Ask Stacked Homes #01 – Top 5 Singapore housing questions of the week

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.

Here at Stacked Homes we get many questions every week on Singapore housing. So, sharing is caring right? We hope you find this resource useful, if you do have any questions that you would like answered you can always reach out to us at hello@stackedhomes.com!

Question 1:

If i buy a resale Executive Condominium that is 7 years old but less than 10 years, am i able to rent it out immediately or do i have to wait for the 5 year MOP?

Answer:

Yes, an Executive Condominium that has fulfilled its 5 year MOP is considered semi privatised and can be rented out. It is only after 10 years that the EC is considered fully privatised and can be sold to foreigners.

Question 2:

If i bought a new condo that has not been built finish, do i incur SSD from my purchase date or only from my TOP date?

Answer:

For new condo purchases, the SSD is calculated from the exercising of the Sales and Purchase Agreement. So as of 11 March 2017, as long as it has been more than 3 years there will be no SSD payable.

Question 3:

I am moving to Singapore for 3 months for an exchange, am i able to rent an apartment here for 3 months?

Answer:

If you are looking at a period of 3 months, you will be able to rent only a private property as that has a minimum period of 3 months. For HDB (public housing), the minimum rental period is 6 months. However, short term rental is harder to find in general as most landlords are looking at longer term lease to minimise gaps in the rental periods.

Rental MarketRenting in Singapore Guide (This will make your renting journey a lot easier)

by SeanQuestion 4:

Hi, is it possible to pay for downpayment for a new condo with CPF? the full downpayment?

Answer:

If you are looking at a new condo, it is a 20% 25% deposit, of which at least 5% must be paid in cash

Question 5:

Hello can i buy a condo if i have already one under my name and then sell the first one? Will i be able to get back the tax money?

Answer:

ABSD remission is a special concession given to only Singaporean married couples. So ABSD remission is applicable if it is a married couple with at least one Singapore citizen spouse and you sell your first property within 6 months after the date of purchase/TOP/CSC. Also note that the property must be purchased under both names of the couple only and both spouses must not own any residential property. If you like to read up more on ABSD remission you can do so here.

So that is it for our first series on Singapore housing questions! Again, if you have any more questions you can reach out to us at hello@stackedhomes.com!

Stanley

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

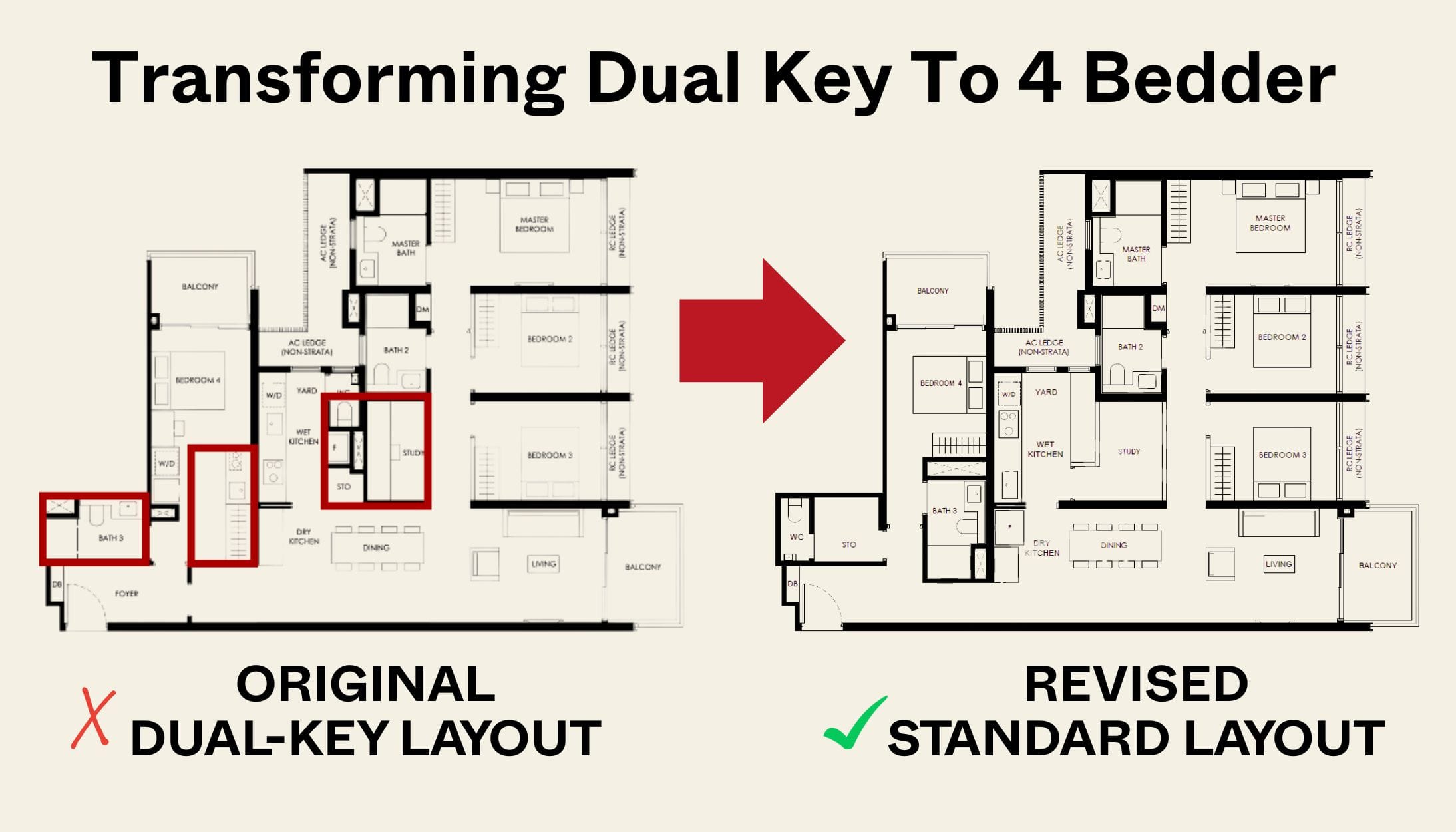

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

Hello stacked homes

I enjoyed reading your articles including sound advices 🙂

Well, I am 48 years looking to invest in existing & relatively young 2 bedder condo with about 1 mil budget (may borrow 300k) with criteria 1) that it can easily be tenanted & 2) with potential capital upside in next 7-10 years when NEW mrt is built near it? 3) preferably located north and/or west area of sgp?

Can you pls advise? Thanks a lot.