New Home Sales Are Down 58% In Dec 2021, But Will It Last?

January 25, 2022

As a fitting end to a roller-coaster year, December 2021 ended with new private home sales down more than half (58 per cent) compared to the previous month. In some ways this was expected, with the implementation of new cooling measures – but with demand at a peak, will we continue to see more subdued sales? Opinions from realtors and investors are quite divided at the moment:

New private home sales fell by more than half, following new cooling measures

The government announced new cooling measures on 15th December 2021. The new policy increases Additional Buyers Stamp Duty (ABSD) for some buyers, and places tighter limits on home loans; you can read about the full range of measures in this article.

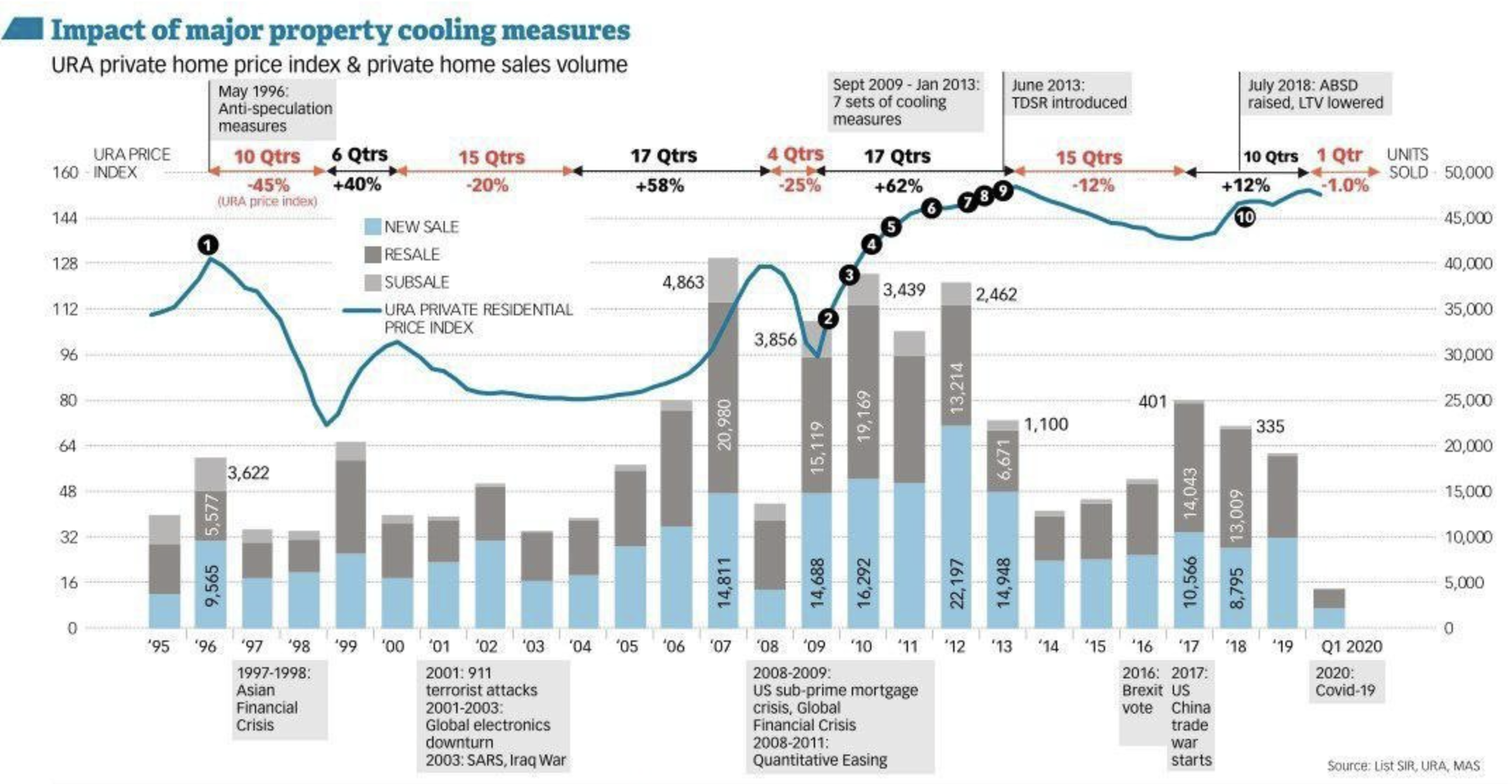

In the past, announcements of cooling measures could sometimes cause a spike in sales volumes; this was because show flats would extend opening hours, and buyers would rush to complete transactions before midnight when new measures kicked in. This time around, however, the government made it a point to release the announcement at 11.30 pm, so it was too late for buyers to react.

December 2021 ultimately ended with just 650 new private home transactions (excluding Executive Condominiums), down from 1,547 transactions the month before.

In the EC market, there were 69 new transactions, with an estimated 125 new EC units still on the market.

In a wider context though, new private home transactions stood at around 13,372 for the whole year of 2021; this is still the highest number since the last peak of 2013.

Some realtors disagree with the cooling measures being responsible

One realtor pointed out that December transaction numbers are not a useful indicator. She says that:

“For December a lot of sales happen in the first half of the month. Buying tends to slow down near the Christmas period; so a lot of transactions would have already happened before the 16th.

Based on this, I think if you just go by the transactions for the second half of December alone, then that’s too small to be an accurate reflection, right? Maybe after Q1 of this year, based on the numbers, then we can draw conclusions about the cooling measures impact.”

A few other realtors felt the dip in volume wasn’t due to cooling measures, but simply fewer new launches. We were told there were just 383 new private homes launched in Singapore for all of December 2021, as opposed to around 1,283 units in November.

It was also highlighted that no new units were launched in the Outside of Central Region (OCR) for December – significant as OCR properties tend to be the most affordable, and hence more popular as well.

On the flip side, some realtors felt cooling measures will have an immediate impact

Some other realtors had personal anecdotes about buyers withdrawing, as a direct result of cooling measures. One realtor said that:

“A lot of people feel home buyers are not affected, but some are. Because the ABSD is up by five per cent*, and some still need to pay in cash first, it has brought up some cash flow issues and made them back off.”

Another realtor opined that whatever the actual numbers, we can’t discount the emotional response of the market. Historically, cooling measures have always been followed by short-term “wait and see” effects, while buyers try to gauge sellers’ responses.

“Most buyers prefer not to be the first ones buying, in the first few weeks after a cooling measure. They think that the cooling measures are because prices are too high – so if they buy now, they buy high before prices drop. We try to explain that developers will not drop prices just like that, but this is the way that some buyers think.”

Another realtor felt that cooling measures would dampen transaction volumes, but this is because of a combination of both bank interest rates and the measures:

“Buyers have a lot of leverage in the property market, so they’re not as put off by the ABSD alone. Ultimately if they’re just putting down five per cent cash**, and the interest rate is below two per cent, it can still be a good deal even with 17 per cent ABSD.

More from Stacked

The Future Of Digital Real Estate And The Metaverse: Should You Invest?

The Metaverse is the latest buzzword, with some investors now rushing to buy digital real estate. As with most novelties,…

It’s actually a combination of the higher tax from ABSD, plus a likely rise in interest rates, that combine to make it make it less palatable”

For most of 2020 and 2021, interest rates were just around 1.3 per cent per annum, half that of HDB loans.

*To clarify, this refers to the ABSD rising by five percentage points, from 12 to 17 per cent, for Singapore citizens buying a second residential unit.

**To clarify, the minimum down payment is at least 25 per cent, not five per cent. But only the first five per cent of your property has to be paid in cash. The next 20 per cent can be in any combination of cash or CPF.

It’s unclear if lower supply, or cooling measures, will have a bigger impact on new home sales

Most real estate firms predict a lower number of new homes for 2022. ERA expects 6,000 to 7,000 new units, while PropNex estimates 7,000 to 9,000 new units; OrangeTee expects 9,000 units (including ECs).

For all of 2021, there were only an estimated 10,800 new homes.

Also, none of the upcoming projects appears to be large mega-developments, such as we saw in Treasure at Tampines (in 2019) or Normanton Park last year; so we don’t expect to see the same huge transaction volumes.

New Launch Condo ReviewsNormanton Park Review: 1,862 Units With Mega Facilities On A Tighter Timeline

by Sean GohWe feel that one of the understated issues, regarding the drop in new home sales, is also the allure of the resale condo market. Resale condos have significant advantages over new launch counterparts right now; and we do think more home buyers will gravitate toward these, instead of new homes.

Resale condos won’t suffer from the potential construction delays due to Covid-19, for example; they’re ready to move in as soon as the deal is done, which is vital for some people in Work From Home arrangements.

From an investment perspective, resale condos can be rented out immediately – and the rental market is at a six-year high. Coupled with the lower quantum of resale condos, investors will probably be asking if a three to four-year construction time (during which they have nothing to rent out) is worth even an early-bird discount.

So while the cooling measures may lower transaction volumes across the board, it’s possible that it’s new private homes, rather than the resale market, that will bear the brunt of it.

But will new private homes get cheaper?

Those looking for a discount should temper their expectations. Even with falling transaction volumes, private home prices are still expected to rise (although many analysts now project a three per cent rise across the board, instead of the previous nine per cent).

Most developers are not in a position to give major discounts. They’ve had to face higher land prices due to scarcity, and are already on thin margins. Now, with ABSD rates heightened for developers, they’re being squeezed even tighter.

In light of this, we wouldn’t hold our breath for any discounts or super-cheap deals (unless perhaps at the luxury end); not even with the new cooling measures. The resale condo market might still be the more sensible choice, for new home buyers on a stricter timeline.

For more on the situation as it unfolds, follow us on Stacked. You can also check out in-depth reviews of both new and resale condos, to make a better-informed purchase in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did new home sales drop significantly in December 2021 in Singapore?

Are cooling measures the main reason for the decline in new home sales?

Will the drop in new home sales continue into 2022?

How do resale condos compare to new private homes in Singapore right now?

Will new private home prices decrease due to the recent sales drop?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments