The Growing Number Of $2 Million Condos In Singapore: Is This The New Norm In 2024?

July 2, 2024

While many buyers still like to compare properties by the price per square foot, ultimately it is the quantum that is still more important. In recent years, we’ve heard some buyers deliberately opting for older or smaller properties with a lower price tag. The theory? If your property is too expensive, you’re less likely to find many buyers who can afford it, making it difficult to resell (unless you drop the price, of course).

So if you are looking at a property for investment, it makes sense to look for one that has the widest pool of buyers that you can appeal to. To check this out, let’s look at the transaction volumes of private homes, based on quantum range:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How do transaction volumes change with quantum?

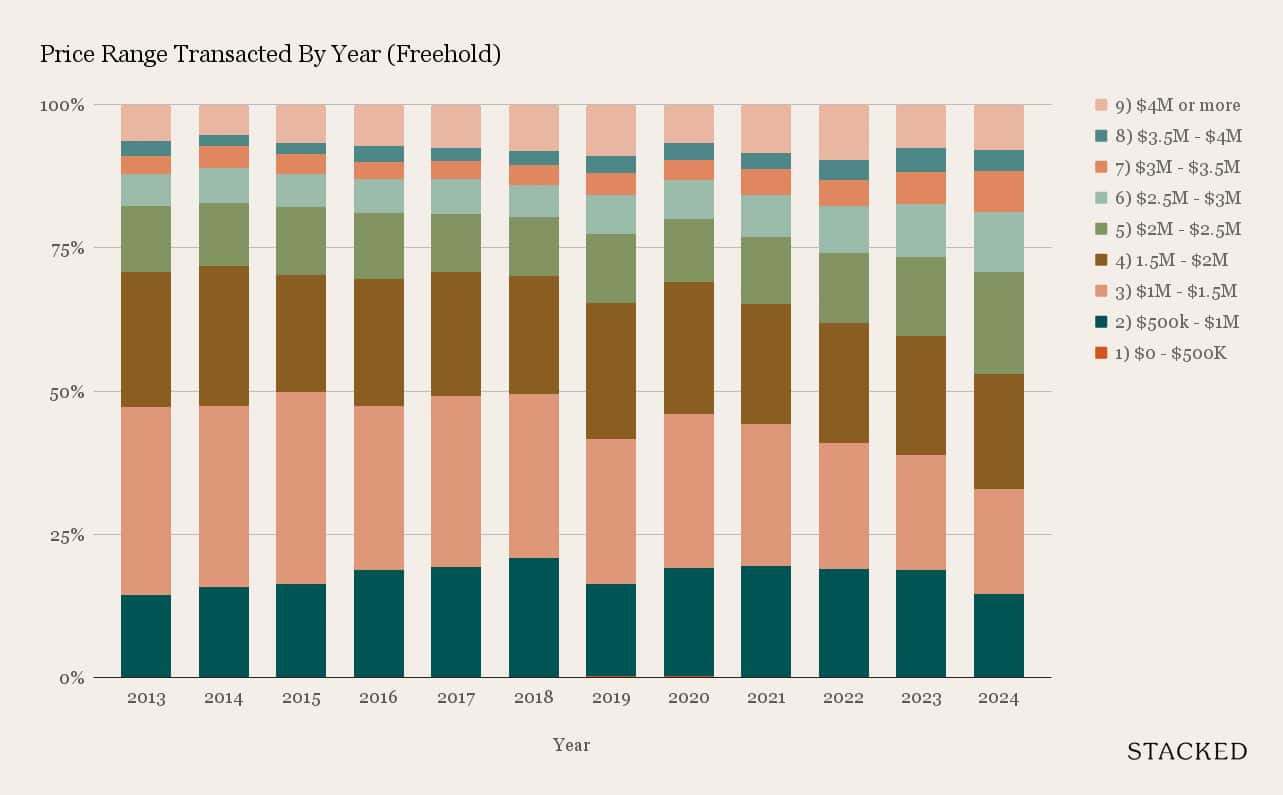

Let’s start by looking at freehold properties at different price ranges. Note that we use resale transactions only for the following, as the point is to see how much more rarely high-priced homes are transacted:

These are the transaction volumes based on quantum range, over a 10-year period from 2013 (the last property peak) to the present.

In 2013, freehold properties of $1.5 million or higher accounted for around 53 per cent of transactions in the relevant market. As of 2024 however, transactions of $1.5 million or higher account for 67 per cent of the market.

This reflects on rising prices among other factors. That is, it’s plausible that the number of transactions below $1.5 million dropped simply because fewer and fewer properties are priced so low, as the years go on.

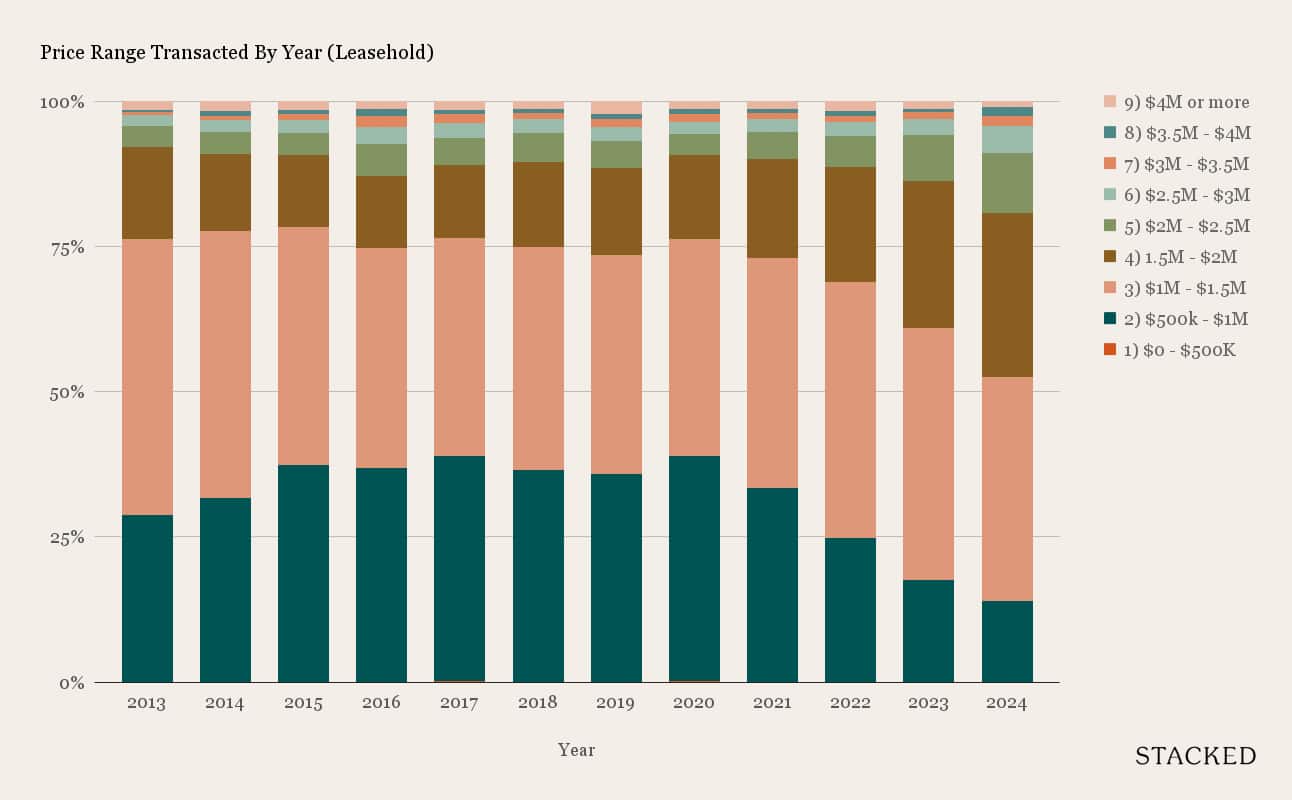

Next, we looked at leasehold properties, where prices in general are lower:

We see a similar direction here, albeit to different degrees. Back in 2013, leasehold transactions of 1.5 per cent or higher accounted for about 24 per cent of the market. By 2024, the number had risen to 47 per cent.

Between the two, the largest buyer demographic (who are mostly HDB upgraders by the way) have always been the ones purchasing $1 million to $1.5 million leasehold homes. This is more or less the “sweet spot” for upgraders, as the down payment, stamp duties, etc. are sufficient for the sale proceeds of the previous flat to cover.

This is a good indicator of just how much prices have jumped over the last 10 years

For leasehold properties, consider how the number of transactions in the $1 million to $1.5 million range has been steadily dropping. Back in 2013, this price range made up almost half the market transactions (48 per cent). But as of 2024, transactions in this range make up just around 39 per cent of the volume.

At the same time, the next price band up (homes in the $1.5 million to $2 million range) went from being a mere 16 per cent of the market in 2013, to accounting for over a quarter of the transactions (28 per cent) today. At the rate we’re going, the quantum range of $1.5 million to $2 million will probably make up the bulk of transactions in a decade from now.

On the freehold side, there was a drastic drop in the number of transactions between $1 million and $1.5 million. This price range accounted for a third of the freehold market in 2013, but now has fallen to just 18 per cent. It would seem that freehold properties in this price range are fast becoming extinct, even among the smaller and older properties.

Even properties in the $1.5 million to $2 million range saw a drop in the freehold market, while the quantum range of $2 million to $3.5 million saw an increase of 15 per cent. It’s quite probable that a minimum of about $2 million will become the new norm for resale, freehold properties.

So how much do buyers accept as a limit in 2024?

On the ground, most buyers we speak to are still hesitant about approaching the $2 million mark. But what we say appears quite different from what we do: the transaction volumes, when divided by price bands, show a growing acceptance toward $2 million – or something close to this – as an acceptable condo price.

On the upside, this means there could be more prospective future buyers, even if you do buy in the range of $2 million right now. On the downside, it may be getting harder to bridge the gap between HDB and private properties every year.

For more on the Singapore property market, follow us on Stacked. You can also reach out to us directly, if you need help with issues like upgrading, selling, or buying. For a more in-depth consultation, you can do so here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are $2 million condos becoming more common in Singapore in 2024?

How have transaction volumes for high-priced properties changed over the past decade in Singapore?

What is the typical price range that most buyers are comfortable with in Singapore's property market?

How have the transaction shares of properties in the $1 million to $1.5 million range changed over the years?

What does the article say about the future of freehold properties priced between $1.5 million and $2 million?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments