How Much Do Industrial Areas Really Impact Condo Prices? A Case Study Of Bishan And Yishun

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

In this Stacked Pro breakdown:

- We examined how proximity to light industrial zones affects condo performance in Yishun and Bishan.

- Some developments near these areas defied expectations over a 10-year period.

- The data points to surprising patterns in value and demand — especially for investors.

Already a subscriber? Log in here.

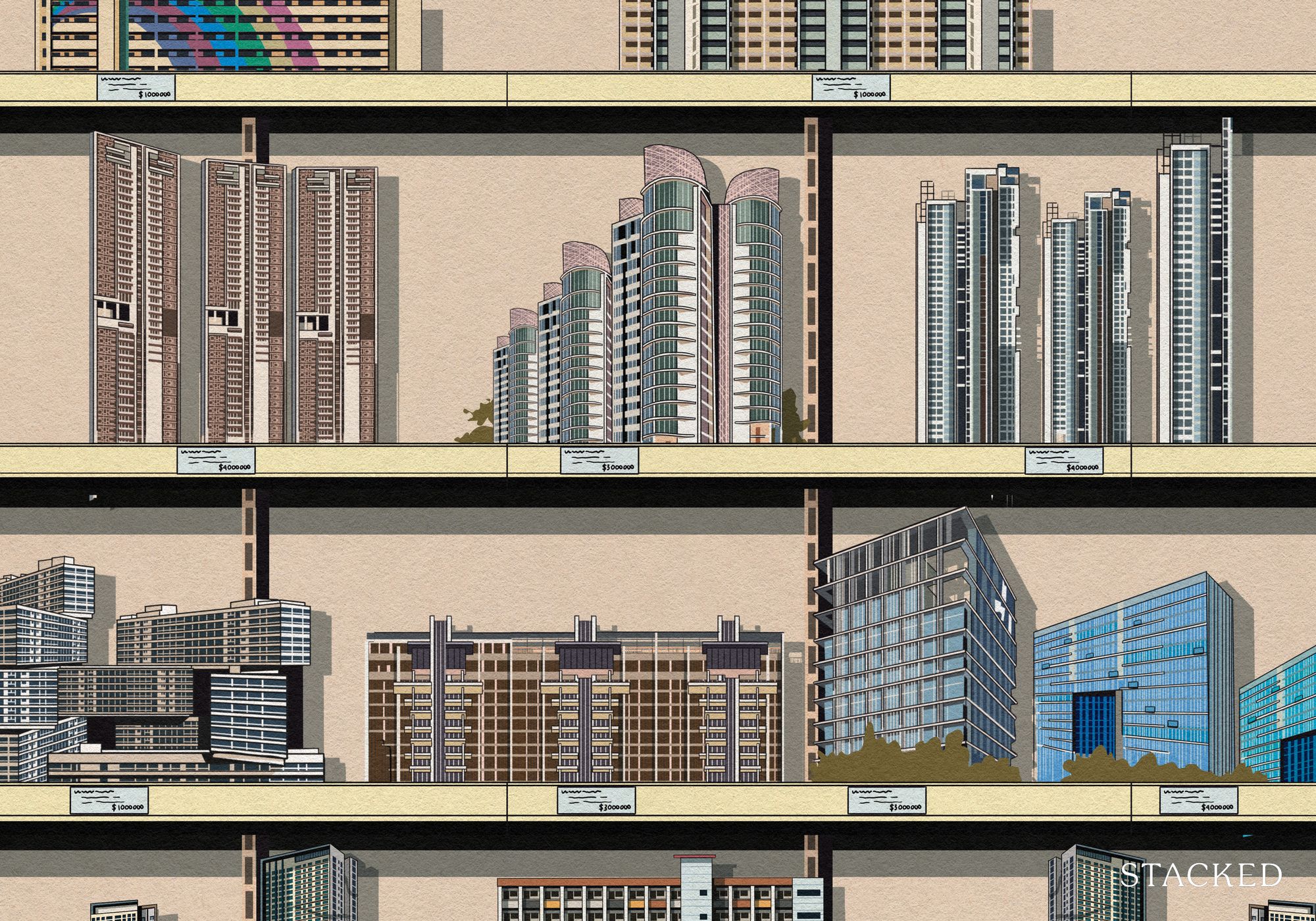

One of the “property facts” most of us assume without question is “nearby industrial areas = bad.” This is a bit simplistic, since not all industrial areas are the same: smog belching heavy industry is actually kept quite far from residential areas, for example, whilst industry near homes tends to be warehouses, materials vendors, etc. Nonetheless, the idea of avoiding industrial areas persists; so let’s take a look at the real data, showing the real impact on housing:

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Market Commentary Where HDB Flats Continue to Hold Value Despite Ageing Leases

Property Investment Insights What Happens When a “Well-Priced” Condo Hits the Resale Market

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

Latest Posts

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Editor's Pick We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Editor's Pick We Review The February 2026 BTO Launch Sites (Bukit Merah, Toa Payoh, Tampines, Sembawang)

Editor's Pick One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

Singapore Property News Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

Editor's Pick Why Buying Or Refinancing Your Home Makes More Sense In 2026

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

Singapore Property News This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Editor's Pick We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

Editor's Pick Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat

Overseas Property Investing What $940,000 Buys You in Penang Today — Inside a New Freehold Landed Estate

seriously? need to pay?