Should You Buy A Bigger Or Smaller 1 Bedder As An Investment? The Data May Surprise You

February 7, 2025

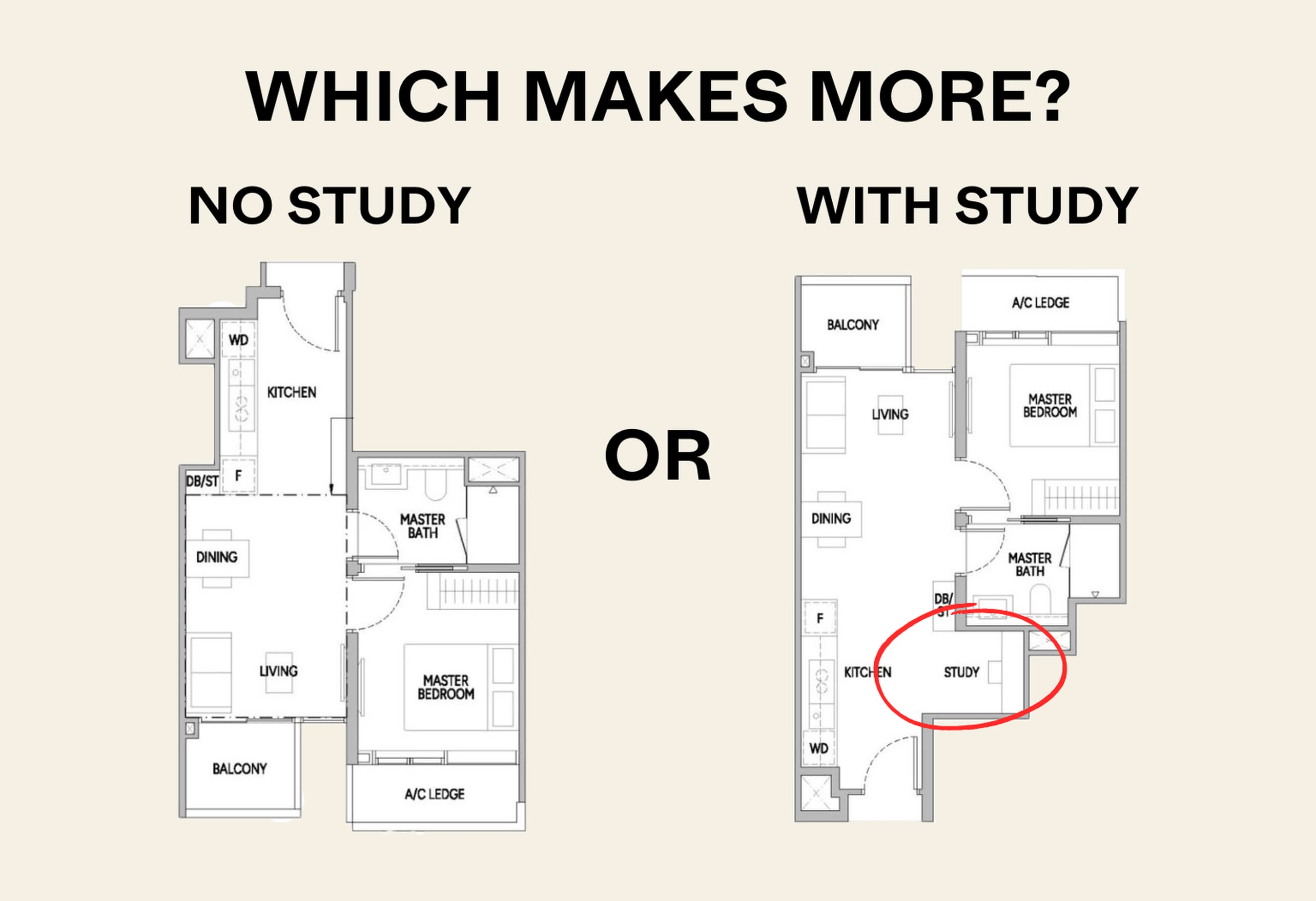

As some of our readers may know, one of the things we like to do at Stacked is to test common sayings in the Singapore property market. One such saying is that investors – in particular landlords – should always opt for the smallest one-bedder layout, if their intention is to buy and rent out such a unit. The larger one-bedders, like the 1+Study, may perform worse. But what’s the reason behind this, and is it true? We checked it out:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s the theory behind picking the smallest one-bedder layout?

The idea behind this is that, from a tenant or future buyer’s mindset, a one-bedder is a one-bedder, regardless of frills. Having a few extra square feet, or a nook that can be turned into a study, doesn’t change this.

Quite often, the extra “study” is too small to be seriously considered an extra room of any worth; and since the value it adds is so minimal, tenants and future buyers aren’t easily persuaded to pay much more for it. For a landlord, this could mean a 1+Study unit fetches an almost similar rental income to a standard one-bedder in the same project; despite the 1+Study unit having a higher quantum.

Let’s see if any of this holds:

Are standard one-bedders better for gains?

For the following, 114 condo projects were initially considered. These were all projects where there are both one-bedders, and 1+Study units. However, we couldn’t use all of them, as we had to make sure they had transactions of both one-bedders and 1+Study units, to compare gains.

Among those that did have such transactions, here’s what we found:

New-to-resale transactions:

| Project | Not Study | Study | |||

| ROI (%) | Volume | ROI (%) | Volume | Which is better | |

| JADESCAPE | 17.5% | 19 | 13.3% | 3 | REGULAR |

| MAYFAIR GARDENS | 9.9% | 1 | 7.7% | 4 | REGULAR |

| MIDWOOD | 9.7% | 4 | 15.9% | 1 | STUDY |

| PARC ESTA | 20.7% | 20 | 23.0% | 7 | STUDY |

| RIVERFRONT RESIDENCES | 27.2% | 1 | 17.1% | 3 | REGULAR |

| SKY EVERTON | 8.3% | 1 | 12.9% | 1 | STUDY |

| STIRLING RESIDENCES | 19.1% | 12 | 23.1% | 14 | STUDY |

| THE JOVELL | 19.1% | 4 | 14.8% | 3 | REGULAR |

| THE M | 6.6% | 1 | 2.9% | 2 | REGULAR |

| THE TAPESTRY | 13.5% | 28 | 13.0% | 32 | REGULAR |

| TREASURE AT TAMPINES | 18.4% | 15 | 23.1% | 5 | STUDY |

| WHISTLER GRAND | 17.7% | 11 | 16.6% | 11 | REGULAR |

Some of these projects have too few transactions (one unit sold) to draw clear conclusions. But from what we can see, the difference is very marginal.

Standard one-bedroom units have a slightly higher average ROI of 17 per cent compared to 16.3 per cent for 1+Study units. A technical win for standard one-bedders, but a 0.7 percentage point difference is an almost negligible difference.

Jadescape, Mayfair Gardens, Riverfront Residences, The Jovell, The M, and The Tapestry all show better performance for standard one-bedders.

More from Stacked

Should You Rent Or Sell Your New Launch Condo In 2023? Here’s How You Can Decide

You're one of the "lucky" ones that bought a new launch condo in 2019/20 before the prices shot up because…

On the other hand, Midwood, Parc Esta, Sky Everton, Stirling Residences, and Treasure at Tampines show better performance for 1+Study units.

For Whistler Grand, there was no clear winner.

What if we look at new-to-sub sale transactions?

What if we look at “flipped” units, the ones that were sold before the project reached TOP? In that case, we see the following:

| Project | Not Study | Study | |||

| ROI (%) | Volume | ROI (%) | Volume | Which is better | |

| THE M | 9.4% | 1 | 15.2% | 2 | STUDY |

| LEEDON GREEN | 11.8% | 1 | 4.5% | 2 | REGULAR |

| THE FLORENCE RESIDENCES | 12.2% | 44 | 17.3% | 10 | STUDY |

| STIRLING RESIDENCES | 13.0% | 4 | 23.9% | 2 | STUDY |

| AFFINITY AT SERANGOON | 13.0% | 50 | 14.0% | 59 | STUDY |

| MAYFAIR GARDENS | 13.9% | 2 | 8.2% | 1 | REGULAR |

| PARC ESTA | 16.2% | 30 | 16.9% | 15 | STUDY |

| JADESCAPE | 16.2% | 7 | 24.0% | 1 | STUDY |

| KENT RIDGE HILL RESIDENCES | 17.1% | 16 | 12.6% | 6 | REGULAR |

| PARC KOMO | 17.5% | 2 | 14.9% | 1 | REGULAR |

| RIVERFRONT RESIDENCES | 17.6% | 104 | 15.8% | 49 | REGULAR |

| TREASURE AT TAMPINES | 17.9% | 37 | 21.9% | 9 | STUDY |

| THE JOVELL | 19.1% | 5 | 14.7% | 3 | REGULAR |

| WHISTLER GRAND | 21.2% | 10 | 14.6% | 3 | REGULAR |

This is in line with new-to-resale transactions. Again, standard one-bedders win by a small, almost negligible margin (16 per cent for standard one-bedders, versus 15.3 per cent for those with an added study space).

There isn’t much new to talk about here, except one interesting quirk: Riverfront Residences has the highest number of transactions here, and the standard one-bedder outperformed the 1+Study by a notable 1.8 per cent.

What if we look at rental yields?

For this comparison, there were only seven condos where we could match URA’s rental records for regular/study units, as well as for resale transactions. But let’s do the best we can, and see what we can glean from them:

| Type | 1BR Regular | 1BR Regular Rent | Regular Yield | 1BR Study | 1BR Study Rent | Study Yield | Price Difference | Yield Difference |

| PARC ESTA | $980,699 | $3,544 | 4.34% | $1,181,333 | $3,650 | 3.71% | $200,634 | -0.63% |

| MIDWOOD | $857,222 | $3,025 | 4.23% | $1,050,000 | $3,206 | 3.66% | $192,778 | -0.57% |

| STIRLING RESIDENCES | $1,046,857 | $3,713 | 4.26% | $1,177,286 | $3,865 | 3.94% | $130,429 | -0.32% |

| THE JOVELL | $709,500 | $2,630 | 4.45% | $804,000 | $2,890 | 4.31% | $94,500 | -0.14% |

| SKY EVERTON | $1,308,000 | $4,120 | 3.78% | $1,370,000 | $4,200 | 3.68% | $62,000 | -0.10% |

| RIVERFRONT RESIDENCES | $782,000 | $2,792 | 4.28% | $878,667 | $3,100 | 4.23% | $96,667 | -0.05% |

| THE TAPESTRY | $768,357 | $2,823 | 4.41% | $808,081 | $3,000 | 4.46% | $39,724 | 0.05% |

From the above, we can see that the common agent’s advice mostly pans out. Regular one-bedders do generally have higher rental yields than 1+Study units, with the yield difference ranging from -0.63% to +0.05 per cent. Regular units outperform their 1+Study counterparts in most cases.

Just as the agents often advise, rental income does not rise proportionately to the size of the one-bedder. It seems tenants aren’t paying more for (or at least much more) for the added space; but the landlord definitely pays more for it when buying.

From this, we can conclude the following:

There isn’t much difference in terms of gains, between regular and 1+Study units. If you decide to buy a 1+Study, it’s best to do it only if the extra space is something you’d enjoy. Don’t count on it helping you to fetch a higher price later.

When it comes to rental, however, the yield for a 1+Study unit is almost always lower; and the gap between these and standard one-bedders only starts to narrow when the quantum is very close.

Numbers aside, 1+Study units are also in a bit of an awkward place for tenants: they’re not two-bedders, so there’s no option to take on an extra roommate to split the rent (not without significant discomfort). At the same time, it’s hard to convince a prospective tenant to cough up much more, when there are cheaper standard one-bedders in the same project.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it better to buy a smaller or larger one-bedroom condo for investment purposes?

Do 1+Study units generate higher rental yields than regular one-bedroom units?

Are 1+Study units a good investment for future resale value?

What should I consider when choosing between a standard one-bedroom and a 1+Study unit for rental income?

Are 1+Study units suitable for tenants who want to share rent with roommates?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments