Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

When it comes to investing in Johor, a number of Singaporeans still frown and mention the “Iskandar situation” back in the early 2000s. For property investors who were present that decade, Iskandar Malaysia once held similar-sounding promises to the Singapore-Johor Economic Zone today. But the end result was disappointment, and a cautionary tale against overzealous real estate speculation. So it’s unsurprising that a common question now is “What’s different this time?” Let’s take a closer look and see if anything has changed:

What is the Johor-Singapore Special Economic Zone (JS-SEZ)?

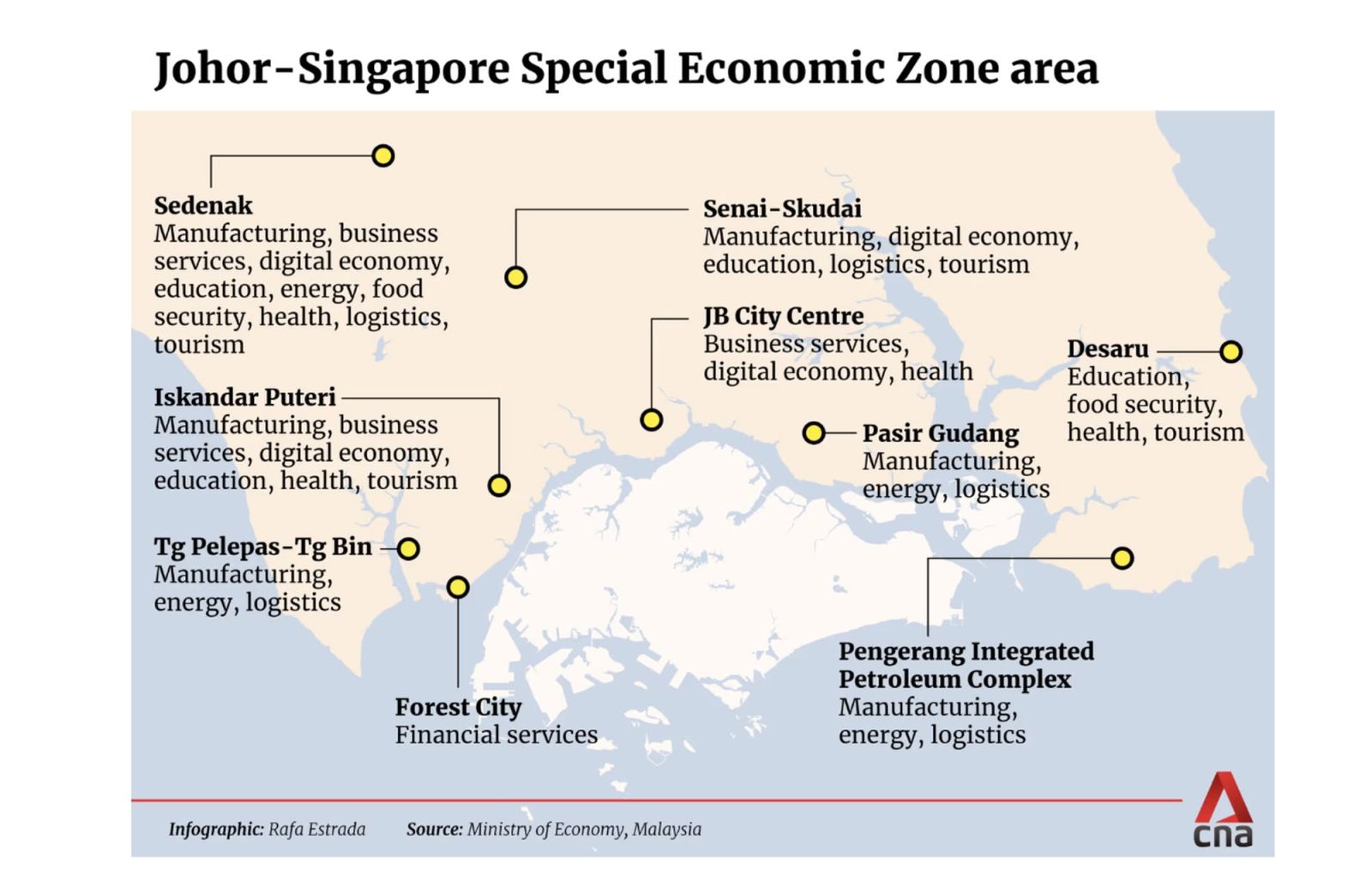

The JS-SEZ was announced in January 2025. It’s a bilateral economic initiative between Malaysia and Singapore; the idea is to create an “economic corridor” in the south of Johor that includes multiple districts (Johor Bahru, Iskandar Puteri, and Pasir Gudang). This will boost key sectors on both sides of the border, including manufacturing, logistics, digital economy, green energy, and others.

Unlike previous regional efforts like the 2000s Iskandar, the JS-SEZ is said to have stronger collaboration between both countries. The initiative includes a joint project office by Singapore’s Ministry of Trade and Industry and Malaysia’s Economic Ministry, for example; this should ensure smoother regulatory systems for investors on both sides of the border.

The zone also includes dedicated incentive packages. Corporate tax rates can be as low as five per cent in the relevant region; and the initiative has plans for the former problem project of Forest City. From what we understand, Forest City will now be repurposed as a Special Financial Zone.

(From available information, this means Forest City will have a separate set of regulations aimed at attracting international businesses, like streamlined visa and work permit processes for foreign professionals.)

Overall, the greatest shift is a refocusing on the region’s growth in sustainable, long-term economic development. There’s a clear intent to avoid the situation in 2000s Iskandar, where it became a property speculation zone more than a business hub.

Why is it going to be different this time?

We would put it down to three main reasons:

- This is a bilateral effort, not a solo project

- Improved connectivity with the RTS link

- We have (hopefully) learned from previous supply issues

1. This is a bilateral effort, not a solo project

Iskandar Malaysia was a largely Malaysian-driven initiative, with limited formal involvement from Singapore. In contrast, the JS-SEZ is a full-fledged bilateral undertaking. As mentioned, both governments are co-steering the effort.

This matters because Singaporean investors now have more assurance that policy alignment, infrastructure coordination, and long-term political will are being handled at the highest level and with our own government’s involvement. The lack of this was a key weakness during the Iskandar years.

For example, we can count on the fact that information and updates will be issued by both governments, with investors on both sides staying equally and fairly informed. Also, a key frustration in Iskandar’s rollout was navigating Malaysian federal and state-level red tape. The JS-SEZ introduces a one-stop centre (IMFC-J) in Johor and commits to smoother processing for investments, so Singaporean agencies are directly involved.

2. Improved connectivity with the RTS link

This one is quite straightforward: back in the previous Iskandar days, the RTS link never materialised. Some might recall certain unfortunate political developments at the time, which caused a shift in the Malaysian government’s priorities. But now the Johor Bahru-Singapore RTS Link is slated to begin operations by end-2026, and with a capacity for 10,000 passengers per hour per direction.

More from Stacked

Living Near A Popular Primary School: The Data On HDB Prices Within 1KM May Surprise You

When it comes to property, the proximity to popular schools is often touted as a significant factor that can influence…

We probably don’t need to explain how much this changes the situation, now that the RTS is backed by hard infrastructure timelines.

3. We have (hopefully) learned from previous supply issues

Iskandar Malaysia became synonymous with ghost towns and empty condominiums. Projects like Forest City were massively overbuilt based on the assumption of constant foreign demand, which never fully materialised.

Today, Johor developers are more cautious. According to data from the National Property Information Centre (Napic), overhang properties in Johor Bahru dropped from 16,799 units in 2022 to 14,063 in 2024. This is a significant 16 per cent reduction that signals quicker market absorption, and greater developer discipline. Meanwhile, due to the nature of the JS-SEZ, incentives are focused on attracting real industrial and services investments first.

This is again a difference from the previous Iskandar situation, where the emphasis was accidentally shifted toward condo flippers and aspiring landlords. Over the past two decades, the property market in Johor has matured, and the demand being targeted – cross-border workers and logistics firms – is more grounded in actual economic realities.

But we know how markets can be unpredictable, and how quickly their participants can slip back into bad habits; so we’re adding the caveat that everyone appears to have learned their lesson, without going so far as to guarantee or confirm it.

In conclusion, imagine the same song, but improvised and performed by a more skilled musician

It’s not really fair to call the JS-SEZ “just Iskandar 2.0.” It’s a full reboot; one with better coordination, real transport links, and targeted economic activity. While investors should still proceed with caution, the foundations look a lot stronger this time – and more likely to turn promise into performance.

Don’t forget though, that currency and political risks remain

Even with stronger bilateral coordination, investors should remain aware that some risks are beyond the scope of the JS-SEZ. The Malaysian ringgit remains volatile against the Singapore dollar, and any gains on paper could be eroded by adverse exchange rate movements.

Likewise, while the JS-SEZ reflects a shared political will at this point in time, domestic policy shifts in either country (especially Malaysia) could still affect the long-term execution. Many investors still remember how earlier momentum for the Iskandar initiative faded after changes in the Malaysian administration.

So while the structure and intent of the JS-SEZ are stronger, these macro risks haven’t gone away and should be factored into any long-term investment outlook.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Singapore Property News We Review The February 2026 BTO Launch Sites (Bukit Merah, Toa Payoh, Tampines, Sembawang)

Singapore Property News One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

Singapore Property News Why Buying Or Refinancing Your Home Makes More Sense In 2026

Latest Posts

Pro What Happens When a “Well-Priced” Condo Hits the Resale Market

Singapore Property News Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

Singapore Property News This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Singapore Property News One of Singapore’s Biggest Property Agencies Just Got Censured

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

Singapore Property News Over 3,500 People Visit Narra Residences During First Preview Weekend

On The Market Here Are The Rarest HDB Flats With Unblocked Views Yet Still Near An MRT Station

Singapore Property News New Condo Sales Hit a Four-Year High in 2025 — But Here’s Why 2026 Will Be Different For Buyers

Pro How a 1,715-Unit Mega Development Outperformed Its Freehold Neighbours