I Moved From Singapore To New York To Work In Real Estate – Here’s What You Need To Know Before Buying

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

When I first moved from Singapore to New York, I had no playbook. I knew few people, I lacked a safety net, and I often questioned whether I had made the right choice. Those doubts, however, became my drive. They pushed me to learn the city inside and out, to understand its real estate market from the ground up, and ultimately to build a career dedicated to guiding others through the same journey.

A pivotal moment came in 2017 when I helped launch a $450 million luxury project in Manhattan with the SERHANT. team. That experience not only shaped my career but also gave me a front-row seat to how transactions at the very highest levels of New York real estate are executed.

Over the years, I have met many Singaporeans drawn to New York, whether for work, studies, or simply the energy of the city. Almost every conversation returns to the same questions: Is it worth buying here? Where do I start? What do I need to know before taking the first step? I understand those concerns deeply because they were the very questions I had when I first arrived.

New York shares much with Singapore: limited land, strong rental demand, and a history of price resilience. Yet it is also bigger, more diverse, and filled with opportunities that are not always obvious at first glance. That blend of familiarity and unpredictability is what makes the market so compelling, but also what makes it easy to feel lost without the right guidance.

This guide is my way of helping you cut through the complexity. Beyond walking you through the step-by-step buying process, it highlights the key factors I wish someone had explained to me when I was just starting out.

1. Budget

Understand what you can afford, as your budget determines the size, location, building type, and condition of the apartment you dream about owning. Most foreign purchasers are cash buyers as it’s easier, faster, less complicated and more room to negotiate. For financing, if you do not have residency or PR in the United States, you would need to find a bank that can pre-approve you for a loan. There are a few in NYC that offer this, and they usually require a larger down payment, and their rates are higher than those of a local bank. Your agent can introduce a mortgage loan officer for you to understand your purchasing power, rates, loan amount, etc.

Many Singaporean buyers will find that using cash is the cleanest, most cost-efficient way to enter the market. It also speeds up transactions in a city where cash buyers are favoured in negotiations, and it sidesteps the complications of securing financing as a foreigner.

2. Neighbourhood

Factors that may affect where you want to live or invest; close to work, college, school, being close to a park or the river. Perhaps you prefer being in a neighbourhood with great restaurants, bars, cafes and nightlife. Every neighbourhood in New York City has its own flair and culture.

Think of Manhattan’s Upper East Side a bit like Bukit Timah—leafy, established, and family-friendly, with proximity to top schools. If you’re drawn to energy and bright lights, Midtown Manhattan is New York’s answer to Orchard Road (or rather, Bugis these days.)

For those who want river views and luxury high-rises, Battery Park City feels a little like Robertson Quay, blending greenery, waterfront promenades, and expat-friendly condos. And if you’re the sort who seeks out buzzy up-and-coming areas, Brooklyn’s Williamsburg is the Joo Chiat–Geylang Serai hybrid: hip, evolving, and home to pop-up markets that somehow outprice malls.

The wonder of NYC is that stepping a few blocks into a new neighbourhood can bring about a total transformation, so it’s best if you visit directly and soak in the atmosphere for a while.

3. Building type and services

If you are not purchasing a house/townhome, you would have to decide between a co-op or a condo. If you are a foreign purchaser and investor, buying a condo would be the way to go. Whether it is a resale or a new construction, there are no limitations or restrictions for foreigners to purchase a condo. A summary of what co-ops and condos are:

Co-ops (Cooperatives): You don’t technically own the unit; instead, you own shares in a corporation that owns the building. Co-ops tend to be less expensive than condos but come with stricter rules and approval processes.

Condos (Condominiums): You own the apartment as real property. Condos usually have higher prices and closing costs but offer more flexibility for renting and selling.

Next, determining if you would want to be in a building with amenities such as a doorman, 24/7 concierge, elevator, gym, roof-deck, pool, courtyard and so forth.

4. Pre-search

Before beginning the search, it is important to understand the professional support you will need in New York. Unlike Singapore, where contracts are more standardised, every buyer in New York must engage a real estate attorney. Attorneys are essential for navigating the many moving parts of contract negotiations, due diligence, and closing. There are also closing costs that extend beyond legal fees, such as mansion tax, title fees, mortgage recording tax, and bank-related charges. An experienced agent can connect you with trusted attorneys and lenders, and also help you model these costs early so there are no surprises later.

5. Do you really need an agent?

In both Singapore and New York, buyers work with lawyers. The key difference is that in New York, your attorney takes the lead from offer to closing, overseeing contract negotiations, due diligence, and the final signing. In Singapore, conveyancing is just as important, but the process is more standardised and the agent’s role is usually more straightforward.

For many Singaporean clients, two parts of the process stand out. The first is the attorney review period, where lawyers can still negotiate or walk away after an agreement is signed. The second is closing costs, which include items such as mansion tax, mortgage recording tax, title insurance, and lender fees. These add up quickly, so it is best to model them early.

Could you search on your own? Yes, but New York’s market is fragmented, fast-moving, and varied. Many buyers miss strong opportunities because they are unaware of off-market listings or building-specific issues like reserve funds, assessments, or sublet restrictions.

More from Stacked

$8.7 Million Profit? 5 Common Traits From The Biggest Property Gains And Losses

While most people can grasp basic concepts like “good location” or “good facilities”, the top gainers are almost always a…

This is where a skilled broker adds real value. The right person helps you cut through the noise, stress-test pricing, line up the right attorney and lender, and move quickly without skipping diligence. In a market this competitive, choosing someone responsive, reliable, and experienced can make the difference between securing the right home and missing out.

My advice is simple: choose someone you trust enough to call late at night when a counteroffer comes in. In New York, that level of responsiveness can be the difference between securing the home you want and watching it slip away. You may be competing against hundreds of other buyers looking for almost exactly what you want. Finding the right broker would mean a competitive advantage over others and someone that not only can get you the best deal but can walk you through the process, who is reliable and responsive and has the track record and experience is key.

Once we establish your criteria and price range during the pre-search, we can start looking at places together!

6. The Search, Offer and Negotiations

Aside from knowing the specifics of the home you want (i.e., how many bedrooms and bathrooms, garage size, backyard space, etc.), you should create a list of the top two or three neighbourhoods that you want to live in. Think about your potential commute to work, where your friends live, and nearby amenities like restaurants, schools, and grocery stores. And don’t forget, New York is a city of five boroughs (Manhattan, Brooklyn, Queens, the Bronx, and Staten Island), each with its own rhythm, culture, and price point. Where you choose to live can change your lifestyle just as much as the apartment itself.

This is where having a good broker comes in handy – they can point out, for example, that certain parts of Brooklyn are just a quick subway ride from Manhattan but come with a much lower price tag; or that some “quiet” neighbourhoods still keep you within easy reach of schools and nightlife.

One classic example is Downtown Brooklyn. By subway, you’re often just one or two stops from Lower Manhattan, making the commute faster than if you lived on the Upper East or Upper West Side. At the same time, home prices are generally lower than comparable Manhattan neighbourhoods.

Your agent will help you throughout your search and can organise showings for homes that best fit your criteria. Once you find a home you love, you are ready to make an offer!

Offers must be made in writing. Your offer should have a pre-approval letter (if you are financing), proof of your assets and liabilities, any contingencies you have before a potential sale goes through, and your attorney’s information.

Once your agent submits the offer on your behalf, the seller may send you a counteroffer, which then begins a back-and-forth process until both parties come to an agreement.

Everything from the viewing, making an offer and signing the contract can be done remotely and signed electronically.

7. Contract and Due Diligence

Once your offer is accepted, an attorney representing the seller will draw up a contract for the buyer. The buyer – with the help of their agent and attorney – will then be allowed to perform due diligence on the property to ensure it doesn’t have any hidden baggage. Due diligence includes home inspections, appraisals, title searches, and more. On average, the due diligence period is around 5 business days, but it can be flexible depending on the situation of the deal.

The buyer signs the contract once due diligence is resolved and forwards the contract with a 10 per cent deposit. The seller/s then countersigns the contract, and the money is held in escrow until closing. It is important to remember that the seller can entertain other offers while contract negotiations are taking place, but cannot do so after signing the contract.

Be sure to ask your agent and attorney what closing costs are associated with the transfer of the property.

8. Mortgage & Approval. *Skip this step if you are purchasing in cash

If you are financing, you should have your pre-approval letter from your mortgage banker. Mortgage applications cannot be processed without an executed contract. You can apply for a mortgage at the bank that pre-approved you, or you can shop around to see if you can get a better offer.

Mortgage applications typically require your employment information, assets and debts, income, credit history, and details about the home you want to purchase.

Once you submit your application, you’ll receive a loan estimate and go through the underwriting process. Mortgage underwriters will determine whether your loan is approved, rejected, or needs to be amended.

9. Closing & Move-In.

After your mortgage is approved, the managing agent will typically set a closing date, while the buyer’s and seller’s attorneys coordinate with the banks to settle on the paperwork and timing. Once everything is signed and the keys are in hand, the apartment is officially yours. It’s the end of the search – and the beginning of figuring out where the nearest grocery store, coffee joint, and subway entrance are.

Once the paperwork is signed and the keys are in hand, the apartment is officially yours. It may mark the end of the search, but it is really the beginning of your New York story: discovering your local coffee spot, learning which subway line gets you home fastest, and settling into a city that many only dream of calling home.

If you are a Singaporean considering this step, know that you do not have to navigate it alone. I asked the same questions when I first arrived, and I have guided many others through the process, from first-time buyers purchasing a pied-à-terre to families making long-term investments. Every journey is unique, and the best place to begin is with a conversation. If you are exploring the possibility of owning a home in New York, the first step is often just a conversation. I would be glad to share what I have learned and help you understand what is possible for you.

You can reach me directly on WhatsApp or iMessage at +1 917-498-9762 and if you’d like to get in touch for a more in-depth consultation, you can do so here.

Chester Yow

Born and raised in Singapore, Chester grew up in a multicultural environment and is fluent in English, Mandarin, and Cantonese. He also served two years in the Singapore Armed Forces Commando Unit, where he honed resilience, precision, and attention to detail.Read next from Overseas Property Investing

Overseas Property Investing Singaporeans Are Buying More Overseas Homes — But Few Have Prepared For These Things

Overseas Property Investing 4 Hidden Risks To Avoid When Buying Property In Malaysia (A Guide For Singaporeans)

New Launch Condo Reviews Summer Suites Condo Review: A Freehold Johor Bahru Condo Near The RTS Link

Overseas Property Investing Why I Bought 7 Properties in Johor Bahru, and Will Still Buy More

Latest Posts

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Pro Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

On The Market Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m

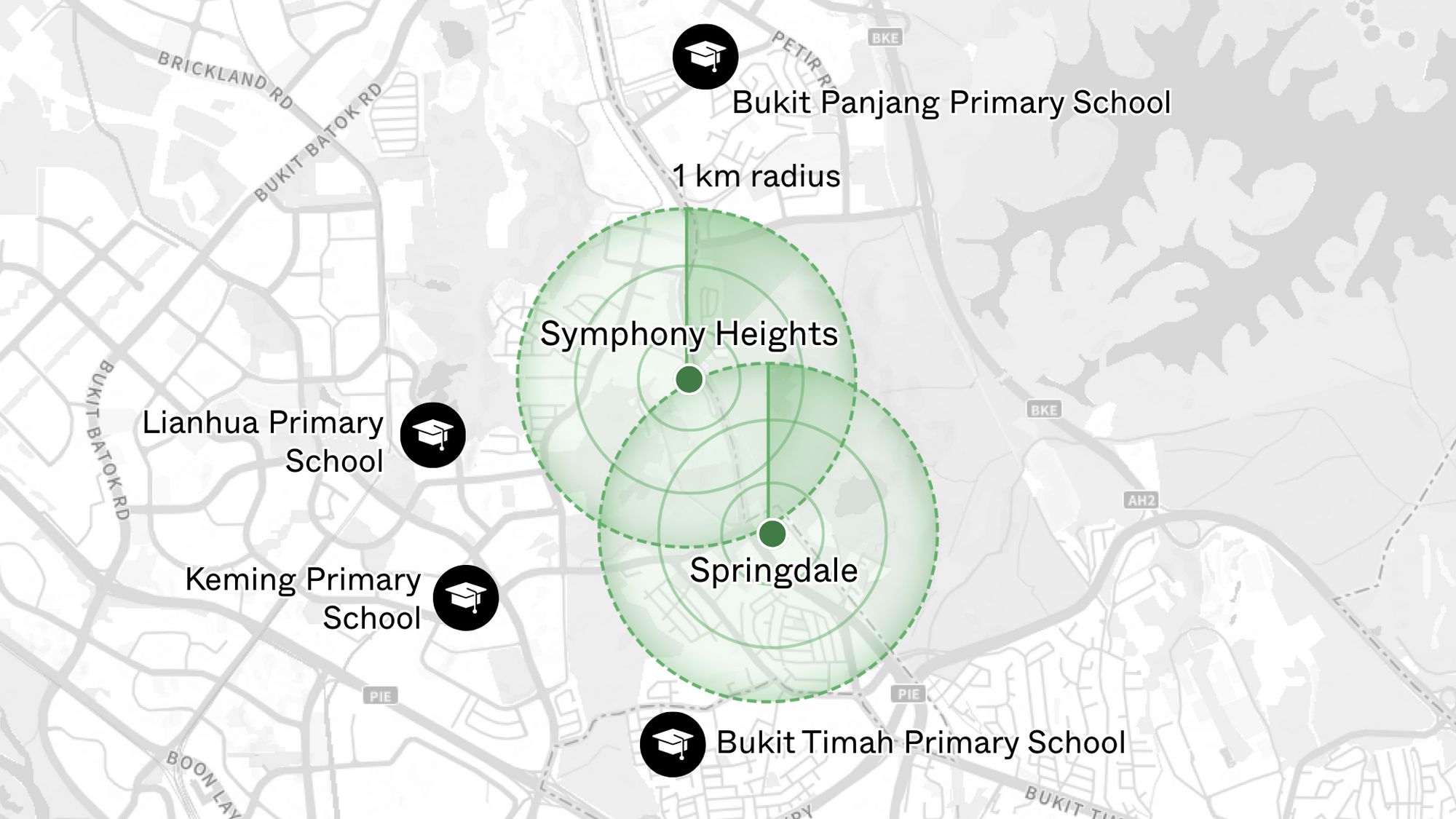

Property Investment Insights Do Primary Schools Really Matter For Property Prices In Singapore? These 6 Condos Suggest Otherwise

Editor's Pick The 5 Most Common Property Questions Everyone Asks In Singapore – But No One Can Answer

Editor's Pick A 5-Room HDB In Boon Keng Just Sold For A Record $1.5m – Here’s How Much The Owners Could Have Made

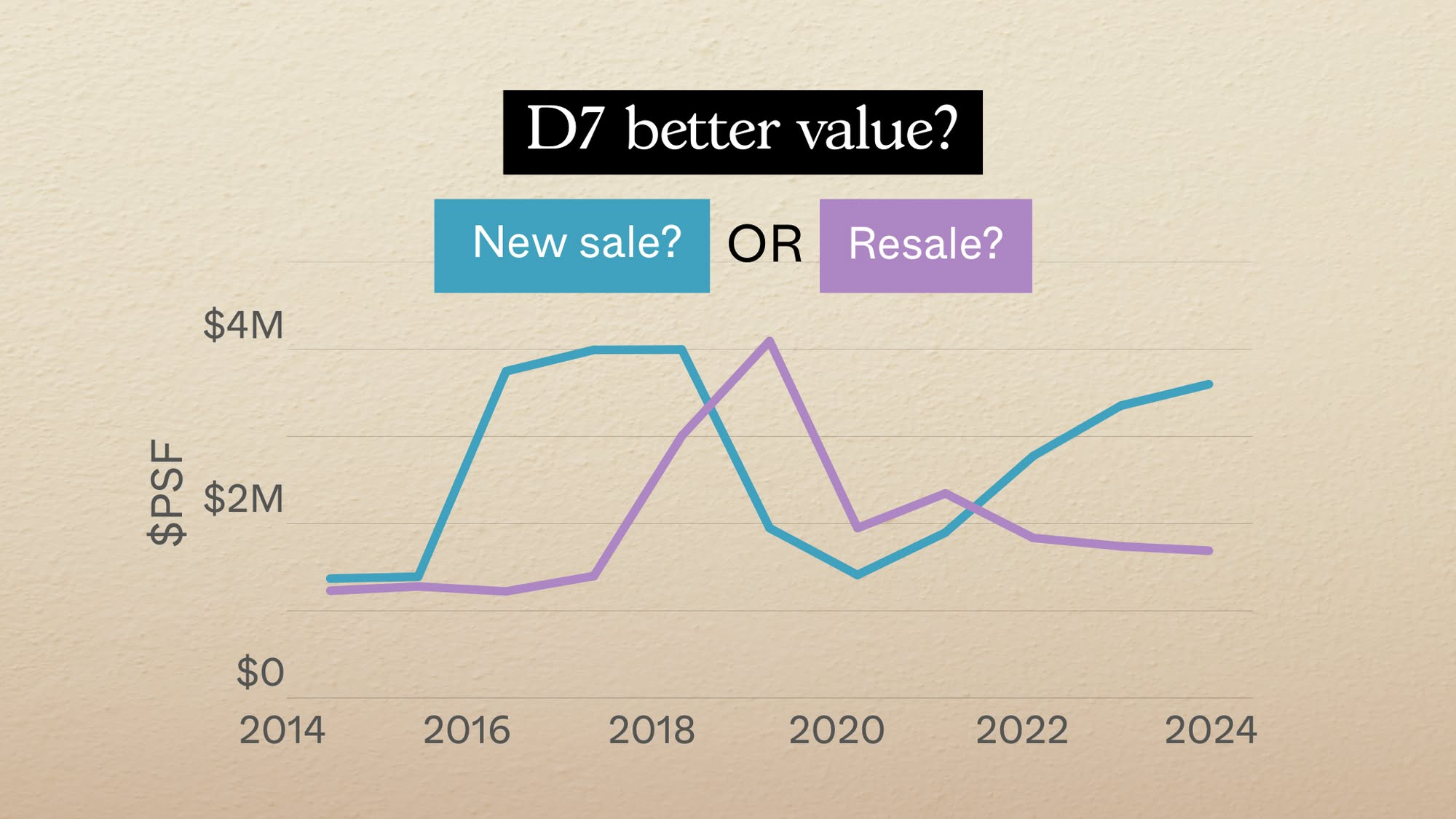

Pro New Launch vs Resale Condos in District 7: Which Bedroom Types Offer Better Value Today?

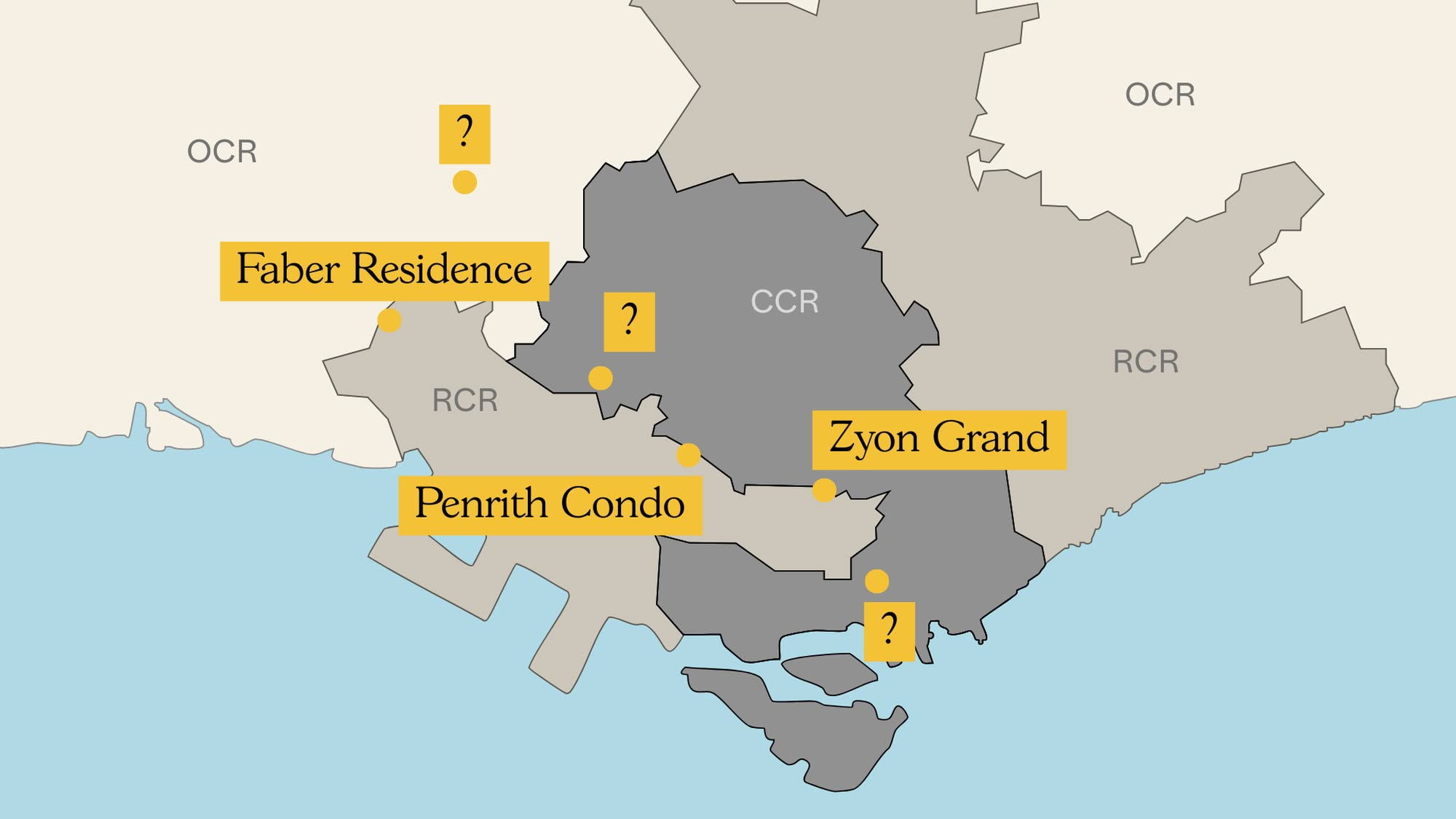

Property Market Commentary 6 Upcoming New Condo Launches To Keep On Your Radar For The Rest Of 2025

Editor's Pick We Toured A Little Known Landed Enclave Where The Last Sale Fetched Under $3 Million

Singapore Property News Decoupling Is No Longer a Property Hack: What the Courts and IRAS Have Made Clear

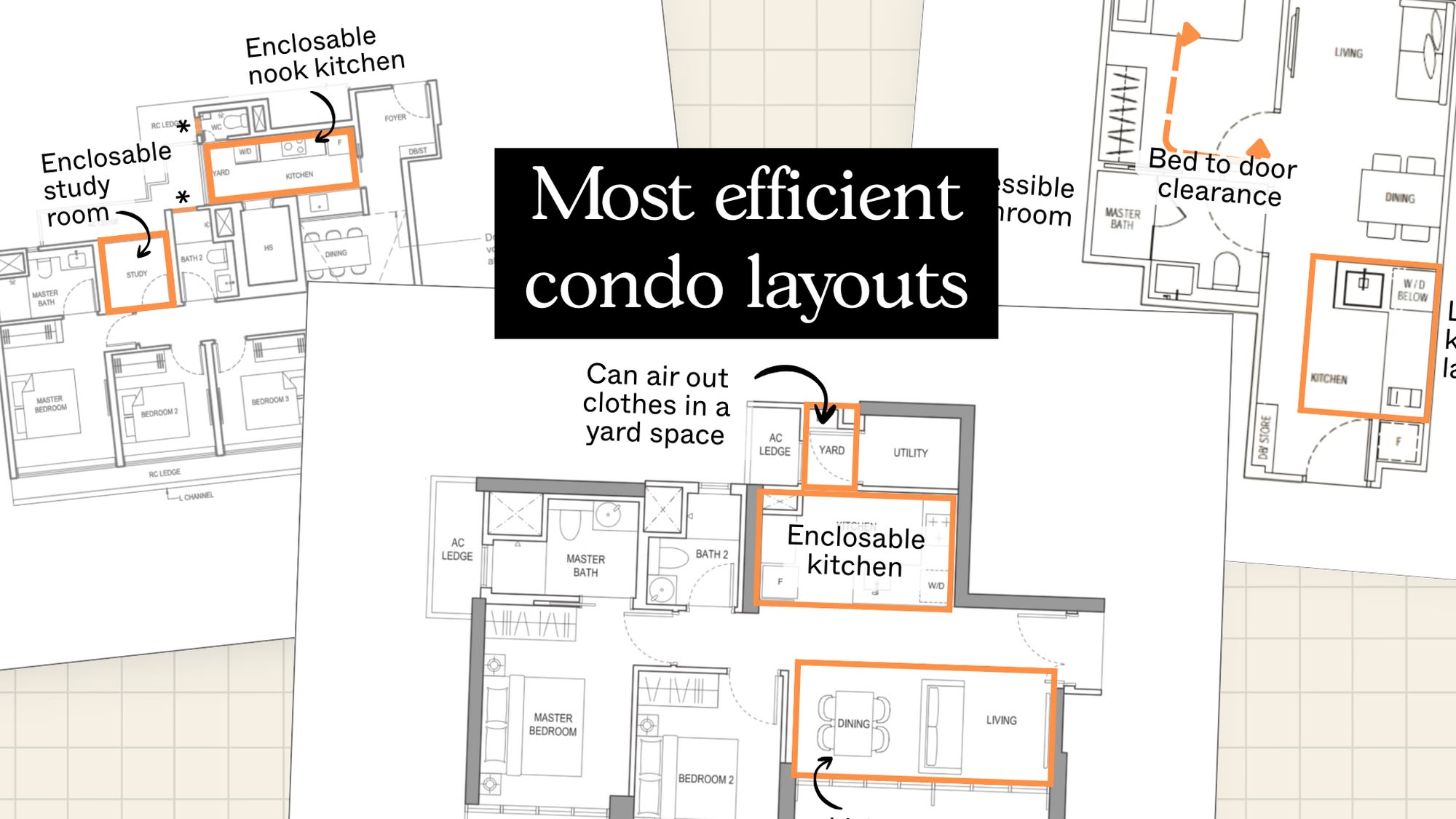

Editor's Pick The New Condos In Singapore With The Most Efficient Layouts In 2025 Revealed – And What To Look Out For

On The Market The Cheapest 4-Bedroom Condos Under $1.7M You Can Buy Today

Homeowner Stories We Could’ve Sold Our Home for More, But We Didn’t — Here’s Why We Let It Go in Just 24 Hours

Pro Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Advice The Hidden Costs of Hiring a “Cheaper” Agent In Singapore