Chuan Park is around $2.6 million, while a four-bedder is around $3.5 million. While that’s not cheap, you’ll notice the prices at Chuan Park are still below that of a terrace house, let alone a detached or semi-D unit. It’s a combination of higher surrounding prices (thanks to the landed enclave), as well as limited condo options, that makes Chuan Park’s prices palatable to buyers.

But more importantly, it also means that some of these landed buyers will be cashing out to right-size to a private property nearby instead.

This may be one of the reasons why a 70 per cent sell-out rate at launch was possible.

As another example, let’s look at another north-east district: Ang Mo Kio

Ang Mo Kio is also a mature area in the same north-east region. However, the landed enclave in this area is more limited:

Ang Mo Kio has around 3,900 landed homes, fewer than what we saw around Chuan Park. Now here are the condo numbers:

| Ang Mo Kio | 3 bedders and above |

| Meadows @ Peirce | 341 |

| The Calrose | 349 |

| Thomson Grove | 116 |

| Far Horizon Gardens | 150 |

| Seasons Park | 225 |

| Castle Green | 412 |

| Bullion Park | 352 |

| Nuovo | 297 |

| The Panorama | 409 |

| Lattice One | 39 |

| Peirce View | 40 |

| Adana @ Thomson | 49 |

| Grandeur 8 | 433 |

| Total | 3212 |

3900 versus 3,212 is a much smaller disparity, compared to what we saw in the Chuan Park/Serangoon area. Condo and landed options are pretty much equally available.

Next, let’s look at the pricing:

| Area | Average Price |

| Ang Mo Kio | $4,195,913 |

| Semi-Detached House | $5,272,876 |

| Terrace House | $3,890,774 |

Prices are lower than in Serangoon, averaging around $4 million.

| Condos | 3BR | 4BR |

| PEIRCE VIEW | $1,200,000 | |

| CASTLE GREEN | $1,495,400 | $1,958,981 |

| SEASONS PARK | $1,597,167 | $2,050,000 |

| NUOVO | $1,656,000 | $1,750,000 |

| GRANDEUR 8 | $1,664,000 | $1,989,333 |

| BULLION PARK | $1,806,615 | |

| LATTICE ONE | $1,901,500 | |

| ANG MO KIO AVERAGE | $1,936,446 | $2,136,421 |

| MEADOWS @ PEIRCE | $2,160,861 | |

| THE PANORAMA | $2,168,618 | $2,620,000 |

| FAR HORIZON GARDENS | $2,248,000 | $3,188,000 |

| THOMSON GROVE | $2,340,875 | |

| THE CALROSE | $2,571,500 | $2,580,000 |

Condo prices are similarly lower, and as such you may expect less price support coming from the landed homes in this area. As with Chuan Park, it does show that buyers tend to view “overall” home prices in the country, or in wider areas, as something of an abstraction. The price sensitivity is affected more by the immediate vicinity; and that’s how labels like “cheap” or “expensive” are formed.

It’s also worth pointing out that, while we often think of HDB as the main contributor to condo prices (because of upgraders), landed homeowners shouldn’t be overlooked. Some people rightsize from landed homes to condos instead of flats, for example, and those who opt for common facilities later on. Quite a number of landed homeowners have made the switch, because condos are easier for family BBQs, poolside parties, etc.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do nearby landed homes influence the prices of new launch condos?

Why did Chuan Park sell 70% of its units during the launch weekend?

How does the number of landed homes compare to condo units in the Chuan Park area?

What is the average price difference between landed homes and condos in the Serangoon area?

How does the availability of landed homes affect buyer choices in mature neighborhoods like Ang Mo Kio?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments