1,765 Punggol Northshore HDB Flats Reaching MOP: Should You Sell Quickly or Wait?

June 7, 2025

One of Punggol’s HDB clusters, the Northshore projects, are reaching their Minimum Occupancy Period (MOP) this year. Given the strong seller’s market in June 2025, this is a good opportunity for those who want to upgrade, be it to a private property or just a larger HDB flat. However, these sellers are facing a bit of a unique situation – while they have an excellent opportunity, the window of time that they have is also very slim. Here’s a rundown of the situation:

Table of contents

What’s happening at Northshore?

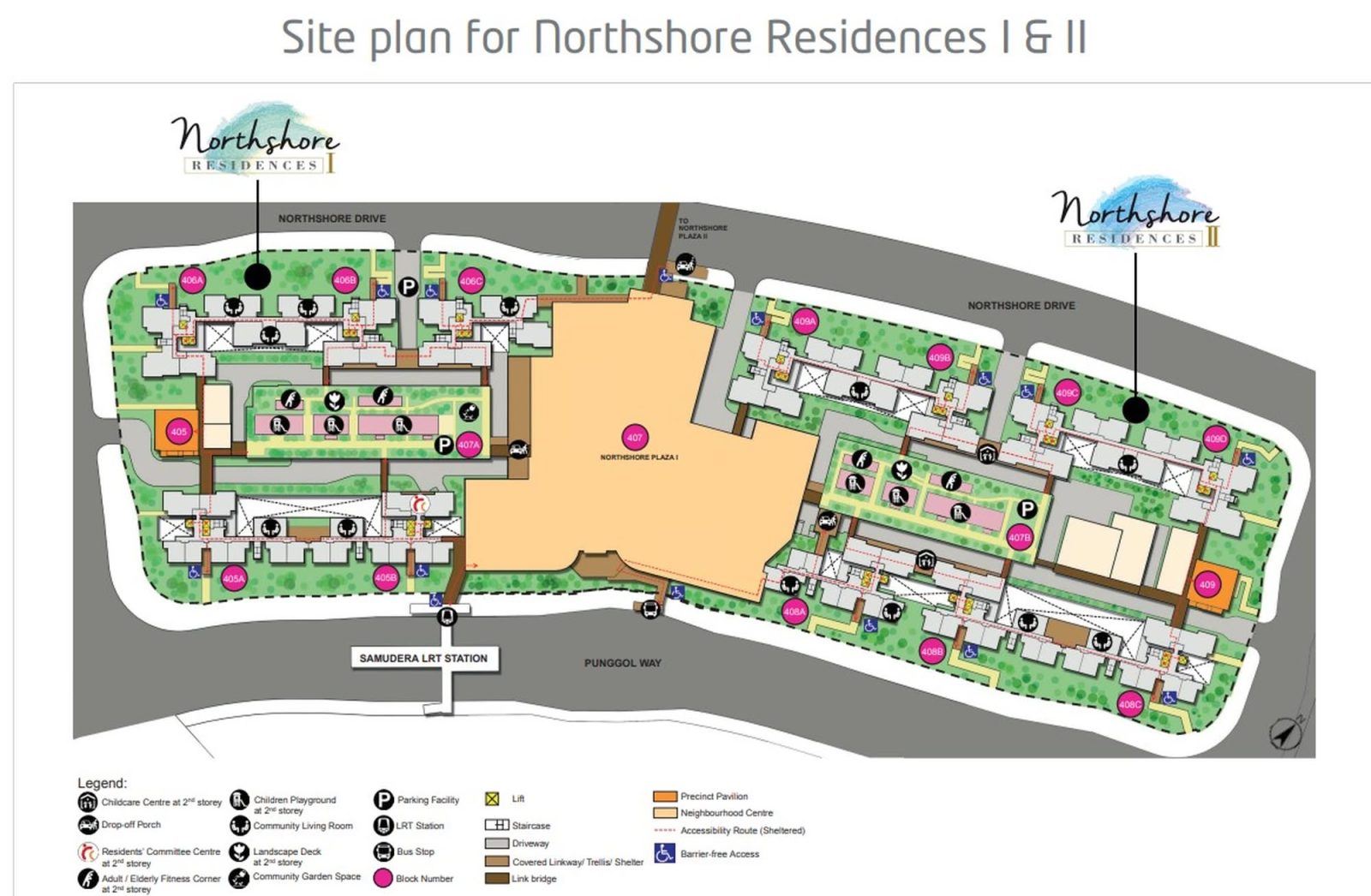

Northshore is a waterfront district located along Northshore Drive in Punggol. It’s made up of three main projects reaching MOP in 2025: Northshore Residences I & II, and Northshore StraitsView.

While there’s no MRT station within walking distance, these blocks have an LRT connection via Samudera and Punggol Point stations. This area is adjacent to Punggol Waterway Park and Coney Island, so it is a desirable seafront estate.

(Samudera LRT is closer to Northshore I & II, while Punggol LRT is closer to Northshore StraitsView).

Now with all three projects reaching MOP at around the same time, resale flat buyers and agents will soon be focusing their attention here.

An unusual concentration of units joining the resale market all at once

Collectively, Northshore Residences I & II and Northshore StraitsView can contribute around 1,765 units to the resale market in 2025. From word on the ground, the estimates are about 588 to 814 potential units from Northshore I & II, and around 1,021 units from StraitsView.

All in, this would be one of the largest concentrations of MOP flats entering the market from a single estate, for the year.

Most of these “new” resale flats (i.e., flats fresh out of the five-year MOP) are also 3-room and 4-room units. These are the most common sizes sought by resale buyers, as they’re sizeable enough for families but also more affordable than 5-room units.

Why Northshore sellers face a tight window

Resale flats command the highest premiums when they’re fresh out of MOP. At this point, they’re ready to move in, existing renovations are very new (i.e., less cost and delay to move in, compared to an old resale flat), and the lease decay is negligible.

But this golden period doesn’t last long, especially with the large number of units potentially entering the resale market at Northshore. Within six to 12 months, more owners will likely start listing, increasing supply. As more supply crowds into the same area, later sellers may see diminishing offers.

This places emphasis on what some agents refer to as the “MOP window” — a short-lived moment of peak resale value, where a well-marketed flat can fetch a premium before the floodgates open.

Simply put, the earliest sellers at Northshore stand to see strong gains; but they need to move fast.

More from Stacked

How Covid-19 May Have Ended Up A Boon To Resale Flats

HDB resale prices and volumes have seen a sharp rebound as of Q3 2020. After almost seven straight years of…

There are also concerns about resale supply in the wider market

Agents said that in the wider market, there are about 6,974 resale flats expected to reach MOP in 2025. While around 43 per cent of MOP flats in 2025 are in Punggol (thanks to Northshore), 22 per cent are in Toa Payoh, 11 per cent are in Tampines, and the rest are spread across Ang Mo Kio, Bedok, and Clementi

Some of these, like Toa Payoh and Tampines, are in notably high-demand, mature areas. So while most of the competition is centred in Punggol, flats in these other areas can offer some serious competition as well (albeit for buyers with higher purchasing power).

Then there’s the upgrade crunch, which also encourages speed

Agents noted that, even if a Northshore flat sells for a respectable $750,000 to $800,000, upgrading is still more challenging this year compared to previous years. Even in the OCR, many new launch family condos are reaching a quantum of about $2 million.

A minimum down payment of 25 per cent is needed to purchase these units, which already comes to about $500,000 for a $2 million unit (and remember that the upgraders will need to refund their CPF usage from the sale of their flat).

The longer they wait, the bigger the potential price gap, so those looking to upgrade will have to move fast. This isn’t specific to the Punggol area, but it’s yet another element that adds to the urgency.

So what can sellers do?

If you’re a Northshore owner planning to sell in 2025, a few things can help:

- Be early. Listing shortly after MOP may give you a crucial advantage in pricing and visibility. Again, you want to try and sell before the floodgates open, and a whole slew of listings rushes to join yours.

- Stand out. Invest in small upgrades or good home staging to compete with other similar units. Staging a five-year old flat is generally easier and cheaper to do, as the condition already tends to be good.

- Price realistically. Don’t just follow the highest asking price on a portal, look at actual transactions from the HDB website. If you’re unclear on pricing, reach out to us at Stacked so we can help.

- Plan your upgrade before selling. It’s not feasible for most Singaporeans to buy their condo before selling their flat (because unless it’s a new EC, you’ll end up paying upfront ABSD). So there will be logistical challenges, as you need to sell, find accommodation, and then buy and wait for your new home. This has to be planned out early on, to minimise the cost of long rental and storage periods.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is happening with the resale flats in Northshore Punggol in 2025?

Why is there a limited time window for Northshore flat owners to sell?

How does the large number of flats reaching MOP in Northshore affect sellers?

What other areas have flats reaching MOP in 2025, and how does this impact the market?

What should Northshore flat owners consider when planning to sell?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments