How Condo Buying In Singapore Became A Game Of Luck

August 3, 2025

Some time ago, I met a condo buyer who told me he spent weeks obsessing over floor plans, stack orientations, and even fortune teller consultations over the better unit for his one-bedder.

He finally settled on the perfect unit: high floor, greenery view, and in the block closest to the side gate for MRT and mall access. He balloted for it under the placement system. He didn’t get it.

And that was that. No fallback, no pivot. The unit went to someone else, and he went home feeling like he had played a game with only one move and lost.

That’s the trade-off with the placement system, which some developers have started using at new launches. On paper, it is neater and simpler to understand; but it can be less forgiving than the more common balloting system.

In the usual balloting process, buyers register interest and are assigned a queue number. When their number is called on launch day, they choose from whatever units are available. Now it can get fast and stressful, especially for popular projects; but there is some flexibility. If you’re prepared, for example, you can walk in with a ranked list, watch the screen, and adjust your picks on the fly.

But the placement system works differently. Buyers select one specific unit before the ballot. If ten people choose the same unit, they are entered into a draw for it. The one who gets picked gets the unit. Everyone else walks away empty-handed.

Now again, placement sounds cleaner on the surface. There’s no last-minute decision-making, and no pressure to make on-the-spot decisions (although again, if you walk in with a ranked list and plan, you won’t have to.)

But what it removes in decision-based stress, it adds back in pre-ballot anxiety.

Buyers are now placed in a position where they’re gambling on the popularity of a unit. Do you go all in on your ideal unit and risk competing with dozens of others? Or do you choose a less popular unit, just to improve your chances of getting something close to what you want?

In the placement system, there is no safety net; your only hope is for the person who secured the unit to somehow change their mind and back out.

(And yes, part of the reason for a placement system is to dissuade this – if you feel you got really lucky and secured a high-demand unit, you’re even less likely to back out and lose it.)

Balloting is not perfect, but most buyers are probably better off with it

If your number is called late, many of your preferred units might already be gone. But at least you are still in the game. It’s especially helpful in projects with higher unit counts and many similar layouts, as you’re still likely to walk away with a unit that fits your needs.

Sometimes, the nature of the project makes balloting better. For example, at a project like Parktown Residence – which has a dozen towers – it doesn’t matter too much if you miss a specific unit. You might be able to get another similar unit at a similar floor, in a different tower. When the project is big enough, balloting is the system you’ll probably hope for.

More from Stacked

Are Resale Flats “Across The Road” From Prime Location HDBs A Better Buy?

One of the effects of Plus and Prime model housing is the impact on pricing “across the road”. Because these…

I’ve also found that, practically speaking, most buyers are not so uncompromising that they want one exact layout and one exact view. Most would rather compromise a little (e.g., go a few floors up or down, or get a different facing) than walk away with nothing.

This isn’t really something we can choose, but it’s something worth bracing for; especially if you’ve spent months narrowing your options to one perfect unit.

If you’re the type who can afford to walk away when that one option falls through, placement might not worry you. But if you still want alternatives, it’s best to talk to an agent about it. And in the event you do face a balloting system, I’d suggest preplanning the alternative picks, in case you end up with a later queue ticket than expected.

Meanwhile, in other property news

- Can you still buy anything at a new launch with $1.5 million or just under that? The answer is yes, and some of the projects are surprisingly central.

- A 50+ year old flat for $1 million is not as crazy as many people think; you just need to be in a different stage of your life to make sense of it.

- Buyer trends are reshaping our priciest prime neighbourhoods in 2025. Here’s what heralds the wave.

- River Green is surprising everyone with its sub-$2 million pricing, despite being next to Great World MRT. But how does it really measure up against nearby projects? Find out with Stacked Pro.

Weekly Sales Roundup (21 July – 27 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $21,060,160 | 4489 | $4,692 | FH |

| UPPERHOUSE AT ORCHARD BOULEVARD | $7,629,000 | 2056 | $3,711 | 99 years |

| MEYER BLUE | $6,037,000 | 1905 | $3,169 | FH |

| GRAND DUNMAN | $4,558,000 | 1787 | $2,551 | 99 yrs (2022) |

| TEMBUSU GRAND | $4,076,000 | 1711 | $2,382 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ROBERTSON OPUS | $1,386,000 | 431 | $3,219 | 999 years |

| HILL HOUSE | $1,396,000 | 431 | $3,242 | 999 years |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,402,000 | 474 | $2,960 | 99 years |

| TEMBUSU GRAND | $1,472,000 | 527 | $2,791 | 99 yrs (2022) |

| PROVENCE RESIDENCE | $1,496,000 | 926 | $1,616 | 99 yrs (2020) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE SOVEREIGN | $6,500,000 | 2637 | $2,465 | FH |

| MARINA BAY SUITES | $6,400,000 | 2691 | $2,378 | 99 yrs (2007) |

| HALLMARK RESIDENCES | $5,000,000 | 2788 | $1,793 | FH |

| SCOTTS 28 | $4,620,000 | 2034 | $2,271 | FH |

| TREASURE ON BALMORAL | $4,400,000 | 1765 | $2,492 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ISUITES @ PALM | $660,000 | 431 | $1,533 | 999 yrs (1878) |

| NESS | $680,000 | 431 | $1,579 | FH |

| VIBES@UPPER SERANGOON | $685,000 | 409 | $1,675 | FH |

| THE INTERWEAVE | $700,000 | 388 | $1,806 | FH |

| # 1 SUITES | $700,000 | 560 | $1,251 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SOVEREIGN | $3,000,000 | 2637 | $1,138 | $3,500,000 | 19 Years |

| PARC PALAIS | $720,000 | 1485 | $485 | $1,679,000 | 21 Years |

| ONE LEICESTER | $808,120 | 1281 | $631 | $1,620,768 | 18 Years |

| WATERFRONT KEY | $898,010 | 1313 | $684 | $1,505,278 | 16 Years |

| GLENTREES | $1,550,000 | 1442 | $1,075 | $1,400,000 | 16 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| DEVONSHIRE RESIDENCES | $2,462,200 | 947 | $2,599 | -$912,200 | 14 Years |

| HELIOS RESIDENCES | $4,880,000 | 1668 | $2,925 | -$630,000 | 11 Years |

| DUO RESIDENCES | $3,496,000 | 1528 | $2,287 | -$46,000 | 11 Years |

| GRAND DUNMAN | $3,604,000 | 1518 | $2,375 | $0 | 0.2 Years |

| THE ARDEN | $1,974,000 | 1141 | $1,730 | $0 | 0.3 Years |

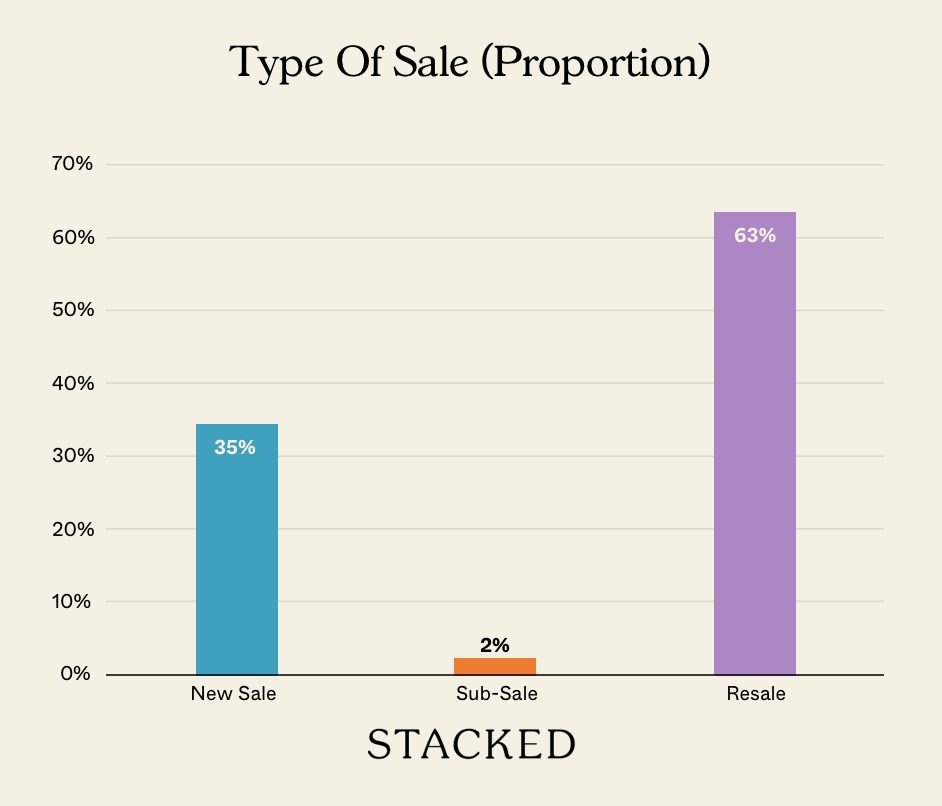

Transaction Breakdown

Follow us on Stacked for updates and deep dives into the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the main difference between the balloting and placement systems in Singapore condo buying?

Why might some buyers prefer the balloting system over the placement system?

What are the risks associated with the placement system for condo buyers?

In what situations might balloting be more advantageous than the placement system?

What should buyers do to prepare for a balloting process?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments