If you’re tired of expensive housing in Singapore, you can always try buying one in Japan.

That’s been talked about lately, with news reports of countryside homes being as low as $33,000. It’s something that seems to come up every once in a while, as people grow disillusioned with the higher property prices here and start seeking for “greener” pastures elsewhere. We’ve seen similar attempts in places like Italy, or even in some US cities. And I’ve even written about it before (back in 2021).

There’s always strings attached of course – ranging from having to live there, to just being required to renovate or pay back taxes. But for the most part, these really are properties at rock bottom prices.

The main reason: these are places where most people don’t want to stay. There are no jobs in these rural areas, or they’re too inaccessible; and you can forget about amenities other than walking trails or bird watching.

If you are too lazy to read the whole piece I wrote, here’s a great summary of the reasons from Reddit:

- Have terrible, out-of-date kitchens with little counter space.

- Low door frames.

- Disgusting bathrooms.

- Very old tatami and sliding doors.

- Poor/non-existent insulation, and flimsy entrances.

- Are prone to termites.

- Have roof issues.

- Are in areas with very few job opportunities.

- Are in areas that are already full of other empty houses, or WILL be in another 15-20 years after the remaining old people die off.

But then again, Singaporeans could believe otherwise.

We’ve seen how Jurong and Paya Lebar have transformed over the years; and we’ve seen the effects of land reclamation works. If anyone on the planet can be optimistic about gentrification, urban renewal, etc., it would be your average Singaporean.

This is also one of the differences I’ve noticed, between Singaporeans who buy (or consider buying) such properties, and non-Singaporeans.

I’ve met, for instance, a German national who has bought just such a property in Italy (a one-euro home), but his sole purpose is to use it as a private escape. The Singaporean who bought one, well, every other month it’s checking the news and talking about how “one day it could be a resort.”

See, even if it’s a $1 or $33,000 house, even if we know there’s a snowball’s chance in a microwave of it appreciating, Singaporeans always have a shred of that owner-investor mentality.

And that’s why, when someone says Singaporeans should accept HDB flats as “just a roof over their head,” or buy a home “just to enjoy it,” I never fully buy it. We may say we do, but on some level, we’re all hoping our neighbourhood is the next Tiong Bahru.

And if any Singaporeans buy a $33,000 house in Japan, I can totally see them bugging the local governor with emails like “So any news? New road? Food court? Going to have train station nearby or not?”

Be careful who you sell to, Japan.

Meanwhile, in serious property news topics:

- Harmonisation of Gross Floor Area (GFA) definitions will kick in from June; good news for renovation paperwork, but we suspect it may have some effect on prices.

- Even “safer” properties like Executive Condos can still transact at losses, though it’s usually a matter of timing. Check out how this has sometimes happened.

- 3-bedder condo units under $1 million: think they’re impossible in 2023? Not if you’re willing to check out some of these resale condo options.

- On a related note, if you want to escape the urban jungle, here are homes under $1 million that still offer a great view of some greenery.

- And if you are looking for a landed home, but still want facilities (and don’t want a cluster landed), we’ve found 44 landed homes within a condo development for you to consider.

Weekly Sales Roundup (10 – 16 Apr)

More from Stacked

Will Rich Foreigners Still Want Your Prime District Condo In 2022?

As of December 2021, there’s been an ongoing debate on whether Singapore property is still attractive to foreigners. Some believe…

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TERRA HILL | $8,200,000 | 3035 | $2,701 | FH |

| KLIMT CAIRNHILL | $7,600,000 | 2056 | $3,697 | FH |

| KLIMT CAIRNHILL | $5,710,000 | 1496 | $3,816 | FH |

| CAIRNHILL 16 | $5,580,800 | 1744 | $3,200 | FH |

| AMBER PARK | $5,452,000 | 2142 | $2,545 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TEMBUSU GRAND | $1,321,000 | 527 | $2,505 | 99 yrs |

| THE LANDMARK | $1,331,000 | 495 | $2,688 | 99 yrs (2020) |

| ONE HOLLAND VILLAGE RESIDENCES | $1,494,790 | 484 | $3,086 | 99 yrs (2018) |

| MIDTOWN MODERN | $1,503,810 | 409 | $3,677 | 99 yrs (2019) |

| THE AVENIR | $1,668,000 | 538 | $3,099 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE PARK | $13,008,888 | 2885 | $4,510 | FH |

| PARC STEVENS | $7,850,000 | 3466 | $2,265 | FH |

| THE LADYHILL | $7,280,000 | 2411 | $3,019 | FH |

| RIVERGATE | $5,750,000 | 2088 | $2,754 | FH |

| WALLICH RESIDENCE | $5,385,000 | 1636 | $3,291 | 99 yrs (2011) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $631,000 | 431 | $1,466 | 99 yrs (2011) |

| EDENZ LOFT | $650,000 | 420 | $1,548 | FH |

| AVANT RESIDENCES | $660,000 | 388 | $1,703 | 99 yrs (2012) |

| THE CRISTALLO | $661,888 | 431 | $1,537 | FH |

| THE VUE | $688,000 | 420 | $1,639 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ARDMORE PARK | $13,008,888 | 2885 | $4,510 | $8,158,888 | 22 Yrs |

| BOULEVARD 88 | $14,000,000 | 2799 | $5,002 | $3,872,000 | 4 Yrs |

| THE LADYHILL | $7,280,000 | 2411 | $3,019 | $3,470,570 | 20 Yrs |

| PARC STEVENS | $7,850,000 | 3466 | $2,265 | $2,651,000 | 16 Yrs |

| RIVERGATE | $5,750,000 | 2088 | $2,754 | $2,555,360 | 14 Yrs |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY SUITES | $5,250,000 | 2680 | $1,959 | -$1,136,000 | 13 Yrs |

| WATERSCAPE AT CAVENAGH | $2,230,000 | 1184 | $1,883 | -$235,000 | 13 Yrs |

| THE CREEK @ BUKIT | $2,300,000 | 1572 | $1,464 | -$191,532 | 5 Yrs |

| MARINA BAY RESIDENCES | $1,540,000 | 732 | $2,104 | -$183,190 | 13 Yrs |

| DAISY SUITES | $1,105,000 | 764 | $1,446 | -$70,000 | 10 Yrs |

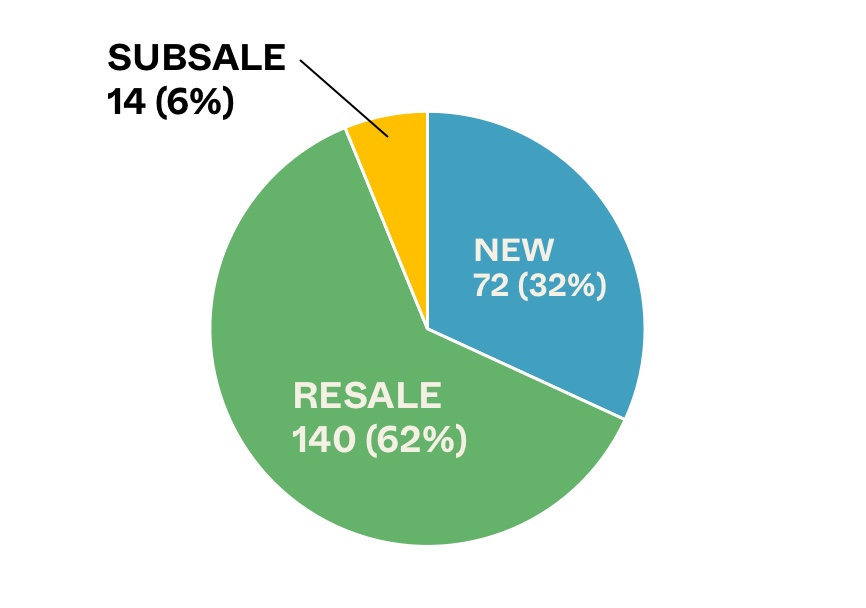

Transaction Breakdown

My interesting links of the week

- Wealthy Indonesian family spends $206.7 million on 3 Nassim mansions

3 Nassim mansions (42, 42A, 42B) changed hands for an average of around $69 million per home, or about $4,500 psf.

If anyone is keeping tabs, that per square foot sale is a new record high when it comes to landed homes in a GCB area, surpassing the last $4,291 psf paid for a Cluny Hill bungalow.

What does that say? Well, the ultra rich continue to pour money into Singapore, and we can probably look to more high-end developments to come up soon given the existing new launch stock is close to being depleted.

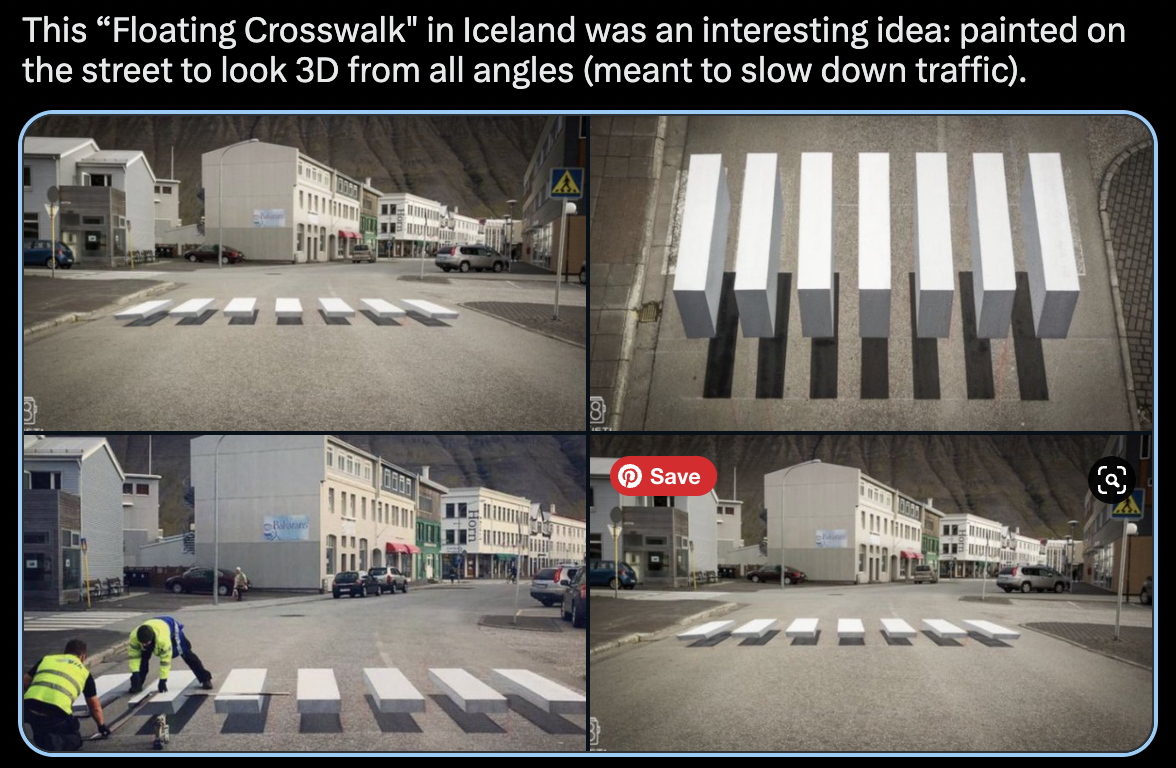

- Floating crosswalk to slow down traffic

I found this on Twitter, and just as I stopped mid-scroll, I would say the same effect would happen as motorists come into contact with such an innovative crosswalk.

On first glance, it looks like it would definitely work. But it also does beg the question of how distracting it could be (that it may cause unintended accidents) or whether it loses its effectiveness once locals get used to it.

I suppose in areas with a high concentration of new visitors this should work well, but perhaps not in residential neighbourhoods when you drive past everyday!

It reminds me of the piano stairs, where just transforming stairs into a piano encouraged 66 per cent more commuters to take the stairs (instead of the escalator) for health reasons.

I can’t quite think of a similar example in Singapore (if you do know one please reply to this!), but it does make you wonder about the little tricks that can be done to improve real estate instead of the same usual boring stuff.

Over the coming weeks, I think an interesting place to look will be the en-bloc market. Developers are at something of a crossroads right now – they need to replenish their land banks, but the wider situation is turning them cautious. Higher Land Betterment Charges, and now changing GFA definitions, may cause even larger developers to put on the brakes; and I do suspect less generous en-bloc offers will be on the table.

Follow us on Stacked, to keep updated on the situation.

Featured Image Credit: koryoya.com

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are houses in rural Japan really as cheap as $33,000?

What are the main issues with buying old houses in rural Japan?

Why do some Singaporeans consider buying cheap houses abroad?

Can buying a cheap house in Japan be a good investment?

What should I be cautious about when purchasing a house in Japan for investment or personal use?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments