DBS Thinks Singapore Property Prices Could Rise Another 55% by 2040 — And the Reasons Might Surprise You

November 6, 2025

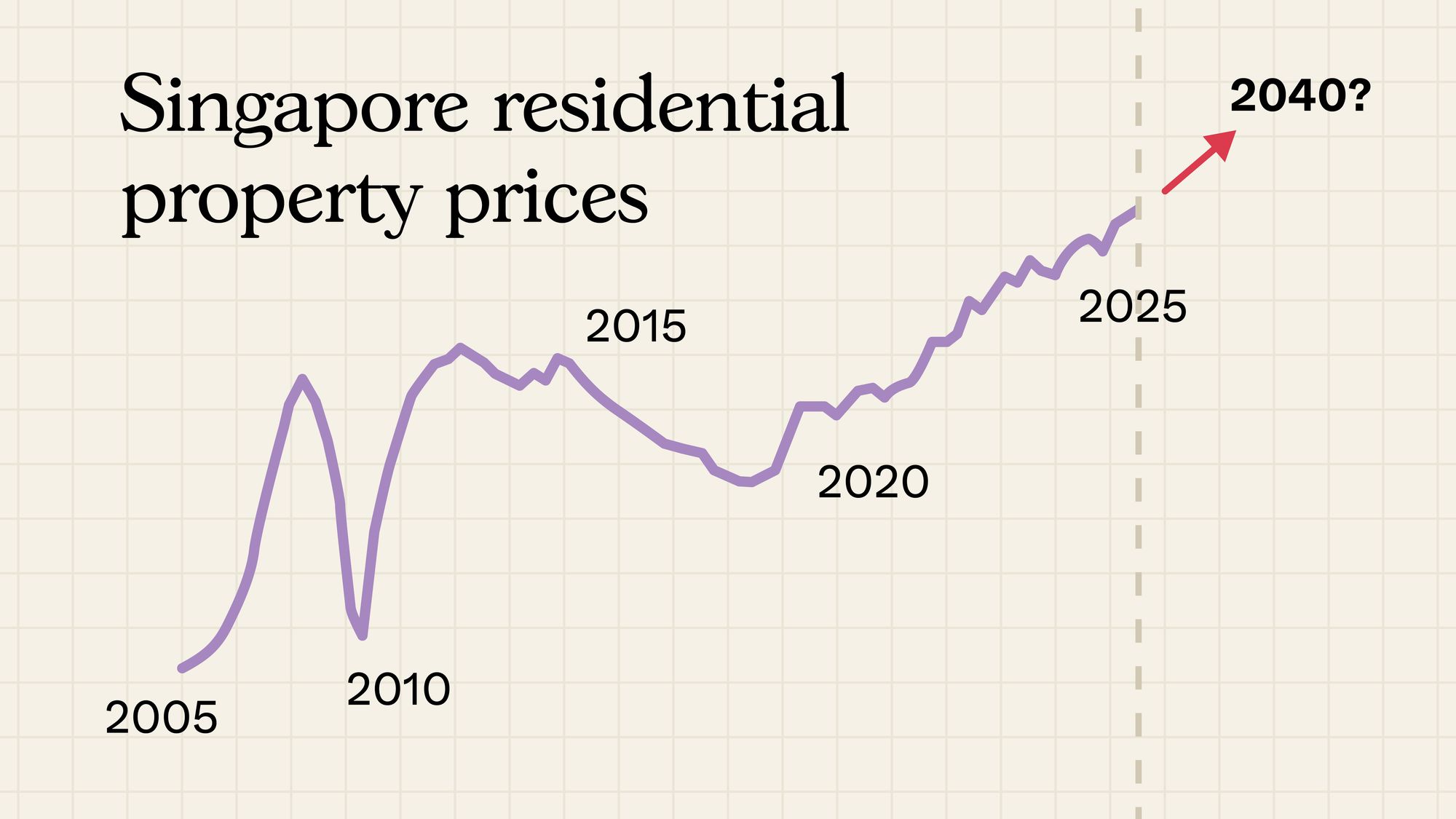

Amidst migraine-inducing prices this year, a common refrain we’ve heard is “It’s unsustainable, the prices MUST come down eventually.” So when DBS reported a possible price increase of between 35 and 55 per cent by 2040, we could practically hear the blood vessels popping. But DBS isn’t being unrealistic here – not when we face the conundrum of a rising population, plus an increasing reluctance for more of us to live under the same roof. It’s a little like the DBS report I mentioned from 2018 – its projected price hikes seemed implausible then, but here we are today.

And if this has you thinking, “Surely prices can’t keep climbing forever,” you’re not the only one. Many buyers are still trying to square what they see in listings with what the data shows. Tell us what you’re considering and we’ll connect you with one of our trusted partner agents who can help you make sense of where prices really stand, beyond the headlines.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What does the DBS report say?

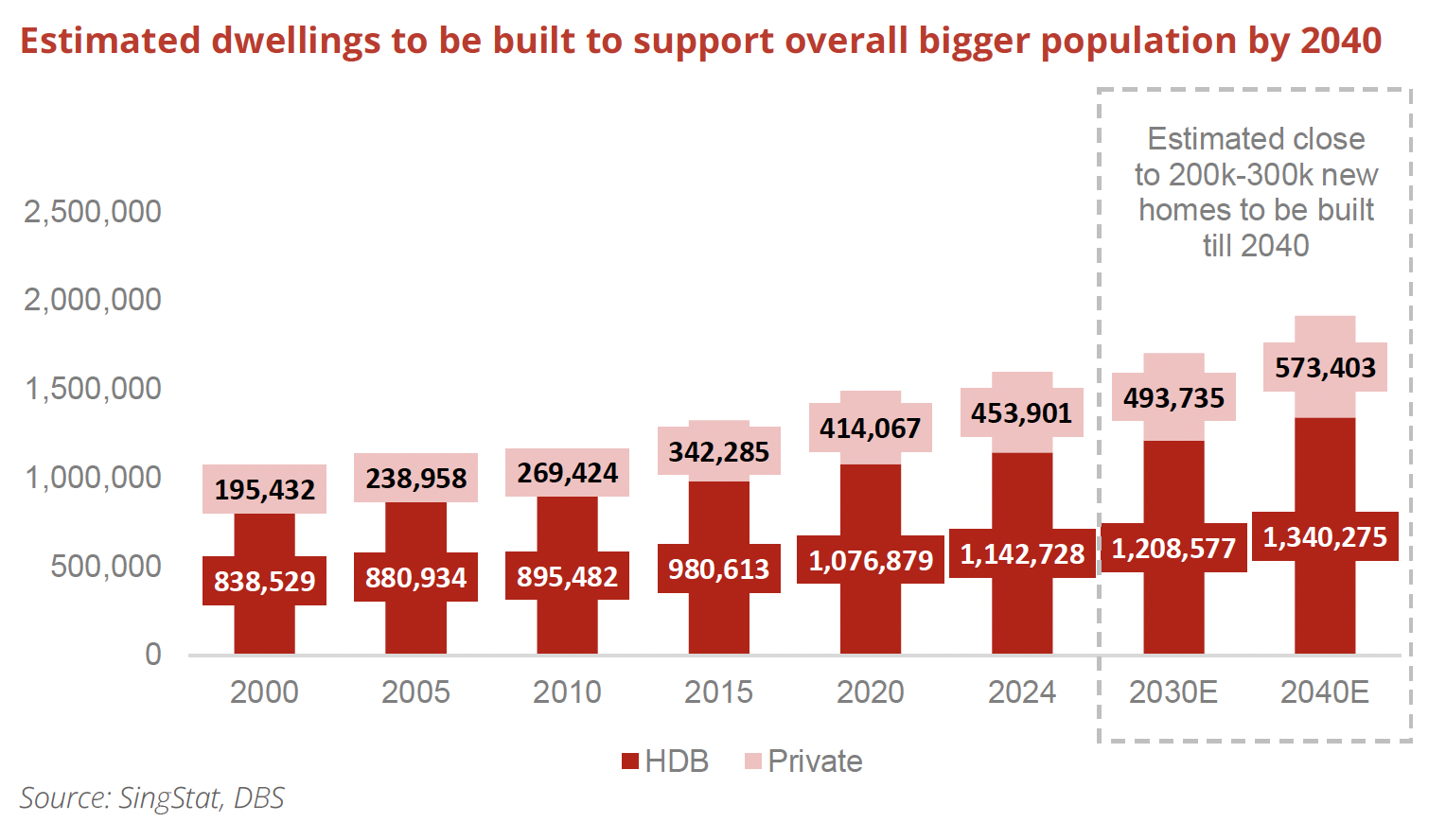

In its latest report (Singapore 2040: The Next 15 Years of Quality and Inclusive Growth), DBS projects that Singapore could see up to 320,000 new homes built by 2040. This is across both public and private sectors:

This is where the expected new supply will come from:

| Housing Area | Est. no. of new homes |

| Paya Lebar Air Base-Defu* | 150,000 |

| Bukit Timah Turf City | 15,000 – 20,000 |

| Former Singapore Racecourse site at Kranji | 14,000 |

| Marina South | 10,000 |

| Sembawang Shipyard | 10,000 |

| Former Keppel Golf Course | 9,000 |

| Mount Pleasant | 6,000 |

| Pearl’s Hill | 6,000 |

| Dover-Medway (Phase 1) | 6,000 |

| Mediapolis | 5,000 |

| Newton | 5,000 |

| Paterson | 1,000 |

*The planned relocation of Paya Lebar Air Base provides the largest source of new homes; you can read more about it here.

However, all this increased supply isn’t expected to lower prices.

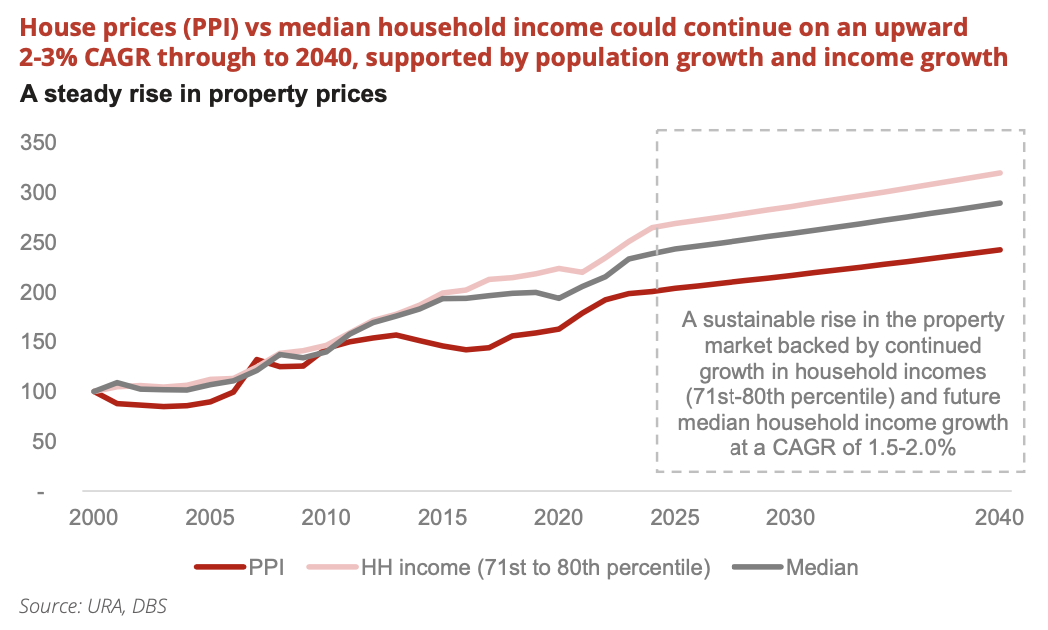

In fact, despite the ramp up in supply, DBS forecasts that property prices will rise by an average of two to three per cent annually, or between 35 to 55 per cent higher than the present, by 2040.

These projections come with an important caveat: they don’t distinguish between HDB and private housing. HDB prices are more tightly controlled by the government; as such, the 35 to 55 per cent projected price increase refers to the overall housing market, rather than specifically to private condos or public flats. It’s also plausible that the government won’t let BTO flats rise at the same pace, whether through increased subsidies or other methods. Private markets, however, are more loosely controlled except via cooling measures.

(As for the resale flat market though, we have no idea how hands-on or hands-off they’ll choose to be.)

In any case, the ramp up in construction supports a rising population, expected to hit about 6.9 million over the next 15 years. The population increase compounds the issue of shrinking household sizes: more Singaporeans – both old and young – are choosing to live independently, as opposed to the whole family living under one roof.

These two factors alone are already sufficient to keep home prices moving upward. But if we then add in median income growth, projected to reach about $7,000 per month by the mid-2030s, then there’s also structural support for those rising prices.

We’re not economists, so we can neither confirm nor deny that median income will reach that level; but if you care to read the report, it appears to be based on GDP growth and on Singapore entering the US$1 trillion GDP club sometime in the next decade.

GDP aside though, we also wonder if an ageing population and a huge transfer of generational wealth (from parents’ saved-up CPF monies, properties handed down to children, etc.) will play a role in supporting rising home prices.

All of this also assumes three factors hold true, going into 2040: Singapore’s continued economic growth, the predicted population increase, and policy stability. It wouldn’t do to ignore the fact that our government is heavily interventionist when it comes to housing policy, and cooling measures can intensify at any moment.

More from Stacked

Why July 2025 Could Be the Best Time Yet for Singles and Second-Timers to Apply for a BTO

By now, it’s pretty well established that being single in Singapore doesn’t go hand-in-hand with being a homeowner. It’s not…

There’s one other factor that we feel should be considered; and that’s land prices

GDP growth can also influence land prices. As the economy expands, overall income, business confidence, and capital flows should (theoretically) rise in tandem. When that happens, land prices tend to go up accordingly.

A strong GDP outlook signals that buyers will have higher purchasing power down the road, and that can also raise developer confidence and their bids. As for how land prices affect condo prices, we have some details here. Overall though, suffice it to say that rising land costs – tied to rising GDP – can also prop up real estate prices.

It’s also worth noting that, if the property market is truly booming, the government lowering reserve prices may not help. Just because a developer is able to buy the land cheaper doesn’t mean they won’t peg property prices to existing market norms or new launches anyway.

Some of these factors are already reflected in the current property market

The most glaring example of this is shrinking unit sizes. As we’ve mentioned here, there are now small families that purchase two-bedders in the 600 to 700+ sq ft. range, for owner-occupancy. This would have been frowned on in the 2010s or earlier, when one or two-bedders were considered mainly rental assets and too small for own-stay use.

But with families shrinking, and some retirees choosing to right-size to one or two-bedders, the dynamic has shifted. We can also see, from projects like River Green, that developers care much less about $PSF and more about quantum. The market has responded well to this, as we’ve seen at launches like Penrith.

With fewer family members under one roof (which can also mean fewer co-owners), it makes sense that lower quantum, smaller housing is making a comeback.

We’ve also seen that very large older condos – particularly the pricey freehold ones – have more issues going en-bloc these days. That’s also a reflection of the changing market: with the government offering up more sites for sale, developers are less inclined to chase collective sales; this could be amplified by the freeing up of even more land once Paya Lebar Air Base and the aforementioned sites open up. We can also see that the appetite for en-bloc sales has fallen a bit, as prospective sellers realise that rising prices make replacement properties tough to find (or at least, a lot smaller than they’d like.)

So with all this in mind, can property prices ever drop?

One possible avenue is, as usual, cooling measures. The government could tighten Loan To Value (LTV) limits, lower debt servicing ratios, etc. This has traditionally worked to cool the market, and would be the most direct way to slow prices.

With regard to resale flats, there could be some relief for older Singaporeans, who can tolerate shorter leases. With SERS now at an end, we might finally see the prices of some older flats – even those in hotspots like Queenstown or Tanjong Pagar – start declining. This could offer a well-located and spacious alternative for older Singaporeans, at prices that aren’t moving the same way as the wider (newer) market.

It’s also worth noting that this DBS report, like the one we saw in 2018, focused on $PSF – but the recent trend of building smaller homes, along with GFA harmonisation, means we’re seeing $PSF go up but not necessarily the quantum (overall cost) of a home. This could be a bit of a silver lining, although one hopes that our homes won’t shrink too much.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does the DBS report say about future property prices in Singapore?

Will the increase in housing supply in Singapore lower property prices?

How might government policies affect future property prices in Singapore?

What factors are supporting the projected rise in Singapore property prices?

Could property prices in Singapore ever decrease?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments