Revealing The Most Profitable New Launch Condos Since 2018 (Find Out Which Bedroom Types Earned the Most)

August 22, 2024

If you are one of those who bought from the bumper crop of new launch condos between 2018 to 2022, you’d be mostly happy with your decision. Prices have risen tremendously since the Covid-19 era, and there have been very few unprofitable transactions since then.

In this piece, we’ve compared the gains between projects, for those who bought new from developers. Here’s what we’ve learned from all those who have made money so far:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

New launches that would have made you money

As price psf tends to increase if the unit is smaller (and vice versa), we’ve divided the following into different segments, by the number of bedrooms:

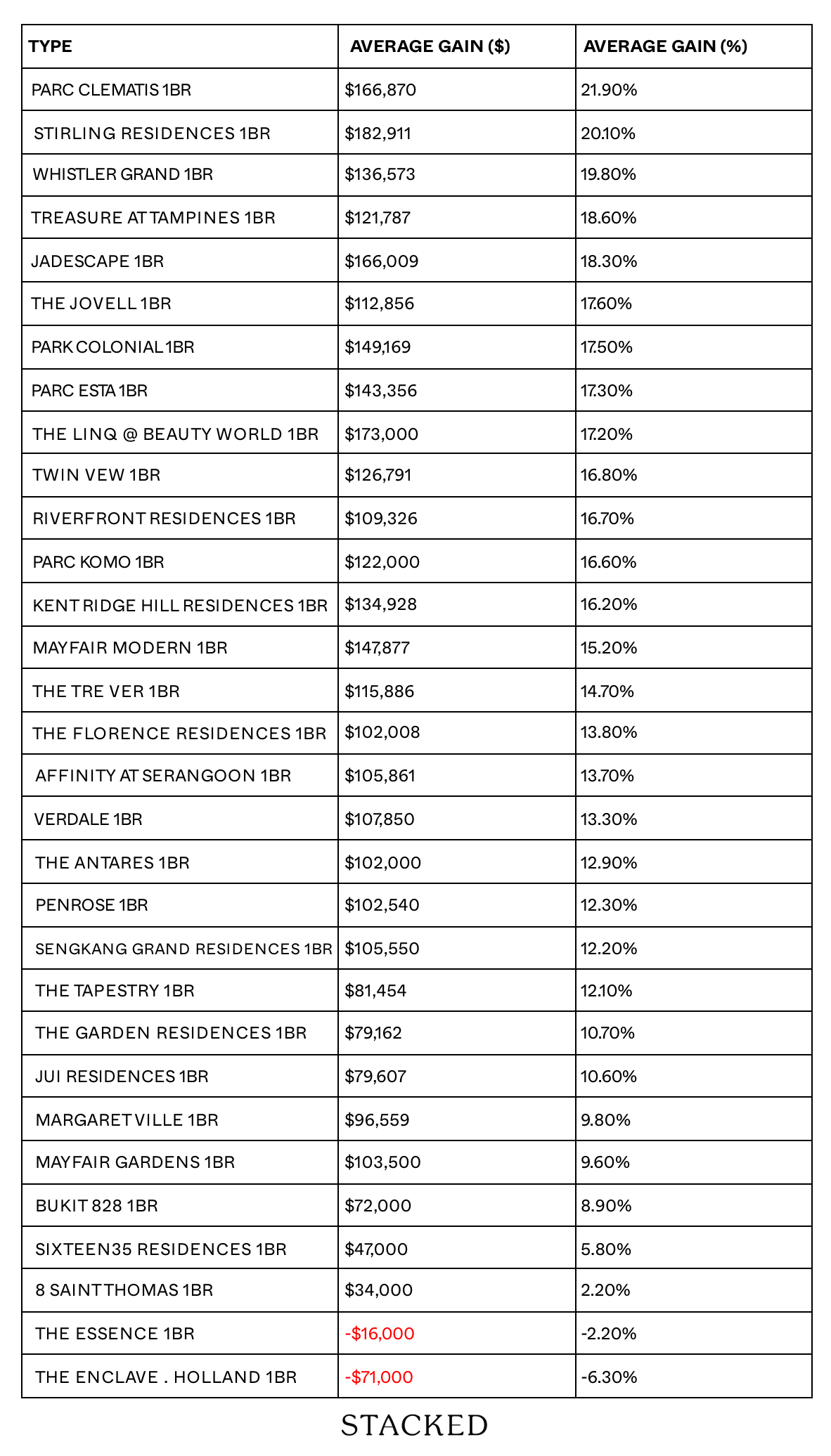

1 Bedders

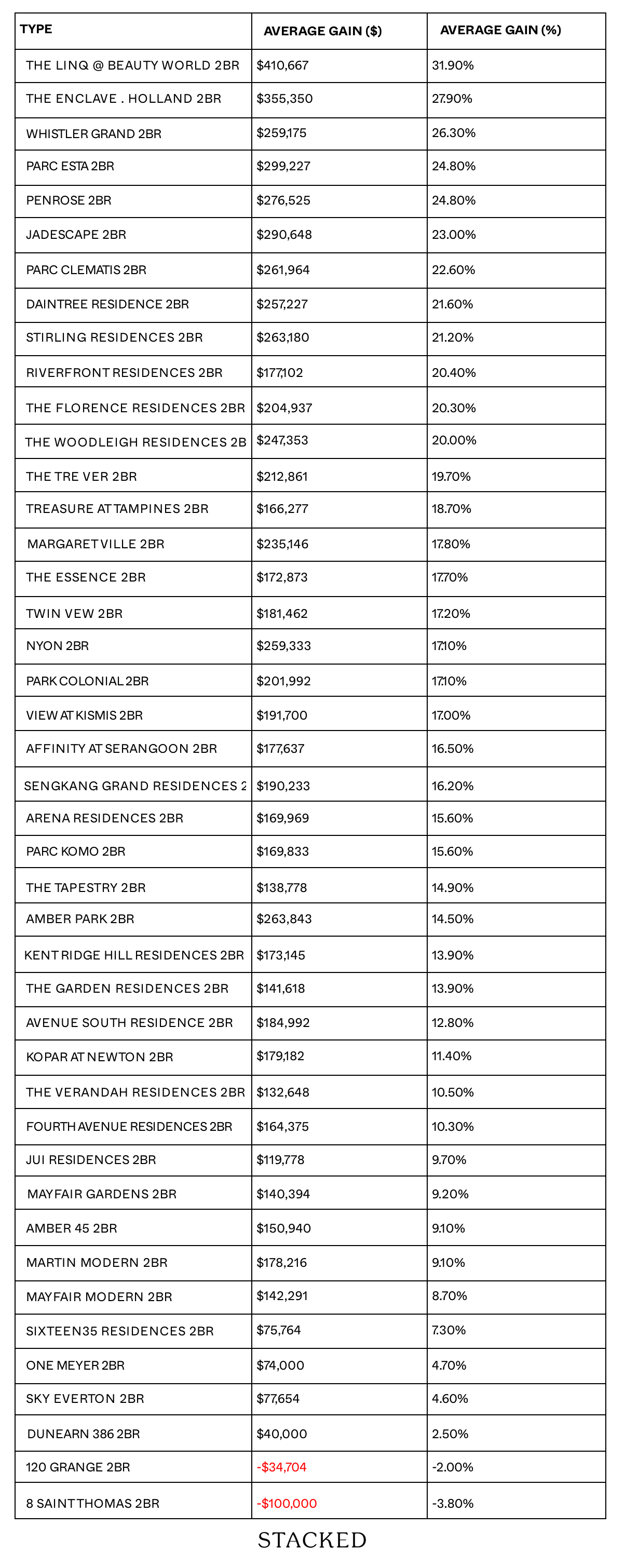

2 Bedders

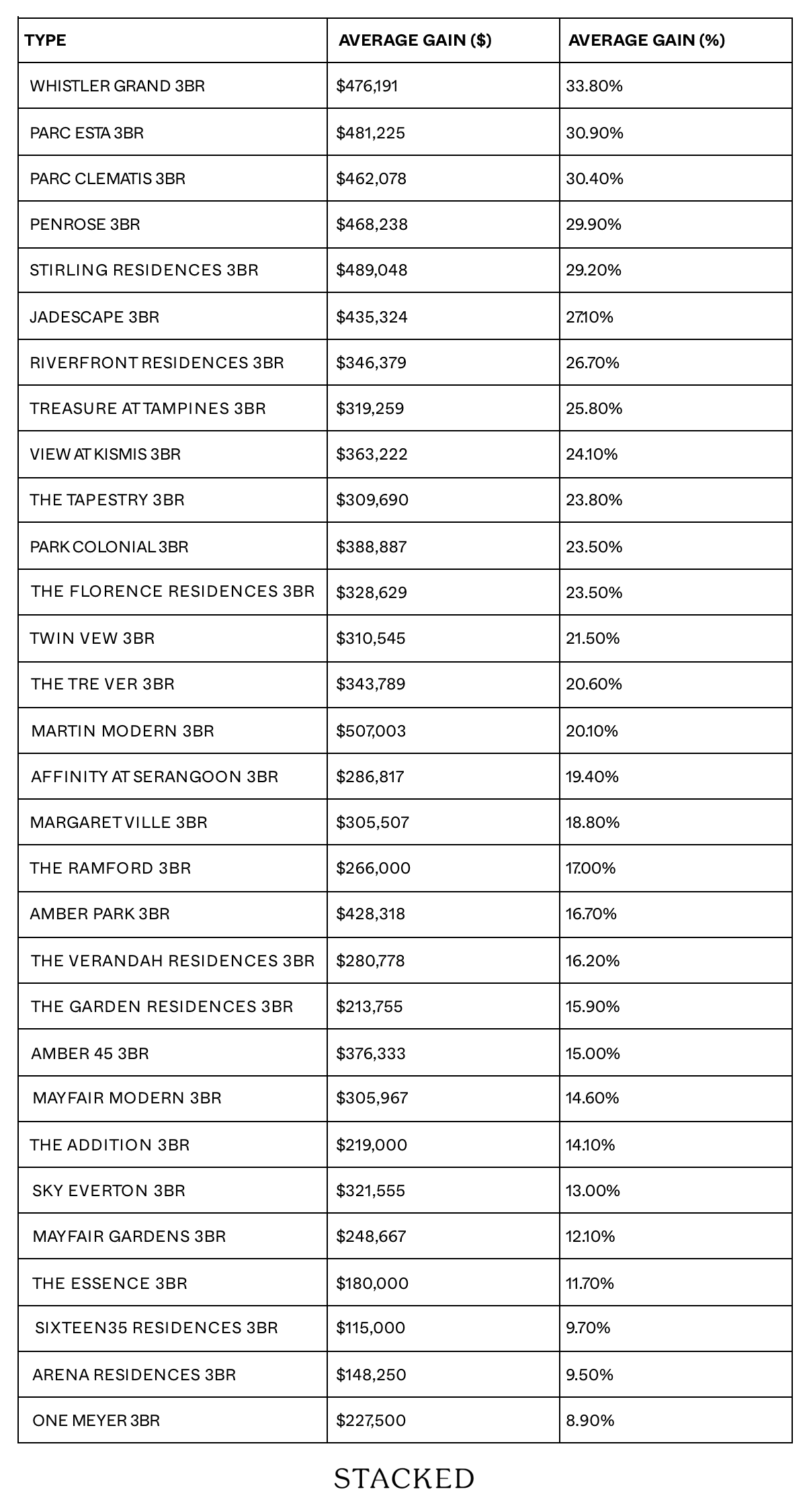

3 Bedders

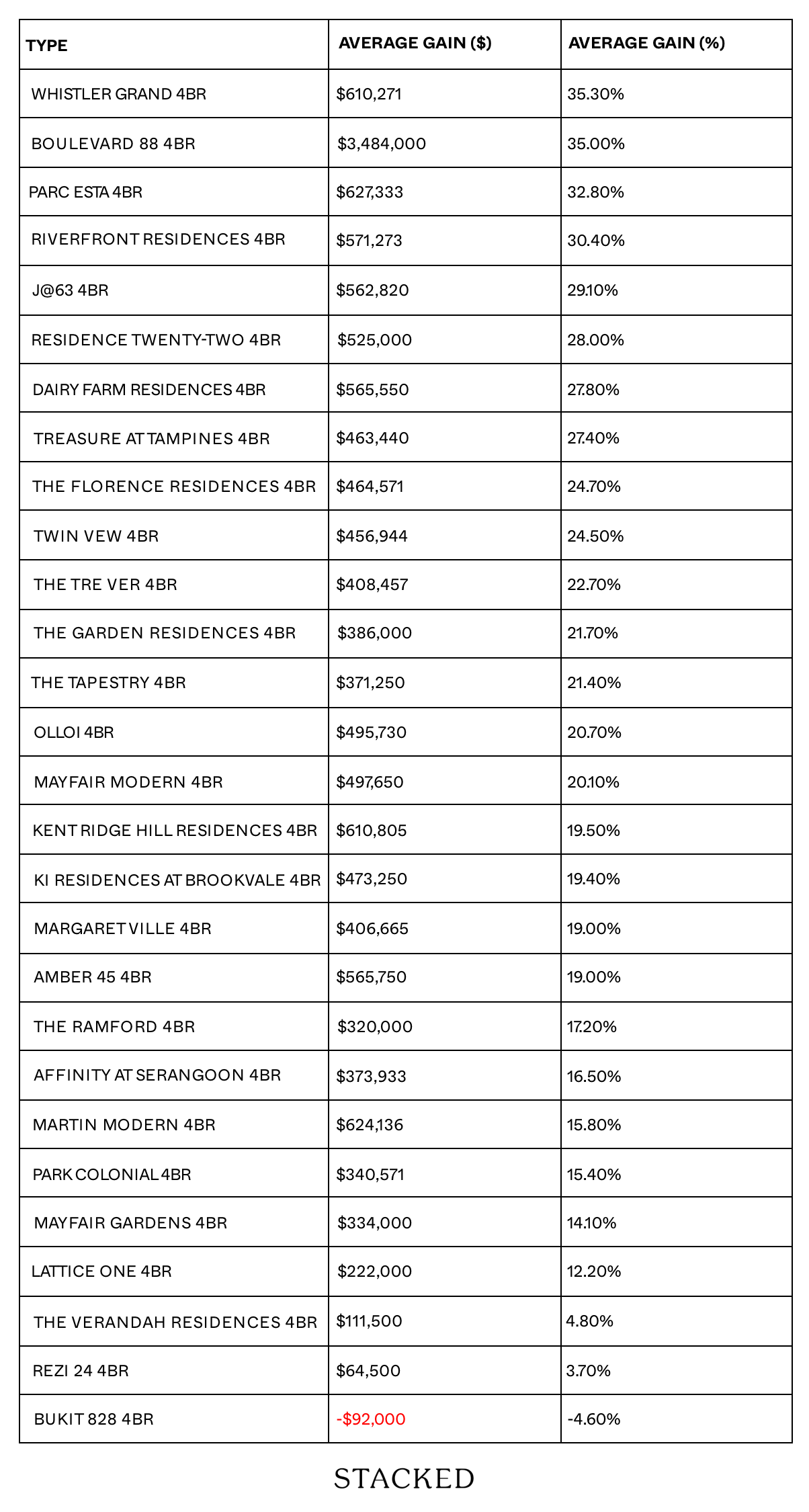

4 Bedders

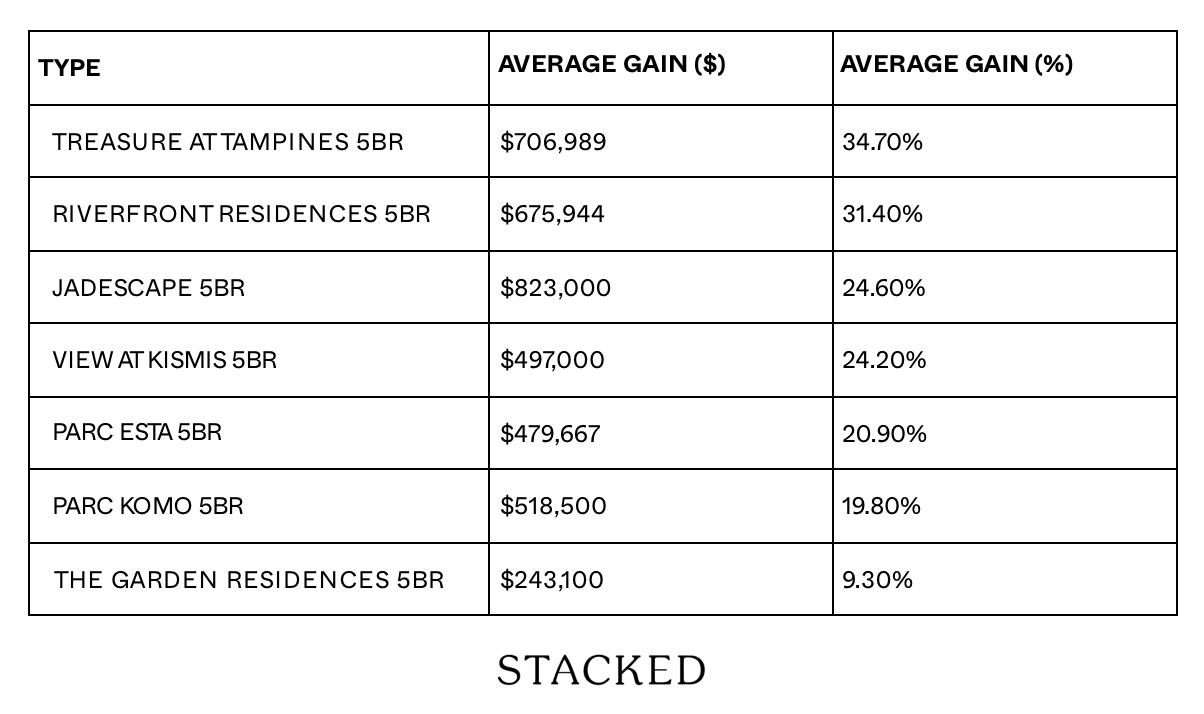

5 Bedders

A quick snapshot of the top and bottom projects

As far as an overall “best” goes, this would appear to be Whistler Grand. It was among the top three for all categories (all sizes). This is related to its lower initial price psf. We have touched on this in an earlier unrelated article: while comparing Whistler Grand to Twin VEW, we noticed the developer aggressively priced Whistler Grand lower, despite paying a higher land price. It was simply a good deal for buyers all around.

When trying to determine the weakest performance though, several factors prevent easy conclusions. The one-bedder at Penrose seemed to not fare as well, for example, but all its larger units did well. Likewise, The Garden Residences seemed to underperform compared to Affinity at Serangoon, but this only seems true for unit sizes besides four-bedders.

Freehold versus leasehold

As the topic is likely to come up, do note that the bulk of projects we looked at are predominantly leasehold (inevitable due to their more common nature.) There are 10 freehold projects compared to 405 leasehold projects.

Here’s a breakdown of the qualifying transactions:

| Type | |

| Total freehold buy/sell transactions | 220 |

| Total leasehold buy/sell transactions | 3275 |

| Freehold-to-leasehold ratio | 6.7% |

Here’s a breakdown of the top 25 qualifying transactions:

| Type | |

| Freehold buy/sell tnx | 10 |

| Leasehold buy/sell tnx | 777 |

| Freehold-to-leasehold ratio | 1.3% |

Mass-market condos are more likely to be leasehold, as are large condos. Where you see better profits for these, it’s commonly due to their lower cost, as there’s no freehold premium.

That said, when it comes to unit sizes, the top three performing units we found were:

- J@63 (for four-bedder): This is a boutique freehold project in District 15, and the four-bedder unit has an annualised return of 12.9 per cent.

- Jadescape (for five-bedder): The five-bedders in Jadescape are almost 2,100 sq. ft., and the transactions show an annualised return of 9.3 per cent. Leasehold status (i.e., no freehold premium), coupled with a highly desirable RCR location and relative newness, may be contributing to this.

- Treasure at Tampines (for five-bedder): Treasure is Singapore’s biggest condo to date, and the five-bedders can be upward of 1,720 sq. ft. Due to Treasure’s competitive pricing from the get-go, and its appeal as a family condo, its larger units unsurprisingly had a lot of room for appreciation.

The bottom three overall were:

- 8 St. Thomas (for two-bedder): This luxury project is about equidistant from Somerset and Great World, but saw a decline of about 0.9 per cent.

- 120 Grange (for two-bedder): This freehold, 56-unit luxury condo is located near Orchard Road. Price movement was almost flat (down a minuscule 0.3 per cent), for largely the same reasons as 8 St Thomas.

- Bukit 828 (for four-bedder): This is a freehold, 34-unit condo along Upper Bukit Timah Road, close to Hillion Mall. The 1,335 sq. ft. four-bedder unit saw a price decline of 2.9 per cent.

What we’ve learned from observing the new launches

Buyer tendencies have changed significantly, from the days when the “shoebox craze” predominated. Likewise, the performance of CCR condos – which were once hailed as being “recession-resistant” due to their prime location – may have garnered less confidence in recent years.

More from Stacked

$317K Condo Profit Vs $105K: We Analysed How Views Affected Clement Canopy Resale Gains

In this Stacked Pro breakdown:

Buyers who fared best with new launches may be the ones who held contrarian opinions and bought regardless of prevailing beliefs. One example would be those who bought on lower floors, or who – despite having bigger budgets – still chose to stick with mass-market, leasehold units in the OCR. From this, here are a few conclusions regarding the current market:

1. The OCR appears ideal for risk-averse investors

The OCR made up around 60 per cent of the top 25 categories here, so it has the most volume. Across all unit sizes, OCR properties generally show the most consistent appreciation. This is also partly because leasehold dominates the OCR, as well as lower initial prices. Apart from one quirk (Bukit 828 in District 23), and a very slim loss at The Garden Residences, no OCR project recorded a loss.

This conclusion probably isn’t of a surprise to anyone, as these areas are where genuine homebuyers are looking at, as well as form the bulk of HDB upgraders.

Another factor, which isn’t reflected in the data here, is that the OCR has the lion’s share of prospective buyers. The quantum of OCR units is generally within the budget of HDB upgraders (usually no more than $1.8 million), which means OCR units also tend to sell at fair prices in a shorter time.

2. The CCR is much more volatile

No surprises here either, as the CCR does have the potential for much steeper losses; and the risk will increase in coming years, as recent ABSD rate hikes have seriously impacted this segment.

That said, the CCR shows a wide range of performance, with both significant losses and significant gains. While 8 St Thomas and 120 Grange came in at the bottom for gains, do note that Boulevard 88’s four-bedder did have strong annualised returns of 9.6 per cent.

So if you were to compare within the development itself, the large four-bedder units were very profitable for the first buyers of B88, as compared to those who bought the smaller three-bedder units.

The high buy price and volatility, however, make this a tough call for new investors. The full impact of the ABSD also remains to be seen: while the number of foreign buyers has declined, local investors may be eager to seize upon the narrowing price gap between RCR and CCR properties, thus providing some price support.

3. Bigger units generally perform better

Larger units tend to perform better, especially in the OCR (as Treasure at Tampines shows). Even among freehold CCR projects, the better performers were the four-bedders like Boulevard 88; while three-bedders (see The Tre Ver and The Verandah) also generally came out ahead.

This would suggest that investors going for one or two-bedders should emphasise longer-term gains from rental income (the rental yield is likely higher than larger units, due to the lower quantum), and temper their expectations for gains.

For more on the Singapore private property market, and reviews of new or resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments