October 2024 BTO Breakdown: Prime And Plus Projects Revealed (And Key Details To Note)

October 10, 2024

The October 2024 BTO launch is just around the corner as we write this, and it’s one of the most significant in recent years. This will be the first launch using the new classification system, where flats are divided into Standard, Plus, and Prime categories. The launch will involve 15 HDB projects, of which seven are under the Plus category, and one is Prime. Here’s what you can expect:

The upcoming BTO sites

A quick note: we’ve already covered the sites in a previous article; but at the time we didn’t have a confirmed statement of which sites were Standard, Plus, or Prime. This is the current breakdown of flat numbers in each category. Note that the numbers are BTO launch estimates, so the exact numbers may differ slightly during the actual launch:

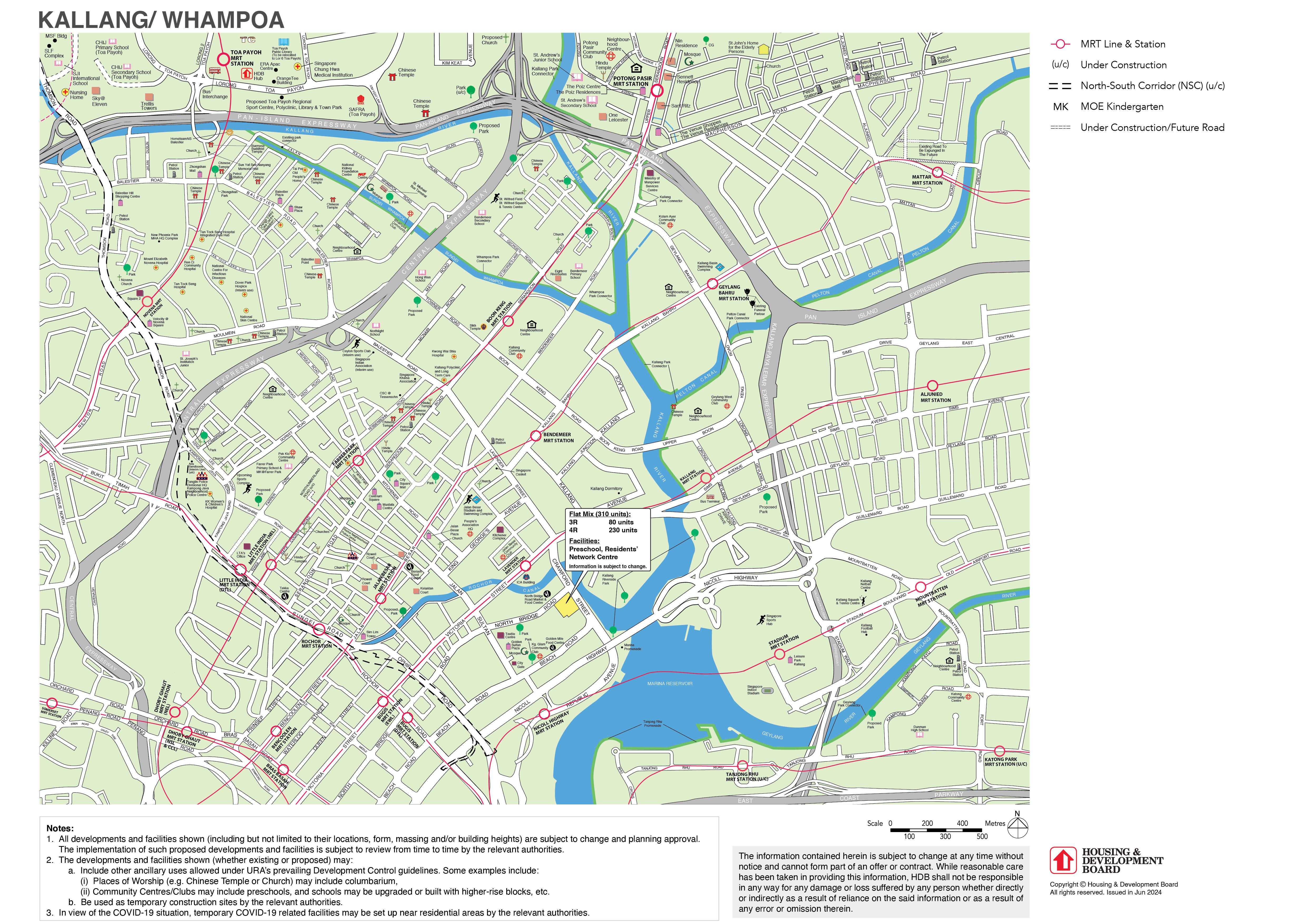

Crawford Heights (Prime, Kallang/Whampoa)

| 3-room | 4-room |

| 80 | 230 |

Kallang View (Plus, Kallang/Whampoa)

| 3-room | 4-room |

| 70 | 200 |

Tower Breeze (Plus, Kallang/Whampoa)

| 2-room | 4-room |

| 140 | 220 |

Central Trio @ AMK (Plus, Ang Mo Kio)

| 2-room | 4-room |

| 160 | 270 |

Bayshore Vista (Plus, Bedok)

| 2-room | 3-room | 4-room |

| 200 | 80 | 450 |

Bayshore Palms (Plus, Bedok)

| 2-room | 4-room |

| 160 | 550 |

Kembangan Wave (Plus, Bedok)

| 2-room | 4-room |

| 110 | 230 |

Merpati Alcove (Plus, Geylang)

| 2-room | 4-room |

| 260 | 160 |

West BrickVille (Standard, Bukit Batok)

| 2-room | 3-room | 4-room | 5-room | 3Gen |

| 130 | 90 | 260 | 170 | 40 |

Taman Jurong Skyline (Standard, Jurong West)

| 2-room | 3-room | 4-room | 5-room | 3Gen |

| 550 | 120 | 590 | 500 | 80 |

Costa Riviera I (Standard, Pasir Ris)

| 3-room | 4-room |

| 90 | 190 |

Costa Riviera II (Standard, Pasir Ris)

| 2-room | 4-room | 5-room | 3Gen |

| 140 | 200 | 110 | 30 |

Fernvale Oasis (Standard, Sengkang)

| 2-room | 4-room | 5-room |

| 180 | 340 | 320 |

Fernvale Sails (Standard, Sengkang)

| 2-room | 3-room | 4-room | 5-room |

| 130 | 90 | 220 | 110 |

Marsiling Ridge (Standard, Woodlands)

| 4-room | 5-room |

| 160 | 130 |

You’ll notice that this is a very high number of flats and locations for a single BTO launch (around 3,270 units). Indeed, the flats offered during the October launch will constitute around 40 per cent of the entire BTO supply for 2024, and it’s one of the biggest single launches we’re likely to see in some time.

Some interesting details about the Plus and Prime sites:

- 1. It’s possible to have Plus and Prime flats in the same town, in the same launch

- 2. In future, “Prime” may not just be based on proximity to the city centre

- 3. For now, there’s little difference besides the SR, between Plus and Prime

- 4. A cap on price growth due to the income ceiling and MSR

- 5. No fixed numbers on Plus or Prime offerings each year

1. It’s possible to have Plus and Prime flats in the same town, in the same launch

Crawford Heights, Tower Breeze, and Kallang View are all within Kallang/Whampoa, but they have different classifications. This is based on access to different levels of amenities: as we mentioned in our previous article, Crawford Heights – being close to North Bridge Road, Haji Lane, etc. – snags a Prime classification, while Kallang View and Tower Breeze are “only” Plus category flats.

This could, however, prompt arguments about how the lines are drawn. Deciding where the amenities are “superior” is not always obvious (especially in more mature towns, where almost everywhere is convenient in its own way). So when Plus and Prime offerings appear in the same town, we think buyers are going to ponder whether the premium for Prime flats is justified.

2. In future, “Prime” may not just be based on proximity to the city centre

More from Stacked

Collective Sale: 6 dead simple ways to spot en bloc potential

Is the collective sale fever dying out in Singapore? After warnings of possible oversupply in early 2018 and rising prices of luxury…

To date, we’ve made the assumption that the main difference between Plus and Prime is that Plus flats might be the hub of fringe neighbourhoods, whereas Prime refers to the city centre; it’s an assumption shared by many of the realtors or analysts we’ve spoken to as well.

But it turns out this isn’t a rule per se. For now, the Prime projects are the ones which are closer to the city centre. In the future, however, there’s a possibility that we’ll see Prime housing even in non-central areas. This reflects quite a lot of confidence in decentralisation; and it’ll be interesting to see how we justify the differences between Plus and Prime in an area like, say, Punggol in the distant future.

(Our guess: it will mainly come down to market rates of surrounding flats, more so than a qualitative assessment of amenities; although the two are interrelated).

3. For now there’s little difference besides the SR, between Plus and Prime

The various restrictions, such as an income ceiling on resale buyers, 10-year MOP, inability to rent out the whole flat, etc. apply to both Plus and Prime. The main difference boils down to price, and the Subsidy Recovery (SR).

(The SR is a clawback, implemented at the point of sale to compensate for the higher subsidies needed to make these flats affordable. The SR only applies to the first batch of owners).

Existing Prime projects have had an SR of nine per cent, and this will be the first time we see the SR of Plus flats. If it’s not too far below nine per cent, some buyers will likely shrug it off as irrelevant and go for the Prime option instead. From word on the ground, we’ve heard the SR for Plus flats may be around six per cent.

In any case, this was a smart move that keeps things simple for buyers. We hope it stays the same, as changing other conditions (e.g., eligibility requirements) between Plus and Prime would make an already complex system even tougher to comprehend.

Speaking of eligibility requirements…

4. A cap on price growth due to the income ceiling and MSR

Plus flats, like their Prime counterparts, impose a $14,000 a month income ceiling even on resale buyers. This is different from standard resale flats, where there’s no income ceiling at all.

The combination of the income ceiling, along with loan curbs like the Mortgage Servicing Ratio (MSR), is aimed at preventing enclaves of the rich from forming in HDB towns. This is intended to restrict the price growth of Plus as well as Prime flats, and create a balanced socioeconomic mix. It’s too early, however, to tell if this will work. On a psychological level, simply grouping the flats into Standard, Plus, and Prime is already a way to stratify the town.

5. No fixed numbers on Plus or Prime offerings each year

We’ve been told there’s no particular rule on the number of Plus or Prime offerings each year. It may even be possible for a year to go by with no such offerings, depending on the viability of the situation.

This is probably good for all of us, as it gives HDB more flexibility to build as needed. However, it also means you shouldn’t assume you’ll have another pick of Plus or Prime properties next year, next launch, etc.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the new classification system for HDB flats in the October 2024 BTO launch?

Can Plus and Prime flats be in the same town or launch?

How does the Prime classification differ from Plus flats in the upcoming BTO launch?

Are there restrictions on who can buy Plus and Prime flats?

Will there be a fixed number of Plus and Prime flats offered each year?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments