How Do You Decide What’s The Right Price To Sell Your HDB Flat In 2024?

August 14, 2024

The resale flat market may be at a crucial turning point: from the introduction of the HDB resale flat listing service (so you can sell your flat on your own), to the recent news of a $1.73 million flat which, whilst being an outlier, is creating all sorts of misguided notions about flat values today.

Sure, everyone wants to be able to achieve a high price for their home. But unless you’re living in an extremely high-demand spot, the reality for most is that you will need to be realistic about the price of your home.

To help provide some clarity, we’ve put together a few basic ways to get a sense of your flat’s value. Here are some of the things to look out for:

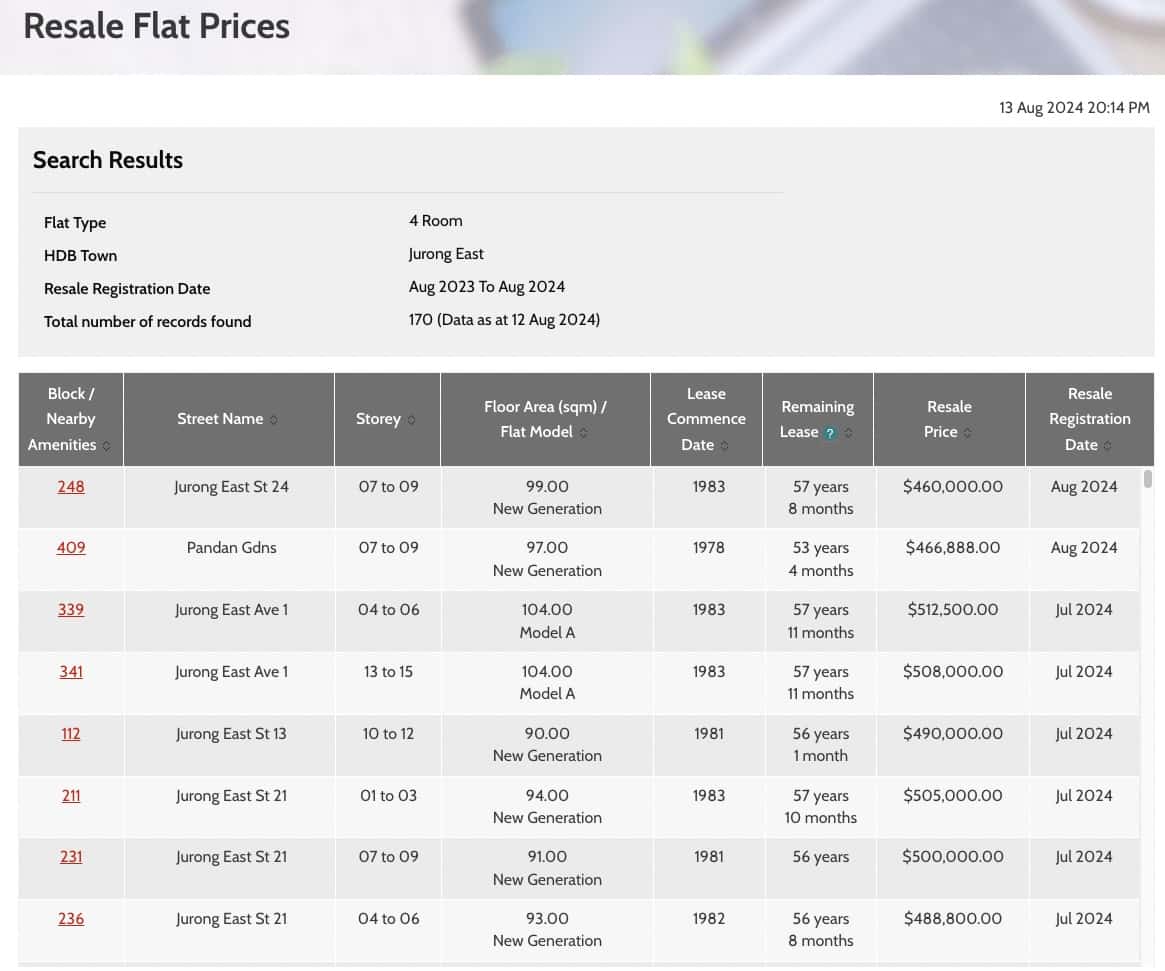

1. Check for similar transactions within the past 12 months

Don’t look at asking prices on property portals; those only reflect when certain buyers are asking, not the actual transaction figures. Instead, check the HDB transaction data. Look for units close to yours (e.g., same flat size, same block, same floor), which have been sold within the past year (any later and the effects of inflation, market changes, etc. could render the numbers inaccurate).

There may be some cases where there’s a lack of transaction volume. This can happen due to location (some areas like Marine Parade are notorious for low transaction volumes), or due to your flat being one of the rarer types (e.g., jumbo or maisonette). In these cases, you may need to broaden the zone of comparable transactions, such as to any similar flats within one kilometre.

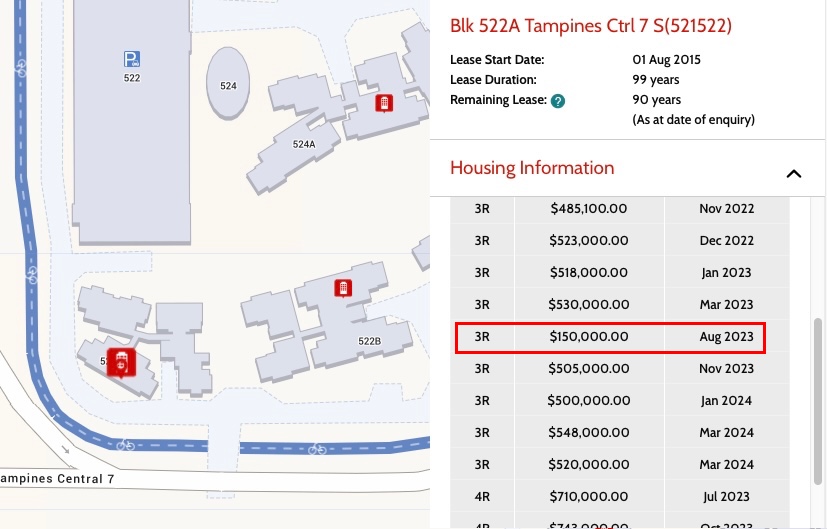

2. Ignore extremes on either end of the transaction history, when trying to price your flat

You need to accept that, because one outlier in your block managed to sell for over $1 million, that doesn’t mean every other flat in the same block will. A high sale price may only be reflective of one highly-motivated buyer or something out of the norm like better renovations, and not on the overall market demand for your flat. Likewise, it’s best to ignore any exceptionally low prices, as these may also be due to unique seller situations (e.g., someone is selling to their own children).

The overall market demand, and hence a fair price for your flat, may lie somewhere in the middle. Ideally, any tools you’re using – or the agent you’re talking to – can provide data on the prices most commonly seen. Set your asking price based on these transactions, rather than on the highest or lowest ends of the scale.

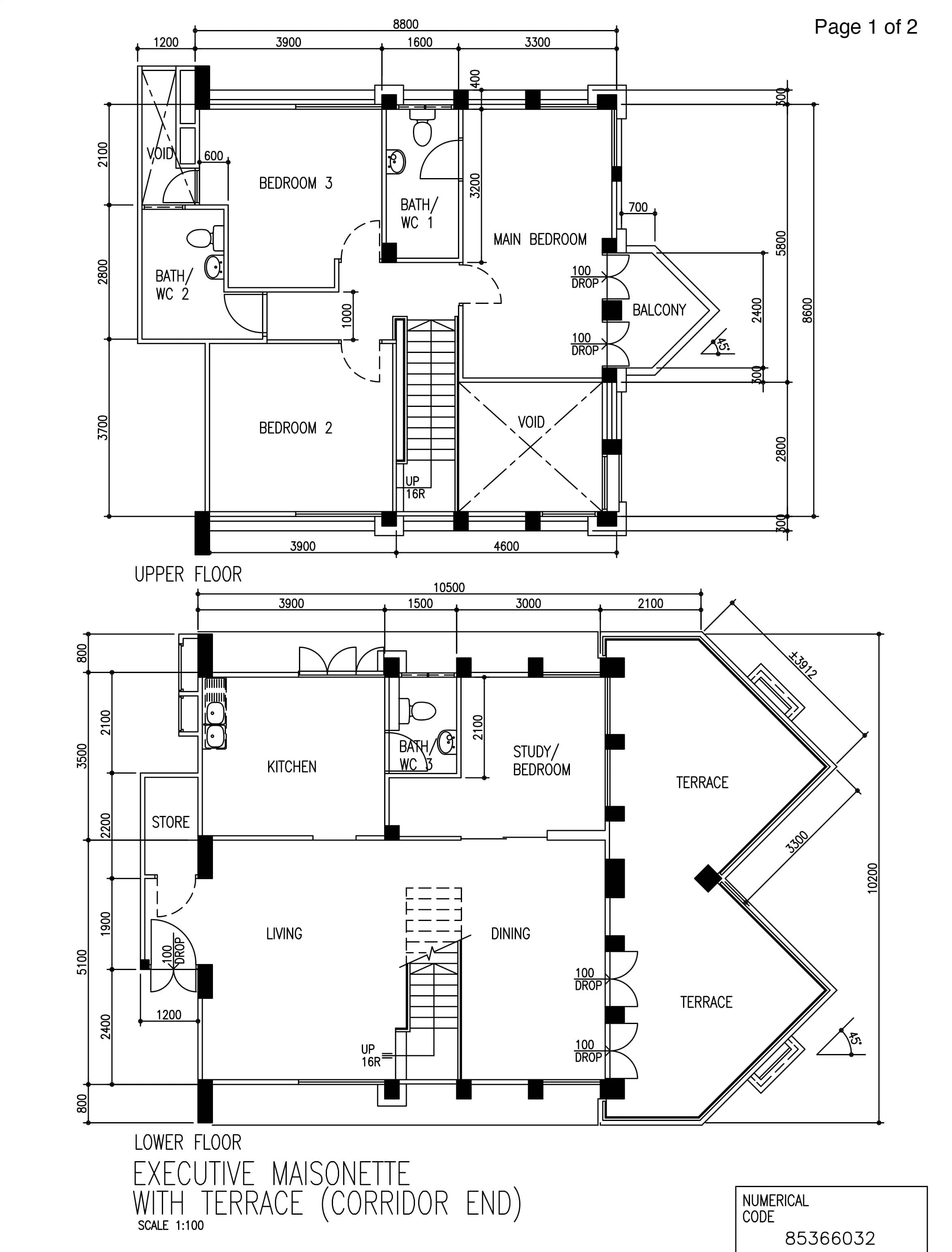

3. Check if your layout is superior to the surrounding blocks

It’s possible for some blocks to be much older or newer than neighbouring ones (except maybe in Marine Parade, which is the most untouched HDB estate since the ‘70s). Some layouts from certain eras are considered more efficient or comfortable, and can command a slightly higher price.

Kitchen service yards only really came about in the 1990s for example, so if the neighbouring blocks are from the 1980s, your newer layout has an edge. Likewise, flats built in the ‘00s tend to have fewer or no corridor-facing flats, which are considered more desirable. On the flip side, HDB flats built before the ‘00s tend to be larger in terms of square footage.

Knowing these exact details will help you justify your price to buyers; and you should know them to price them in, in the first place.

4. Document and explain your renovations

Don’t throw away the details and receipts of your renovation work, if they’re still recent. If the renovation is just one or two years old, this is new enough to spare buyers from having to renovate on their own; or at the very least, it gives them the option to move in first, and later renovate without using a loan (some people just need more time to save up the money).

You can also point out any highlights like imported tiles, any custom work, etc. as a means of supporting your price. To be clear, it’s inevitable that future buyers won’t value your renovations as much as you personally do – everyone ultimately wants to turn their home into a reflection of their own style. But many do appreciate not having to immediately fix and renovate, right after the major cost of purchasing a home.

5. Check for the availability of surrounding units

The best way to use property portals is to check for total nearby listings, not to check for price (see point 1). Look around for listings that are similar to yours, such as being of the same size, being in the same block, and so forth. As a general guide, the fewer similar listings, the bolder you can be in your asking price.

Simply put, a buyer who needs a flat in your location, but can’t find alternatives, is more likely to pay what you feel is fair.

When checking property portals, note the amount of time that other listings have been on. Usually, the longer the listing remains up, the more suspicious buyers start to become. It’s assumed that homes which take too long to sell have “something wrong” with them, or that you’re getting desperate and they can lowball you.

If you’re not in any hurry, you can opt to wait until there are fewer competing listings, to get a fairer price for your flat.

(Ps. The toughest time to list might be right after the five-year MOP, when many aspiring upgraders may all rush to sell at the same time).

Finally, do consider selling your flat before you try and secure your new home

With the exception of Executive Condos (ECs), you’ll need to pay the ABSD on your second property; this is currently 20 per cent of its price or value, whichever is higher. Your ability to get ABSD remission is then contingent on selling your previous home within a six-month period.

When you get closer to this deadline, panic often sets in. In effect, you place a time limit on yourself, and you’ll likely settle for a worse price as it runs out. (Although it has to be said, selling first may also result in you panic buying and overpaying because you need a place to stay).

So as much as you want to “lock in” a good replacement home, you should focus on selling the existing one first. You’re more likely to get fair or better value for your flat this way.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

0 Comments