The Untold Impact Of Golden Mile Complex Conservation On En-bloc Sales

November 18, 2021

On 22nd October this year, the unthinkable happened: Golden Mile Complex, long assumed to be next for demolition after Pearl Bank, was slated for conservation. A win for Singapore’s architectural milestones to be sure; but with regard to property investors and homeowners, it could be taken as bad news. Conservation means tighter restrictions, and that could be off-putting to developers. However, the government has found something of a middle road, which may have implications for the future:

What’s important about Golden Mile Complex?

Golden Mile Complex was famous for its architecture, both in its prime and at present. It was also one of the first times we saw mixed-used developments, blending commercial and residential interests. And of course, it was designed by a trio of Singaporeans: William Lim, Tay Kheng Soon, and Gan Eng Oon, who were then part of Design Partnership, and now known as DP Architects.

Over the years, Golden Mile Complex went from being seen as an icon of national pride, to being called a sleazy slum, to now being considered part of Singapore’s heritage. Few other developments have had such a long history, with so many ups and downs.

Golden Mile is one of the cheapest condos in District 7

Due to the lease decay (99-years starting in 1969), Golden Mile has been fantastic for homebuyers who prize location over fancy frills and resale value. It’s also been a favourite among landlords who prize pure rental yield.

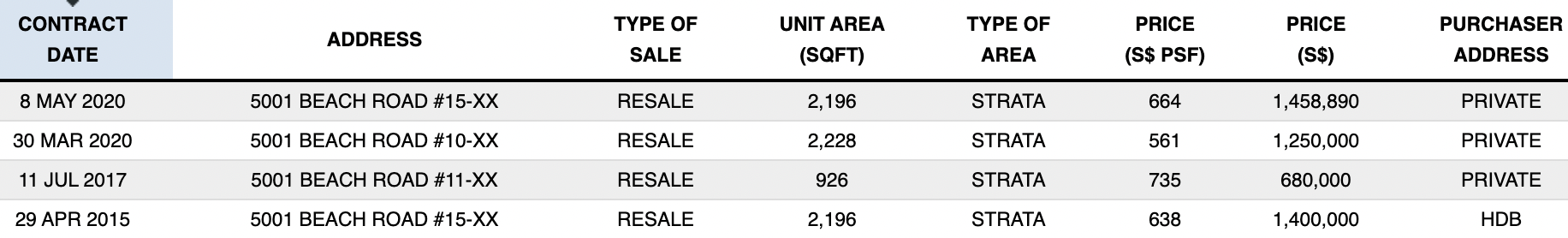

There are only 68 units in Golden Mile Complex, which rarely change hands. The last few transactions showed prices of around $664 psf.

For comparison, the average price of a 4-room flat, islandwide, is $513 psf, while most condos in the same area (District 7) average $2,049 psf.

The last transaction, on 8th May 2020, saw a massive 2,196 sq. ft. unit transact at just $1,458,890.

That’s about the price of a mass-market condo, despite being a 10-minute drive to the CBD and Orchard, and a nine-minute walk from Nicoll Highway MRT.

As you can imagine, developers of every stripe were eager to buy up the land. Any condo built here is likely to succeed on the strength of its location alone. However, two attempts to en-bloc – the last being in 2006 – were utter failures. There were also intense disagreements between owners of the three different segments: commercial, office, and residential.

Note that the commercial portion of Golden Mile Complex is way bigger than the others, with 411 shops to 226 offices and 68 homes.

Many of these shops are closely associated with the foreign worker communities, particularly the Thai community – they have a strong niche, which they don’t want to lose by moving elsewhere.

A redevelopment solution for Golden Mile Complex

When Golden Mile was gazetted for conservation, some of the owners were less than happy. The restrictions on conserved buildings are often off-putting to developers, who have their own ideas for the site.

However, to encourage redevelopment / en-bloc interest, URA has offered incentives for this project:

- An increased Gross Plot Ratio (GPR) to 5.6. The multi-storey carpark currently present can be replaced by a 30-storey tower, due to the increase in floor size.

- Partial waiver of the Development Charge (DC) for the increased floor area, capped at 10 per cent of the projects market value or estimated land value (whichever is lower). You can find out about DC in our previous article.

- DCs also waived for the increase in value of the conserved floor area

- The developer will be allowed to adjust the boundaries of the 50,085 sq. m. land plot, into a more regular shape.

- Freedom to adapt the resulting development to a variety of uses (although something like the current mixed-use configuration is the most sensible for the Beach Road area)

- A top-up of the lease, back to 99-years

The developer will have to abide by certain conditions, however, such as maintaining the existing façade.

This may set the tone for future en-bloc sales of iconic developments

When a buyer is found, Golden Mile Complex will be the first strata-titled, conserved development to go on collective sale.

This may reflect a new attempt to preserve modernist buildings in Singapore’s architectural history, whereas prior conservation efforts have focused only on colonial buildings.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How To Get Money Out Of Your Home Without Selling It: 4 Creative Ways To Do It

It’s a story we come across surprisingly often: someone has a fully-paid up flat, condo, or perhaps even a $6…

These buildings come from a phase between the end of WWII, and the late 1990’s; and they weren’t previously considered historically significant, because of how purely functional they were. Nonetheless, it seems URA is more alert to the risk that we’re about to wipe out an entire era of our history, by losing these buildings.

We note that two such icons – Pearl Bank Apartments (now One Pearl Bank) and the former Shaw Tower are already gone.

So it’s entirely possible that some other buildings from the era – such as Pandan Valley or People’s Park Complex – might get the same conservation treatment as Golden Mile Complex instead.

On the ground, however, we’re hearing from a lot of skeptics

We spoke to someone in the employ of a developer, who asked not to be named; she opined that the incentives are “frankly quite insignificant”.

The chief issue she pointed out was that DCs, while a cost concern, was not the biggest factor in redevelopment. Rather, the issue is the sheer size of these developments.

Unlike colonial buildings, which are individual detached houses, or small rows of shophouses, projects like Golden Mile are huge developments that typically span over a hectare of land.

Developers are faced with an Additional Buyers Stamp Duty (ABSD) of 30 per cent of the land price, if they’re unable to complete and sell a development in five years. This applies whether the development has just 50 units, or over a thousand.

Coupled with the need for conservation, which can further complicate construction, these projects present a huge risk to developers. A partial waiver of DCs is too small to mitigate the issue, as it possibly amounts to no more than $1 million; even in a development as large as Golden Mile.

As such, much more is needed, to convince developers to step in and help with preservation. She felt that, even if Golden Mile is redeveloped, it would be due to factors like the location; not any of the incentives.

One of the realtors we spoke to was skeptical about the preservation aspect.

While he felt developers would be eager to take part, the “spirit” of the place would fade out. He pointed out that Golden Mile’s distinctive characteristic – the Thai discos and supermarkets, the travel coaches to Malaysia, and the late-night mookata joints – have little place in redevelopment:

“Even if you conserve it, the new development is going to be beyond the budget of existing tenants. There’s no way the new owners can charge the same rental rates as right now. So in the end they all move out, all you have is an empty shell: you have the façade, but you still lose the spirit of the place.”

He felt that subsidies to the existing management, to refurbish and preserve these places, would better serve conservation goals.

For homeowners and investors, this could be a help or hindrance

If you live in a particularly iconic development, like People’s Park or Pandan Valley, this can go both ways for you.

On the one hand, URA giving out small incentives can help to push an en-bloc sale. On the other hand, some might argue conservation pushes developers away (e.g., they are more restricted in how they can rebuild, to maximise gains).

The clear winners are the lovers of Singapore’s heritage and history. But for existing homeowners and investors, this all sets a new precedent, and it’s uncertain yet as to whether this is a plus or minus.

For more on the situation as it unfolds, follow us on Stacked. You can also check out our in-depth reviews on new and resale properties alike, if you’re looking for your next home.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the significance of Golden Mile Complex in Singapore's architecture?

How does conservation of Golden Mile Complex affect property developers?

What are the potential impacts of conserving Golden Mile Complex on homeowners and tenants?

What incentives does URA provide for the redevelopment of Golden Mile Complex?

Could conservation of Golden Mile Complex influence future preservation efforts in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments