How a 57% Rent Spike Drove Flor Patisserie Out — And What It Says About Singapore’s Retail Scene

Gail is the Chief of Staff at Stacked, where she also writes stories about homes, neighbourhoods, and the human side of real estate. From the quiet struggles of local businesses to the milestone moments of first-time homeowners, she believes meaningful stories can shape how we see the spaces we live in. Got one to share? Reach her at gail@stackedhomes.com.

In 2001, Singapore abolished the Control of Rent Act—a move that changed the landscape for commercial tenants.

In 2025, a beloved Japanese-inspired bakery named Flor Patisserie announced the closure of its Siglap Drive outlet after facing a 57% rent increase upon lease renewal.

These two events, separated by nearly a quarter century, are more connected than you might think.

As commercial rents across Singapore reach levels that even successful, established businesses can no longer sustain, we’re witnessing a fundamental restructuring of our urban landscape—one that increasingly favours chains and well-capitalised operations over the independent businesses that give our neighbourhoods their unique character.

The numbers tell the story: Flor’s landlord demanded $8,500 monthly for a location 21 minutes from the nearest MRT with limited parking and visibility—the same amount they once paid for their prime East Coast outlet with superior frontage and accessibility.

The Reality Check: Location Value vs Actual Value

Flor’s owners didn’t mince words in their Instagram announcement: “Never thought our out-of-the-way, 21mins by bus, 15min by walk from the nearest MRT station, no-parking-nearby outlet could be worth $8,500 in monthly rent.”

For perspective, that’s the same amount they were paying at their now-closed East Coast outlet—a location with better frontage, parking, and accessibility.

The math simply doesn’t add up, especially when you consider what nearby businesses are actually paying. As Flor told us when we reached out for comment: “Our next door neighbour at #44 renewed their rent just this January for $4,500, and the next most recent transaction is Classic Cakes at #52, renewed in November 2024 at $3,900.”

Their landlord’s justification for the dramatic increase? According to Flor, he cited that “the rental market has moved up significantly since 3 years ago” and that his “cost to service the mortgage for the place has similarly gone up with interest rates.”

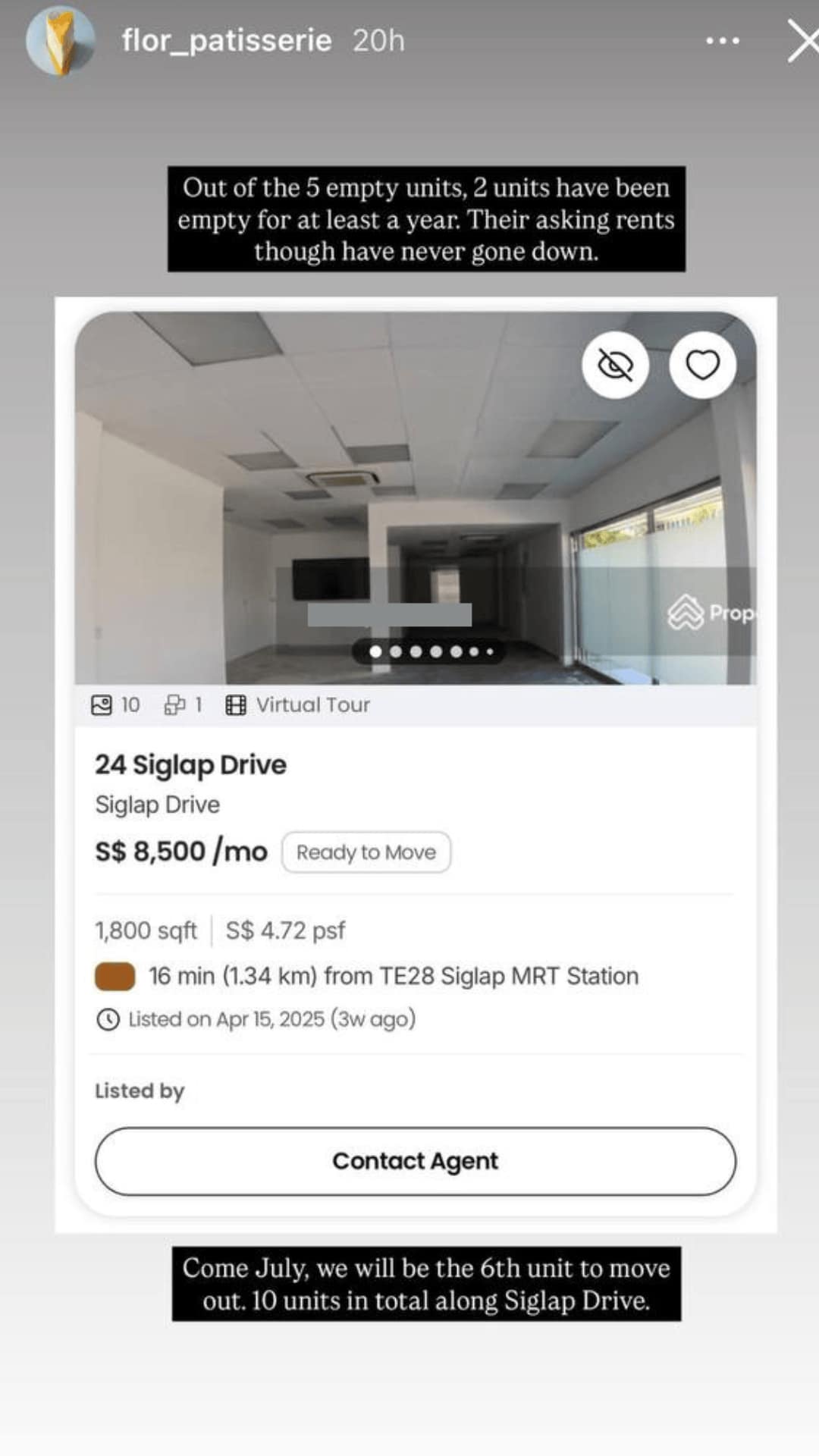

What’s particularly revealing is the landlord’s benchmark for “market rate”, not the actual transaction prices of similar nearby units, but “the current asking rents of the empty units along the Siglap drive stretch. They are all empty.”

This distinction between asking rates and transaction rates highlights a fundamental disconnect in how commercial property value is being calculated versus what businesses can actually sustain.

The Investment Property Trap

The relationship between Flor and their unit reveals another troubling pattern in Singapore’s commercial property market: the shift from long-term landlord-tenant relationships to investment-driven ownership.

“With the original landlord, over 10 years, she only increased our rent by $500,” Flor shared. “When this new landlord bought over the unit in 2022, he immediately increased our rent by 20%, from $4,500 to $5,400. And now, asking for $8,500.”

This trajectory illustrates how commercial properties are increasingly viewed not as spaces for businesses to operate, but as investment vehicles where rental yields directly impact potential resale value, often at the expense of business sustainability.

“Just Move!” The Hidden Costs of Relocation

A common response to rent increase stories is: “If you don’t like the rent, just move!” But as Flor explained, the reality is far more complex.

“When we took over Siglap Drive 13 years ago, we invested in upgrading of electrical power and building a walk-in chiller for our needs. We can’t bring them with us when we move, and will have to fork out a hefty amount to replace these features at the new space.”

These sunk costs create a form of tenant lock-in that landlords can exploit. The business must either absorb punishing rent increases or incur significant capital expenses to relocate, on top of lost business during the transition period.

Flor has explored alternatives: “I’ve looked at other spaces, Joo Chiat ($9.5k), Swan Lake Avenue ($6.8k), even along the same stretch. Their asking rents are just not sustainable.”

The Financial Reality for Small Businesses

What would a 57% rent increase actually mean for Flor’s operations? The bakery shared their cost breakdown:

- Cost of goods sold: 22%

- Overheads (including utilities, licensing, administrative costs): 13.7%

- Rent: 20%

- Labour cost: 42.8%

“Even like this, we are barely making profits,” they told us. “With the rent increase, assuming we don’t increase our prices and same gross sales, rent would have taken up 30% of our operating costs, eating into profits. If we can’t weather the slow months (March – August), we will have to fold.”

This financial breakdown reveals why so many small businesses can’t simply “pass on costs to consumers”—the necessary price increases would drive away customers in a competitive market, creating a no-win situation.

Customer Loyalty vs. Market Reality

Despite these challenges, Flor’s community has rallied around them. “Our customers have been the most supportive. We are very lucky in that aspect. Which is why we refused to take on high rents because it will drive up our prices.”

This commitment to keeping products accessible reflects the values that made Flor successful in the first place, but it’s also why they’re more vulnerable to rent pressures than businesses willing to charge premium prices.

Some well-meaning customers have suggested alternatives: “The most heard solution we had is to go be a home baker,” Flor shared with a laughing emoji. “We made an IG story addressing exactly this. Home-based business has its own restrictions, and my home cannot fit a professional pastry kitchen, which is what we need for our level of cakes.”

Potential Solutions

The bakery suggested an interesting solution on their Instagram: “Implementing a grace period in which a commercial property can be empty for. We suggest a cap of 6 months. After which, the landlord will be fined 50% of the asking rent every additional month that it’s on the market.”

Would it work? Maybe not. But it acknowledges a reality many tenant businesses face—landlords often prefer to leave properties empty while waiting for their ideal rental rate rather than negotiate with existing tenants.

The Case For (and Against) Commercial Rent Controls

As more small businesses face similar challenges, there’s growing discussion about whether some form of commercial rent control might be necessary.

Potential benefits include:

- Helping small businesses stay afloat, protecting them from being priced out by steep rent hikes

- Maintaining urban diversity by preserving a mix of retail options instead of pushing out unique tenants in favour of chains

- Reducing volatility in business costs, allowing for longer-term planning and investment

- Promoting economic resilience during recovery periods by stabilising commercial activity

But implementation challenges are significant:

- Rent controls could disincentivise landlord investment in property maintenance and improvements

- They might discourage redevelopment of underutilised land or outdated buildings

- Controls could create an uneven playing field between businesses with rent-controlled units and those without

- Landlords might find ways around controls through backdoor fees or aggressive lease terms

- The prospect of regulations might chill new commercial real estate investment, reducing long-term supply

Beyond “Landlord Bad, Tenant Good”

This issue isn’t as simple as villainising property owners.

Many commercial landlords are themselves servicing loans with rising interest rates. Some are dealing with their own increased costs.

But the current power imbalance is undeniable, as Flor pointed out: “Right now, landlords hold overwhelming negotiating power.”

The bakery has approached newly elected East Coast MP Edwin Tong, not asking for “handouts or preferential treatment” but for government policies to “create a fair playing ground for businesses and landlords.”

Their core argument is compelling: high rents directly impact the cost of goods sold, which impacts everyday prices for all Singaporeans.

Flor Speaks Out: Real Solutions, Not Handouts

When we reached out to Flor for their perspective on potential solutions, they were clear about what they’re seeking—and what they’re not.

“We would like the government to bring back some form of rent control,” they told us. “We used to have Control of Rent Act until it was abolished in 2001. Perhaps an updated form of this act can be reintroduced.”

Their proposed approach is nuanced, not a blunt instrument: “Upon renewal of lease, if landlords want to increase rent, they need to provide justification beyond citing market rate. Did they do anything to make the unit better? Were any restorative or upgrading works done to justify?”

They also highlighted another problem with “market rate” justifications: “Market rate should be tagged to recent transactions, not asking rental rates of the area.” This distinction matters, as asking rates may not reflect what businesses are actually willing or able to pay.

Beyond rent control, Flor believes the current Fair Tenancy Act needs strengthening: “Right now, it’s more of a code of conduct. There is no teeth of law to the act, and current standard rental contract sides overwhelmingly with landlords.”

Perhaps most importantly, they stressed what they don’t want: “We do not want rebates/vouchers/cash from the government. The last thing I want to see is using taxpayer’s money to fund speculative property investor’s bank account.”

This important distinction clarifies that the issue isn’t about seeking government subsidies, but rather creating a more balanced commercial property ecosystem where small businesses have a fighting chance.

What’s At Stake?

Beyond the immediate loss of a beloved bakery, this trend threatens Singapore’s diverse small business ecosystem.

When asked what they’ll miss most about closing their Siglap location after 13 years, Flor’s answer was immediate: “We will miss our customers the most! A lot of our East side customers are now friends who would drop by and bring us food sometimes. It’s a very nice feeling.”

That sense of community connection is precisely what’s at risk in the current commercial property environment.

Finding The Middle Path

While there’s no easy solution, Flor’s situation highlights the need for balanced commercial property policies that serve both investment needs and business sustainability.

Perhaps the answer lies not in strict rent controls, but in targeted interventions:

- Incentives for landlords who maintain long-term tenancies with reasonable rent increases

- Tax benefits for property owners who lease to local businesses at below-market rates

- Zoning requirements that ensure a percentage of commercial space remains affordable

- Mediation services to help landlords and tenants find mutually beneficial terms

The goal, as Flor puts it, is for the government to “create a level playing field for both landlords and tenants so that small businesses like ours can flourish.”

Rethinking The Social Value of Local Businesses

There’s another perspective worth considering, articulated by behavioural economist Rory Sutherland about pubs in the UK: “I don’t think pubs, cafes and restaurants should pay rates or taxes because they’re actually a social space.”

This radical view challenges how we value commercial spaces in our economy. What if we recognised that places like Flor Patisserie contribute more than just GST and corporate taxes? What if their primary value isn’t economic but social?

Local cafes, bakeries, and restaurants create gathering places that foster community. They provide spaces where people connect, neighbourhoods form identities, and social capital grows. These are benefits that don’t show up on GDP calculations but significantly improve quality of life.

When we measure success purely in terms of rental yields and property values, we miss the incalculable social infrastructure these businesses build. The price mechanism alone can’t capture the full value of having distinctive local businesses that give neighbourhoods their character and communities their gathering places.

Perhaps the solution isn’t just about regulating rents, but fundamentally reimagining how we value and support these “third places” between home and work, recognising that their contribution goes far beyond what can be measured in dollars per square foot.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Gail

Gail is the Chief of Staff at Stacked, where she also writes stories about homes, neighbourhoods, and the human side of real estate. From the quiet struggles of local businesses to the milestone moments of first-time homeowners, she believes meaningful stories can shape how we see the spaces we live in. Got one to share? Reach her at gail@stackedhomes.com.Read next from Homeowner Stories

Homeowner Stories Buying A Walk-Up Apartment In Singapore? Don’t Overlook The Shops Below – Here’s Why

Homeowner Stories I Almost Sold My Home In Singapore—Here’s Why I’m Glad I Rented It Out Instead

Editor's Pick Why This Singapore Homeowner Wakes At 5AM To Commute – And Has Zero Regrets

Homeowner Stories “We Treated Our Flat As A Liability” How One Couple Paid Off Their HDB In 15 Years

Latest Posts

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Pro How Different Condo Views Affect Returns In Singapore: A 25-Year Study Of Pebble Bay

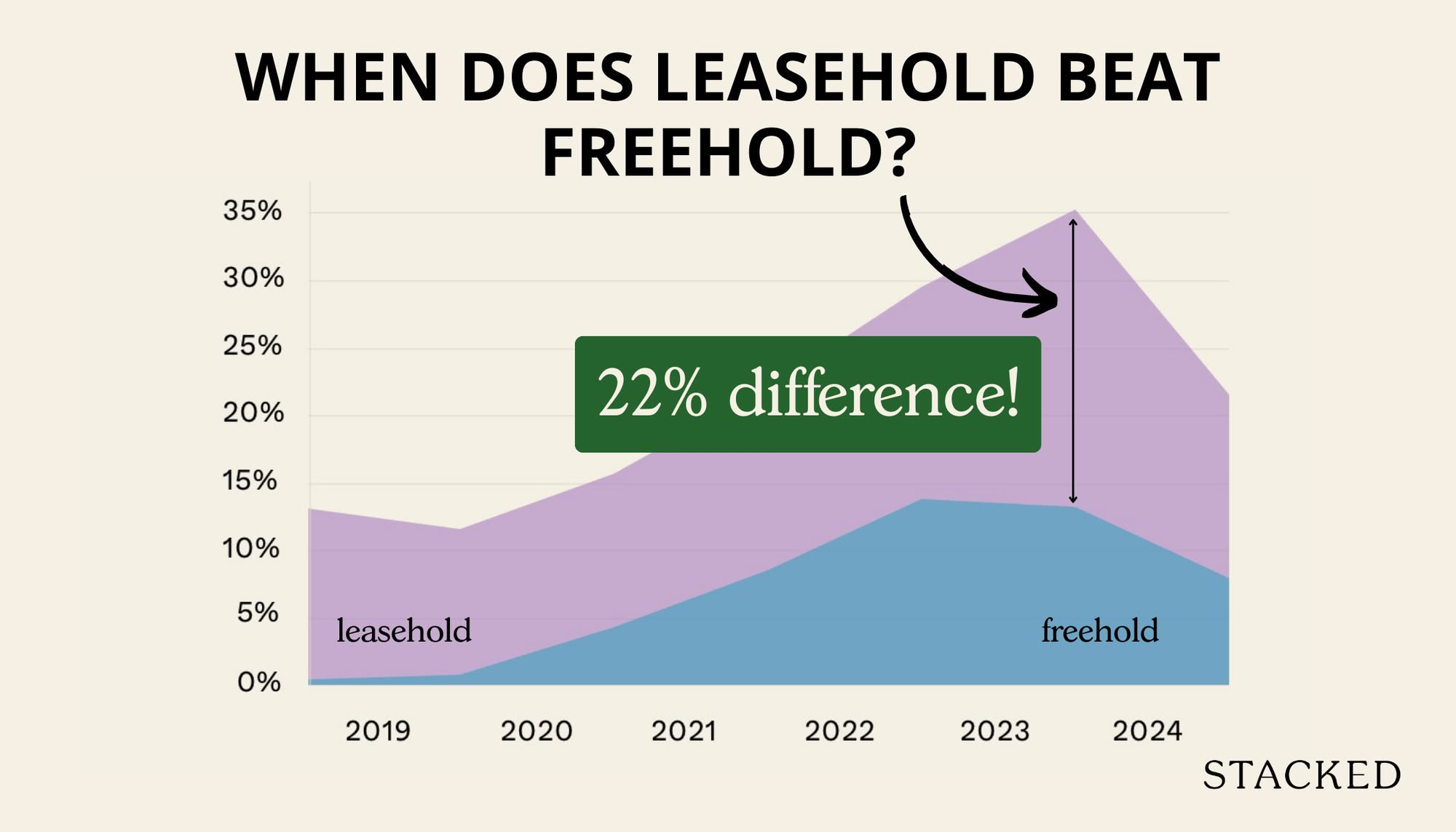

Pro Can Leasehold Condos Deliver Better Returns Than Freehold? A 10-Year Data Study Says Yes

Home Tours Inside A Minimalist’s Tiny Loft With A Stunning City View

On The Market 5 Most Affordable Newly MOP 4-Room HDB Flats From $585k

Property Market Commentary Distressed Property Sales Are Up In Singapore In 2025: But Don’t Expect Bargain Prices

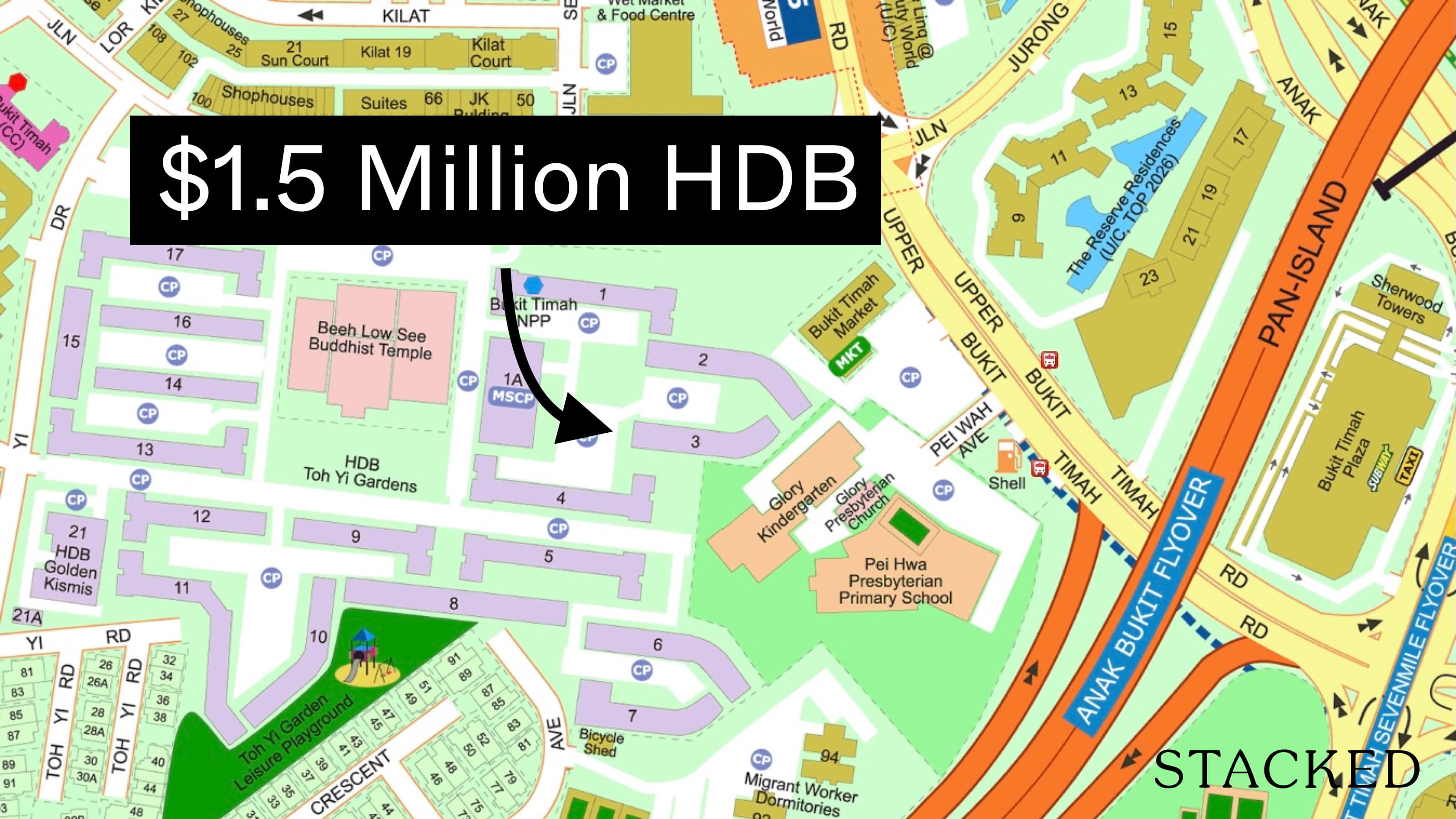

Singapore Property News This $1.5M Bukit Timah Executive HDB Flat With 62-Years Lease Left Just Set A Record: Here’s Why

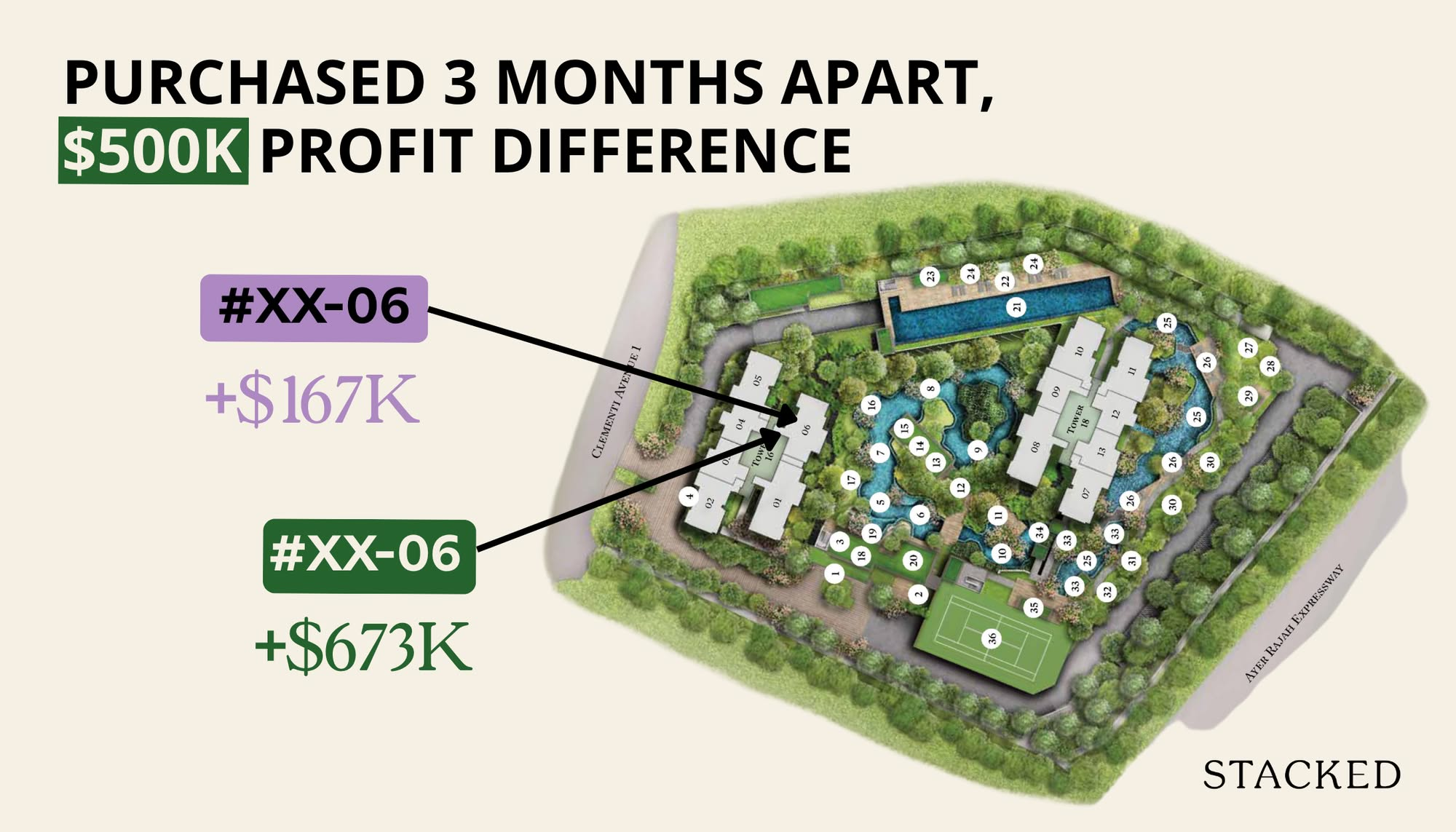

Editor's Pick How A Clement Canopy Condo Buyer Made $700K More Than Their Neighbours: A Data Breakdown On Timing

Editor's Pick Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Advice The Ultimate Work From Home Homebuyer Checklist (That Most People Still Overlook)

Editor's Pick These $4m Freehold Landed Homes In Joo Chiat Have A 1.4 Plot Ratio: What Buyers Should Know

Editor's Pick Now That GE2025 Is Over, Let’s Talk About The Housing Proposals That Didn’t Get Enough Scrutiny

Property Advice When ‘Bad’ Property Traits Can Be A Bargain For Homebuyers In Singapore

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025