From A HDB Undersupply To Interest Rates Hikes, Here’s Why The New Cooling Measures Were Necessary

January 4, 2022

There’s been much talk and chatter around the new cooling measures. Understandably so, as housing is always such a touchy topic for many people.

So far there have been lots of contributions and viewpoints on how the new cooling measures may impact the property market, and that’s all fine and dandy. But I do also think it’s worth covering the underlying reasons behind it, and why things have played out the way they have.

I’ll start with the undersupply of new HDB BTO flats.

The undersupply of new HDB flats is one key factor that led to the turnaround and the rise of HDB resale prices in the last 2 years. This is after 3-4 years of price decline before Covid-19, when supposedly employment and incomes were under threat by uncertainties during the pandemic and now from the mutating virus.

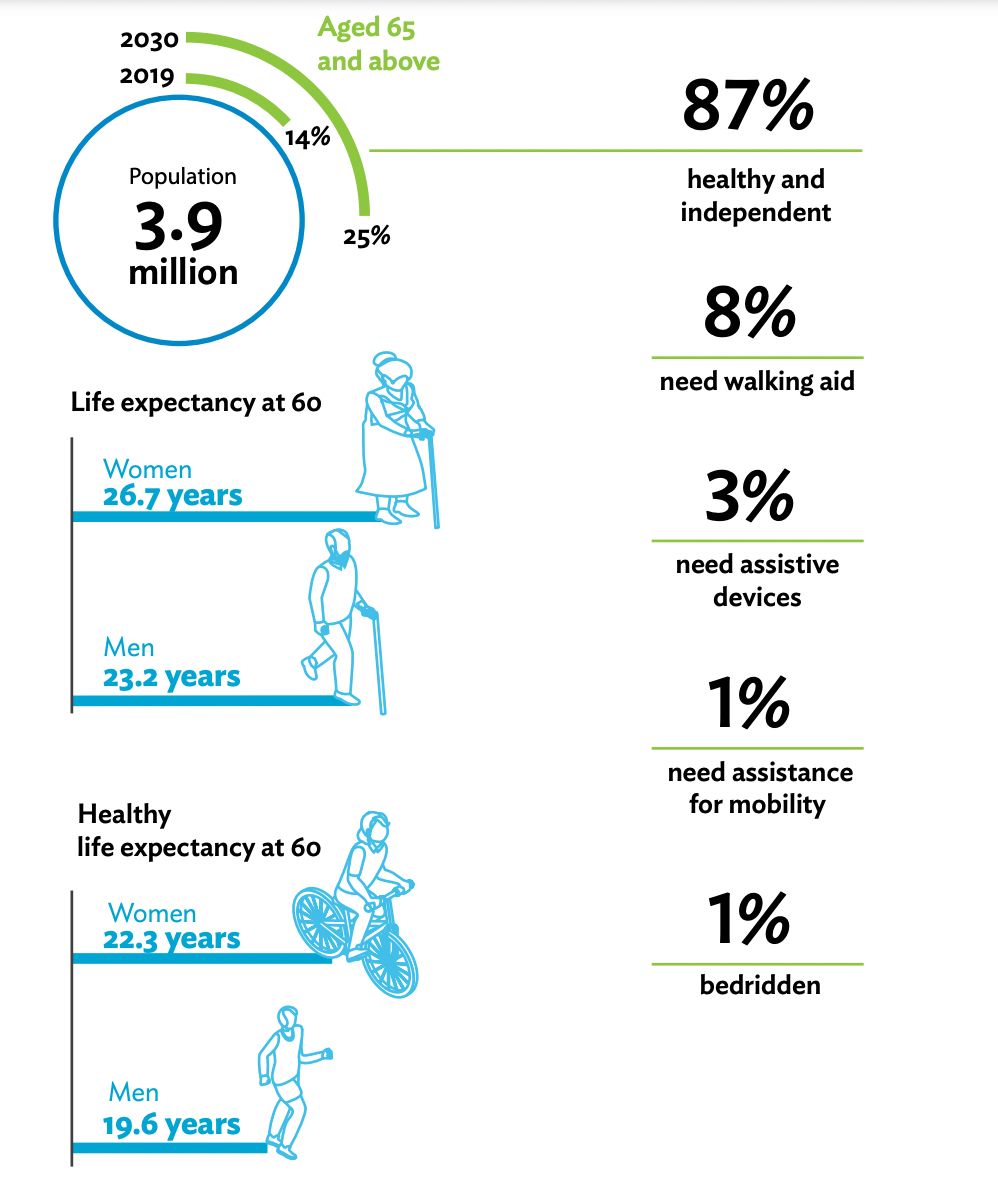

I believe the Government, with data visibility that we are not privy to, can see an increasingly ageing population, a slower net growth in population, and a rising mortality rate among the Pioneer and Merdeka generations.

Because of the decaying value of old and older HDB flats hence falling prices and falling interest in them, I suspect the Government was worried about a possible oversupply of HDB flats.

This, in my view, is a foundational cause of the surging demand and prices of resale HDB prices.

Upgraders were then pushed to consider and buy private resale units and new launches, especially in OCR and some RCR projects.

This uplift in demand drove both prices and volume transacted, especially in the OCR and RCR markets, to new heights.

The above is what worries the Government who has a social compact with the majority of the voting population to maintain a stable and sustainable housing market for first-time house owners.

If anything, the Government is less worried about the high-end CCR and RCR projects where buyers are likely to be more affluent and sophisticated in their real estate needs and investment.

With 2 years of price rises, during the pandemic, especially in the HDB resale market, the OCR and RCR segments, the social compact was breaking, while in parallel prices were running ahead of income growth.

Now, on interest rate.

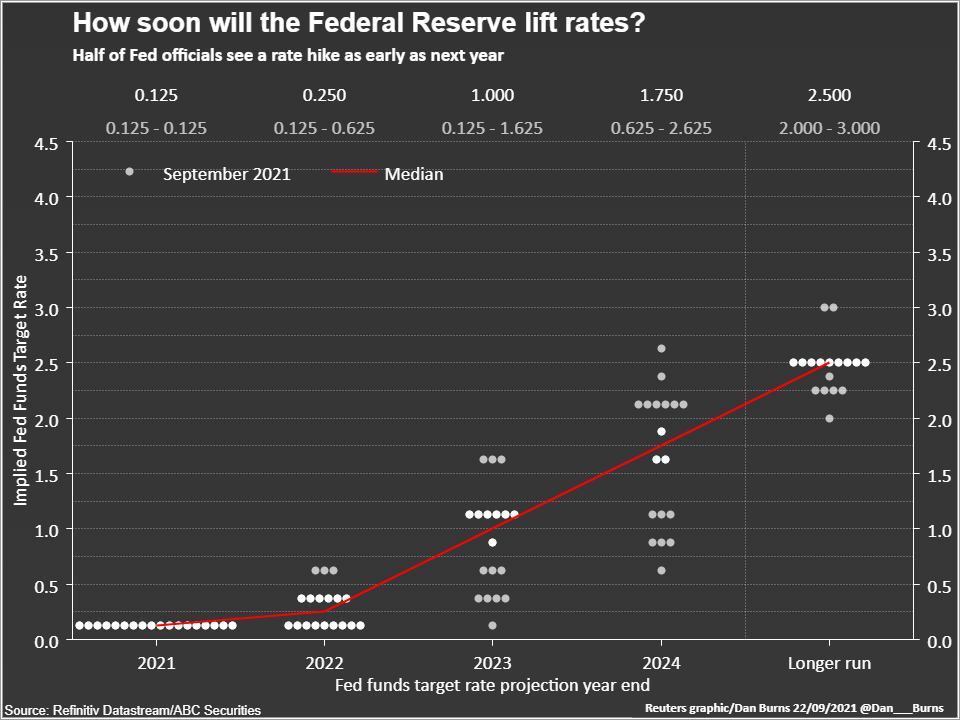

Despite the Fed retiring the word “ transitory “ in its narrative on inflation trajectory, hence the spectre of rising interest rate, the interest rate increases suggested by the Fed are incremental. With 3 increases this year to take the interest rate to around 0.75 % by the end of 2022.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

7 Key Requirements To Make Your Property A Retirement Asset

Home prices are at a peak in 2021, and the Additional Buyers Stamp Duty (ABSD) has raised questions on whether…

The Fed was also talking about rates stabilising around 2% to 2.25% in two years time.

In absolute terms, 2% to 2.5% is not debilitating. Hence in my view, the interest rate increase is priced in and manageable, and has limited impact on buyers and investors.

What is more uncertain and complex is the mammoth liquidity in the market, after trillions of dollars were printed and borrowed in the richer nations in the last 2 years

With the unpredictability of crypto and a volatile equity market, it is likely that profits would be taken and placed in real estate in global gateway cities.

This is where possible consequences have to be managed to avoid market swings and collapses when shocked by uncontrollable external forces or domestic policy mistakes.

With the situation described above, and at this point in time, a responsible government will do its best to ensure a stable and sustainable property market for its citizens and permanent residents.

In my view, as a keen property observer, I support the cooling measures which could have come sooner by 2-3 months.

In order for the Government to achieve its built environment, we should welcome and support policies that helps to keep the market stable and sustainable.

Many of us have been expecting the new measures to cool and reset the market for stability and sustainability.

It is a win for those who genuinely need an affordable home to start a family or upgrade to a larger home to meet their growing family needs.

These hardworking people, amongst others, will power GDP growth which in turn benefits property developers, agents, and taxes collected to pay for the relentless reinvention of Singapore to stay relevant and attractive to talent and funds from abroad.

In my view, it is a win win win, if one sees through the shadows and focuses on the future of Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the government introduce new cooling measures for the property market?

How does the undersupply of new HDB flats affect resale prices?

What impact do rising interest rates have on the property market?

Why is the government concerned about the rising prices in the resale HDB market?

What external factors influence the property market besides interest rates?

How do the new cooling measures benefit first-time homebuyers and families?

Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments