What is so expensive, you can have US $1.1 billion and still find yourself coming up short?

That’s what makes me scratch my head, when the grand-daddy of property portals has been cutting jobs and closing some units. The portal I’m referring to is (in the link) is the dominant force in the property listings business: it was here first, it’s still the biggest, and if it ever raised its listing fees to “mandatory organ donation”, property agents would still feel compelled to pay it.

Since it has a virtual monopoly on the property listing business in Singapore, it should be nigh-impossible to make too many wrong turns. So what is it doing that’s so expensive, that it isn’t an insanely profitable business? Some kind of AI feature, which warns when a flat price will irritate HDB? A responder that automatically emails swear words to the agent when their listing’s fake? Telepathic user interface?

All jokes aside, it does shed light on one thing though: the difficulty of running a property portal site, which I once raised in connection with HDB’s resale portal. This business is a bigger nightmare of complexities than you’d think.

On the surface it seems very simple: it’s just constantly updated lists. But then you run into things, like the marketing needed to bring people to the site, the tools you need to develop for agents*, the classes you need to hold to teach agents how to use the portal, filtering out scam listings, it goes on and on.

Which in conjunction with the looming threat of HDB’s resale portal, it seems to be a strange time to buy.

Especially from the data we’ve seen on onlinemarketplaces.com, it would suggest that there is a huge reliance on Singapore’s real estate market. I quote: “With its Data and Fintech offering yet to flourish and the Vietnamese market experiencing a downturn, a massive percentage of PropertyGuru’s profits come from Singapore, specifically from Singaporean agents’ pockets.”

In a country where the majority of the population lives in public housing, this forms a big chunk of their listing volumes.

On the private end, the big property agencies are no doubt wary of the reliance on such portals, and have tried in the past to create a portal of their own (anyone remember Soreal).

Plus from the research that I’ve seen on property portals, much bigger sites like Zillow are focused on being a housing super app. There is a ceiling on how much you can charge property agents, which is why there was a need to look at other sources of revenue (mortgages and home services).

The real money maker, however, is getting a bite of the transaction (look at their 2023 revenue of $150m vs just one agency, Propnex at $838m. Not an apples to apples comparison, I know, but you get what I mean).

So given everything that has happened, all signs were pointing to the need to squeeze more revenue out. The surprise was just how fast they acted.

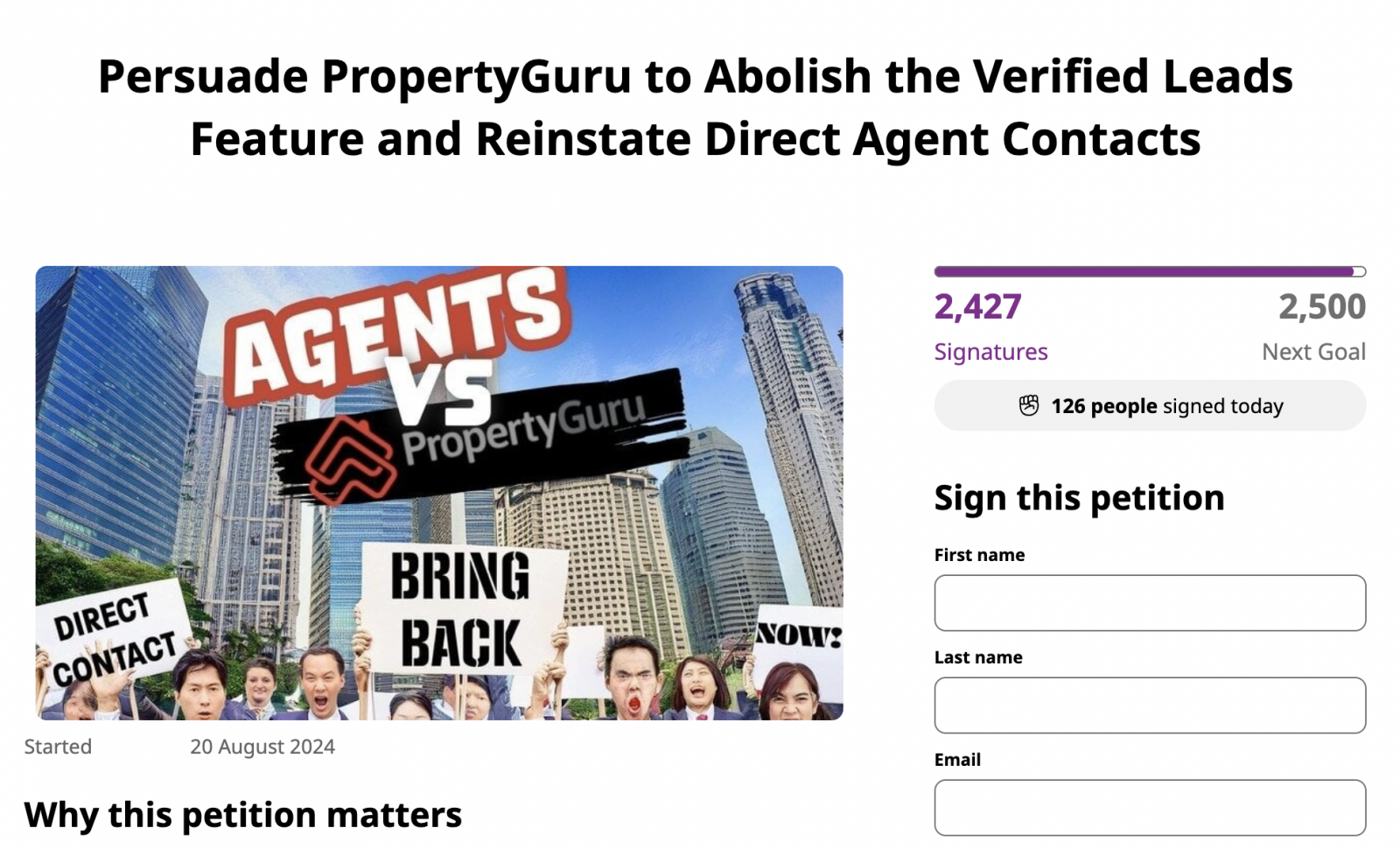

Barely after the announcement, there was a sudden change in how property agents would receive their leads. Instead of a direct whatsapp button, it was replaced with a verified lead system that meant extra steps and an additional layer (doesn’t take a genius to understand what they are trying to do).

Well, you can imagine the uproar (both from agents and frustrated buyers).

More from Stacked

What Will Happen To The Resale Condo Market For The Rest Of 2021?

For a brief moment in May and June, resale condo volumes started to fall from record highs. It was a…

While they’ve apparently gone back to the previous system, it’ll be interesting to see how this plays out given their new owners…

Speaking of money and disclosing figures…

I keep coming across self-employed home buyers who overlook servicing ratios, so take this as a sort of public service announcement:

Before you decide to declare as low an income as possible (however you do it, I don’t condone tax crimes), you may want to know its effects on your home loan application. Which is that namely, it can result in you having to make a gigantic down payment.

The Total Debt Servicing Ratio (TDSR) caps your maximum home loan repayments to 55 per cent of your monthly income. The Mortgage Servicing Ratio (MSR), for HDB properties, caps it at an even stricter 30 per cent. And the bit that a lot of self-employed people miss:

If your income is variable, you get a 30 per cent hair cut to whatever you’ve declared. So if you make $7,000 a month, as far as the bank is concerned, you make $4,900 a month. If you’ve been naughty and insisted you only make $4,000 a month….you get it: chances are you’re going to bust the MSR or TDSR. And then it’s hello giant down payment, or something silly like having to commit a fixed deposit at a terrible rate to the bank.

Remember, you probably can’t change your declared income right now. You need to wait a while for it to be fully reflected in your records; and whilst I don’t know the exact time required, it probably isn’t in the narrow 21-day window before the OTP lapses.

So if you’re self-employed and intending to make a home loan application soon…well you’ve been warned.

Meanwhile in other property news:

- 3,000 sq.ft. landed homes from $2.98 million? It’s possible, if you don’t mind cluster housing.

- What are home owners really looking for in new launch condos these days? Here are some of the top considerations.

- Got a high budget? Check out some of the most spacious and luxurious condo units in the Singapore market right now.

- So you want a mixed-use unit for convenience, but don’t want a massage parlour downstairs, or some weird back alley. We’ve got you covered: these mixed-use units have amenities that actually contribute to you.

Weekly Sales Roundup (12 August – 18 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $6,135,000 | 1851 | $3,314 | FH |

| THE RESERVE RESIDENCES | $4,173,000 | 1625 | $2,567 | 99 yrs (2021) |

| ONE BERNAM | $3,700,000 | 1421 | $2,604 | 99 yrs (2019) |

| 19 NASSIM | $3,668,000 | 1055 | $3,477 | 99 yrs (2019) |

| TEMBUSU GRAND | $3,583,000 | 1432 | $2,503 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $990,000 | 474 | $2,090 | FH |

| GEMS VILLE | $1,150,000 | 517 | $2,226 | FH |

| TEMBUSU GRAND | $1,384,000 | 527 | $2,624 | 99 yrs (2022) |

| LENTORIA | $1,538,000 | 732 | $2,101 | 99 yrs (2022) |

| CANNINGHILL PIERS | $1,728,000 | 484 | $3,567 | 99 yrs (2021) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| YONG AN PARK | $8,600,000 | 3434 | $2,505 | FH |

| REGENCY PARK | $7,840,000 | 3649 | $2,149 | FH |

| THE MAKENA | $7,000,000 | 3154 | $2,220 | FH |

| CAPE ROYALE | $5,417,000 | 2508 | $2,160 | 99 yrs (2008) |

| RESIDENCES @ KILLINEY | $5,080,000 | 2368 | $2,145 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $661,888 | 517 | $1,281 | 99 yrs (2011) |

| SUITES @ SHREWSBURY | $700,000 | 366 | $1,913 | FH |

| LE QUEST | $730,000 | 431 | $1,695 | 99 yrs (2016) |

| JOOL SUITES | $735,000 | 431 | $1,707 | FH |

| VENTURA VIEW | $735,000 | 581 | $1,265 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| YONG AN PARK | $8,600,000 | 3434 | $2,505 | $4,422,888 | 26 Years |

| REGENCY PARK | $7,840,000 | 3649 | $2,149 | $1,590,380 | 24 Years |

| HAIG COURT | $3,000,000 | 1550 | $1,935 | $1,570,000 | 20 Years |

| PANDAN VALLEY | $2,800,000 | 1647 | $1,700 | $1,473,900 | 23 Years |

| THE MAKENA | $7,000,000 | 3154 | $2,220 | $1,438,000 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SEASCAPE | $4,500,000 | 2680 | $1,679 | -$2,529,000 | 14 Years |

| ONE SHENTON | $3,300,000 | 1894 | $1,742 | -$1,520,270 | 18 Years |

| ONE SHENTON | $1,530,000 | 926 | $1,653 | -$414,600 | 14 Years |

| 120 GRANGE | $1,588,000 | 570 | $2,784 | -$238,000 | 6 Years |

| WALLICH RESIDENCE | $3,200,000 | 1098 | $2,915 | -$200,000 | 4 Years |

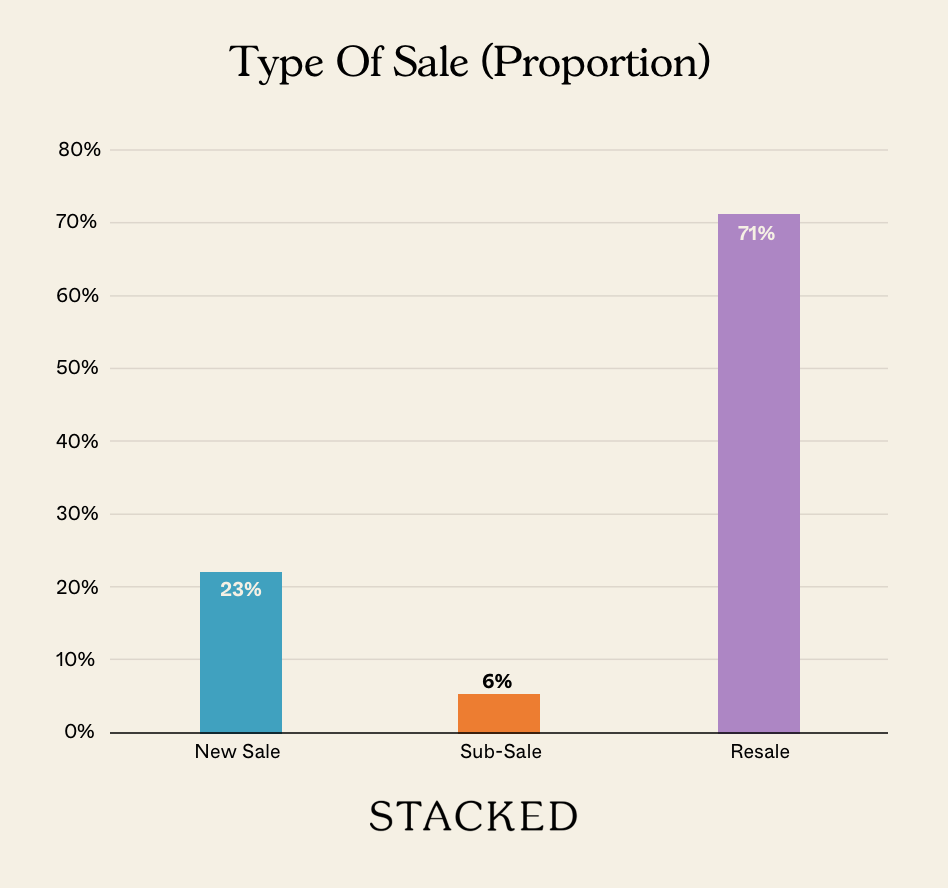

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is PropertyGuru's $1.1 billion valuation justified given its business challenges?

Why is running a property listing website so complicated?

How does Singapore's reliance on property portals affect the market?

What are the recent changes in how PropertyGuru handles property leads?

What should self-employed home buyers consider regarding loan applications?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments