Singaporeans Share Their Frustrations About “Affordable” Public Housing: Here Are Some Of The Best Points From Reddit

October 26, 2022

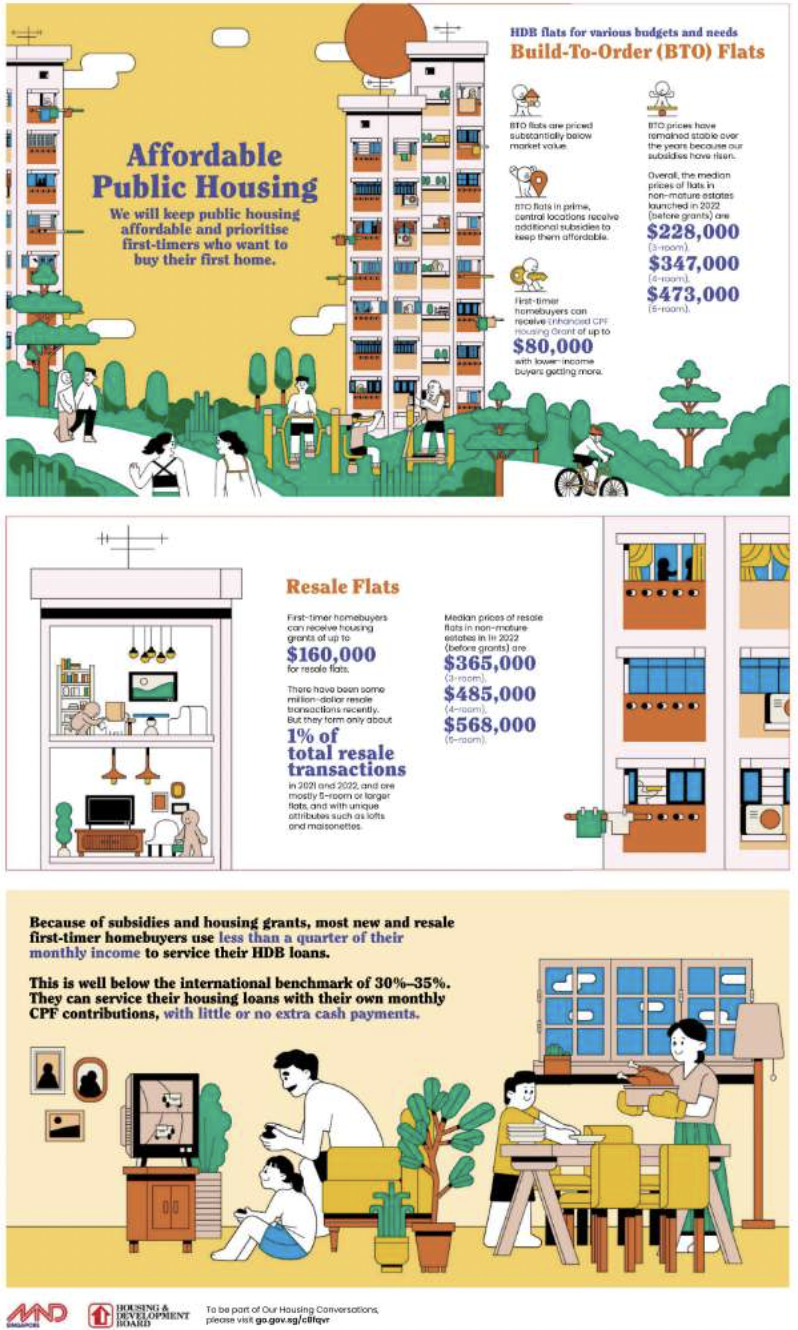

There have been some split opinions on the affordability of HDB housing, following an infographic in the Sunday Times.

Of late, the topic seems to hold two divergent opinions: the first that HDB is too expensive and these infographics are justification attempts, and the second that Singaporeans are too picky as buyers and expect too much. However, there are more ways of looking at this situation – here are some view points that some Reddit users have expanded on to consider:

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Time and flexibility need to be considered part of the cost

This perspective holds that we should look beyond the usual parameters, such as income and quantum. It’s true that most BTO flats are affordable in a dollars-and-cents manner; but the compromise on time must be considered.

A BTO flat takes about five years to build. On top of that, the Minimum Occupancy Period (MOP) is another five years. All in, this means that buyers of BTO flats are “locked” into the same location for around a decade.

As one Reddit user noticed:

“How about wait times before collecting BTO key? Time is money too and people cannot afford to wait so long.”

Another pointed out that:

“However you are tying up a couple to a location for 10 years across construction and MOP. It’s not unreasonable for them to ballot only if the location is near their workplace/parents when the commitment is so long. It’s not as if there are many 3-gen units offered where their parents can move in with them and eliminate travelling for visits.”

2. The issue of single versus dual-income families

As one Reddit user noted, regarding the previous generation: “Also would like to add that back then most families were single income, so they had at least one partner at home so availability of services was not as crucial as one partner was free to do household stuff throughout the day. Nowadays both partners are usually working.”

It’s true that, for the most part, rising home prices have followed rising wages – but are the perceived “rising wages” ultimately due to the normalisation of the dual-income family?

Among most HDB owners we’ve spoken to, the norm of is for both – typically spouses – to contribute to the mortgage. But HDB affordability might be significantly lower, if we look at single income families.

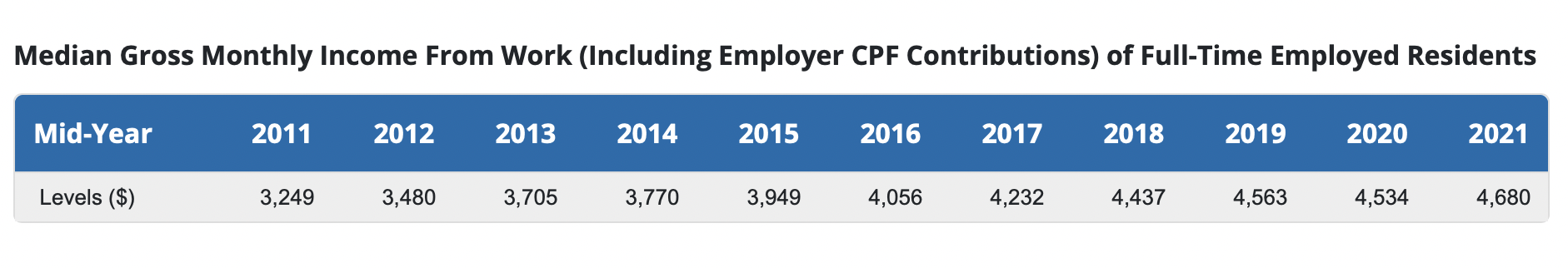

For example, for two spouses earning around $3,000 each (below median income as of 2022), a collective income of $6,000 allows for a home priced at about $360,000.

This is using CPF’s 3-3-5 guideline, which we also discuss here; this limits the maximum home price to five times annual income, among other requirements.

According to the infographic, this is sufficient to purchase a 4-room BTO flat, for which the given median is $347,000.

However, we need to remember that a dual-income family is operating with a more fragile safety net. If one spouse is unable to work, for example, affordability is effectively halved: whereas a unit at $360,000 was once affordable, the acceptable amount now plummets to $180,000.

This is, according to the infographic, below the median price of even a 3-room unit. Of course, the CPF’s 3-3-5 guideline is one that is very prudent, but that is the most “official” guidelines that is out there.

Now, we don’t have data on how many HDB owners were single-income families in the past, compared to today. But if it turns out that, say, a third of HDB owners were single-income back in the 80’s, but this ceased to be viable in recent years, then it’s arguably a sign that affordability has fallen, and that we’ve lost a bit of security in the sense of needing both spouses at work. (Although it must be said, it’s also unfair to compare different times as Singapore is so much more developed today compared to the past).

As such, it’s reasonable to consider that this may – in a less visible sense – be contributing to later marriages and a lower birth rate. After all, if you don’t have help from parents, and it takes more than a couple of years to BTO to have your own space, and both have to work to maintain the home, you can see why it’s so difficult to even think about having kids in today’s context.

3. Affordability means resale affordability too

This is somewhat related to point 1, in that it involves time. To some home buyers, you can’t call HDB flats affordable unless it’s true for resale flats as well. This is most apparent for those who cannot buy cheaper BTO flats.

More from Stacked

A First-Time Homebuyer’s Journey: The Pros And Cons Of Buying An Old, Resale Condo With En-bloc Potential

Last week, I concentrated my property hunt in the Pasir Panjang region, and after finding 1 property to shortlist, I…

For families where both buyers are Permanent Residents, for example, there’s no chance to ballot for a BTO flat. Likewise, some families need a resale flat they can move into right away, whether for work or living conditions (e.g., and it’s tough for a young couple with children to also squeeze into a 3-room flat with in-laws).

For these buyers who can’t get BTO flats, it’s difficult to argue that HDB is “cheap” – not while the resale flats they need are at an eight-year peak (and still rising).

Recent cooling measures do attempt to help this group though; In September, cooling measures imposed a 15-month waiting-period, to prevent private home sellers from immediately buying up resale flats. This is unless if you are 55 years or older, however, and are selling your private property to buy a 4-room or smaller flat. If so, the wait-out period does not apply to you.

Another group of home-buyers, who believe in the importance of upgrading, also need resale flats to be affordable.

Some home buyers believe it’s essential to upgrade to a condo, as the appreciation of a flat will now help their retirement fund. This in itself is a huge topic for debate – but for now, let’s assume they have the right idea.

For these buyers, affordability must also mean affordable resale units. BTO flats are out of the question for them, due to the time involved.

Consider that, five-years ago in October 2019, average resale condo prices (according to Square Foot Research) were at $1,802 psf. This November, they’re at $2,256 psf; an increase of 25 per cent, while waiting for the MOP alone to expire.

Every year they wait, the prices of private properties rise further, and make it harder for them to upgrade. There’s no way they can settle for a BTO flat, wait five years for construction, and then wait another five years to upgrade.

There is, however, an irony in that this group wants both affordable resale flats, and for resale flat prices to keep pace with the private market.

4. Perhaps it’s not so much about being picky over location, but about what buyers value today

Every generation before the last likes to say that the new generation gets it easy, but the truth is that the situation is completely different to be compared fairly.

For example, what buyers value in the past, as compared to what is important to buyers today.

As another Reddit user wrote:

“But perhaps it’s really about differing perceptions of what constitutes good value – for older generations, it was just about having their own space to start families. Time (spent commuting, waiting for BTO, traveling to parents’ house to pick up their kids) and capital appreciation were not as much of a priority when they were starting out.

Young people today get married at 32, not 22, so time is much more important for them – they don’t have the luxury of waiting for BTO, or spending 3 hours daily on the bus, train, LRT. They need to have kids sooner but they can’t take time off their careers to stay home, so being close by to parents is necessary. And they need the capital appreciation because they have a shorter timeframe to save for their kids, help with their parents’ expenses (they don’t have 6 other siblings to chip in), and plan for their own retirement.”

In that sense, it’s not so much about trying to promote that non-mature areas are affordable, but about making them even more attractive to home buyers.

Besides pushing Work From Home initiatives or a 4-day work week, the same Reddit user notes that more can be done:

“Maybe HDB should consider lowering their commercial rents in these areas for creative/interesting businesses that add value and life to the neighbourhood, in addition to park connectors and community facilities.”

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with reviews of new and resale projects, so you can make a better-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do some people think HDB flats are not as affordable as they seem?

How does the time it takes to get a BTO flat affect its affordability?

Does the income level of families impact HDB affordability?

What factors are changing buyers' priorities when choosing public housing?

Are resale flats considered affordable for all buyers?

What suggestions are there to make older or non-mature areas more attractive for buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

1 Comments

It is affordable as long as people stop being deluded and buy what they can afford.

Ie if you make peanuts live in Sembawang or Yew Tee.