How To Decide What Is A “Fair” Price For Your HDB Flat In 2024

August 8, 2024

Most first-time homebuyers start with an HDB flat; and given how high resale flat prices are of late, it can be a tough call. The situation is a little more difficult now with seeing frequent headlines of million-dollar HDB flats, and the introduction of the HDB resale portal. For one, there may be increasing expectations from some sellers to hit new highs when they see such headlines. And two, for those who are attempting to sell their homes on the portal on their own, the truth is, that most sellers tend to overvalue their properties.

To complicate things further, HDB flats can be quite varied in layout and type (we may think they’re all cookie-cutter, but there are differences between the 80s, 90s, and present-day flats).

But before we get into it, it is worth mentioning that the concept of a “fair” price is inherently subjective and varies greatly from one individual to another. What one person considers fair may not align with another due to differing personal circumstances and priorities.

For instance, consider a buyer who urgently needs to relocate due to a new job or family reasons. For them, a fair price might mean paying a premium to secure a flat quickly and avoid the hassle and stress of an extended search.

Conversely, for someone looking for a forever home to retire in, a fair price might encompass different considerations. This buyer may prioritise factors such as long-term value, the suitability of the location for their retirement years, and the overall comfort and amenities of the flat. In this scenario, a fair price isn’t necessarily the lowest price but one that ensures the home meets all their long-term needs and aspirations.

For everyone else, here’s what you should consider looking for when trying to judge the “fair” price for a resale HDB:

1. Find out how many transactions have been occurring

Depending on where you are looking to buy, some areas may just have fewer transactions. If you have a strict requirement on that particular area, it would be good to know just how many transactions have been happening there.

This is because if listings are hard to come by in the area, and you have a timeline to move quickly – you may want to consider being a little more flexible with the price. As always with resale listings, it is difficult to ascertain when units may come up on the market.

2. Check how long the listing for the flat has been around

If a flat has been up for a long time, chances are the sellers may be more eager to dispose of it. This is especially true for sellers facing urgent circumstances, such as those who have to sell to meet the deadlines for ABSD remission. Under these circumstances, there’s more “wiggle room” for negotiation. If you have the money ready to go, and can close the deal right now, you may get it even if your offer isn’t the highest.

(The annoying part is that you have to look on more than one property portal, as sometimes the older listings for the same flat are scattered in different places. Also, the way some portals work with boosting the listings means it is hard to keep track of the age of the listing by the date – you just have to be frequently browsing and noting the older listings. )

That said, you should still be wary of a “problem” flat, if the listing has been up for too long (e.g., well over a year). Sometimes, a flat has stays available due to problems like loan sharks targeting the address, being inhabited by a former hoarder, etc. In these cases, it’s probably not a good buy, even if the seller lets it go for a little less.

3. Compare the asking price to actual transacted prices

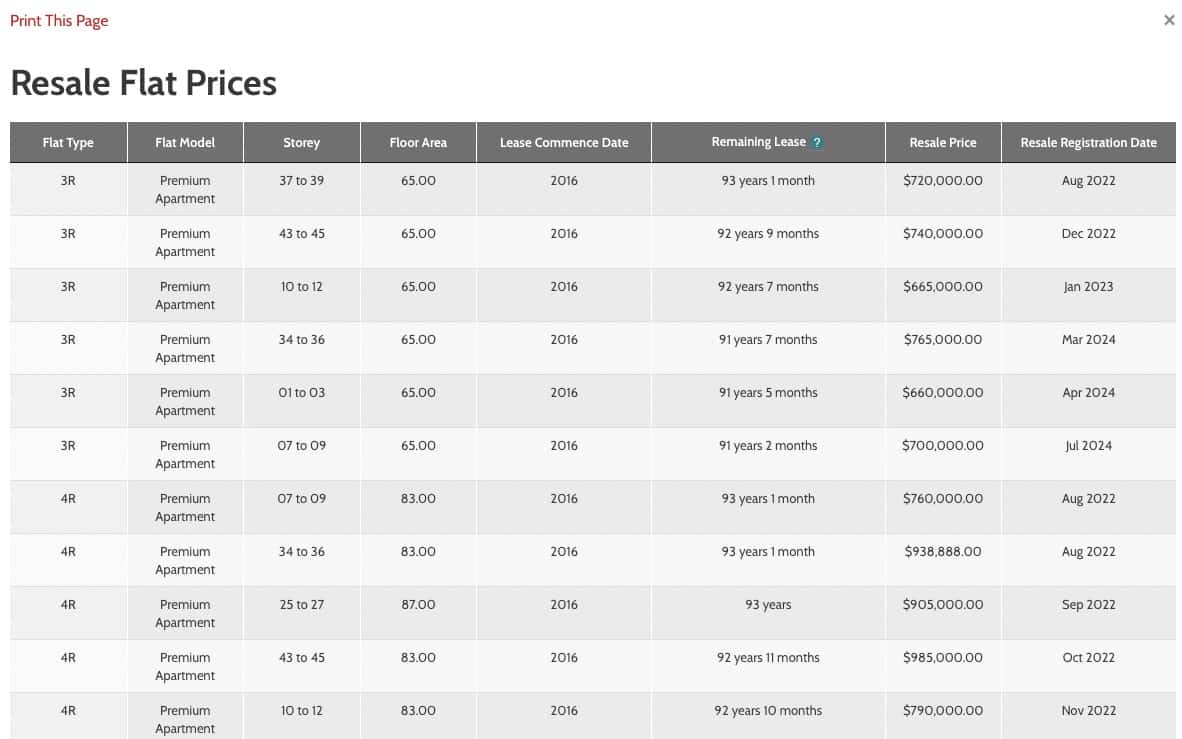

HDB does provide guidelines, and some property portals provide recent transaction details as well. The following, for instance, was from HDB map services:

Other portals may provide such data to varying degrees; but some are paid services.

But a few things to note here are:

- Ensure you’re comparing against actual transacted prices, not other asking prices. I.e., look at transaction records and not just other listings.

- The pricing data is time-sensitive. Any transaction that occurred more than 12 months ago may not be relevant as a point of comparison.

- You need to make sure the transactions are for units highly similar to yours; that means roughly the same floor, size, age, etc. A bottom-floor unit, for example, can be expected to transact for less than a 30th-storey unit in the same block.

In some neighbourhoods, the transaction volume may be very low; your best bet in this case is to compare with similar flats that are within a one-kilometre radius.

4. Quantify the repairs the sellers are willing to make

You probably already know that, when viewing the property, you should take note of things that need fixing. This is because in most situations, the rule of “caveat emptor” or “buyer beware” applies. In other words, you are responsible for finding out if the property has any defects before purchasing it. Do note that in most cases, sellers are not expected to be upfront about issues or flaws of the property.

As such, aside from doing your own due diligence, you can also take a step further in finding out the likely costs of these repairs to help you decide a “fair” price. As a recent example:

One of our readers was considering a resale flat in Hougang, where there was some water seepage. But as the couple’s in-laws happened to work in construction, they knew it would be an easy fix. They then communicated to the seller that they would overlook the seepage, if their offer was accepted.

As it turns out, the next (higher) offer came from buyers who wanted the sellers to fix the seepage, along with some other issues. The sellers turned this down, and instead sold it to the couple willing to accept the condition of the flat.

The total cost of repairs turned out to be low; less than the amount they would have had to raise their offer by, to match the other buyers.

Now we get that not everyone is lucky enough to have family members with a construction background. However, you can ask to take a few pictures and run the issue past a contractor, to estimate how much the fix will cost. From there, you can decide if the current price is a reasonable one to pay, or one that you may need to further negotiate with.

5. Check if the sellers are upgrading or have a strict timeline

This isn’t always possible if you’re in a rush to move in yourself; but if you have time, it can be a good way to help with the price negotiation, while also helping your seller to save some money.

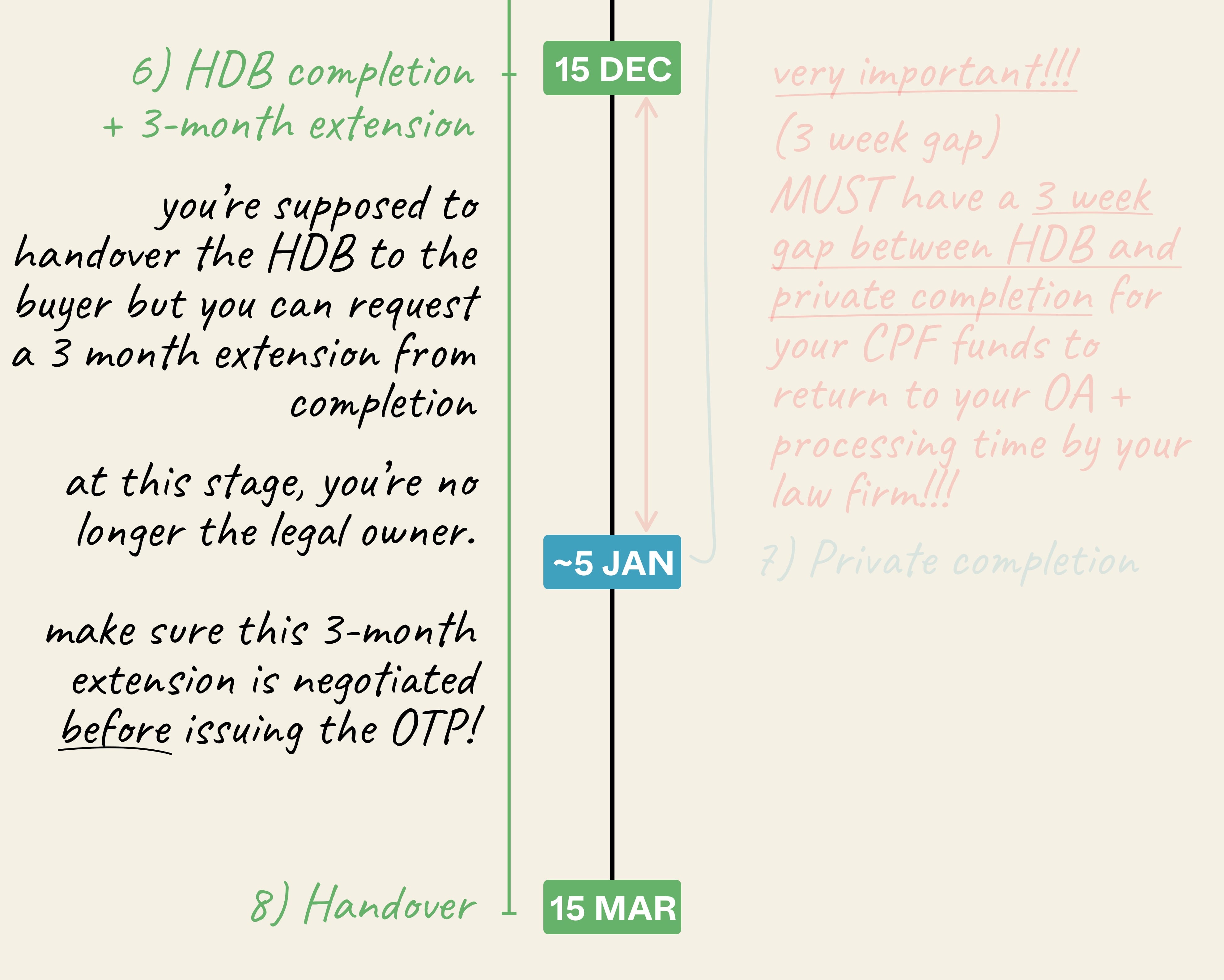

As an example of how this works, check out our explanation of this timeline for upgraders. Sometimes, if a seller can stay in the unit for a while longer, it gives them the chance to only move once; they won’t need to rent or pay for storage in the interim. This can be a helpful negotiating tool, if your offer is just a bit under the next highest one.

(A variant of this is to charge rent to the seller for staying on in the unit, but the principle is effectively the same: you’re getting a lower cost for your flat, by moving in later).

6. Check the age and quality of existing renovations

Unless you have the budget to immediately hack away everything and renovate, a common approach is to live with the existing reno first. Later, over a couple of months, you can gradually tear down and replace things; this helps with cash flow, and can prevent the need for pricey reno loans.

As such, a fair price should take some account of existing renovations. If these were done very recently (e.g., just two or three years ago), and it’s in a good state, it will save you the cost of having to immediately redo everything. Conversely, if the flat has been subject to things like hoarding, pest issues, broken light fixtures, etc. this should be grounds to lower your offer.

(As of 2024, reno loans are typically capped at $30,000, and have annual interest rates of about five to seven per cent)

As an aside, be on the lookout for the replaceability of certain things, if you don’t want to renovate immediately. If only a few tiles are broken, but there are no replacements as that kind of tile isn’t sold anymore, then you may have to redo the entire floor upon moving in (or live with ugly patches on the ground).

Finally, for scarce flats with unique attributes or places where private prices have a widening gap, common conventional wisdom may not apply

As with what you’ve seen in the recent $1.73m record HDB sale, for such homes that are unique or where private properties have also gone through the roof – it becomes much harder to decide what is a “fair” price.

At this end of the market, you may be competing with buyers with much bigger budgets. This could be older buyers who are right-sizing from more expensive private properties and have the cash, or even younger buyers who may be priced out from private property in the area.

As such, even a $1.5m flat may seem “cheap” in comparison, when an equivalent sized private property in the same location may cost $2.5m and up.

Also, rarer types of flats, such as jumbo flats, DBSS flats, and maisonettes, may not have good nearby equivalents for comparison.

Some of this may require quite a bit of number crunching, or some data sources may not be available. If you run into this situation, you can reach us here with your questions. Alternatively, if you’re looking for a more in-depth consultation, you can contact us here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

On The Market Here Are The Cheapest 4-Room HDB Flats Near An MRT You Can Still Buy From $450K

0 Comments