How To Curb Our High Property Prices In Singapore (Hint: Follow Tokyo)

June 18, 2023

When the property market heats up, we start to look overseas

But I don’t mean buying property abroad. Rather, comparisons start to be made. Why is Singapore so expensive? Why is rental cheaper in Vienna? Why don’t we follow rent control like New York? And on and on, often while ignoring the fundamental issue that our whole country is just the one city.

But sometimes, there are lessons we could pick up.

One frequent conversation involves Japan, where despite some parts of Tokyo being pricey (every bit on par with central Singapore), there are still affordable options.

In Singapore, private properties have a median house price to income ratio of about 15.4. This means that in general, Singaporeans will take just over 15 years to pay off a private property. But in the Tokyo – Yokohama region, the ratio is just 4.7.

Besides, rent there is more affordable than you might think as well. Apparently, rental prices have only risen by 20 per cent in Tokyo prefecture over the last 15 years.

But what makes Japan so much more affordable, when they share many of our issues (limited island land space, ageing population, high cost of living, etc.)?

One of the reasons is the efficient urban zoning system.

In Japan, zones aren’t strictly defined as “residential”, “industrial”, and so forth. The city planners don’t obsessively pinpoint what goes where. Instead, a zone has a certain percentage of space for open use. (You can read more about it here).

So a plot can be mainly residential, but there’s a little “open use” space for schools, restaurants, convenience stores, etc. to fill in as needed. This helps neighbourhoods to function as decentralised enclaves, and not everyone has to rush toward one particular area for amenities. This prevents sky-high premiums from forming in the densest areas, as even the fringes are quite convenient and liveable.

As such, if you own a single-family home in Tokyo and decide you want to tear it down to build a couple more units instead, there’s not much your neighbours can do to stop you.

This may result in an “ugly” or messy landscape, as there is little visual co-ordination or structure, but the built environment is according to the individual demands.

Another interesting quirk is the focus on new homes

Old properties (30+ years) and resale properties are not popular in Japan. In fact, Tokyo is known for its obsession with constant rebuilding, and most buyers want new homes (small homes in Japan are torn down at an average of 30 years old). There are cultural and geographical reasons for this (e.g., earthquakes, and the child in me screams Godzilla), but the impact remains:

Tokyo is also huge on supply. At one point in 2014, there were more homes in Tokyo than there were in all of England; though I don’t know if anyone has checked more recently.

Other interesting facts include New York starting construction on just under 30,000 new housing units in 2020, while Tokyo started on 130,000 units. Tokyo also has more housing than households every year since 1968, and they are continuing on that surplus.

This has two practical effects on cost:

Japanese people aren’t faced with a “million-dollar resale flat” situation like Singaporeans are. Older homes depreciate, but new ones quickly become available. Japanese people don’t need to worry about older, premium-priced properties, whereas some Singaporeans live off Cai Png for three years to pay their Cash Over Valuation.

More from Stacked

We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Way back in 2012, Singapore saw its first-ever million-dollar HDB flat transaction: a rare a flat at 149 Mei Ling…

(And if you do want an old property in Tokyo, well, it can get dirt cheap).

That’s scratching the tip of the surface, but the answer is apparent: it’s all about supply and demand. The freedom to build what’s needed as situations change, and a focus on constantly renewed housing stock instead of letting old properties become money sinks.

In Tokyo, housing is being built where people live,

Meanwhile in other property news this week:

- Are you sick of tiny condo swimming pools? Do you want gigantic lagoons? Maybe a pool spanning several blocks, that’s big enough to drown a T-Rex in? Check out these condos that have the most impressively sized swimming pools in Singapore.

- So you have a valuable home, but you need cash – and selling or renting are out of the question. Here are your options:

- HDB flats with balconies are rare these days, but here’s where you can still find them.

- Check out some new condos that are already seeing gains, even before they’re built.

Weekly Sales Roundup (05 – 11 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CAIRNHILL 16 | $5,606,112 | 1744 | $3,215 | FH |

| MIDTOWN MODERN | $4,135,230 | 1442 | $2,867 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $3,832,492 | 1625 | $2,358 | 99 yrs (2021) |

| ONE PEARL BANK | $3,680,000 | 1399 | $2,630 | 99 yrs (2019) |

| CAIRNHILL 16 | $3,575,712 | 1292 | $2,768 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LAVENDER RESIDENCE | $1,012,000 | 463 | $2,186 | 99 yrs |

| TEMBUSU GRAND | $1,288,000 | 527 | $2,442 | 99 yrs (2022) |

| THE LANDMARK | $1,316,300 | 495 | $2,658 | 99 yrs (2020) |

| LEEDON GREEN | $1,509,000 | 603 | $2,503 | FH |

| THE ATELIER | $1,509,690 | 549 | $2,750 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GOODWOOD RESIDENCE | $7,150,000 | 2497 | $2,863 | FH |

| ORCHARD BEL AIR | $5,000,000 | 3229 | $1,548 | 99 yrs (1980) |

| REFLECTIONS AT KEPPEL BAY | $4,900,000 | 2476 | $1,979 | 99 yrs (2006) |

| THE TRIZON | $4,176,000 | 2067 | $2,021 | FH |

| CHANCERY PARK | $4,150,000 | 2486 | $1,669 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SKIES MILTONIA | $640,000 | 484 | $1,321 | 99 yrs (2012) |

| RIVERBANK @ FERNVALE | $700,000 | 495 | $1,414 | 99 yrs (2013) |

| LAUREL TREE | $720,000 | 463 | $1,556 | FH |

| THE ALPS RESIDENCES | $730,000 | 506 | $1,443 | 99 yrs (2015) |

| NORTH PARK RESIDENCES | $755,000 | 431 | $1,754 | 99 yrs (2015) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ORCHARD BEL AIR | $5,000,000 | 3229 | $1,548 | $2,612,000 | 18 Years |

| CHAPEL LODGE | $2,381,200 | 1528 | $1,558 | $1,706,200 | 26 Years |

| FERNWOOD TOWERS | $2,020,000 | 1195 | $1,691 | $1,415,000 | 6 Years |

| TREASURE PLACE | $2,080,000 | 1335 | $1,558 | $1,255,000 | 17 Years |

| WORTHINGTON | $2,250,000 | 1733 | $1,298 | $1,244,860 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| REFLECTIONS AT KEPPEL BAY | $4,900,000 | 2476 | $1,979 | -$596,300 | 10 Years |

| POLLEN & BLEU | $2,700,000 | 1442 | $1,872 | -$224,850 | 6 Years |

| STARLIGHT SUITES | $1,230,000 | 560 | $2,197 | -$102,045 | 4 Years |

| THE LAURELS | $2,380,000 | 883 | $2,696 | -$57,080 | 11 Years |

| PRINCIPAL GARDEN | $950,000 | 495 | $1,919 | $58,000 | 10 Years |

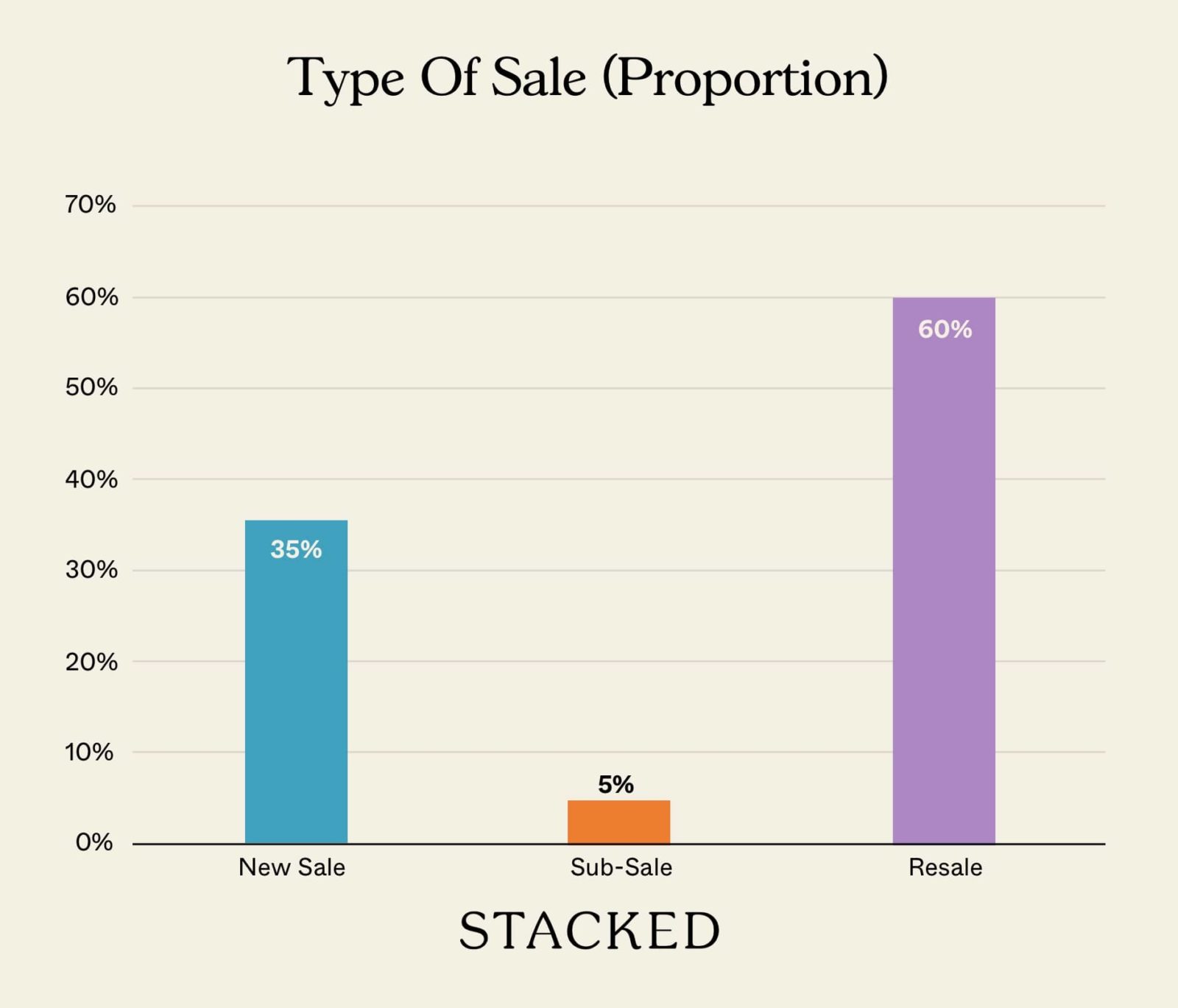

Transaction Breakdown

My most interesting links of the week:

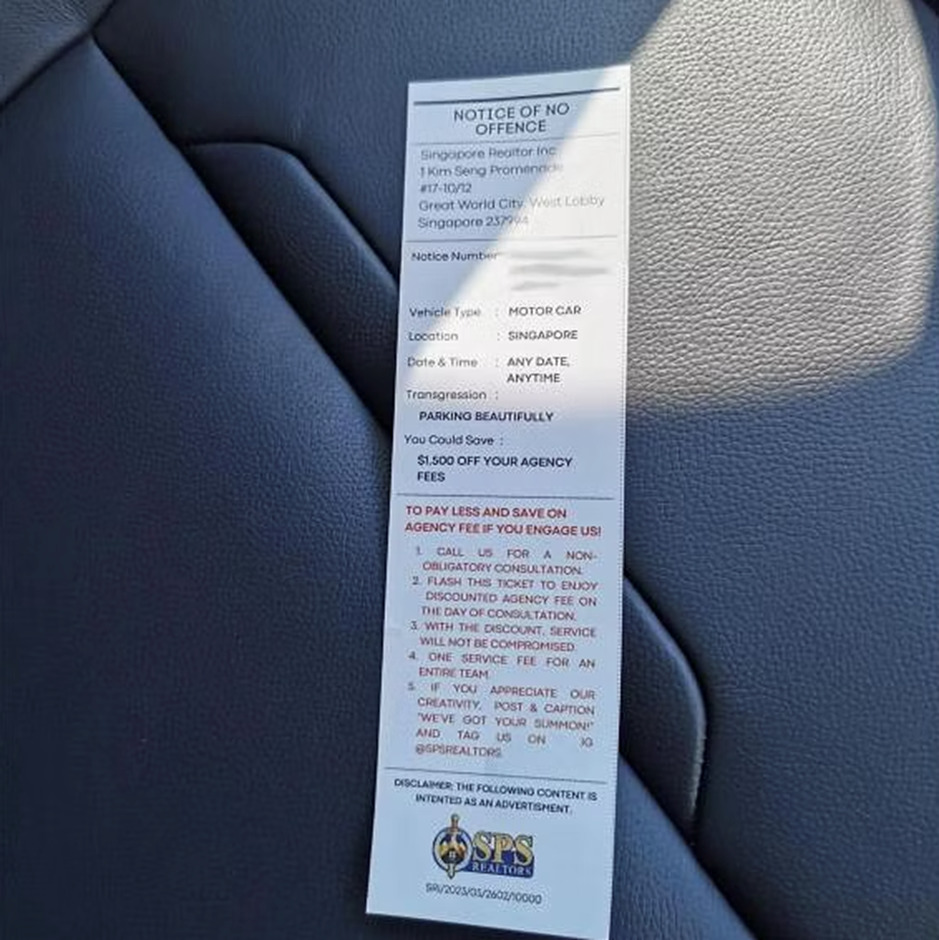

- “Parking summon” to sell real estate?

This was flagged out by an anonymous user from the Facebook page Complaint Singapore Unrestricted, and the person was not happy at all to receive this.

I must admit, it can be a bit of a rude shock – no one wants to see a parking summon on their windscreen.

But, I do applaud the creative element to try something different here (even if this isn’t the first time it’s been done). I’d love to know the hit rate of this advertisement, was anyone tickled enough to reach out?

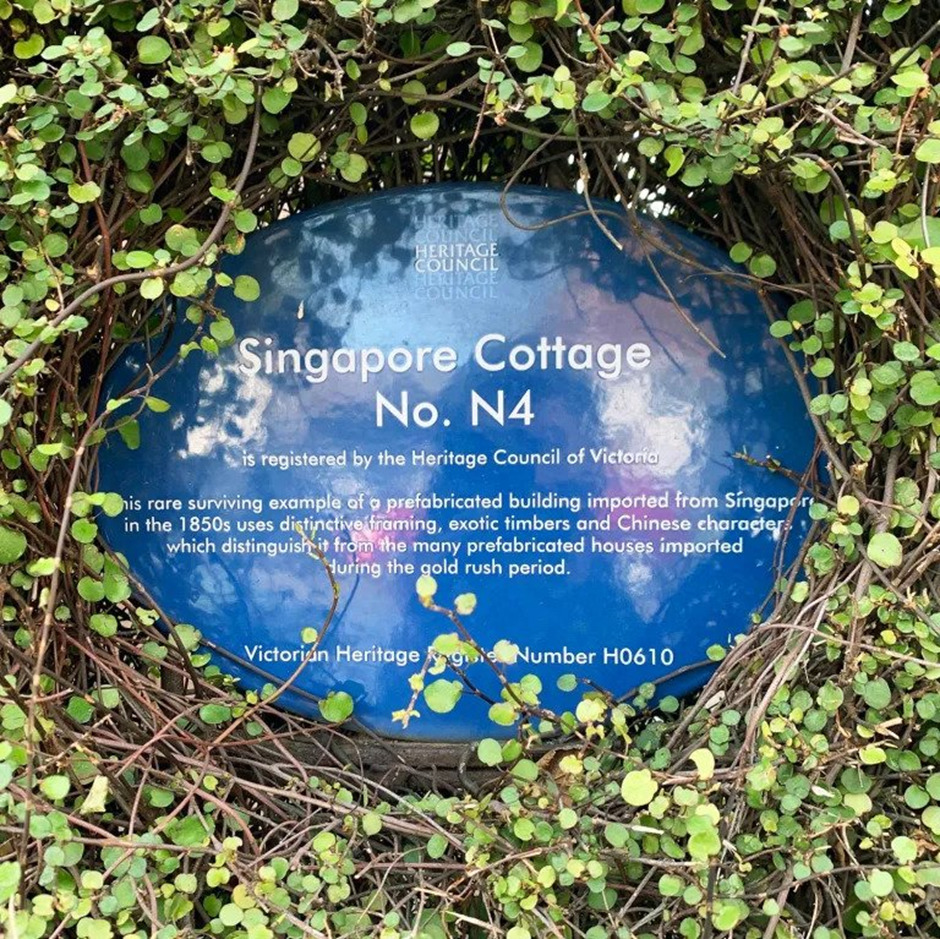

- A Singapore prefab home in Melbourne

This might be old news, but it was still very interesting to know that there’s a prefab home from Singapore that was shipped to Melbourne in the 1850s! Apparently they were made from tropical hardwood in Singapore, and shipped to Australia during the gold rush.

It does make you wonder though, how many of these are just lying around?

For more on the Singapore private property market follow us on Stacked. We’ll keep you up to date on the latest trends.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are property prices in Singapore so high compared to Tokyo?

How does Japan's urban planning help keep property prices affordable?

What is the Japanese approach to housing supply and demand?

Why do Japanese prefer new homes over older properties?

How does the focus on new construction in Tokyo impact property prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments