Here’s How NOT To Sell A Condo…

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

No way, not another lawsuit over KAP.

I thought the issues with KAP Residences were settled, after the legal entanglements with the developer. Owners at KAP Residences were more than a little peeved, when promised tenants like McDonald’s and Cold Storage didn’t materialise. I don’t know what happened with that lawsuit, but it didn’t seem like much was happening. And KAP Mall is doing much better now by the way, under the control of the owners themselves.

But it seems there’s a sequel to all this come 2024; and this time the property agency may be caught in the middle of it too. The shop owners in the mall are making claims of misrepresentation, and again the names McDonald’s and Cold Storage get brought up.

These two names are a huge deal in commercial real estate by the way. Some shop buyers specifically follow McDonald’s, for instance, as the fast food-chain is famously acute at picking out hot spots (as I’ve written here before, McDonald’s is actually a real estate company that just happens to sell fast food.)

In any case, one thing about all this strikes me: “Oxley claimed it did not know of Huttons’ co-broking arrangements and the representations were not made based on instructions it had given Huttons.” (From the linked article)

Now I’m not making any claims as to who is right here, I haven’t a clue. But you know how you’re always told to “do your homework” before buying? Well it’s an empty platitude in a situation like this.

If there really is a disconnect between the developer and their agent, how is a buyer to know? No amount of Google-skills and inquiries will reveal it, until it’s way too late. And I do wonder if developers should be more involved with what agents are saying, when they huddle up with prospective buyers.

Most people wouldn’t think to double-check what they’ve heard from an agent with the developer, even if they knew who to contact. And more importantly, they shouldn’t have to. A more thorough look at the sales presentations and materials may be in order.

(Which isn’t to suggest agents are being deliberately malign – there may be genuine and unintentional miscommunications).

Regardless, this should serve as a warning sign to those looking to buy or invest in real estate. Even if the buyers do come up on top here in this legal case, it’s probably not worth the time, stress, or opportunity cost that has been saddled with a deal such as this. Do your own homework, and don’t take everything just at face value.

Meanwhile, some flat sellers are using the Prime and Plus model as a way to justify higher prices.

This has been in the news, and not to flex, but we kind of saw it coming. It was inevitable that someone would look at a Prime project, see the 10-year MOP, and then walk around for 10 minutes and find a nearby block with no such restrictions.

More from Stacked

Why The 2 Pine Grove Plots Are The Next Property Sites To Watch

There haven’t been many Government Land Sales (GLS) sites in 2021, so almost any plot is likely to draw developer…

Now I think the situation will resolve itself over time: a lot of the flats in the most desirable locations (that predate the Plus and Prime model) are old. Some are almost halfway through their lease, and that should lead to their eventual depreciation. But in the meantime, it’s easy to see why there would be a surge of interest in resale flats near plus or prime locations, but which are free of their counterparts’ restrictions.

There’s also the issue of Prime housing not having 5-room flats (so far, Prime housing seems to stop at 4-room flats). Now if a big family can’t get the space they need via a BTO flat, they might just turn to resale. This could push up the prices of resale 5-room or larger flats, which happen to be near Prime areas.

Meanwhile, in other property news:

- Are Singapore property prices finally starting to fall? We take a look at some of the possible signs.

- One North is a hub, though not on the level of Paya Lebar and Jurong East. That may change soon though, so investors should pay attention.

- Tired of getting soaked on your way to the MRT station? Here are 23 condos with fully sheltered walks to the train.

- Luxury freehold properties: Great for living, so-so for investing. Here are the issues involved.

Weekly Sales Roundup (09 October – 15 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $6,425,000 | 1808 | $3,553 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $5,590,000 | 1496 | $3,736 | FH |

| GRAND DUNMAN | $4,016,000 | 1690 | $2,376 | 99 yrs (2022) |

| MIDTOWN MODERN | $3,834,000 | 1464 | $2,619 | 99 yrs (2019) |

| MYRA | $2,990,000 | 1324 | $2,258 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,326,000 | 721 | $1,839 | 99 yrs |

| TEMBUSU GRAND | $1,328,000 | 527 | $2,518 | 99 yrs (2022) |

| 10 EVELYN | $1,391,780 | 495 | $2,811 | FH |

| MIDTOWN MODERN | $1,493,000 | 409 | $3,650 | 99 yrs (2019) |

| PULLMAN RESIDENCES NEWTON | $1,578,000 | 463 | $3,409 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KARTAR APARTMENTS | $18,000,000 | 6964 | $2,585 | FH |

| AALTO | $5,050,000 | 2024 | $2,496 | FH |

| THE MEYERISE | $5,028,000 | 1819 | $2,764 | FH |

| THE SEAFRONT ON MEYER | $4,650,000 | 2110 | $2,204 | FH |

| THE GLYNDEBOURNE | $4,620,000 | 1991 | $2,320 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CAVAN SUITES | $650,000 | 323 | $2,013 | FH |

| PARC ROSEWOOD | $658,000 | 431 | $1,528 | 99 yrs (2011) |

| THE CRISTALLO | $700,000 | 431 | $1,626 | FH |

| D’NEST | $730,000 | 484 | $1,507 | 99 yrs (2010) |

| 8@WOODLEIGH | $731,888 | 398 | $1,838 | 99 yrs (2008) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE ARCADIA | $4,280,000 | 3735 | $1,146 | $2,900,000 | 19 Years |

| THE IMPERIAL | $4,500,000 | 1905 | $2,362 | $2,804,400 | 20 Years |

| RIVEREDGE | $3,900,000 | 1884 | $2,070 | $2,081,920 | 15 Years |

| AALTO | $5,050,000 | 2024 | $2,496 | $1,500,000 | 12 Years |

| THE SEAFRONT ON MEYER | $4,650,000 | 2110 | $2,204 | $1,450,000 | 9 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ALTEZ | $1,520,000 | 861 | $1,765 | -$80,000 | 1 Year |

| THE ENCLAVE . HOLLAND | $1,050,000 | 420 | $2,501 | -$71,000 | 5 Years |

| CAVAN SUITES | $650,000 | 323 | $2,013 | -$18,000 | 9 Years |

| SOPHIA HILLS | $1,128,000 | 506 | $2,230 | $75,000 | 6 Years |

| ECO | $870,000 | 549 | $1,585 | $79,210 | 11 Years |

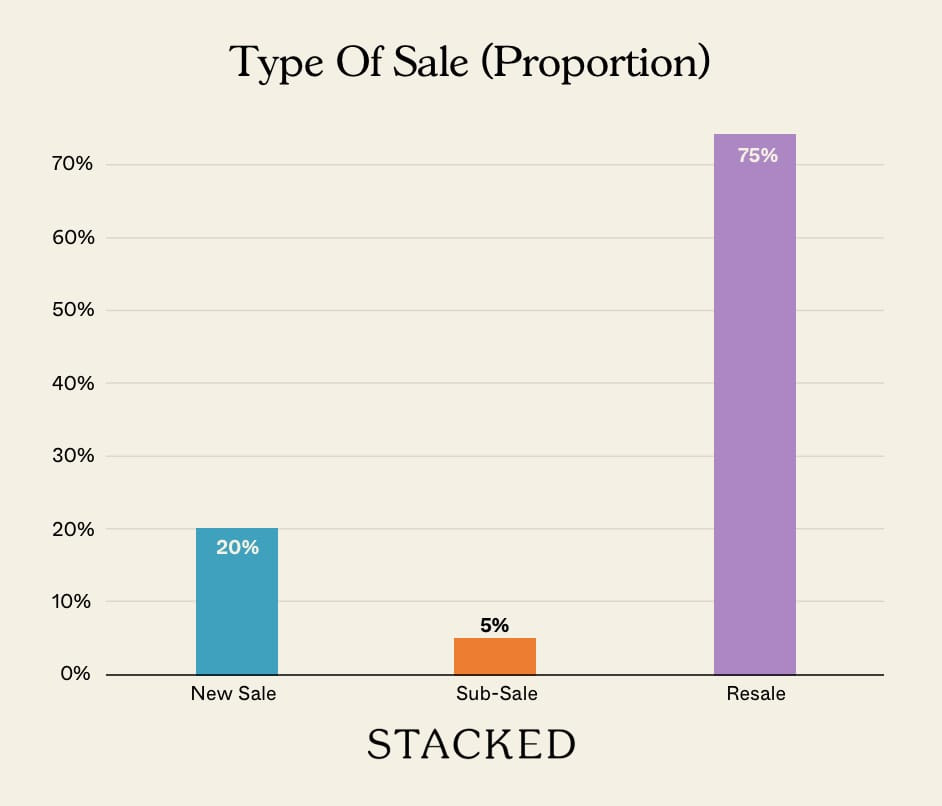

Transaction Breakdown

My interesting links of the week

– Hong Kong properties on sale at steep discounts

Hong Kong has 20,483 new vacant properties in Q3 2023, which is their highest in nearly 20 years. It’s the usual bunch of reasons for the poor demand: a weak economy, rising interest rates, and buyer hesitancy are affecting the market.

Besides this, there is also a relation to China’s shaky economy (and the risks of Country Garden defaulting). It also probably doesn’t help when you read headlines such as “Hong Kong homeowners slash prices as they race to sell before property values fall further.” In a way, this becomes like a self-fulfilling prophecy as people get more afraid and start to behave in an irrational manner.

If anything, this is a warning sign to us in Singapore of how important it is to thread the line of supply and demand.

Do follow us on Stacked for more news and updates on the Singapore property market.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden